“Social media giant, X, has earned a regulatory license to process cryptocurrency payments in the United States, by obtaining the Rhode Island Currency Transmitter License. This move, supported by several states, strengthens X’s potential to facilitate virtual transactions, possibly expediting the mainstream adoption of digital currency.”

Search Results for: NEAR Foundation

SUI Network’s Rally Fades: Is it All Downhill or Reprieve in Sight? Plus, Rise of Sonik Coin

“Sui Network’s recovery wanes despite an initial 40% rally. Although struggling with variable market conditions, its layer-1 technology for faster smart contracts sees growth, with active accounts nearly doubling in a week. However, technical structures suggest possible future downturns. Meanwhile, Sonik Coin is gaining momentum, with a promising staking APY and a community-focused vision, distinguishing it in the meme coin market.”

EOS Gains Ground in Japan: An Underdog Cryptocurrency’s Resurgence and Its Implications

The EOS Network has received endorsement from Japan’s cryptocurrency authority, granting EOS token rights for trade against the yen on Japan’s regulated cryptocurrency exchanges. EOS Network Foundation CEO, Yves La Rose, views this as a unique opportunity for EOS to grow within a regulated market known for stringent transparency. This development also opens up potential for game tokenization, an untapped sector in Japan.

Colombia’s New Stablecoin nCOP: Boon or Bane for Latin America’s Remittance Market?

Num Finance has launched a stablecoin, nCOP, tied to the Colombian peso on the Polygon network. This overcollateralized fiat-backed coin is seen as a game changer for Latin American remittance recipients given its stability and yield-offering feature. Colombia’s robust remittance market provides prime opportunities to “tokenize” remittances with nCOP.

Navigating Bitcoin’s Unsteady Path: Influence of SEC Regulations and Fear of Inflation

In this article, we explore the recent 10% drop in Bitcoin value, critiqued regulatory methods of the US’s Securities and Exchange Commission and its influence on Bitcoin’s price fluctuation. A looming economic disaster by Federal Reserve policy mishaps is also cautioned, potentially influencing the future trajectory of Bitcoin.

Revolutionizing Multiple Industries: The Future of AI Intertwined with Blockchain Technology

“The combination of AI and blockchain technology could revolutionize industries by powering secure, self-improving data streams. However, integration challenges include scalability, privacy, and the need for skilled personnel to navigate AI algorithms and blockchain protocols.”

Navigating Bitcoin’s Turbulent Whirlwind: Grounding a Bullish Stand at $28,000

In the recent bearish cryptocurrency market, the BTC price is working to maintain a foothold at $28,000. However, with a risk of a breakdown and due to a slump in buyside interest triggered by Federal Reserve minutes, the BTC/USD dipped to nearly two-month lows of $28,300. Market observers are preparing for potential further support retests.

ZTX’s Impressive $13 Million Seed Round: A Positive Sign for Web3 Metaverse’s Future or a Risky Leap?

Web3 metaverse platform, ZTX, recently secured a $13 million seed funding led by influential crypto firm, Jump Crypto. ZTX, backed by industry vets from firms like Apple and Roblox, and successful web3 ecosystems like Cosmos and Solana, plans to provide creators an infrastructure layer. Its legacy business, ZEPETO, has achieved success in the Web2 metaverse space. ZTX aims to take a defining role in the future of Web3.

Unraveling BTC20: The Revolution of Decentralization and Staking on Uniswap

The ‘Bitcoin on Ethereum’ coin BTC20 has gained significant attention on the decentralized exchange Uniswap. Offering an impressive annual percentage yield of 79.47% and stable income stream for stakers, the BTC20 boasts stability with a solid foundation attracting lower-risk-tolerance market participants. It potentially marks a significant gain as Bitcoin surges.

Aptos’ Token on High: The Microsoft Partnership, AI Blockchain, and the Journey to $100

The price of Aptos’s native token, APT, surged on news of a partnership with Microsoft for AI blockchain products. The collaboration will develop an AI-powered chatbot, the Aptos Assistant, to simplify smart contract and decentralized app development, as well as create blockchain-based financial products.

Bitcoin on a Razor’s Edge: Confidence and Concern on the Road to $29,000

“Bitcoin holds steady near $29,000, influenced by the optimistic predictions of investor Cathie Wood and institutional investors reducing their Bitcoin shorting. Wood suggests multiple Bitcoin ETFs could get simultaneous approval, influencing the industry’s direction. Meanwhile, changing attitudes among institutional investors point to a brighter Bitcoin future.”

Balancing Act: Unpacking the Prospects and Challenges in the Adoption of Blockchain Technology

“Blockchain technology guarantees transparency and decentralization, with substantial benefits in security and transparency. On reverse side, it also faces hurdles like market speculation, financial unpredictability impacted by cryptocurrencies prices fluctuation; and problems raised by blockchain’s immutable nature which makes correcting erroneous transactions almost impossible.”

Ripple’s Struggles and the Rise of XRP20: An Investment Showdown in the Crypto World

Ripple’s value faces a downtrend following the Ripple vs SEC case, signaling potential recovery and hitting $0.61. Meanwhile, XRP20, a new altcoin that emulates Ripple’s philosophy while focusing on retail markets, exhibits potential with its staking rewards system in a deflationary ecosystem. Remember, crypto investing carries high risk and requires vigilance.

Unveiling the Mystery of Aptos Token Unlocks: A Boon or a Bane for the Market?

Aptos blockchain’s upcoming unlock of more than 2% of the APT token’s circulating supply could potentially lead to a significant drop in its value, based on data from TokenUnlocks. Traditionally, these unlocks often correlate with asset price decreases as investors preemptively sell their holdings before additional tokens saturate the market. This impending event continues to draw attention from crypto enthusiasts.

Ripple vs SEC: The Unfolding Drama and Its Implications on Crypto Regulation

“The Ripple case underlines the complexity of cryptocurrency regulations and the uncertainties prevalent due to its rapidly evolving landscape. This regulatory maze demands transparent regulations, fair oversight, and a consensus. The industry craves clear guidelines; until then, instances like Ripple’s will continue illuminating the nuances of cryptocurrency regulations, fostering legislative paths.”

Unmasking Worldcoin: The Human-AI Interface and the Quest for Proof-of-Personhood

Worldcoin, a new crypto project, operates on the principle of proof-of-unique-personhood to prevent deep-fake bots. Despite rapid engagement, concerns about potential Orwellian surveillance and exposure of sensitive biometric data have arisen. Advocates argue that the collected data is converted to untraceable hash codes and no raw human data is stored. Ethereum founder Vitalik Buterin underscored the risk of centralized models not fully safeguarding data.

Solana Developer Automata: A Victim of Precarious Crypto Climate or Overambitious Game Plan?

Solana game developer Automata makes mass layoffs due to substantial financial losses and slower development of its Star Atlas game. The downturn is linked to the in-game token Atlas’ 80% value decline impacting 33% of the project’s revenue. Meanwhile, trading platform Robinhood accelerates UK expansion. The volatile crypto landscape necessitates strategic, informed decisions.

Chimpzee’s Eco-Mission: Balancing Passive Income Earning and Wildlife Conservation with NFTs

Chimpzee, a blockchain-based project, funds environmental initiatives and protects endangered wildlife. Its new Chimpzee Gold Passport NFT collection allows eco-friendly crypto investors to mint exclusive digital artworks and earn significant passive income. Pledged investors will trade 750,000 $CHMPZ tokens to earn these NFTs which unlock an 18% yield stake in the Chimpzee network.

$ECOTERRA: A Green Crypto Initiative Combining Investment and Environmental Action

“$ECOTERRA, the green cryptocurrency initiative, has attracted $6 million from backers, providing an avenue for investors to contribute to reducing carbon footprint while seeking significant returns. This innovative approach offers a stable asset from eco-friendly foundations and includes a unique recycle-to-earn (R2E) program promoting environmental action.”

Will Bitcoin hit the $100,000 Mark: Analyst Predictions vs Market Reality

Bitcoin’s fluctuating market has prompted speculation about a potential $100,000 valuation this year. Advancements, like institutional interest in spot Bitcoin ETFs, may set a robust foundation for a dynamic market. However, volatility and resistance levels also present risks. As always, careful assessment is critical before investment.

Cryptic Outflows in Multichain: Unraveling the Mystery of the $120 Million Token Exodus

Multiple bridge contracts run by Multichain encountered significant outflows involving widely held tokens. The Fantom bridge was nearly emptied, surpassing $120 million in total value. The unexpected withdrawals created concern across social media, with some suspecting a potential digital intrusion or ‘hack’. Cryptocurrency projects are reassuring communities about this potential exploit.

Unveiling Base: Coinbase’s Disruptive Layer 2 Blockchain Safeguards and Its Mainnet Launch Challenges

“Base, Coinbase’s layer 2 blockchain, successfully passed a series of security audits ahead of its mainnet launch. Created with Optimism, Base aims to attract one million new crypto users. Over 100 experts examined its code, finding no significant vulnerabilities, reflecting Coinbase’s dedication to security.”

New Faces Take Helm at ApeCoin DAO: A Step Forward or a Wave of Contention?

ApeCoin DAO, the organization behind ApeCoin (APE), has welcomed two new members, Waabam and CaptainTrippy, to its Special Council governing body. Despite governance fluctuations, the community expresses optimism. However, concerns about the remuneration capacity of the council members have emerged, leading to proposals for salary cuts.

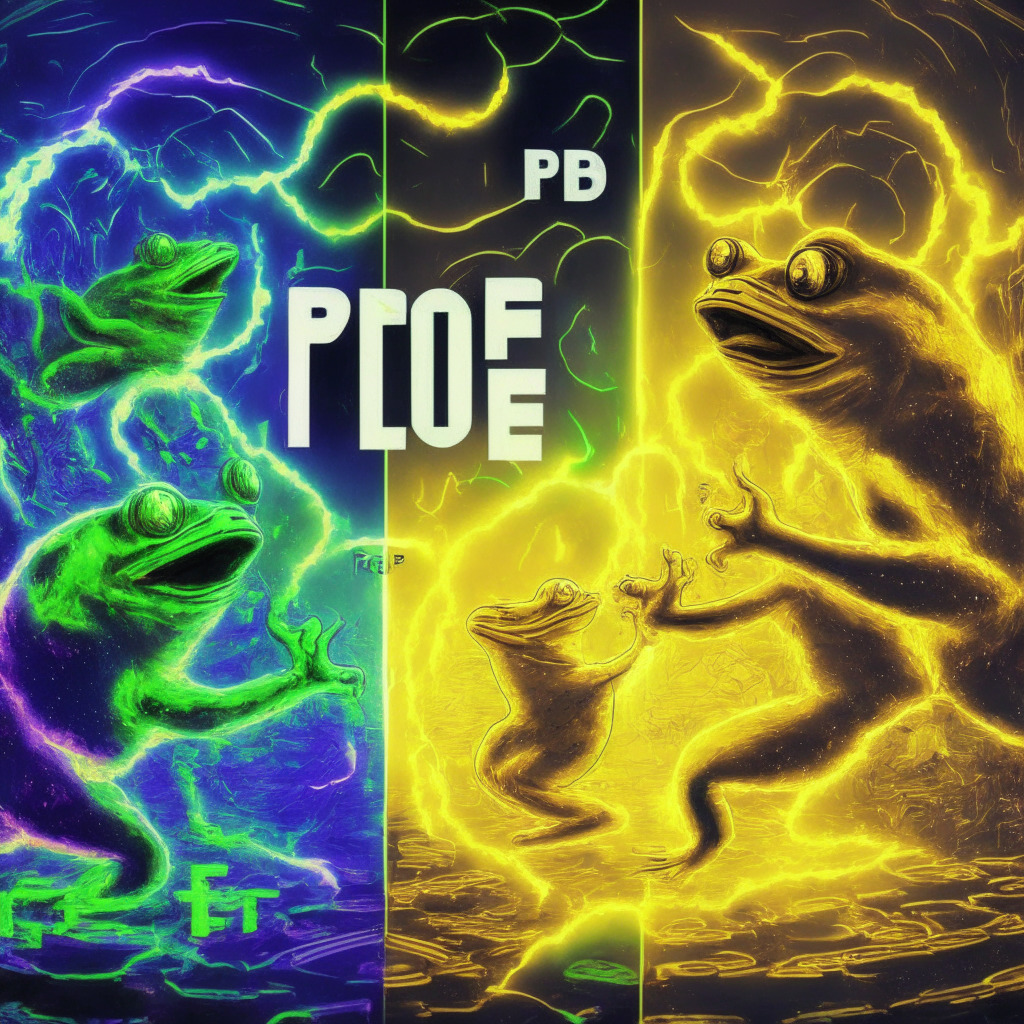

PepeCoin vs Dogecoin: Ultimate Memecoin Battle or Passing Trend in Crypto World?

PepeCoin recently gained prominence in the memecoin sector, challenging Dogecoin’s dominance. With native Ethereum integration and a fixed supply, it shows potential for growth, but it must overcome Dogecoin’s first-mover advantage and network dominance to become a mainstream memecoin contender.

Exploring Blockchain’s Future: Pros, Cons, and the Path to Mainstream Adoption

Blockchain technology’s decentralized and secure nature holds immense potential for applications in finance, supply chain, and peer-to-peer networks. However, challenges like scalability, energy consumption, and government regulations need to be addressed to ensure widespread usability, sustainability, and success in various industries.

Maker Ecosystem $1.16M Settlement: Lessons on Crypto Regulation and Investor Protection

Maker ecosystem firms have agreed to a $1.16 million settlement with investors over financial losses during the “Black Thursday” COVID crash in March 2020. The class-action lawsuit claimed Maker Foundation and related entities misrepresented risks of collateralized debt positions, resulting in $8.3 million losses. This case highlights the importance of regulatory oversight, balancing innovation and investor protection.

Web3 Investments: Hedge Against Tech Disruption or Hype? Exploring the Truth Behind the Trend

Web3 investments serve as a potential hedge against tech industry disruption, despite regulatory challenges and market downturns. Investors increasingly back Web3 and DeFi startups, seeking genuine value in solid projects. Though overcoming reputational and regulatory obstacles remains crucial, the future of blockchain, AI, and crypto-driven industries appears promising.

Dogecoin Price Rebound: Analyzing the Potential for a Bullish Future and Possible Resistance

The Dogecoin price rebounds, breaching the $0.0632 resistance mark due to increased investor interest and support from a positive market sentiment. Triggering a significant recovery, recent developments suggest a potential bull cycle and a possible bullish upswing as the price surges above the 20-day EMA.

AI Hype & Crypto Frenzy: Lessons, Risks, and Potential Synergies for Disruptive Tech

This article examines the hype surrounding AI and cryptocurrency, comparing their meteoric rise and the potential for unrealistic expectations. It emphasizes focusing on long-term benefits and striking a balance between radical innovation and practicality to build a solid foundation for future technologies.

Cardano’s Symmetrical Triangle: Breakout or Breakdown? Exploring ADA’s Future Price Movements

Cardano’s ADA price has formed a symmetrical triangle pattern within the 4-hour timeframe chart, potentially signaling a temporary pause before resuming primary trend. Bollinger Bands and RSI indicate trapped momentum and underlying bullish momentum, respectively. However, market conditions and crypto volatility warrant caution when predicting trajectory.

Abra Accusations: Securing Crypto Investments Amidst Fraud and Insolvency Claims

The Texas State Securities Board accuses crypto lender Abra and founder William Barhydt of misleading the public, securities fraud, and insolvency. Regulators allege Abra offered investments with materially misleading statements targeting Texas investors and secretly transferred assets to Binance Holdings Limited. The safety of investors and users is at risk, and authorities aim to protect them by bringing these irregularities to public attention.

Solana Hard Fork Debate: SEC Pressure, Decentralization, and Developer Stance Unraveled

Last week, the SEC labeled Solana’s SOL token as a security, leading to intense debate on Crypto Twitter about a potential hard fork. Despite concerns over regulatory clampdowns and the protocol’s relationship with the now-defunct crypto exchange FTX, developers and the Solana Foundation have not seriously considered the fork.