It often feels like there’s rarely a week that goes by without a significant advancement in the cryptoscape. A noteworthy entrant is the Bitcoin’s Lightning network. This week, (COIN), a leading cryptocurrency trading platform, has announced its intentions to incorporate this groundbreaking feature into its services.

The leading voice behind this pivotal move, CEO Brian Armstrong, elucidated their intentions, claiming a non-trivial undertaking towards exploiting the potential of Bitcoin payments. Armstrong went as far as responding to a tweet by Jack Dorsey, the founder of Block Inc., encouraging a collective push towards this innovation.

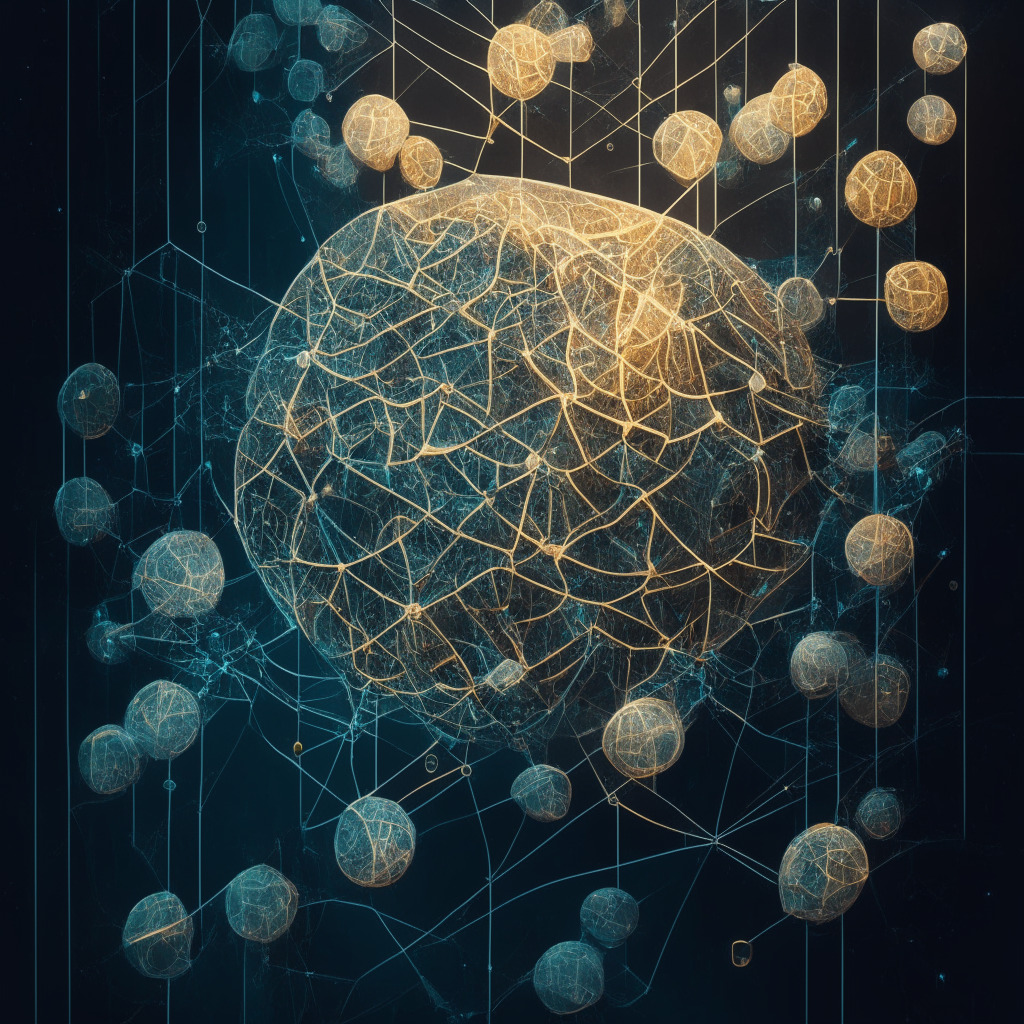

However, it’s fair to examine why this decision presents a notable shift in the crypto operations. The Lightning Network underscores an innovative second layer for Bitcoin transactions. It leverages micropayment channels, known as nodes, to accelerate transaction speeds on the Bitcoin blockchain while significantly reducing associated costs.

These channels facilitate a clever workaround for reducing network congestion. Essentially, two parties can commit their on-chain funds into a mutual pool. What follows is a series of independent transactions, aggregated into one and eventually submitted to the primary blockchain.

It’s undeniable that this new method comes with pros. Indeed, who wouldn’t relish the notion of faster transactions and lower costs? It’s a game-changer for both businesses and individuals, radically improving the feasibility of using Bitcoin as a method of payment.

Nevertheless, the idea isn’t without reservations, and these underline the robust efforts ahead for Coinbase. There exist doubts over the security of these channels considering that the locked funds have to be processed separately. Moreover, the technical intricacies of implementing such a protocol may present varied challenges which Coinbase must navigate.

As at Wednesday, the total capacity of the Lightning network, calculated as the aggregate of Bitcoin locked across all channels, was approximately 4,686.64 Bitcoin. At current market values, this is slightly over $138 million. While this is not an insignificant sum, the scope and market penetration of lightning payments remain to be seen.

Ultimately, only time will tell if this can truly revolutionize the way we transact with Bitcoin, and whether the community is ready for this pivotal shift. Coinbase’s foray has certainly added another twist to the narrative, reinforcing the ever-evolving dynamism present in the realm of cryptocurrency.

Source: Coindesk