MATIC tokens face a sharp price decline due to significant transfers among whales and institutions, Robinhood’s delisting announcement, and regulatory scrutiny. A massive transfer of MATIC tokens on exchanges like Binance and Coinbase suggests a possible coordinated sell-off, leading to a 29% drop in price within 16 hours.

Search Results for: robinhood

Robinhood Delists ADA, SOL, MATIC: SHIB Unaffected and Burning Tokens Skyrockets

Robinhood announced delisting of Cardano (ADA), Solana (SOL), and Polygon (MATIC) by June 27, 2023, but Shiba Inu (SHIB) remains unaffected. This follows Robinhood’s review of its crypto offerings, amidst speculations of recent SEC lawsuits’ influence on exchange operations and regulatory compliance.

Robinhood Ends Support for Cardano, Polygon, and Solana Amid SEC Lawsuits: Impact on Crypto

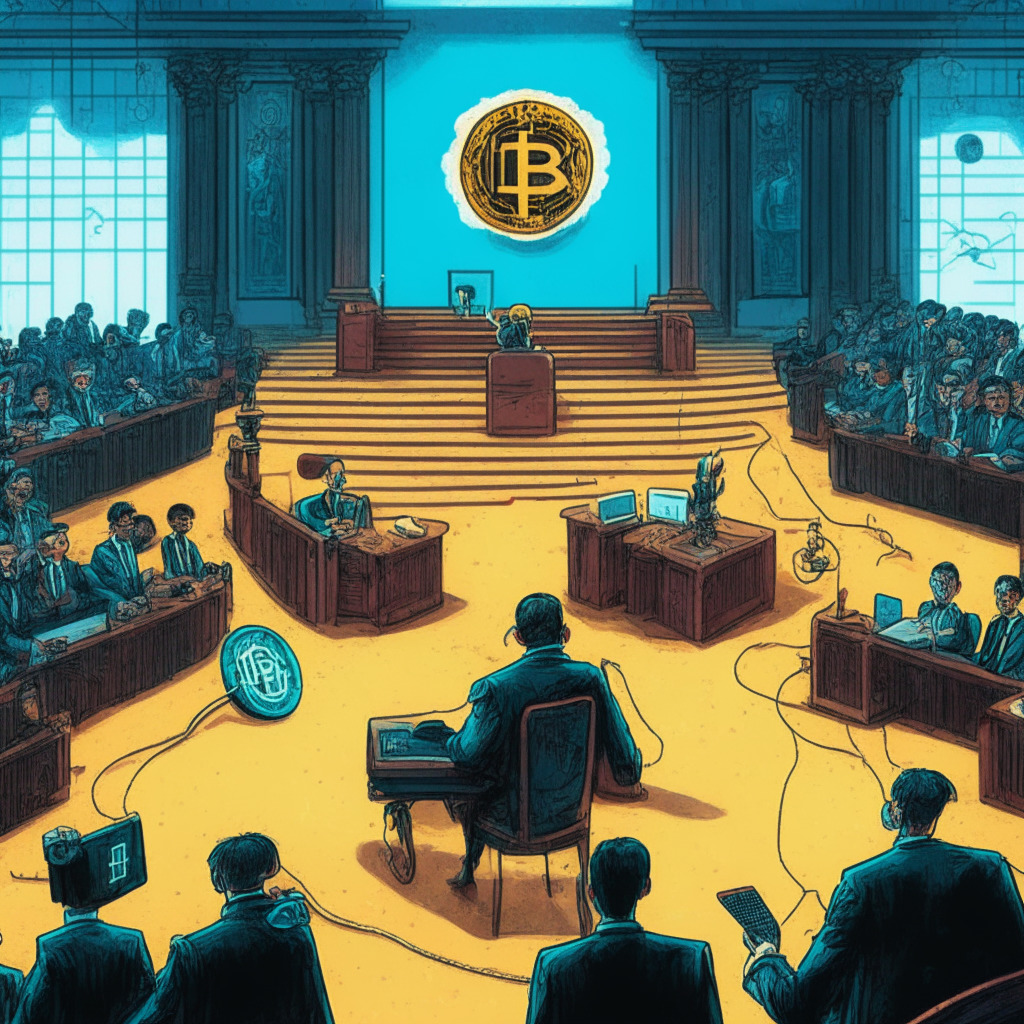

Robinhood announced the end of support for Cardano, Polygon, and Solana due to their identification as unregistered securities in SEC lawsuits against Binance and Coinbase. The decision aims to advocate for regulatory clarity and protect customers amidst the ongoing legal uncertainties.

Robinhood Delists Cardano, Polygon, Solana: Impact of SEC’s Crypto Exchange Crackdown

Robinhood announced its decision to delist Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27 due to the SEC’s claims that they are securities. This comes amidst the SEC’s ongoing crackdown against major crypto exchanges Binance and Coinbase, raising concerns about regulations and market growth.

Robinhood Ends Support for ADA, MATIC & SOL: Impact on Markets and Regulatory Compliance

Robinhood is ending support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27, 2023, after regular review of their crypto offerings. The decision follows SEC lawsuits against Binance and Coinbase, which claimed these tokens were unregistered securities, raising questions about the crypto market and regulatory compliance.

Robinhood Ends Support for Top Cryptos: SEC Lawsuits Impact and Market Reaction

Robinhood announced plans to end support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) amidst recent SEC lawsuits against Binance and Coinbase. The decision raises questions about the impact of regulation on cryptocurrencies and challenges in navigating the evolving regulatory landscape.

SEC Pressure on Crypto Exchanges: eToro and Robinhood’s Compliance Commitment

As the SEC increases regulatory pressure on cryptocurrency exchanges like Binance and Coinbase, major platforms, including eToro, emphasize their commitment to compliance and collaboration with regulators. This ensures access to a variety of asset classes for investors, shaping the crypto industry’s future while promoting investor protection and fostering innovation and growth.

Cardano Price Breakdown: Analyzing the Impact of SEC Disagreement and Robinhood Fears

ADA price experienced a significant breakdown, intensifying selling pressure and adding uncertainty to the market. Downward trending daily EMAs indicate hurdles for buyers, while $0.3 remains a crucial psychological support point. The oversold RSI suggests temporary consolidation or pullbacks. Proper research is essential before making cryptocurrency investments.

SEC’s Crackdown on Crypto Securities: Impact on Cardano, Robinhood, and the Need for Clarity

The SEC recently filed a lawsuit against Binance, classifying cryptocurrencies like Cardano as securities, leading to resistance from Cardano Foundation’s CEO. This classification could result in potential delisting of popular tokens from trading platforms like Robinhood, emphasizing the need for regulatory clarity and ongoing dialogue between industry players and regulatory bodies.

Robinhood Rethinks Crypto Offerings Amid SEC Actions: Balancing Regulation vs Innovation

Robinhood is reevaluating its digital asset offerings following the SEC’s actions against major crypto exchanges like Binance and Coinbase. With the SEC identifying several tokens, including popular ones like Solana, Cardano, and Polygon, as unregistered securities, the debate on cryptocurrency regulation intensifies as market participants balance regulatory clarity with the potential stifling of innovation.

Navigating Crypto: Robinhood’s Dilemma Amid SEC Crackdown on Binance and Coinbase

Amid the SEC’s crackdown on major exchanges like Binance and Coinbase, Robinhood re-evaluates its cryptocurrency offerings. The company’s legal chief, Dan Gallagher, recognizes the importance of reviewing the SEC’s analysis. Robinhood’s users await news on possible changes to its crypto offerings, highlighting the ongoing struggle between innovation and regulation in the crypto industry.

24-Hour Trading on Robinhood: Bridging Gap with Crypto or Fueling Risky Behavior?

Robinhood introduces 24-hour trading service for select stocks, aiming to bring traditional assets on par with digital assets. The 24 Hour Market feature increases liquidity during off-hours but also raises concerns about impulsive trading and higher volatility levels.

Declining Crypto Revenue on Robinhood: A Market Shift or Passing Trend?

Robinhood reported a 30% decline in cryptocurrency trading revenue for Q1 2023; however, crypto assets under its management increased by 36%. While the dip in revenue raises concerns, overall market health and stock prices remain strong, indicating a generally upward trajectory.

Robinhood’s Crypto Revenue Drops 30%, Yet Total Revenue Soars: Analyzing the Reasons & Impact

Robinhood’s Q1 2023 results reveal a 30% year-on-year drop in crypto trading revenues, amounting to $38 million. Despite this, the company’s total net revenues have grown, highlighting its strong business model. Factors like market fluctuations, competition, and the growth of decentralized finance could contribute to the decline in crypto trading.

PEPE Coin’s Rapid Rise: Impact on Crypto Market and Possible Robinhood Listing

PEPE Coin quickly joined the top 100 crypto tokens, impacting other cryptocurrencies like Bitcoin’s price. With recent listings on top exchanges and potential Robinhood listing, PEPE has gained popularity, while Bitcoin sees positive momentum at $28,000. Market research remains crucial for investors.

Regulation Vs Innovation: Robinhood’s Legal Battle with Massachusetts and Its Impact on Crypto

Robinhood is in a legal battle with the Massachusetts securities division, accused of targeting inexperienced investors and violating fiduciary duty standards. The ongoing clash between innovation and regulation calls for careful examination of platforms’ practices to ensure fair market access and user protection.

Navigating Regulatory Waves: How Crypto Exchanges Adapt to Survive

The crypto industry is evolving to navigate tighter global regulations. Exchanges like Kraken and Gemini are developing innovative strategies to thrive. For instance, to overcome regulatory challenges, Kraken is exploring securities trading, and Gemini is expanding in India’s tech-focused market.

Kraken Crypto Exchange’s Brave New Leap: Stocks and ETFs By 2024

San Francisco’s crypto exchange Kraken is reportedly considering introducing stock and ETFs on its platform, marking the first crypto exchange to expand past cryptocurrencies. Given the target year of 2024, these additions could flag a new era in trading platforms. Despite challenges, if successful, this could serve as a benchmark for other crypto exchanges to diversify asset classes.

Regulatory Tug-of-War: The SEC, Blockchain, and the Struggle to Control Crypto Assets

“SAB 121, the SEC’s new regulatory bulletin concerning crypto assets, faces criticism and controversy. Issued without involving key industry bodies, this document has stirred skepticism due to its broad implications for digital asset custody, inherent risks, and the broader crypto space.”

Kraken’s Leap into Stock Trading: A Bold Move or a Risky Venture?

“Kraken, a crypto exchange, is reportedly considering a venture into US stock trading, planning to launch its stock trading services in the US and UK in 2024, despite legal and regulatory challenges. The move indicates a potential significant diversification for platforms typically exclusively focused on digital assets.”

The Suspended Projection of Apple into Stock Trading Arena: A Revisit in The Making?

“In 2020, Apple and Goldman Sachs aimed to introduce a stock trading feature in Apple’s ecosystem. However, due to financial volatility, this was suspended. Despite Goldman Sachs pulling out of consumer banking, the groundwork for this feature remains, with potential for revisit. Incorporating stock trading positions Apple against established platforms like Robinhood, SoFi, and Square. Crypto trading expansion by these platforms indicates possibilities for future digital trading, but Apple’s participation is still uncertain.”

Regulatory Tug of War: Examining NYDFS’s New Proposal on Crypto Coin Listings

“The New York Department of Financial Services (NYDFS) proposes stricter regulations on digital coin listings, increasing scrutiny for licensees and necessitating more comprehensive risk assessment. The updated list of “greenlisted” coins can be listed by licensees without facing additional regulatory hurdles.”

Turbulence in Crypto Regulation: NYSDFS Deputy Superintendent’s Departure and its Impact

Peter Marton’s departure from his position as deputy superintendent of virtual currency at the New York State Department of Financial Services signifies a significant shift in the regulatory governing virtual currencies. His move to the private sector, after overseeing rigorous policies surrounding the crypto market including BitLicenses, leaves an influential gap in this sector, posing the question – who will fill this role?

Dogecoin Vs. Cardano Race: Twitter Payments, Innovative Tokens, and Future Implications

“Dogecoin’s current market position against Cardano in the crypto market cap rankings remains despite a recent drop. With DOGE payments on Twitter potentially on the horizon, the crypto community remains hopeful. Launchpad.xyz (LPX), a practical token offering various features and benefits, is gaining recognition in a sea of meme and junk tokens.”

Grayscale’s Billions in Bitcoin: A Hidden Treasure or Exaggerated Claim?

Arkham Intelligence recently unveiled that Grayscale is the world’s second-largest BTC holder, with over 1,750 wallet addresses and holdings worth $16.1 billion. However, Grayscale has not disclosed wallet addresses due to security concerns, igniting speculation and skepticism within the crypto community.

Dogecoin’s Future: Will the Meme Token Gain Traction or Fade Away?

“Despite a slight market dip, Dogecoin (DOGE) showed potential stability with a 2% gain in the last 24 hours. However, its overall gains remain modest and investors remain uncertain. Developments like DOGE-based swaps on Robinhood and potential Twitter integration could boost its adoption, yet the road ahead is still unclear due to a potentially oversaturated meme-token market.”

Financial Misconduct Scandal at Crypto Exchange FTX: Ripple Effect on the Crypto Industry

“Recent filings at the United States Bankruptcy Court indicate financial irregularities at crypto exchange FTX. Documents suggest misuse of company funds by executives, with transactions aimed to enrich the top brass at FTX and Alameda Research.”

Unpacking the Crypto Turbulence: Breakthroughs, Setbacks, and the Future Uncertain

“This week in crypto saw Grayscale Investments move closer to transforming its Bitcoin Trust into an ETF, despite SEC concerns. Meanwhile, turmoil rocked the BitBoy Crypto brand due to allegations against Ben Armstrong. The SEC delayed decisions on multiple Bitcoin ETF applications while Robinhood recovered 55M shares from ex-FTX CEO. These events underscore the balance needed between celebrating advancements and managing challenges in the blockchain and cryptocurrency world.”

Unmasking the Powerplay: The Convergence of Bitcoin and AI and the Surge of DeFi

“Cathie Wood, CEO of Ark Invest, and Changpeng “CZ” Zhao of Binance express optimism about the future of Artificial Intelligence (AI) and Bitcoin, and the potential of decentralized finance (DeFi). Despite high volatility, regulatory uncertainties and potential misuse of AI, Wood and Zhao see transformative potential and investment opportunities in these areas.”

Alameda Co-CEO’s Lavish Yacht Purchase: A Look at Cryptocurrency Transparency and Ethics

“The court documents reveal undisclosed financial transactions made by FTX and Alameda Research executives, including a $2.51 million yacht purchase. This raises questions about transparency within blockchain-based corporations. While crypto markets offer high rewards, the potential lack of regulations and transparency can be treacherous.”

Unravelling the Blockchain Future: Justice, Global Sanctions, Charity Initiatives, Twitter Vulnerability, and Investment Trends

“In the face of persistent complications, the future of blockchain teeters precariously between pathbreaking transformation and a potential bubble. Blockchain’s breathtaking scope and opportunities invariably throw up a set of challenges for us to navigate. Our choices shape the blockchain of tomorrow.”

Crypto Controversies: Tornado Cash’s Legal Troubles, FTX Founder Behind Bars, and Huge Bitcoin Concentration

“The crypto industry is grappling with legal and ethical challenges, whilst showing high-risk, high-reward nature. With recent controversies involving Tornado Cash co-founders, FTX founder, and the parent company of Prime Trust, it’s clear that proper evaluation and risk-assessment are crucial.”