Former FTX CEO Sam Bankman-Fried’s lawyers may request trial postponement due to alleged issues with access to discovery materials. He faces 12 criminal charges. Meanwhile, there’s been a breach involving a bankruptcy claim by FTX that potentially exposed user data, underlining inherent risks in the crypto arena.

Search Results for: SQ

Unveiling the Dark Side: How FTX’s Data Breach Exposes Crypto Vulnerabilities

“A cybersecurity breach at Kroll, a bankruptcy claims agent for cryptocurrency platform FTX, resulted in a leak of users’ sensitive data, contrary to earlier reports. This incident highlights the unresolved issues of user data protection in the crypto industry, raising questions about the future of blockchain technology and its mainstream market readiness.”

Binance Quietly Removes Banco de Venezuela: Blockchain Freedom Versus Economic Sanctions

Cryptocurrency exchange Binance has silently removed Banco de Venezuela from its P2P service list, mirroring U.S Treasury-imposed financial sanctions. The move raises concerns among Venezuelan crypto enthusiasts, notably because the bank plays a crucial role in Venezuela’s digital currency ecosystem. Despite the silent removal, users can reportedly circumnavigate the ban due to the P2P nature of the services.

Navigating Regulatory Shifts: Binance’s Shift, Impact Theory’s Legal Woes, and Emerging Blockchain Innovations

“Binance’s Belgian users can now dodge local regulations by accessing the platform via its Polish branch. This resourceful solution permitted them to continue operations within the European Economic Area after the parent company ceased. However, due diligence is important. On the other hand, Venezuela’s key banking institution has been removed from Binance’s P2P payment options due to alleged international financial sanctions.”

Navigating the Crypto World: Market Fluctuations, Legal Challenges, and Growth Opportunities

“This week’s bearish sentiment among crypto traders forced Bitcoin under $26,000. Current market behavior indicates possible surge in volatility. Meanwhile, market is apprehensive about potential firming of rates to control inflation resurgence. Legal cases and settlements also impact the crypto world.”

Forecasting the Crypto Bull Run of 2024: Strategies, Risks, and Balancing Act

Crypto bull market, likened to a tornado, attracts millions of new investors expecting their first bull run. Navigating through crypto volatility can be challenging therefore strategies like setting clear goals, utilizing dollar-cost averaging and avoiding overexposure are essential. Well-being must not be compromised over crypto investments, as wise investing balances optimism with caution.

Rise of XRP: Unraveling Factors Influencing its Bullish Momentum and Potential Pitfalls

“The rise of XRP, bolstered by Ripple’s alliance with Moroccan central bank, has grabbed attention in the crypto world. Popularity in South Korea and banks’ embrace of Ripple’s technology have also fueled the surge. However, with the crypto market’s volatility, future predictions for XRP remain uncertain.”

Pepecoin’s Future Questioned: Insider Trading and Heist Allegations Cause Market Unrest

“The Pepecoin community faces allegations of insider trading and the heist of 16 trillion PEPE tokens. Renowned crypto enthusiast, Jeremy “Pauly” Cahen, has accused insiders of significant internal selling and strategic offloading of tokens. His findings suggest the existence of multiple accounts linked to the Pepecoin team, housing PEPE tokens worth millions. These unsettling revelations have negatively affected Pepecoin’s market performance.”

Visa and Mastercard Sever Ties with Binance: A Shake-up or Just a Ripple in the Crypto Market?

“Payment giants Visa and Mastercard have distanced themselves from Binance amid ongoing regulatory challenges for the leading crypto exchange. Despite this, industry experts predict modest impact on Binance’s market share. The situation illustrates how institutional caution could affect the cryptocurrency market’s future.”

Federal Reserve vs. Bitcoin: Predictable Paths and Uncertain Futures in Economic Stability

At the annual Federal Reserve gathering in Jackson Hole, chairman Jerome Powell’s policy foretells an uncertain economic future. This unpredictable, human-driven system contrasts with the mathematical certainty of cryptocurrencies like Bitcoin. However, the decision between fiat and cryptocurrency still lies in the hands of individual investors.

Navigating the Crypto Storm: Powell’s Speech, ETF Dreams, and the Shifting Market Landscape

“Cryptocurrencies experienced mixed responses to the indication of further U.S. interest rate hikes from Jerome Powell, Federal Reserve Chairman. While some digital assets dipped, others held steady, revealing an evolution within the crypto market towards resilience in the face of monetary tightening and ever-growing interest in internal crypto narratives.”

MakerDAO’s Investment Risk: Parsing the Pros and Cons of Blockchain Credit Platforms

An upcoming default on tokenized loans threatens blockchain-based platform, MakerDAO’s $1.84 million investment. A borrower from the credit pool, currently in a court dispute, is on the edge of liquidation, raising questions about the robustness of blockchain credit platforms.

Pepecoin Turmoil and the Rising Star of Sonik Coin: A Diverging Crypto Trajectory

Concerns linger over Pepecoin’s future due to changes in multi-signature wallet requirements and a significant market plunge. Conversely, newcomer Sonik Coin shows promise with an ambitious $100 million market cap goal, a high staking APY, and a successful presale. However, caution is encouraged when investing in high-risk crypto.

Navigating the Tokenization Wave: Growing Value and Unique Challenges in Blockchain-based Assets

Tokenization uses blockchain to monetize tangible and intangible assets, making them tradable and transparent. Despite cryptos’ ridicule for lack of tangible value, blockchain’s potential to transform assets is increasing. There’s even exploration of derivative, swap, and fixed income security systems. Companies like Pendle Finance and Dinari are demonstrating this potential, while concerns rise about tokenizing user engagement. Elsewhere, Central African Republic is aiming to tokenize its fiat money, a move that could inspire other countries.

Num Finance’s nCOP: Bringing Blockchain Innovations to Colombia and Beyond

“Num Finance has launched nCOP, a token pegged to the Colombian peso, utilizing the Polygon framework for transfer, payment, saving, and earning through blockchain. Stablecoins offer flexibility and can be used for remittances, store of value, and potentially yield profit.”

Vessel Capital’s Bold $55M Fund for Web3: Stabilizing Crypto Start-ups or Risky Bet?

Vessel Capital recently established a $55 million fund for Web3 infrastructure and applications, particularly aimed at early-stage crypto startups. Despite a downturn in crypto venture capital, this investment could impact the internet economy by fostering a decentralized world through Web3 applications and infrastructure.

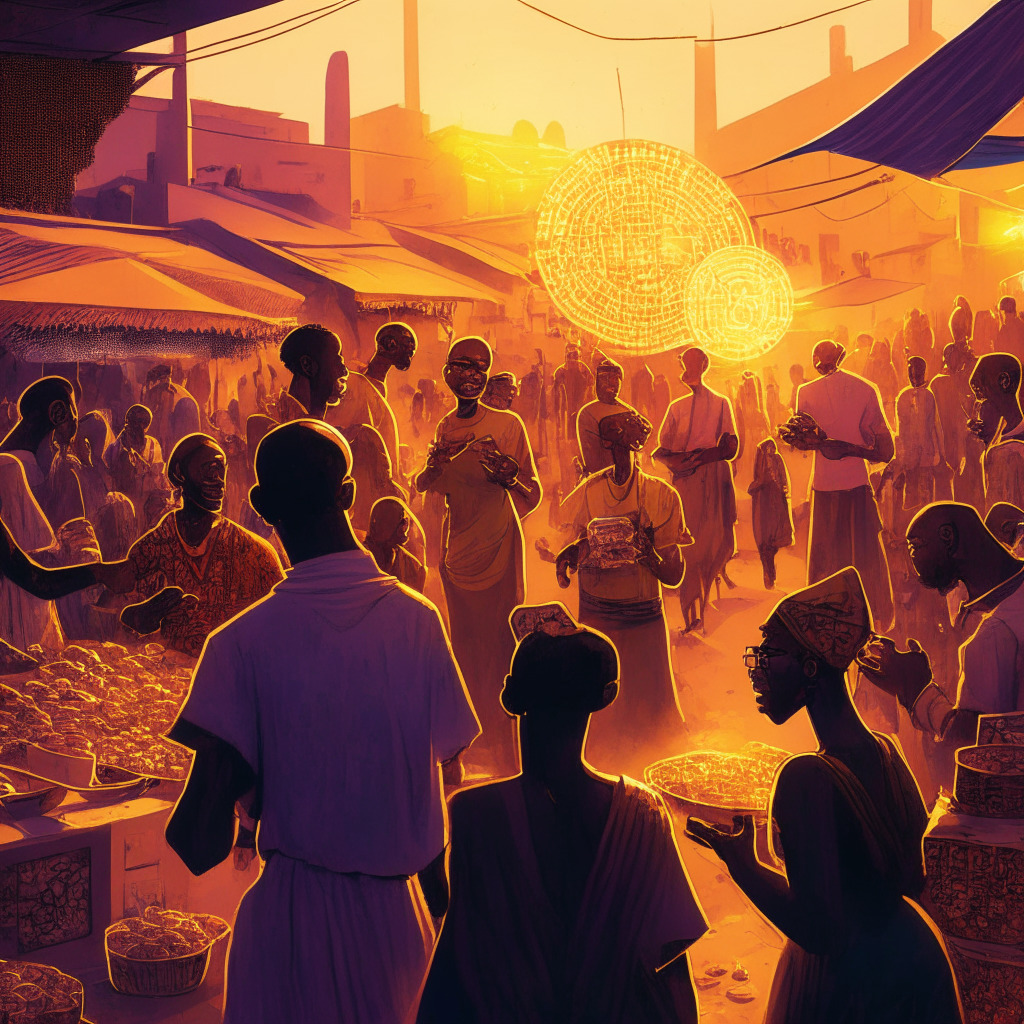

Blockchain and Cryptocurrencies: A Rising Force in West Africa Amid Economic Dissatisfaction and Potential Pitfalls

“Blockchain technology, particularly Bitcoin, is gaining traction in West Africa, thanks to education efforts and dissatisfaction with regional monetary policies. However, the journey towards adoption is filled with opportunities and potential pitfalls, emphasizing the need for careful navigation and robust education.”

Navigating the Crypto Winds: The Highs, Lows and Ambiguities in Blockchain’s Future

“Unstoppable Domains has unveiled Unstoppable Messaging, a product of the Web3 messaging network XMTP. Meanwhile, Binance.US has paired with MoonPay to allow customers to convert USD into tether (USDT) amidst their comeback from a dollar deposit suspension. Despite advancements, cybersecurity challenges persist in the blockchain world.”

Choosing the Right Blockchain for NFTs: A Roadmap to Success or Path to Disaster?

“In the realm of non-fungible tokens (NFTs), the choice of blockchain such as Ethereum or Solana can significantly impact the success of your collection and the community’s perception of your brand. Lesser-known blockchains like Ripple, Tezos, and Polygon are also becoming attractive options. However, choosing a blockchain demands careful consideration of factors such as security, transaction speed, cost, scalability and smart contract functionality.”

Privacy vs. Transparency in Blockchain: A Look at Friend.tech’s Controversial Crypto Wallet Leak

“In the blockchain sector, privacy and security are essential. However, the release of a list of crypto wallet addresses connected to Friend.tech users on a GitHub repository stirred controversial discussion. The concern arises from the potential of viewing blockchain transactions linked to those wallets. As the blockchain technology continues to infiltrate social platforms, users should remain wary of the risks associated with data visibility.”

Bankruptcy Woes of Cryptocurrency Giant FTX: A Clash Between Debt Settlement and Due Diligence

The cryptocurrency arena’s turbulence, exemplified by FTX’s bankruptcy, illuminates the complexities of digital asset exchange regulations. FTX is striving to resolve their debt issue. Meanwhile, the U.S. Trustee questions the settlement motion and deems $10 million as an excessive “small” claim. These events underpin the intricacies governing future cryptocurrency development and exchanges.

Gryphon Digital Vs Sphere 3D: Legal Clash Over 26 BTC Scam Reveals Cryptocurrency Security Flaws

“Gryphon Digital requests court dismissal of a lawsuit filed by former partner Sphere 3D, blaming their inadequate security for a “spoofing” attack which caused a loss of $500,000 in BTC. This situation highlights the tensions between crypto companies and the severe ramifications of security breaches.”

Drama in the Crypto Arena: FTX’s Co-founder Faces Legal Challenge amidst Accusations of Fund Misuse

FTX’s co-founder, Sam Bankman-Fried, seeks temporary release from detention to strategize with attorneys over documents relevant to his case. Accused of fund misappropriation and more, his ordeal reflects the need for caution and transparency in the fast-paced crypto arena.

Crypto Community’s Internal Upheavals: Layoffs, Regulatory Confusion, and Billion-dollar Flash Crashes

“The cryptosphere is grappling with fundamental discords and minor tribulations. Beyond technical issues, it deals with the anxieties of those invested in it – its quintessentially human aspect. Amid all this chaos, we long for the simplicity amidst complex strife, mirroring crypto’s ambition to simplify finance while wrestling with its complexities.”

Crypto Shockwave: Unprecedented $55m Ether Liquidation Shakes Binance

An anonymous trader lost $55 million on an Ether trade against Binance USD as the crypto markets experienced a sudden drop. This trade, consisting of 38,986.528 Ether, was liquidated at the $1,434 price level, making up nearly 30% of all liquidated futures on Binance. The incident underscores the inherent risks involved in the volatile field of cryptocurrency.

FTX Legal Ordeal: Unfolding Drama, $176 Million at Stake, and Future of Crypto Safety

FTX cryptocurrency exchange faces a legal filing involving a proposed settlement with Genesis entities worth $176 million. If successful, FTX and its affiliates could bypass various complications and gain significant economic advantages. Wider discussions highlight the crucial role of such legal decisions in shaping future cryptocurrency regulation and safety.

Unraveling the SHIB Price Drop: Shibarium’s Technical Woes and Meme Tokens’ Potential

“The SHIB token price experienced a significant drop following the tumultuous public launch of Shibarium, a layer-two network, with technical glitches leading to a loss of trust and depreciation in the token’s value. Amid this, the new ERC-20 meme token Sonik Coin (SONIK) exhibits potential for near-future growth, though crypto investments carry high risk.”

CBDCs: Innovation or Totalitarian Control Tool? Davidson’s Struggle Against Ripple’s CBDC Plan

US Congressman Warren Davidson opposes the expanding realm of Central Bank Digital Currency (CBDC), viewing them as tools for coercion and control. Davidson’s proposal would criminalise the creation and implementation of any CBDCs, likening them to a “financial equivalent of the Death Star.” CBDCs, according to Davidson, threaten the future of digital assets and could infringe upon citizen privacy.

Regulatory Clarity in Canada: Boon for Crypto Exchanges or a Bane for Small Platforms?

According to WonderFi CEO Dean Skurka, Canadian financial institutions are showing increased interest in cryptocurrencies due to unfolding regulatory clarity. Despite major exchanges exiting the Canadian market over stringent regulations, Skurka sees it beneficial for WonderFi, leading to increased activity and market consolidation.

Cross-Border Crypto Regulations: A Comparative Study between the US and Canada

“Jeremy Koven, president of CoinSmart, discusses the differential path of crypto regulations in various countries, emphasizing the clarity in Canada compared to the fragmentation in the US regulatory landscape. This perspective highlights regulatory hurdles possibly hindering US crypto growth.”

Sei: New Trading-Focused Blockchain Star Amid Controversies and Growing Expectations

“Sei, a trading-focused blockchain network created by Jump Crypto and Multicoin Capital, debuted a market cap of over $400 million. Despite a successful launch, controversy over a delayed airdrop and eligibility issues, coupled with a lack of transparency, have raised concerns. 40% of SEI’s circulating supply is for the team and private investors, 48% for airdrops and ecosystem reserves, with the rest for the SEI Foundation and Binance launchpool incentives.”

Navigating the Ripple Labs and SEC Lawsuit: A Critical Look at Cryptocurrency Regulations

The US SEC’s dispute with Ripple Labs evolves as the court permits an investment banker declarant’s entry, a move Ripple objected to earlier. This drives doubts about fair representation during these legal proceedings. Ripple seeks authorization to challenge XRP’s categorization, while the SEC aims to appeal the decision, questioning our understanding of cryptocurrency regulations.