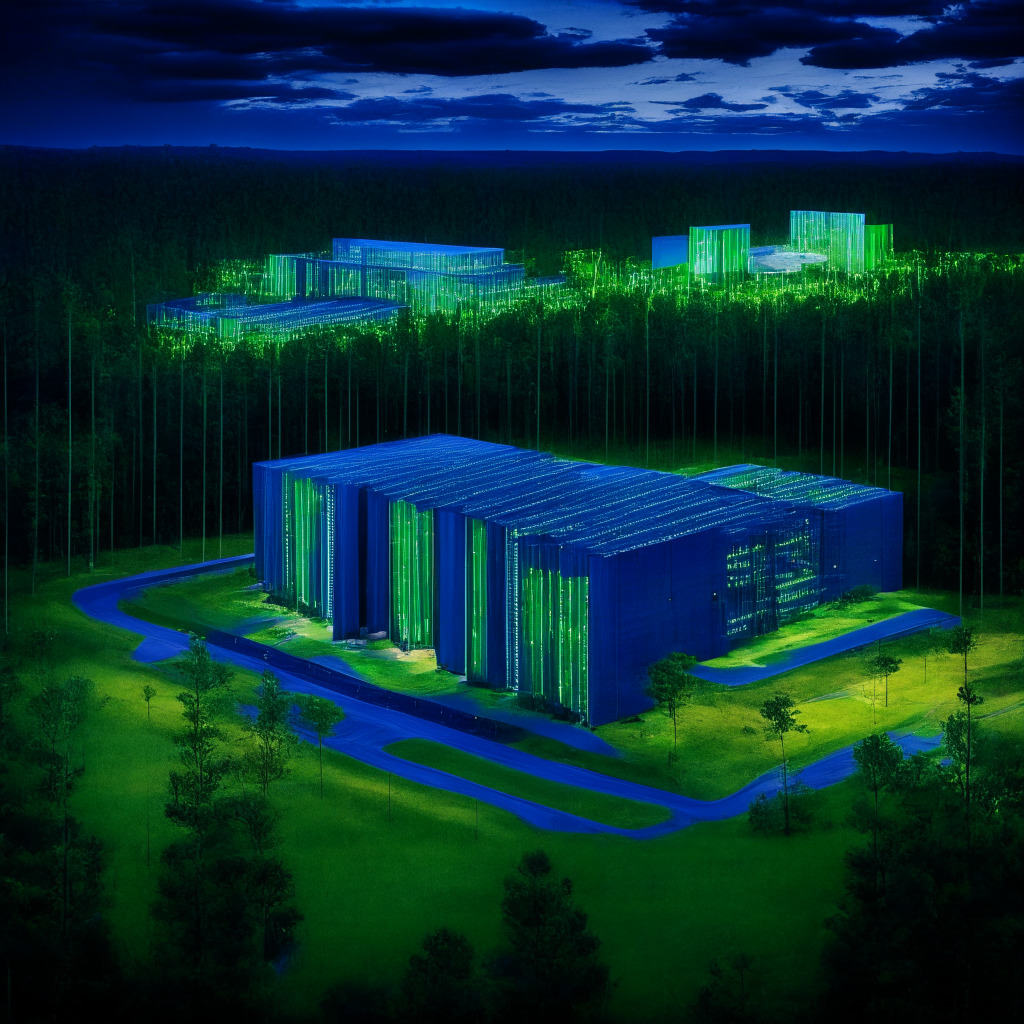

Bitcoin mining is moving towards renewable energy, with Genesis Digital Assets Limited opening a hydroeletricity-powered data center in Sweden. This reflects a trend, proving that Bitcoin mining and clean, renewable energy can coexist, which potentially addresses the industry’s environmental concerns.

Search Results for: New Bitcoin City

The Dollar’s Tenacity: How Its Resilience Could Influence Bitcoin’s Pricing Trajectory

“Recent currency instability in China, Russia, and Argentina has cast doubt on de-dollarization, potentially affecting Bitcoin’s pricing trajectory. The stability of the USD forces struggling nations to rethink their financial strategies. This, coupled with unpredictability of cryptocurrencies like Bitcoin, underscores the need for careful investment and staying updated with currency trends.”

Navigating Bitcoin’s Dance with US Inflation-Adjusted Bond Yield: Unraveling Market Movements

“Recent market analysis shows Bitcoin and the U.S. inflation-adjusted bond yield showing the strongest negative correlation in four months. This dynamic suggests that traditional finance and macro influences on Bitcoin’s price movement are audible once more. This trend showcases the influence of real yields on high risk alternatives such as technology stocks and cryptocurrencies.”

The Global Disparity in Bitcoin Mining Costs: An Eye-Opener or Misleading Data?

“The disparities in Bitcoin production cost globally are due to varying electricity costs. Mining a single Bitcoin in Italy could cost $208,500, whereas in Lebanon it’s 783 times cheaper. However, only 65 countries are profitable for solo Bitcoin miners considering domestic electricity rates.”

Blockstream’s Big Bet: Investing $50M in Undervalued ASIC Mining Gear Amid Bitcoin Recovery

“Blockchain firm Blockstream plans to raise $50 million for the bulk purchase of undervalued ASIC mining equipment. Partnering with STOKR, they aim to launch the Blockstream ASIC Note, with most investments expected in Bitcoin. This strategy indicates a promising future despite the declining price of ASIC miners and Bitcoin’s recent price recovery around $30,000.”

Europe’s First Bitcoin ETF: Opportunity Amidst Turmoil in Crypto Realm

“Jacobi Asset Management has launched Europe’s first spot bitcoin exchange-traded fund (ETF), now trading under the ticker “BCOIN” on Euronext Amsterdam. The fund’s custody responsibilities are undertaken by Fidelity Digital Assets. Meanwhile, recent research by Coinbase suggests a strong investment case for bitcoin, considering current global macro uncertainties.”

Bitcoin’s Subtle Dip and the Seismic Shocks Awaiting Crypto Markets: A Closer Look

“Bitcoin’s subtle dip in trading price can be attributed to insights from industry experts, company actions, and regulatory developments. The future prospects for Bitcoin seem promising, with its value fluctuating between core thresholds of $29,600 and $29,250. But remember, the realm of crypto is frenetic, where fortunes are made and lost overnight.”

Navigating Bitcoin’s Uncertainty: Halving, ETF Approval and Inflation Impact on BTC Future

“Bitcoin currently stands at $29,400 with two significant events on the horizon – the third Bitcoin halving, scheduled for April 26, 2024, intensifying its scarcity, and an impending decision by the US Securities and Exchange Commission (SEC) on an ETF application, possibly affecting BTC prices.”

Owning One Bitcoin: Your Path to Fortune or A Precarious Step?

Industry stalwarts posit that owning a Bitcoin could turn one into a millionaire, if Bitcoin evolves into a multi-trillion-dollar market. This comes with the belief in a global “monetary revolution”, placing Bitcoin at the forefront of a decentralized, transparent, and inflation-resistant monetary system. However, hurdles exist, including regulatory initiatives by the SEC, evolving regulations, and monetary policies.

RIOT’s Surging Trajectory Amid Bitcoin Boom: A Blend of High Profits and Fiscal Caution

RIOT, a leading bitcoin miner, shared a mixed financial perspective in its Q2 update. Despite falling short of expected revenues, it saw increased revenue from Bitcoin mining, data center hosting, and engineering. CEO Jason Les highlighted their resilience amidst volatile conditions and the successful scaling of operations, particularly with a significant drop in mining costs. RIOT maintains optimism for the future, despite industry challenges anticipated until 2023.

Futurama’s Satirical Take on Bitcoin Mining: Farce or Harsh Reality?

“Futurama’s satire takes a comedic look at Bitcoin mining in the future, highlighting issues such as excessive electricity consumption and price volatility. This increased focus on cryptocurrency themes in entertainment underscores digital currencies’ growing relevance in our everyday lives.”

Harnessing Green Solutions: How Bitcoin Mining Could Drive Us Towards A Carbon-Neutral Future

“Bitcoin mining’s energy consumption has raised environmental concerns. However, recent innovations like flare gas solutions and nuclear energy are promising enhancements. Harnessing flare gas, an underused resource, for mining operations could drive a carbon-neutral era. Further potential lies in microgrids and nuclear power, despite safety and regulatory concerns. All these seek to incentivize blockchain use beyond Bitcoin mining, significantly reducing the industry’s carbon footprint.”

Bitcoin Cash Struggles Amid Market Volatility: Shibie Token Enters the Scene

“Bitcoin Cash (BCH) has recently experienced market decline with its ongoing struggle with the 20-day moving average. Nevertheless, amid its consolidation, a new token, Shibie – a blend of icons Barbie and Shiba Inu, is gaining attention with its inclusivity and marketing drives.”

Navigating Stormy Seas: MicroStrategy’s Bitcoin Journey From Chaos To Profit

In the past year, Michael Saylor, MicroStrategy’s executive chairman, has adopted a risky strategy, pouring the company’s cash into Bitcoin. Despite significant drops in Bitcoin’s value and initial losses, the company has seen rebounds and Saylor remains committed to this venture, even outperforming powerhouse tech companies like Apple and Google in stock price gains. The future is uncertain, but Saylor is confident in this cryptocurrency investment.

Miami Mayor Launches Presidential Bid accepting Bitcoin Donations Amid CBDC Criticisms

“Miami Mayor Francis Suarez, a champion of cryptocurrencies, announced his presidential campaign will accept Bitcoin donations. Suarez criticized the Biden administration’s cryptocurrency management and expressed disdain for the concept of central bank digital currencies, pledging to ban them if elected. Despite setbacks, he continues emphasizing the importance of crypto familiarity in government leadership.”

Bitcoin to Surpass $100,000 by 2024: Adam Back’s Bold Bet Spurs Market Speculation

Bitcoin OG Adam Back, CEO of Blockstream, predicts BTC will surpass $100,000 before the 2024 Bitcoin halving. Back has wagered one million Satoshis ($290) on this outcome, bringing speculative energy and discussion to the crypto market’s future development.

Tether’s New Mining Software: Unleashing Enhanced Efficiency or a Security Nightmare?

“Tether has unveiled an innovative mining software aimed to streamline mining capacity in cryptocurrency. The software, devised by Tether’s developers, includes JavaScript libraries designed to manage commands in Bitcoin mining hardware. With future open-source access promised, this upgrade could significantly increase the computing capacity in cryptocurrency.”

Bitcoin Mining: Futuristic Boom or Looming Risk? A Deep Dive into the State of BTC Production

“Bitcoin miners are increasing their mining power, with 16 key public companies controlling 16% of all BTC mined. However, the industry is unbalanced, favouring large miners with low production costs. The anticipated BTC halving in 2024 may further impair miner profitability. However, exchange-traded-fund approvals and institutional involvement could potentially improve conditions.”

Bitcoin Miners’ Peril: $98,000 BTC Required for Profits Post-Halving?

“Despite fluctuations in BTC’s value, Bitcoin miners may need the price to reach over $98,000 for profitability due to the upcoming halving. This price leap, crucial for their revenue sources, is viewed as a necessity than a prediction. Prolific organizations like Standard Chartered forecast a $120,000 Bitcoin price by 2024, providing an optimistic outlook despite the challenging landscape for Bitcoin miners.”

Bitcoin’s Resilience and Forecasted Surge: A Peek into the Future of Cryptocurrencies

“Bitcoin retains its ground above the $29,000 mark while expectations rise for an approved spot Bitcoin ETF application by the US SEC. Favourable updates from the US Treasuries and the intent of Microstrategy to expand its Bitcoin portfolio have sparked sudden activity.”

Bitcoin Enters the Gaming Zone: Exciting Innovation or Risky Move?

“New Bitcoin City, a recently launched platform, uses Bitcoin to create games, conduct NFT auctions and operate a marketplace. Further expanding Bitcoin’s utility, developers have leveraged BRC-20 standards to issue tokens and create DeFi applications, extending Bitcoin’s impact beyond just a digital currency.”

Bitcoin Mining Giants Take the Green Leap: Genesis Digital Assets Expands in South Carolina

Genesis Digital Assets (GDA) inaugurated three eco-friendly data centers in South Carolina, contributing to over 2% of the total Bitcoin network hash rate. These expansions notably utilize local energy resources, strengthen local energy grids, and align with GDA’s clean energy ethos, potentially leading crypto mining towards a more sustainable, eco-friendly future.

Bitcoin Lightning Network: Coinbase’s Game Changer or Risky Adventure?

Coinbase, a leading cryptocurrency trading platform, plans to incorporate Bitcoin’s Lightning Network to its services. This innovative second layer for Bitcoin transactions leverages micropayment channels to accelerate transaction speeds and reduce costs, potentially transforming Bitcoin as a payment method. However, security concerns and technical challenges lie ahead.

RFK Jr. Defends Bitcoin Amid Environmental Criticisms: Unveiling A Path To Financial Liberty

Robert F. Kennedy Jr. countered common environmental criticisms of Bitcoin, arguing that such narratives should not limit financial liberty. He concurred with Sangha Systems’ Daniel Feldman who proposed Bitcoin mining could bolster renewable energy production, further improving the electric grid. This divergent perspective also underscores the neglected economic advantages of Bitcoin mining.

Crypto Giant’s Expansion: Genesis’ New Data Centers and the Push for Eco-Friendly Mining

Genesis Digital Assets has expanded their cryptocurrency mining operations with three new data centers in South Carolina, marking its strategic move into the North American market. CEO, Andrey Kim, emphasizes the company’s aspiration for industry leadership in environmentally-friendly Bitcoin mining.

Unraveling Russia’s Bitcoin Mining Boom: Economic Incentives and Geopolitical Pressures

Despite international sanctions following Russia’s invasion of Ukraine, the country’s bitcoin mining industry is booming due to low-cost energy and a cold climate. However, businesses operating there face risks including prohibited associations with sanctioned entities and potential reputational damage. Interestingly, this doesn’t discourage foreign companies; Russia’s economic advantages and Ordinals project-enhanced blockchain activity keep improving the country’s mining conditions.

Bank of Japan’s Yield Curve Control Adjustment: How Might it Affect Bitcoin and Other Cryptocurrencies?

“The Bank of Japan (BOJ) has raised the hard cap on 10-year Japanese government bond yield from 0.5% to 1%, a move seen as hawkish by market analysts. Given Bitcoin and other cryptos are considered risk assets, such monetary policy changes could impact the crypto sphere. The BOJ’s approach may signal turbulent times for these assets as world shifts toward future interest rates hikes.”

Bold Projections for Bitcoin: Yusko Predicts $300,000 Value by 2028, But is it Plausible?

Mark Yusko, CEO at Morgan Creek Capital Management, predicts that by 2028, Bitcoin could reach a value of $300,000, equivalent to the monetary value of gold. His prediction is based on Bitcoin’s portability, divisibility, scarcity, and halving process, which systematically reduces the reward for mining a block by 50% every four years to control new Bitcoin supply and support price growth. Despite Bitcoin’s current volatility, other experts also foresee significant price increases.

Shaping the Future of Renewable Energy: The Unforeseen Role of Bitcoin Mining

“Bitcoin mining appears as an unexpected solution to the ‘duck curve’ – mismatch of peak energy demand and production times. By absorbing excess energy during high production periods, Bitcoin miners help balance grid management, enhancing profitability of renewable infrastructure and contributing to a sustainable future.”

XRP’s Rollercoaster Journey: Price Climb, SEC Bout, and New Competitors from Meme Coins

Despite a 10% dip in the last week, XRP has seen a significant increase in the past month, thanks partly to Ripple’s victory against the SEC. Analysts forecast further growth, with predictions of XRP reaching $1 in the coming months. XRP’s resilience, Ripple’s ongoing development, and recent reintroduction to US exchanges could position the altcoin as a strong contender in market cap and trading volume.

Decoding the Environmental Paradox of Bitcoin Mining: Unexpected Green Revolution

“Bitcoin miners solidify energy grids’ resistance, promote renewable energy, and respond with precision to grid frequency situations. They provide benefits like utilizing stranded energy during low demand periods and actively supporting renewable energy infrastructure investment. This promotes a greener energy mix and mitigates inefficiencies.”

Navigating the Bitcoin Mining Labyrinth: Texas’ Struggle between Economy and Ecology

“Texas, a significant bitcoin mining hub, is experimenting with integrating mining into power grids. However, this move has been criticized for potentially prioritizing an environmentally harmful industry over local communities. On the other hand, supporters highlight the potential grid benefits and job opportunities, but concerns about sustainability and water usage persist.”