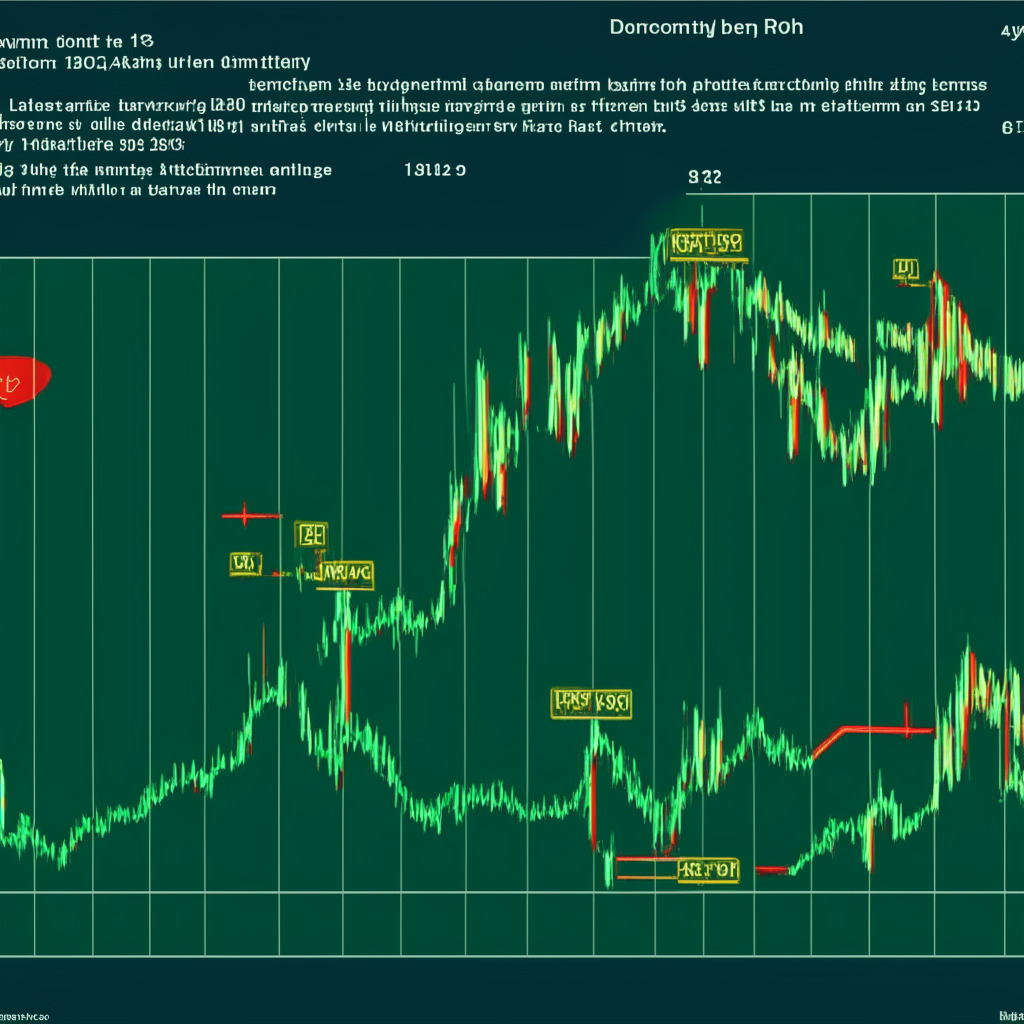

Amid market choppiness, Dogecoin’s price remains stagnant, showing uncertainty with short-body candles on the daily chart. A falling wedge pattern suggests a possible correction phase, but a bullish recovery could emerge if it breaks the overhead trendline. Nevertheless, high market volatility requires exercising caution before investing.

Search Results for: Dogecoin

Dogecoin’s DRC-20 Token Boom: A DeFi Pathway or Network Congestion Risk?

Dogecoin’s daily transaction volume briefly surpassed Bitcoin and Litecoin due to the introduction of the DRC-20 token standard, paving the way for potential decentralized finance services on its blockchain. However, critics argue this may lead to network congestion and high fees, impacting its adoption as an everyday currency.

Dogecoin Surpasses Bitcoin in Transaction Volume: Scalability Opportunity or Congestion Risk?

Dogecoin (DOGE) has experienced a significant increase in daily transaction numbers, surpassing Bitcoin, primarily due to the growing interest in minting DRC20 tokens. This highlights Dogecoin’s scalability and potential for global acceptance, but also raises concerns about network congestion and the need for dedicated Layer-2 solutions.

Dogecoin’s Price Recovery: Analyzing Bullish Reversal Pattern & Market Uncertainty

The DOGE price might see a bullish upswing in the upcoming week with several lower price rejections at the support level of $0.071. Technical indicators, such as the 4-hour Relative Strength Index, suggest potential bullish movement, raising the possibility of an upswing towards the overhead trendline.

Twitter 2.0: Dogecoin’s Role and the Future of Crypto under Linda Yaccarino’s Leadership

Linda Yaccarino takes over as Twitter CEO under Elon Musk’s influence, with a possible integration of payment services featuring Dogecoin and cryptocurrencies. The future remains uncertain as market conditions and Yaccarino’s leadership could impact adoption and recognition of digital currencies.

New Twitter CEO’s Ties to Dogecoin: Will She Embrace Crypto or Keep It in Limbo?

Linda Yaccarino, the newly announced CEO of Twitter, has connections with the Dogecoin and Shiba Inu communities. Although her stance on cryptocurrencies remains unclear, her past experiences and online presence suggest potential support for crypto integration on the platform.

Dogecoin’s Falling Wedge Pattern: Potential for a 47.8% Rally Amid Market Downturn

Dogecoin (DOGE) price experienced a sharp 31.6% correction, from $0.105 to $0.07, following a falling wedge pattern. A bullish breakout could potentially trigger a 47.8% rally, but the ongoing correction is expected to persist. Strong bearish momentum is evident in technical indicators.

Dogecoin’s Struggles vs Rising Meme Tokens: Is Recovery Imminent or Far-Fetched?

With Dogecoin’s recent losses, traders are gravitating towards other meme tokens like Pepe and SpongeBob. However, DOGE’s chart suggests a possible rebound, with a brighter outlook in its relative strength index and support level. Market trends for meme tokens should be observed with optimism and caution as the cryptocurrency world unfolds.

Elon Musk’s Tweet Boosts Milady NFTs: Are They the Next Dogecoin or Just a Short-lived Hype?

The Milady NFT collection saw a 60% price surge after recognition from Elon Musk, drawing parallels to Musk’s influence on dogecoin. However, the collection’s creator faces controversy, and short-lived spikes in token values following Musk’s tweets raise skepticism about the sustainability of Milady’s newfound popularity and valuation.

Frog-Themed PEPE vs Dogecoin: The Battle for Memecoin Supremacy and Market Capitalization

Memes have given rise to “memecoins” like PEPE and Dogecoin, created for entertainment purposes. Despite uncertainty in their future, these coins exemplify the growing influence of internet culture in the financial world and cryptocurrency market.

Dogecoin Struggles Amid New Meme Tokens Rise: Can DOGE Make a Comeback?

Dogecoin’s value has fallen 2.5% in the past 24 hours, experiencing an 8% week-over-week drop and a 30-day decline of 11%. In contrast, newcomer SpongeBob (SPONGE) has gained a staggering 9,000% since its launch. A major issue for Dogecoin is its dependence on Elon Musk for traction, which has lessened as Musk remains less vocal about crypto. Meanwhile, SPONGE emerges as the new hot meme token, gaining interest from traders and investors.

Dogecoin Price Correction: Exploring Falling Wedge Pattern and Potential Recovery Rally

The Dogecoin price is currently experiencing a correction phase within a falling wedge pattern, indicating potential entry opportunities for traders. A bullish breakout from the pattern’s resistance trendline is required for a fresh recovery rally. However, both bullish and bearish influences contribute to market uncertainty, requiring investors to conduct extensive research before investing.

Pepe Coin Skyrockets: Outpacing Dogecoin and Shiba Inu – A Meme Coin Phenomenon or a Risky Gamble?

Pepe coin (PEPE) has quickly surpassed dogecoin and shiba inu in trading volume, reaching a market cap of $366 million. Factors contributing to PEPE’s success include listings on major crypto exchanges and growing investor interest. However, the inherent risks of meme coin investments demand caution and research.

Ditching the Sinking Ships: Why Investors are Flocking to Presale Gem Sparklo Amidst Dogecoin and Monero Downfalls

In the highly volatile and unpredictable world of cryptocurrencies, even old guards like Monero (XMR) […]

Unraveling the Ripple: Bitstamp’s Glitch, XRP’s Price Plunge, and Ties with Bitso

Bitstamp Exchange quickly resolved a temporary snag affecting XRP trade, halting affected orders to fix the glitch. This sparked rumors of problems with Bitcoin and Dogecoin pairings, triggering an uncharacteristic plunge in XRP’s price. Despite these issues, partnership between Bitstamp and Ripple remains strong, utilizing XRP’s potential for seamless cross-border payments.

Swinging DOGE Trends: A Dance between Rebounds and Depreciation, and a Look at Rising TG.Casino

Dogecoin (DOGE) has seen a 14% dip in prices since the start of the year, with its 30-day EMA lingering beneath its 200-day average, indicating a period of decline. Although its community remains hopeful for integration into cryptocurrency payment by a former Twitter-owned company, speculation about future spikes in value remains uncertain. Meanwhile, potential investors are exploring other coins with tangible use-cases, such as TG.Casino’s native TGC token.

South Korean Crypto Market’s Exponential Rise Amid Regulatory Optimism: A 2023 Mid-year Analysis

“South Korea’s virtual asset market recorded a buoyant performance in H1 2023, reaching a market cap of $21.1 billion, a 46% increase from last year. Crypto exchanges enjoyed an 82% rise in operational profits, supported by an 11% growth in deposits. However, daily transaction value and the number of crypto traders experienced slight decreases. New legislation promises to enhance transparency and security in the crypto trade, signaling the increasing legitimization of cryptocurrencies.”

Shaky Ground: Navigating Crypto Markets amidst Bitcoin Stagnation and the Rise of Memecoins

“Cryptocurrencies like Bitcoin and Ether show mixed responses to external factors such as U.S. economic performance and labor market data. Attention is turning towards low-cap coins, offering volatile, short-term gain opportunities. Crypto presales might offer a less-risky, high-reward strategy for investors willing to navigate a delicate balance of risk and return.”

From Wall Street Jokes to Commanding Crypto: The Rapid Ascent of Wall Street Memes Coin

“In a week, Wall Street Memes ($WSM) has become the third most traded meme coin with $95 million 24-hour trading volume. Listed on Gate.io, CoinW and others, $WSM offers token holders capital appreciation and yield-earning potential, revolutionizing financial markets by advocating for the little guy.”

Unleashing the Meme Kombat Revolution: Merging Gaming, Meme Coins and Gambling

“Meme Kombat, a new platform in the crypto world, aims to combine gaming, meme coins and gambling. It stands out for offering rewarding staking programs and by integrating wealth accumulation with gaming fun. A crucial feature is its audited security, yielding no significant issues.”

Rising Star: Wall Street Memes Coin’s Astonishing Journey from Debut to 4th Most-Traded Meme Coin

Wall Street Memes ($WSM) has become the fourth most traded meme coin globally within a week of its listing on OKX, with nearly $60 million worth of $WSM traded. This new player in the meme coin market has gained popularity due to its connection with Elon Musk and its distinct feature – a staking system for users. While $WSM’s future seems promising, potential risks and challenges specific to meme coins should be considered carefully.

Cryptocurrency Market: A Tug of War Between Bulls and Bears in Flux

“In the ebb and flow of the cryptocurrency market, BTC held its ground despite the fluctuating market and signs of trader stagnation. Investment in the market continues, potentially signaling a market reversal. However, competitive tension and high unpredictability dominate, urging traders to tread cautiously amidst volatility.”

Surge of Wall Street Memes Token: A Game Changer or Just Another Meme Coin?

The Wall Street Memes token has raised $1.4m in 24 hours, setting the stage for one of the year’s largest presales. Its goal is to leverage the meme stocks movement into cryptocurrency, offering an innovative approach to decentralization in finance. The token will be listed on multiple top-tier exchanges from September 26th, with potential for significant fundraising acceleration. Not merely an amusing variant of meme coin, its vibrant online community and successful NFT Collection minting point to a promising launch.

GALA’s Market Struggles Amid Co-founders’ Legal Standoff: A Sign of Distress or Potential Opportunity?

“GALA faced a 7.5% price decline over the past week, attributed to ongoing legal problems. Despite increased trading volume, weak RSI and moving average signal troublesome health. However, an active network and a growing user base could stimulate recovery.”

Macro Winds Drive Traders to Niche Markets: Highs and Lows in the Crypto Landscape

“As Bitcoin and Ether face resistance, traders are exploring niche markets, notably new coins like XDOGE and EmotiCoin. Rising newcomer, MoonDAO token, is drawing attention too. Alternatives to these include crypto presales, offering great potential returns, though with high risks.”

Crypto Market Rollercoaster: Bear-Bull Tug of War and the Uncertain Future Ahead

“The crypto market displayed broad losses, with Bitcoin, Ethereum, and Binance Coin experiencing downturns. However, Ripple registered a slight increase. This current state of unease reflects investors’ uncertainty about the crypto market’s direction. Market trends hint at the continuous struggle between bullish and bearish tendencies influencing the market’s future.”

Navigating the Whirling Tide: RLB’s Performance in the Midst of Crypto Market Instability

Despite Rollbit Coin’s (RLB) recent price decline amidst a broader crypto market slowdown, the currency’s compelling economics and deflationary nature help navigate market downturns. Meanwhile, Wall Street Memes’s token ($WSM), a new contender with a disruptive status, mirrors the buzz of popular coins but also highlights the volatile nature of cryptos.

Exploring Bitcoin BSC – Bitcoin’s New High-Yielding Staking Alternative

Bitcoin BSC, a new staking cryptocurrency, has recently secured over $2 million during its presale now offers a potential better risk-reward than Bitcoin due to its yield-generating staking feature. Unlike other Bitcoin alternatives, Bitcoin BSC operates on a cost-effective BNB Smart Chain network. It offers transparency, audited smart contracts, and guaranteed liquidity upon listing on Uniswap’s decentralized exchange.

Riding the Bull and Bear Market: Crypto Rebounds Amid Regulatory Challenges

“The digital era brought advancements including the surging value of Bitcoin and other altcoins. Despite potential leverage liquidations for altcoins like Solana’s SOL, coins like Bitcoin Cash, Maker DAO’s MKR, and Ether are on the rise. Important influences on the market include regulatory oversight, legal challenges, and increasing participation from traditional financial institutions.”

Surging Bitcoin and Altcoins Amidst Market Volatility: An Eye on Risk and Reward

“Bitcoin has shown strong upward move, with other cryptocurrencies like XRP, ETH, SOL, TRX, and Dogecoin also seeing price hikes. The market spotlight is on SOL which, after suffering a drop, has now seen sharp recovery. Market conditions urge investor vigilance due to the potential impact of liquidations and exaggerated price movements on crypto market volatility.”

Crypto Market Cap Surges: Ties to Inflation Data and Federal Reserve Rates

Cryptocurrency market capitalization has risen by 1.24%, reaching $1.035 trillion as of September 14, largely due to gains in Bitcoin, Ethereum, and Solana. This increase reflects eased inflation concerns and speculation surrounding a potential pause on Federal Reserve interest rate hikes. Additionally, solid fundamentals or promising technical analysis have led to gains in other cryptocurrencies such as Hedera, Wall Street Memes, THORChain, Bitcoin BSC, and Curve DAO.

Cardano’s Ambiguous Journey: Rising against Odds, yet Challenged by Regulatory Shadows

“Cardano (ADA), the layer-1 blockchain protocol, has been cautiously ascending, with a 6% uptick since Monday but still undergoing a 30% drop since July. The uptrend moved ADA’s market cap ahead of Dogecoin’s, making it the seventh-largest crypto by market cap. However, ADA’s potential U.S adoption might be hindered by the U.S SEC’s attempts to label ADA an unregistered security.”