Gary Gensler, Chair of the Securities and Exchange Commission (SEC), has adopted a circumspect approach towards cryptocurrencies since his appointment, voicing concerns over potential systemic risks. Amid criticism, he increased his legal actions against prominent industry players like FTX, Binance, and Coinbase. However, a recent judgement favoring Grayscale could compel SEC to reconsider its regulatory rigidity towards the crypto market.

Search Results for: JPM Coin

Navigating the Paradox: The Risks and Rewards of AI Adoption in the Media Industry

“Media companies grapple with the use of AI technologies like OpenAI’s ChatGPT. While some, including CNN and the New York Times, have implemented measures to prevent AI’s access to their content, others like Netflix explore AI’s potential. Amid potential and risks, businesses tread the road ahead cautiously.”

USTY Tokens: Revolutionizing the Financial Sector Despite Intense Rivalries and Market Volatility

“USTY tokens, a tokenized version of shares in a U.S. Treasury bond ETF, are the prime example of the tokenization of real-world assets. This transition towards tokenization could create a $5 trillion market within five years. Despite challenges, tokenization has potential to transform financial infrastructure, backed by nearly sixfold increase in demand for tokenized Treasuries to $622 million this year.”

Downtrend Departure: The Future of Crypto and Possibility of an Upturn Amid Fluctuating Regulatory Landscape

“Analysts from a leading American bank have observed the recent cryptocurrency market downturn and predict its end, citing a decline in open interest in Bitcoin futures contracts. However, this prediction does not account for unpredictable future disruptions such as regulatory or economic changes.”

Cryptocurrency Disruption: Diving Deeper into Futures, Influences and Legal Ambiguities

The report by JPMorgan suggests the open interest in Bitcoin futures at the CME is nearing the end of its cycle, indicating an optimistic approach to the near-term impact on crypto markets with a limited downside. The SEC’s ongoing Ripple case, market dynamics, and tech assets adjustments are influencing market fluctuations. The future course for digital assets will be shaped by macroeconomics, regulatory developments, and industry-specific events.

The Digital Canvas Mourns While Crypto Regulation Tightens: A Week in Blockchain Review

“Cheems, the Shiba Inu who inspired countless memes and an NFT collection, sadly passed away. Governmental involvement in crypto continues, with Kenya probing Worldcoin and Somalia banning crypto-friendly messaging app Telegram. Individual Bitcoin miner successfully mined block 803,821, revealing competitiveness against mining pools.”

Crypto Markets Calm as Storm Brews Behind the Scenes: Failures, Diversification, and Anticipated Swings

Major cryptocurrencies showed a stable trend, despite turbulence like the slump of SHIB partially due to its unsuccessful Ethereum layer 2 network, Shibarium. Ethereum co-founder, Vitalik Buterin, transferred $1 million worth of cryptocurrency whilst facing a market downturn. This turbulent environment led to a strategic shift for bitcoin miners into new business areas.

Exploring the New Horizons: How Crypto Miners Diversify Revenue Streams into AI Market

“Bitcoin and Ether miners are branching into new business areas including high performance computing services for the artificial intelligence industry, seeking to diversify revenue and reduce crypto reliance. This follows the Ethereum blockchain Merge, leaving a surplus of GPUs on the secondary market, used for gaming, rendering services and mining other cryptocurrencies.”

Revolutionizing Finance: Blockchain and the Future of Asset Tokenization

“Blockchain technology has the potential to revolutionize financial assets trading by tokenizing real world assets. This process can enhance liquidity, reduce costs, and improve risk management. However, with the goal of benefiting economic growth and SMEs, a more standardized tokenization process must also accurately represent financial obligations, liabilities, and cash flows.”

Decentralized Finance: Far from Dead or a Doomed Experiment?

“Despite setbacks and criticisms, such as the recent Curve Finance controversy, the DeFi sector is far from ‘dead.’ It’s actually seeing significant interest from corporate stalwarts like Mastercard, Visa, and BlackRock, all harnessing its efficiency-enhancing capabilities. Decentralized finance technology promises transparency, efficiency, disintermediation, and self-custody, indicating the sector’s potential for long-term growth.”

Navigating the Turbulence: CFO Change, Rising Revenues and Legal Battles in Digital Currency Group

Digital Currency Group (DCG) has appointed Mark Shifke as the new CFO, following the departure of former CFO Michael Kraines. DCG has reported Q2 revenues of $216 million but also consolidated quarterly losses of $79 million. Ongoing negotiations to settle claims for defunct subsidiary Genesis Global Holdco and a lawsuit from creditor Gemini Trust hint at turbulent times for DCG.

The Inevitable Clash: Central Bank Digital Currencies Versus Private Banks

“Central bank digital currencies (CBDCs) aim to regain monetary control by utilizing the blockchain, posing a threat to private financial institutions. Amid this, 93% of central banks are conducting CBDC research, predicting 24 CBDCs in circulation by 2030.”

Unveiling FedNow: Monetary Revolution or Strategic Response to Blockchain?

“The ‘FedNow’ service, launched by the U.S. Federal Reserve, aims to make financial transactions swifter. However, its inception may also signify a move towards a Central Bank Digital Currency (CBDC), potentially merging traditional banking with emerging blockchain technologies.”

Navigating the Crypto Course amidst the United States’ Macroeconomic Shocks

The crypto market closely watches upcoming U.S macroeconomic events. Despite a favorable swing in the CPI, the US central bank sticks to hiking the interest rate. The hawkish financial stance affects crypto prices, increasing investor concerns about central bank overreach. Other significant influences include retail sales, industrial productivity, home sales, and weekly jobless claims data.

Unleashing AI in Crypto Trading: A Leap of Progress or a Pandora’s Box?

Brett Harrison, former FTX.US president, has launched Architect, a new trading platform harnessing AI for trading strategies. The platform could equip traders to buy cryptocurrencies like Bitcoin on Coinbase when the market price drops, while also fostering an understanding of the technology. However, the integration of AI into trading raises questions about potential complications.

The Future of Tokenization: CBDCs, Decentralization, and Global Monetary Landscape

The IMF and BIS published reports discussing the future of the monetary system and the potential impact of crypto and central bank digital currencies (CBDCs) on tokenization. Tokenization represents claims digitally on a programmable platform, integrating records of underlying assets with their transfer rules and logic. The reports emphasize tokenized CBDCs’ role in maintaining settlement stability and “singleness of money.”

Crypto World Update: Scandals, Legal Battles, Innovations, and Safety Concerns

This week in crypto, deception and legal battles intertwined with ambitious innovations. Key highlights include Crypto.com’s internal teams trading tokens for profit, Valkyrie Funds filing a Bitcoin ETF application, and global governments exploring digital currency regulations. Safety remains crucial as crypto crime and hacks persist.

From Bankruptcy to Galaxy Digital: Examining Leon Marshall’s Crypto Journey and Industry Resilience

Crypto veteran Leon Marshall joins Galaxy Digital as global head of sales, bringing valuable experience from Gnosis, CryptoCompare, UBS, and JPMorgan Chase. Despite recent challenges, Marshall remains optimistic about the digital asset industry’s future and Galaxy’s role within.

Ripple’s Singapore Milestone: Growing Influence and Crypto Regulation Balancing Act

Ripple received in-principle approval for the Major Payments Institution License in Singapore, allowing it to offer regulated digital payment token products and services. This move expands the use of Ripple’s On-Demand Liquidity service and reinforces its commitment to engaging with regulators worldwide.

Embracing Purpose Bound Money: Revolutionizing Finance or Inviting Scrutiny?

Singapore proposes a common standard for digital currencies, including stablecoins, tokenized bank deposits, and CBDCs, with contributions from major banks, investors, and global leaders. The Monetary Authority of Singapore’s whitepaper on Purpose Bound Money (PBM) aims to revolutionize the financial landscape by allowing senders to specify conditions and improving settlement efficiency, merchant acquisition, and user experience. However, increased regulatory scrutiny is a challenge to be considered in this rapidly growing digital financial landscape.

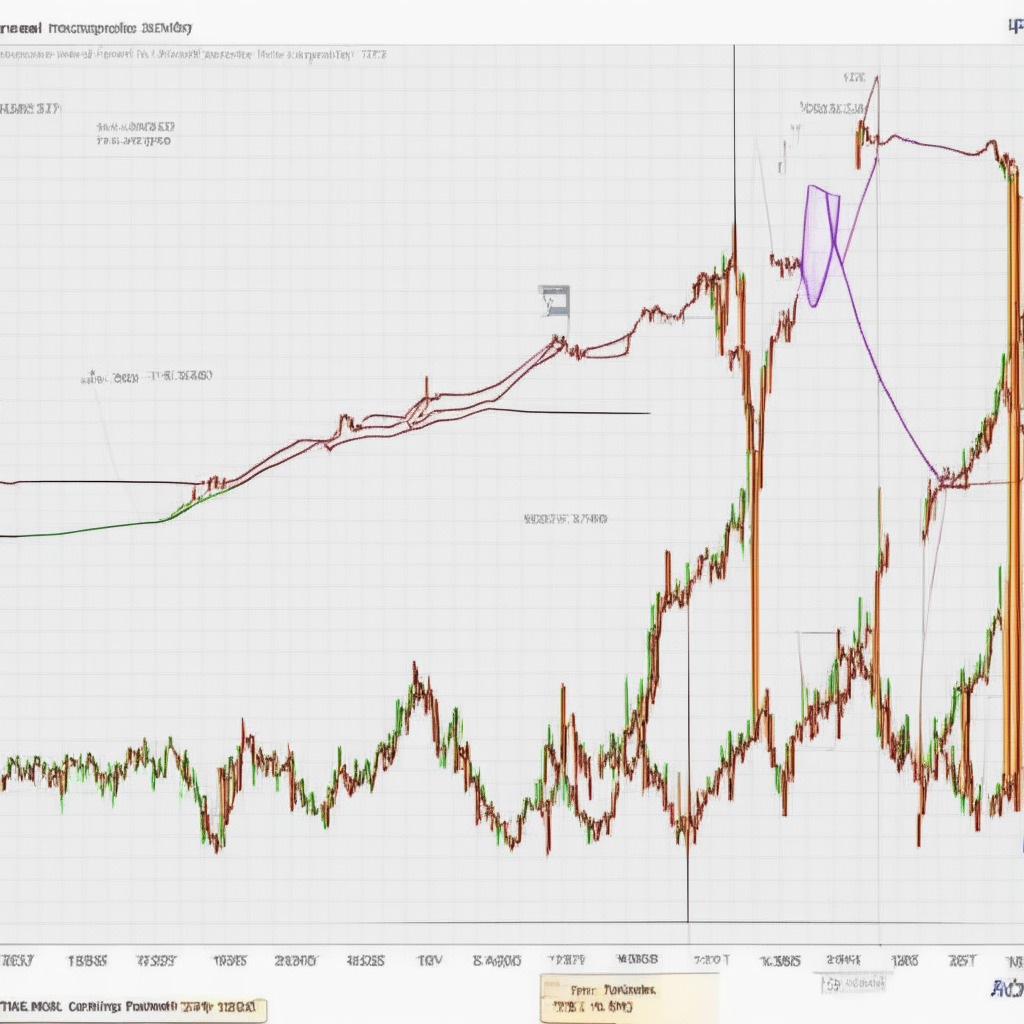

Ethereum Price Rally: Analyzing the Resistance Barrier and Potential Breakout Prospects

The Ethereum price recently experienced an 8.5% surge after encountering a crucial support level, reaching a resistance zone of $1775-$1765. However, selling pressure halted the rising momentum, suggesting possible consolidation before a significant recovery rally. JPMorgan recently backed Ethereum, despite some disagreements within the crypto community.

ETF Hopes and Market Maker Controversies: A Dissection of Crypto’s Bullish Potential

Crypto enthusiasts discuss market fluctuations, the impact of BlackRock’s potential Bitcoin ETF, and concerns over internal market makers on exchanges like Binance. As DeFi’s automated market makers offer a transparent alternative, UK crypto laws reflect growing mainstream adoption of digital assets.

How Revealing Hinman Documents in Ripple-SEC Case May Benefit Ethereum and the Crypto Sphere

JPMorgan analysts believe that the release of the Hinman documents in the Ripple vs SEC legal battle could benefit Ethereum. Internal SEC messages from 2018 suggest ether did not resemble a security, which could create a “regulatory gap” for decentralized tokens. This may influence US congressional efforts to regulate the cryptocurrency industry, potentially enabling ether to dodge the security designation.

Stable Crypto Weekend Meets Regulatory Developments: Market Impact and the Future of Decentralization

The cryptocurrency market showed stability over the weekend, while a federal judge approved a temporary agreement between the SEC and Binance. This agreement ensures only Binance.US employees access customer funds amidst ongoing legal developments and increased emphasis on decentralization in the industry.

SEC

The JPMorgan research report suggests that recent lawsuits against Binance and Coinbase by the SEC highlight the urgent need for a comprehensive US regulatory framework in the crypto industry, addressing responsibilities of the SEC and the CFTC.

TASE’s Blockchain PoC Success: Tokenizing Bonds, Fiat & Future Impact on Financial Industry

The Tel Aviv Stock Exchange (TASE) completed the proof of concept phase of Project Eden, exploring blockchain technology for issuing and settling government bonds. The PoC featured tokenization of the Israeli Shekel and used Ethereum Virtual Machine-compatible blockchain, with support from major international and local banks.

Blockchain Revolution in Banking Meets AI-Generated Fraud: Unleashing Potential or Unraveling Trust?

JPMorgan collaborates with six Indian banks to enable real-time interbank dollar settlements on its blockchain-based platform, Onyx. However, concerns emerge over AI-generated fraud in the crypto and blockchain sectors. Meanwhile, the UK’s APPG proposes recommendations for crypto regulation, and the US Treasury Department’s sanctions on Tornado Cash face legal challenges.

Ethereum’s Journey: Reshaping Finance, Debating Principles, and Navigating Challenges

Ethereum has evolved into the most active blockchain, supporting novel financial systems and reshaping future payment methods. Despite co-creator Vitalik Buterin’s concerns of a “dystopian future,” Ethereum has demonstrated remarkable flexibility and foresight, adapting to challenges and pushing technological boundaries in finance and technology.

Tokenization Revolution: Taurus, Polygon & the Future of Mainstream Finance

The partnership between Swiss digital asset infrastructure provider Taurus and Ethereum scaling network Polygon highlights the growing traction of blockchain technology and tokenization within mainstream finance. With numerous financial institutions seeking blockchain-agnostic and token-agnostic infrastructure, the landscape will continue to evolve, attracting players from various sectors and revolutionizing asset management solutions while addressing security, scalability, and compliance concerns.

Crypto Market Bounceback: Cautious Optimism Amid Historically Low Trading Volumes

Bitcoin and other cryptocurrencies show mild bounceback, but investors should maintain caution as weekly trading volumes drop to historically low levels. Market sentiment remains negative with Bitcoin finding it difficult to maintain a bullish momentum above $30,000. Exercise caution and conduct thorough research before investing in cryptocurrencies.

US Default Risk Looms: Stock Market and Crypto Impact, Market Turbulence Ahead?

The US debt ceiling deadlock poses a significant threat to financial markets worldwide; however, the stock and crypto markets remain relatively unaffected. JPMorgan warns of potential volatility surge as the default deadline approaches, which could impact the cryptocurrency market and influence Bitcoin’s support level.

US Bank Mergers: Solving the Crisis or Creating Riskier Financial Giants? Debating Pros and Cons

US Treasury Secretary Janet Yellen discussed the possibility of more bank mergers amid the ongoing banking crisis. However, concerns arise over the growing power of financial giants, potentially posing a threat to Americans and the economy. The delicate balance between ensuring stability and preventing “too big to fail” institutions remains a challenge.