The London Stock Exchange Group is preparing to integrate blockchain technology into its trading procedures for traditional financial assets. This follows a year of research into the feasibility of combining conventional markets with blockchain’s transparent infrastructure. However, the proposed system will exclude cryptocurrencies, focusing on using blockchain to increase efficiency.

Search Results for: RSI

Litecoin’s Bull vs Bear Showdown: Insights and Future Predictions Amid Market Jitters

Litecoin, among the top 10 most traded cryptocurrencies, is making headlines due to recent price fluctuations. Despite a looming market uncertainty, technical indicators suggest a potential rise amid mixed sentiments. Meanwhile, Wall Street Memes (WSM), a meme coin, represents an intriguing growth opportunity, having raised $25 million so far.

Unpacking the Crypto Turbulence: Breakthroughs, Setbacks, and the Future Uncertain

“This week in crypto saw Grayscale Investments move closer to transforming its Bitcoin Trust into an ETF, despite SEC concerns. Meanwhile, turmoil rocked the BitBoy Crypto brand due to allegations against Ben Armstrong. The SEC delayed decisions on multiple Bitcoin ETF applications while Robinhood recovered 55M shares from ex-FTX CEO. These events underscore the balance needed between celebrating advancements and managing challenges in the blockchain and cryptocurrency world.”

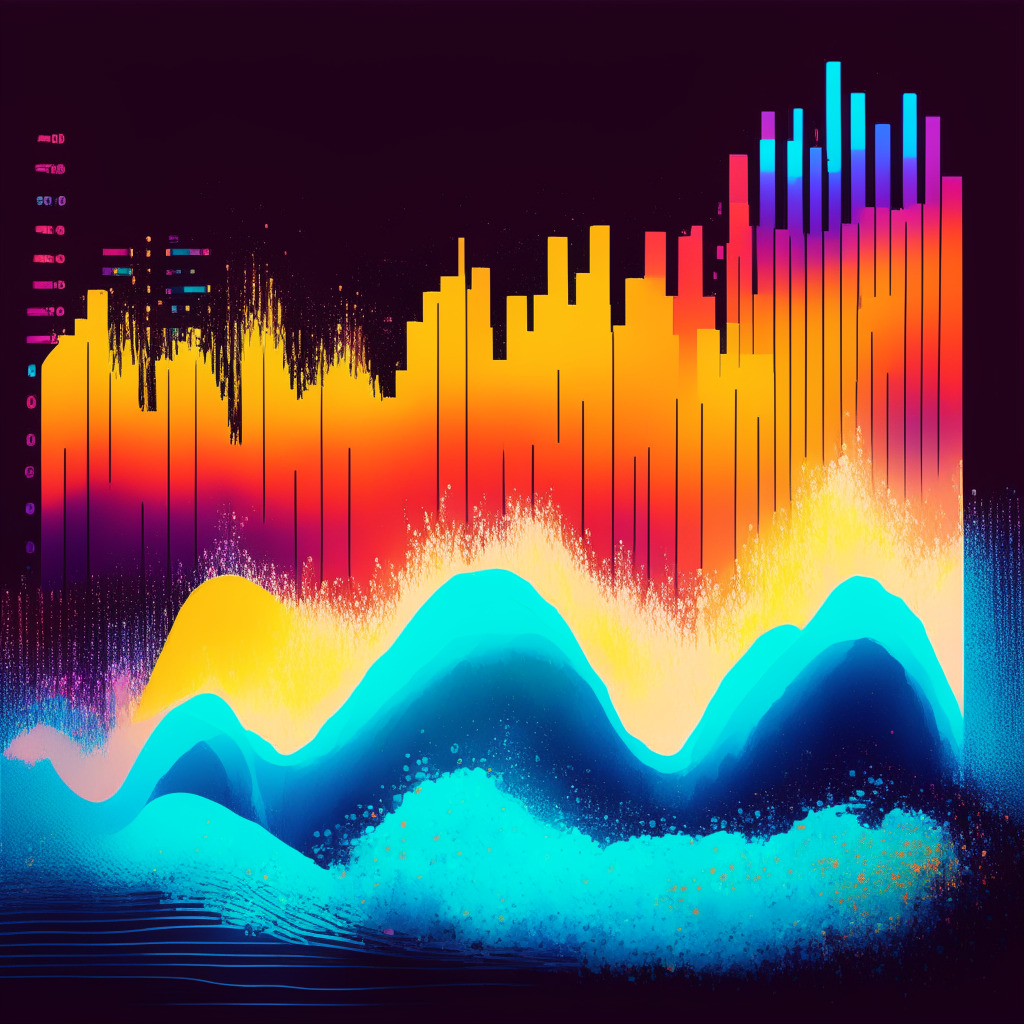

Bitcoin’s Resilient Stand Against Bearish Momentum: A Market Overview

Bitcoin currently holds a value of $25,904.23, with an impressive $8.4 billion trading volume, making it king on CoinMarketCap. However, recent analysis points to a potentially bearish trend, suggesting investors closely watch the $25,400 pivot point for future Bitcoin trajectory.

Ripple’s XRP at a Precipice: A Deep Dive into Emerging Trends and Future Predictions

“Ripple’s XRP currently hovers at a tense $0.497, with speculations regarding whether its descent will persist or rejuvenate. The cryptocurrency is undergoing a consolidation phase, trapped between 0.4900 and 0.550011. Varied movements in factors like the RSI and MACD reflect this uncertainty. Projections suggest that if XRP tumbles below 0.4900, the next solid ground might be near 0.4500.”

Ethereum’s Staking Limit, Argentina’s Bitcoin Surge, and Blockchain Security: Weekly Crypto Roundup

“In an evolving crypto landscape, Ethereum staking providers limited their ownership to 22%, towards decentralization. Bitcoin adoption rises in Argentina contrasting El Salvador’s caution. Binance addresses regulatory environment while security concerns persist despite OpenZeppelin’s Defender 2.0 upgrade. NFTs, CBDCs progress, and stricter crypto regulations emerge.”

Two Key Paradigm Executives Step Down Amid Regulatory Standoff with SEC

“Paradigm’s CFO and General Counsel are set to step down, with Chief Legal Officer, Katie Biber, taking the legal reins. The firm challenges the SEC’s authority to regulate secondary crypto markets and advocates for penalizing companies that haven’t complied with existing regulations. This brings a needed discussion on crypto regulatory ambiguity to the forefront.”

Bitcoin Stumbles as Wall Street Memes Rise: Navigating the Crypto Rollercoaster

Bitcoin’s price fell over 5.5% following SEC’s delay on Bitcoin ETF application approvals. High volatility continues with emerging meme coins such as Shiba V Pepe (SHEPE) and Wall Street Memes (WSM). These developments evidence the evolving and high-risk nature of cryptocurrency investments.

Navigating the Web3 Era: Exploring the Potential and Pitfalls of NFTs in Various Sectors

“Adidas has launched a digital artist-in-residency program in its Web3-based Triple Stripes Studio promoting creative talent within the NFT sphere. However, with the potential risks associated with Web3 and NFTs, volatility and speculation, thorough research and cautious participation are advised.”

MakerDAO’s Blockchain Future: Exploring a Forked Solana Codebase and Risks Involved

MakerDAO’s co-founder, Rune Christensen, proposes the use of a forked Solana codebase to build ‘NewChain’, MakerDAO’s prospective blockchain. Despite connections with Ethereum, this has generated interest and skepticism within the decentralized finance domain. This marks a possible change in direction for MakerDAO’s projects.

Bitcoin Plunge and Emerging Altcoins: Prospects and Pitfalls in Today’s Market

“The recent increase in Bitcoin’s exchange net flow coincides with a decrease in price, suggesting that long-term holders are selling their reserves. Also, a decline in Bitcoin velocity indicates a weak market. Analysts suggest seeking refuge in altcoins like PARROT, ANUBIS, and SOJU which are showing promising growth.”

Fusing AI and Classic Analytics: A Look into yPredict’s Revolutionary Forecasting Approach

“yPredict, a new project under development, aims to revolutionize financial forecasting by blending traditional analytical methods with modern AI technologies. It intends to democratize predictive analytics by introducing a subscription-based Prediction Marketplace, transforming financial data scientists’ earning platform and unlocking new market potential.”

Bitcoin Whales Expanding Their Wealth Despite Price Slumps: Breakthrough or Breakdown?

“Bitcoin ‘whales’ have significantly boosted their stakes, increasing assets by $1.5 billion in late August. This growth occurred despite a slump in BTC’s price, suggesting increased optimism among institutional investors. This follows a court resolution pushing for Grayscale to list a spot Bitcoin exchange-traded fund (ETF) in the U.S.”

Navigating Bitcoin’s Recent Dip: Analyzing Market Reactions and Future Predictions

Bitcoin sees a 4.6% retreat, stirring market interest in buying the dip. Its current circulating supply is nearing its capped total capacity. However, despite a bearish trend, If Bitcoin successfully breaks the $25,400 barrier, significant potential resistance may appear at $25,900 while a bullish crossover could aim towards $26,400 or $27,000.

The DeFi Dilemma: Balancing Game-Changing Innovations with Rigorous Security

“Decentralized finance (DeFi) protocols are reshaping sectors but facing security complexities as shown by the Balancer protocol losing $900K due to a flagged vulnerability. Despite challenges, DeFi’s consistent innovation and adaptability demonstrate resilience. Yet, escalating security incidents suggest a need for more rigorous measures.”

Riding the IOTA Wave: Evaluating Investment Potential Amidst Crypto Fluctuations and Rising Newcomers

IOTA, a cryptocurrency, has recently been showing modest growth, sparking speculation about potential significant investments. Despite challenges, technical indicators hint at continued investor interest. Meanwhile, new entrant Launchpad XYZ aspires to simplify Web3 processes. However, careful evaluation is advised due to inherent high risk in cryptocurrency investments.

Rollbit Coin’s Bull Run: Short-lived Triumph or a Path to Greater Heights? Exploring Launchpad XYZ’s Web3 Ambitions

“Rollbit Coin (RLB) has soared over 800% since July, hitting an all-time high of $0.2131 on August 2. However, its consistent resting at the 20-day EMA and dampened trading volume may imply faltering bullish momentum. Meanwhile, Launchpad XYZ, a Web3 ecosystem, aims to bridge cryptocurrencies, gaming hubs, decentralized exchanges, and more, offering long-term engagement opportunities for crypto enthusiasts.”

Warren Buffett vs. Bitcoin: Is the Oracle of Omaha’s Strategy Outdated in the Crypto Age?

“Even though Bitcoin saw a price surge of 683% in the year following Buffett’s critical comments on non-productive commodities, Bitcoin’s performance unmatched the returns from Berkshire Hathaway’s pertinent stock holdings. The consistent outperformance of Bitcoin’s price against Berkshire Hathway’s shares encourages investors to view Bitcoin as a viable alternative store of value.”

Navigating Stormy Crypto Seas: How BTC Slump Could Spur Market Resurgence

“The cryptocurrency market dips as BTC slumps towards a two-week low. However, experts suggest this downside risk could hold potential favoring points for traders. On-chain monitoring suggests possible losses in September, but a surprise rally could also take place, proving the market’s volatility.”

Infamous Chisel vs Blockchain Innovation: A Tug-of-War in the Crypto Space

“The Russian malware, Infamous Chisel, is presently threatening cryptocurrency wallets and exchange applications, specifically targeting Brave browser, Binance and Coinbase exchanges, and Trust Wallet. The malware provides persistent access to infected Android devices, constantly extracting valuable information. Alchemy’s recent support for Base opens new opportunities for blockchain development.”

Unveiling Polygon’s Open Source Developer Stack: Scalability Promise vs. Skepticism

Polygon’s new open-source sidechain developer stack is set to power Layer 2 solutions on Ethereum, backing its commitment to the evolution of the Ethereum ecosystem. Key to this advancement is the integration of zero-knowledge proof technology, considered critical for the scaling of the Ethereum blockchain. However, critics raise concerns about potential inefficiencies and differing architecture.

Infamous Chisel Malware: The Hidden Threat to Crypto Wallets on Android Devices

“Crypto wallet owners are warned of a new malware, “Infamous Chisel,” linked to the Russian military intelligence agency. It targets Android devices, primarily Binance, Coinbase and Trust wallet applications, posing a significant threat to crypto security.”

Bitcoin ETFs: A Tug of War between Market Fluctuations, Regulatory Battles and Future Stability

Despite an 11% drop in August Bitcoin’s price, the market remained relatively stable due to the possibilities of a Bitcoin ETF. This was spurred by Grayscale’s legal victory against SEC’s planned obstruction of its Bitcoin Trust conversion to an ETF. However, SEC’s delay in approving other ETF applications signals authorities’ hesitancy to fully embrace cryptocurrencies. Regardless of regulatory uncertainties and market oscillations, optimism for cryptocurrency technology’s future remains.

Blockchain Philanthropy: Celebrities Embrace Crypto for Charity, Balancing Potential and Skepticism

Celebrities Oprah Winfrey and Dwayne Johnson have integrated cryptocurrency into the People’s Fund of Maui, a philanthropic effort aiding wildfire victims. The fund embraces various digital currencies, including Bitcoin and Ethereum, in a move towards mainstream adoption, although concerns persist about the crypto market’s volatility and potential misuse.

Crypto Regulation and Legal Landscape: How Bankman-Fried’s Fraud Trial Could Reshape Everything

The FTX crypto exchange founder, Sam Bankman-Fried, may face high charges from his expert witnesses during his fraud trial. The dynamics of this trial could shape the future regulatory landscape, impacting the function of blockchain markets. As the crypto industry evolves, a comprehensive understanding of blockchain technologies within the justice system is crucial.

Pepe Coin’s Plunge, Crypto Whales, and Rise of Sonik Coin: A Tale of Meme Cryptocurrencies

Pepe Coin has experienced a steep loss in recent weeks, falling 81% from its May-high. Yet, some ‘crypto whales’ are still acquiring the coin, hinting at a temporary resurgence. Potential further declines may precede a recovery. There’s notable risk for average retail investors due to the coin’s lack of fundamental utility and susceptibility to market whims. Newcomer SONIK, an ERC-20 meme coin, is filling PEPE’s void, boasting a robust foothold and innovative tokenomics.

Adidas’ Web3 Manoeuvre: Courting Crypto Generation While Fueling Digital Art Innovation

‘Residency by Adidas’ offers a new platform for web3-powered digital artists to innovate and create valuable connections within the Adidas community. This venture seeks to bridge physical and virtual worlds with collaborations and its introduction takes place at the Korean Blockchain Week with partnership by NFT Now.

Navigating the Choppy Waters: Crypto Regulation’s Impact on Future Market Stability

The future of significant cryptocurrencies like Bitcoin may hinge on regulation. This comes as the U.S. Securities and Exchange Commission (SEC) delayed crucial decisions on spot bitcoin exchange-traded fund (ETF) applications, causing major cryptos to lose their weekly gains. The impact of this emerging era of crypto regulations remains difficult to predictable, posing a paradox of digital currency liberation versus regulatory control.

Coinbase vs SEC: Unfolding Regulatory Tensions and the Future of Blockchain Technology

“While Congress actively drafts cryptocurrency regulations, the SEC persists on its own path, complicating the regulatory landscape. This raises questions regarding the SEC’s authority over digital assets. Recent losses to Ripple and Grayscale intensify the need for regulatory clarity, underlining the SEC’s inconsistencies in classifying cryptocurrencies.”

OKX’s Bold Exploration into India’s Crypto Space Amid Array of Regulatory Hazards

Crypto exchange OKX is venturing into India’s web3 space despite regulatory uncertainties. The firm aims to engage and collaborate with India’s developer community, even as the authorities focus on stringent tax measures and anti-money laundering protocols for cryptocurrency. OKX’s strategy showcases an approach of cautious audacity towards the Indian market.

Ethereum’s Liquid Staking: Controversy Erupts over 22% Validator Cap Debate

Ethereum liquid staking providers, including Rocket Pool, StakeWise, Stader Labs, and Diva Staking, have agreed to a self-imposed limit of 22% ownership of validators to maintain Ethereum’s decentralization. Proposed by Ethereum core developer Superphiz, this limit is seen as a means to prioritize network health over profits, requiring at least four major entities to finalize the chain. However, Lido Finance, the leading Ethereum staking provider, opposes this limit.

Australia’s Crypto Future: Binance’s Battle for Acceptance Amid Regulatory Tensions

“Cautious optimism pervades the Australian crypto community as Binance Australia General Manager Ben Rose voices confidence that regulators will create suitable guidelines for digital assets, despite recent regulatory tensions and banking blocks. Restoration of banking relationships and resuming fiat ramp service are top priorities.”