A new Bitcoin holder has recently emerged, owning around 118,300 Bitcoin worth about $3.1 billion. This unidentified wallet is now the third-largest Bitcoin holder. This activity began in March, with significant transactions primarily coming from Gemini, leading to speculation that the wallet may be a “hot wallet” used for major acquisitions, possibly linked to BlackRock’s recent filing for a Bitcoin ETF.

Search Results for: robinhood

Resurgence or Fallacy? Assessing XRP20’s Burn Event Amid Cryptocurrency Instabilities

Despite a general downturn in the cryptocurrency market, XRP20 seems primed for potential gains following the announcement of a 5% burn event. However, the sustainability of the constant deflationary nature is questioned. Despite XRP struggling, XRP20’s high yield and compatibility with Ethereum attract crypto investors.

Weathering the Storm: How Exodus Survives and Thrives Amid Crypto Ebb and Flow

“Despite a bearish market, multichain wallet Exodus reported Q2 2023 revenue of $12.4 million, a modest 4% dip year-over-year. Notable was a strong fiat onboarding revenue increase, up 220% from 2022. High trade volumes came from Bitcoin, Tether and Ether. Strikingly, Exodus alleviated some financial stresses by drastically cutting administrative and marketing budgets by 65%, resulting in administrative expenses shrinking to 32.2% of revenue.”

Crypto Giants Report Stellar Q2 Profits Despite Regulatory Scrutiny: Unpacking the Figures

“Major crypto firms displayed strong financial performance last quarter due to a surge in crypto asset prices. Companies like MicroStrategy and Block reported significant profits and revenue increases, attributed to growing Bitcoin sales despite market fluctuations. The overall health of the crypto market shows its resilience and potential growth.”

Crypto-Centric Public Firms: A Tale of Surpassing Earnings and Challenges Ahead

“Recent financial reports show crypto-centred public firms like MicroStrategy and Coinbase exceeding Q2 forecasts with significant profit leaps, attributing to a crypto market upturn. However, the volatile nature of the market imposes sudden price swings and regulatory uncertainties, suggesting cautious optimism for the crypto sector.”

Coinbase’s Earnings Exceed Expectations: A Deep Dive into Analysts’ Mixed Reactions

Cryptocurrency exchange Coinbase’s recent earnings surpassed expectations but major institutions raised concerns about its long-term growth potential. Issues include a lack of sustainable everyday utility value in the crypto industry, concerns about revenue diversification, and reduced transaction volumes. Despite this, Coinbase remains confident about its prospects.

GameStop Abandons Crypto Wallets: Combat or Capitulation Against the US Regulatory Pressure?

“GameStop, after a year of providing crypto wallets, plans to withdraw support due to US regulatory uncertainties. The removal of these crypto conduits, facilitating transactions on GameStop’s NFT marketplace, aligns with considerable staffing reductions. This reflects intense scrutiny by regulatory bodies, prompting some cryptocurrency companies to consider overseas operations.”

Solana Developer Automata: A Victim of Precarious Crypto Climate or Overambitious Game Plan?

Solana game developer Automata makes mass layoffs due to substantial financial losses and slower development of its Star Atlas game. The downturn is linked to the in-game token Atlas’ 80% value decline impacting 33% of the project’s revenue. Meanwhile, trading platform Robinhood accelerates UK expansion. The volatile crypto landscape necessitates strategic, informed decisions.

FTX Scandal: Unpacking the Billion-Dollar Accusations and the Cryptocurrency Exchange’s Struggles

An executive team led by John Ray levelled a charge against former key executives of the now-defunct cryptocurrency exchange, FTX, to recover over $1 billion allegedly misused. Charges include splurging customer funds on luxury items, political donations, and speculative investments. Interestingly, FTX’s former CEO and co-founder are accused of using customer funds to purchase Robinhood shares worth nearly $546 million.

Surging Solana and the Rise of Meme Token WSM: Cryptocurrency Opportunities and Risks Unveiled

“Solana has maintained a firm footprint in the crypto market despite significant challenges, thanks to the resilience of its DeFi ecosystem. Meanwhile, Wall Street Memes, a small-cap meme coin, is drawing investors’ attention with its robust social community.”

The Monopoly Billion-Dollar Disagreement: FTX, 3AC, and SEC Vs BlockFi’s Bankruptcy Plans

“FTX, Three Arrows Capital (3AC), and the SEC contested BlockFi’s bankruptcy plans, arguing manipulation of rules involving billion-dollar disputed transactions. FTX alleges the plan reduces its claims against BlockFi, while 3AC and SEC question procedural fairness and sufficiency of the disclosure statement.”

Dissecting the BlockFi-FTX Legal Drama: Decoding Regulatory Challenges in Crypto Space

The legal conflict between BlockFi and FTX emphasizes the complexity of financial transactions in the crypto world, with over a billion dollars in dispute. Both cases highlight the emerging regulatory challenges, as well as the necessity for comprehensive control mechanisms to maintain faith in the crypto market’s health and safety.

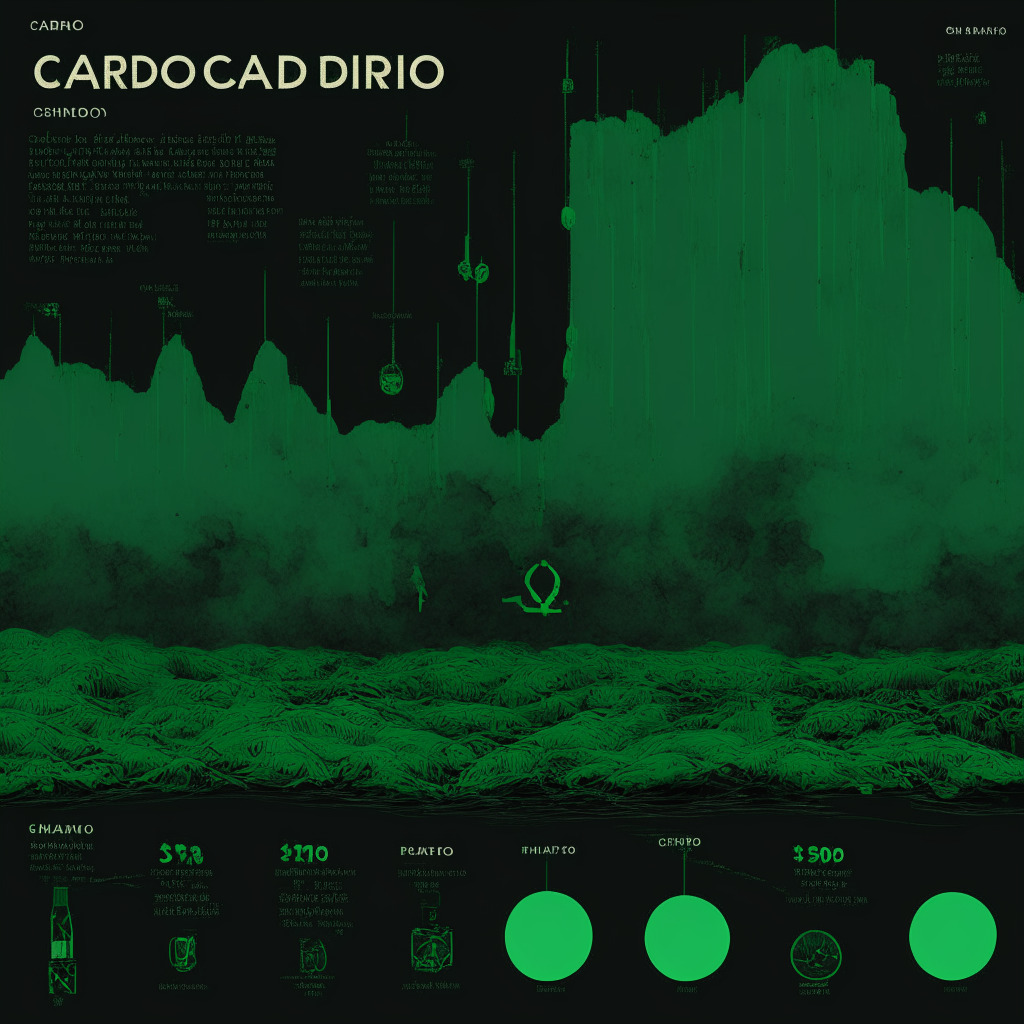

Navigating Regulatory Turbulence: The Shifting Landscape of Cardano’s Pricing Trajectory

The SEC’s allegations against 64 cryptos, including Cardano’s ADA token, have caused market instability and price fluctuations. With heightened regulatory scrutiny, ADA’s price struggled, falling from its May peak of $0.45 to $0.22 in June. The token’s future remains uncertain amidst fears of further losses and delisting from the Robinhood trading app.

Ark vs BlackRock: Battle for the First Spot-Bitcoin ETF Approval Heating Up

ARK Investment Management believes it has secured frontrunner status for spot-Bitcoin ETF approval, despite BlackRock leading the race. USDC CEO Jeremy Allaire mentioned well-regulated custody infrastructures, mature spot markets, and effective market surveillance as factors supporting potential approval.

MATIC Price Recovery: Can Polygon Coin Surpass $0.75 Amid Market Sentiment Shift?

The MATIC price displays a steady uptrend with dynamic support to buyers, suggesting the potential to surpass the $0.75 mark. However, decreasing volume in its current recovery and possible selling pressure from overhead trendlines could impact this momentum. Technical indicators suggest a short-term buy signal, but market conditions remain subject to change.

Expanding Cryptocurrency Custody: Fireblocks Partners with Cloud Giants, Security Concerns Linger

Cryptocurrency custody technology provider Fireblocks has expanded its support to cloud service providers including Amazon Web Services, Google Cloud Platform, Alibaba Cloud, Thales, and Securosus, aiming to cater to banks using on-premise and cloud-based IT infrastructures.

Bitcoin’s Max Pain and AI-Driven Shift: Exploring Crypto Market Developments

Bitcoin holds above $30,000 while Ether trades lower as the crypto market anticipates upcoming quarterly options expiry. Meanwhile, investors shift focus to AI technologies, and financial institutions adopt tokenization as crypto’s new buzzword.

FTX 2.0 Revival: Crypto Exchange’s Restructuring Attracts Big Players and Controversy

FTX Debtors plan to revive the troubled crypto exchange FTX through a bankruptcy restructuring, with notable 363 Sales Parties like Nasdaq, Ripple Labs, and BlackRock expressing interest. FTX 2.0 aims to relaunch amidst traditional financial firms’ growing involvement in the cryptocurrency industry.

Dutch Bitcoin Equities ETF: Gaining Access to Crypto Stocks within a Regulated Framework

The new Bitcoin Equities ETF by Melanion Capital on Euronext Amsterdam offers Dutch investors a regulated way to gain exposure to the Bitcoin ecosystem through stocks of crypto-related companies. However, the ETF may have potential discrepancies in correlation to Bitcoin’s performance.

68 Blockchain Tokens Classified as Securities: Implications for Users and Exchanges

The SEC has identified 68 blockchain tokens, including Solana’s SOL and Cardano’s ADA, as securities, affecting over $100 billion assets. The classification raises questions on users’ access and potential regulatory constraints on centralized exchanges, while highlighting the challenge in balancing regulations and blockchain technology’s open nature.

Crypto Market Recovering Amid Regulatory Tensions: Binance vs SEC and CBDC Evaluations

The crypto market shows signs of recovery as the U.S. inflation rate cools and the Fed abstains from raising interest rates. Leading cryptocurrencies report nominal gains, while Binance faces legal battles with the SEC. Key events this week include discussions on central bank digital currencies and support for a draft bill to regulate cryptocurrencies, indicating that regulatory debates play a crucial role in shaping the future of the crypto market.

Bakkt Delists Solana, Polygon, Cardano: Regulatory Impact on Crypto’s Future and Adoption

Bakkt delists Solana, Polygon, and Cardano due to regulatory uncertainty following the US SEC’s announcement considering them securities. This decision mirrors Robinhood, and both are proactively awaiting further clarity on offering a compliant list of coins.

Bakkt Delists Top Cryptos: Regulatory Clashes Impacting Crypto Markets and Innovation

Bakkt delists major cryptocurrencies Solana, Cardano, and Polygon due to regulatory uncertainty, following the SEC’s legal actions against Coinbase and Binance. This highlights the need for clear regulations that ensure a stable trading environment without inhibiting growth and innovation.

Delisting ADA, SOL, and MATIC: Balancing Regulatory Compliance and Crypto Innovation

Bakkt Inc delists Cardano, Solana, and Polygon following their designation as investment contracts by the SEC. This move aims to ensure compliance with regulatory guidelines, but may hinder the growth potential of affected digital currencies and the broader crypto industry.

Maximizing Returns for Institutional Staking Clients: Foundry and the MEV Revolution

The blockchain industry has experienced remarkable growth, with institutions participating in block validation and staking for returns. Foundry offers staking services to institutional clients, tapping into Maximum Extractable Value (MEV) to optimize returns and benefiting the broader blockchain marketplace. Backed by the Digital Currency Group, Foundry provides security and profitability to staking clients.

Solana Hard Fork Debate: SEC Pressure, Decentralization, and Developer Stance Unraveled

Last week, the SEC labeled Solana’s SOL token as a security, leading to intense debate on Crypto Twitter about a potential hard fork. Despite concerns over regulatory clampdowns and the protocol’s relationship with the now-defunct crypto exchange FTX, developers and the Solana Foundation have not seriously considered the fork.

Crypto Dominance Rises Amid Regulatory Crackdown: Will Altcoins Recover?

The crypto market sees Bitcoin, Ethereum, and stablecoins dominance surge to the highest level since February 2021, as investors flee smaller tokens amidst U.S. regulatory clampdown. This shift raises questions about the future of smaller tokens and industry-wide investment behaviors.

eToro’s Delisting Dilemma: Balancing Crypto Growth with Regulatory Compliance

Crypto trading platform eToro will delist tokens like Algorand and Polygon for US customers due to recent SEC legal action against crypto exchanges. Increased regulation raises questions about the future of cryptocurrencies, balancing consumer protection and market validation with potential stifling of innovation.

Polygon 2.0: Navigating Global Regulatory Hurdles and Community Control Challenges

Polygon unveils its upcoming project, Polygon 2.0, focusing on development and deployment outside the US amid a tough regulatory environment. With the aim to attract the global community’s attention, Polygon 2.0 will be a network of ZK-powered L2 chains, emphasizing community-driven decisions and facing challenges from US regulatory crackdowns on digital assets.

Cardano’s Uncertain Future: Market Challenges and Promising Competitors like Ecoterra

Cardano (ADA) experienced an 8% increase within 24 hours, partially recovering from its recent drop partly due to SEC action against Binance and Coinbase. However, with unclear signs of substantial recovery and possible delisting by other US-based exchanges, ADA’s future remains uncertain.

Bitcoin Stability Amid SEC Crackdown: How Altcoins Suffer & Future Market Implications

Amid the SEC’s crackdown on the crypto market, Bitcoin exhibits commendable stability, maintaining support above $25,000 and its market share approaching 50%. However, altcoins experience instability, with SEC allegations implicating tokens like Solana, Polygon, and Algorand.

SEC Targets Solana, Polygon, and Cardano: Unraveling the Security Debate and Market Impact

The SEC claims Solana, Polygon, and Cardano are securities, amidst lawsuits against Binance and Coinbase for offering and trading these tokens. The three coins undergo price decline and defend their regulatory statuses, emphasizing collaboration with regulators and exploring potential legal arguments.