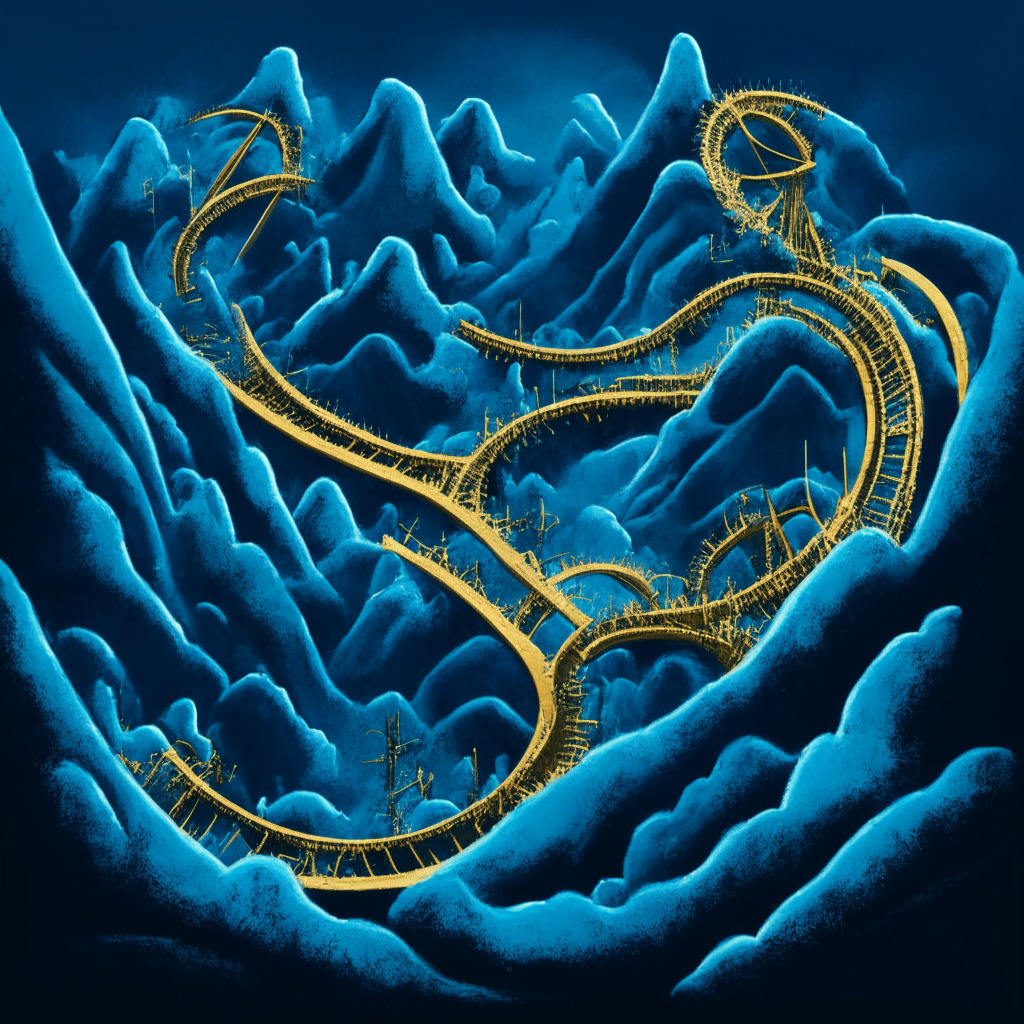

In the fascinating world of cryptocurrencies, millions of new investors are forecasting their first crypto bull run as early as 2024. This thrilling twist is unlike anything else you’ve ever experienced. A crypto bull market has been described as a tornado, complete with chaos and unpredictable dynamics. These interesting remarks come from Ben Simpson, founder of education platform Collective Shift, and serve as a precursor for what’s potentially possible.

For the uninitiated, a lot of emphases is on avoiding the pitfalls of holding onto their crypto assets for too long being caught in undue euphoria. Novice investors, enthralled by the possibility of amplified profits, tend to hold their assets for an extended period, often leading to potential losses. To maneuver around this, Simpson advises on setting clear investment goals and firm sell prices. This way, the likelihood of losses might be mitigated due to quick alterations in the market dynamics.

An alternative approach to handle crypto volatility comes from CoinShares’ Head of Research, James Butterfill. He suggests implementing the strategy of dollar-cost averaging to balance the unpredictability of cryptocurrencies. This technique involves regular, small asset purchases or sales which could lessen the volatility’s influence on one’s portfolio.

When it comes to selection, CK Zheng, co-founder, and CIO of hedge fund manager ZX Squared Capital, discourages investors from pursuing the less established, volatile cryptocurrencies (better known as memecoins) and urges them to stick with the giants – Bitcoin and Ether. Diversification, in this case, is advocated from the perspective of distributing investments between speculative and mature cryptocurrencies like these.

Despite the prospects of a potential crypto bull run, it is crucial to observe that getting involved in the crypto market comes with its own spectrum of risks. Several industry leaders, including Simpson, Zheng, and Deryck Graham, the founder of a crypto hedge fund, have warned against overexposure to crypto. This includes taking loans to invest in the market, investing more than what one can afford to lose, or risky practices like trading using leverage.

Entering the crypto market undoubtedly comes with several potential windfalls, but it’s equally critical to ensure that emotional and mental health isn’t compromised while staying invested in such an unpredictable market. Thus, seasoned traders and newcomers alike are urged to ensure they maintain a healthy work-life balance and well-being.

Crypto investments are, after all, just one facet of our lives. Wise investing requires balancing optimism with caution, and in doing so, keeping the tornado of the crypto bull run at a manageable distance.

Source: Cointelegraph