“Hollywood studios propose scanning actors’ digital likenesses for unrestricted use in future projects, raising concerns around consent and compensation. Amidst fears of job losses and dehumanization, Screen Actors Guild and Writers Guild of America push back, igniting industry-wide discussions on AI’s role in creativity and job security.”

Search Results for: Six Digital Exchange

The Untold Story: Algofi Closure, Algorand’s Technology & Regulatory Tensions in Crypto

Despite the closure of Algofi, a lending protocol founded on Algorand’s blockchain system, developers remain confident in Algorand’s technology. The unexpected shutdown highlights the complex dynamic between technological innovation and rigorous regulatory policy within the crypto landscape, emphasizing the unpredictability of the evolved financial system.

Unraveling the FTX Debacle: A Disproportionate Price for Crypto Bankruptcy?

“The FTX bankruptcy has raised concerns due to disproportionately high restructuring and recovery costs compared to similar past cases. These expenses already exceed $200 million, impacting large creditors and retail investors. This situation underscores the complexities of the fast-paced digital economy and the need for transparent regulatory paths and enhanced caution in future situations.”

SEC vs. Ripple: Unraveling the Complexities of XRP Lawsuit and Its Impact on the Crypto World

The ongoing legal battle between the SEC and Ripple leaves the crypto community awaiting clarity on digital asset regulations. As the lawsuit stretches beyond seven months, understanding and staying updated on regulatory developments is crucial for making informed investment decisions in the crypto industry.

Australia’s Tech Agnostic Crypto Approach: Balancing Innovation, Consumer Protection, and Global Trends

The Australian Treasury plans to adopt a tech agnostic, principles-based approach to defining crypto assets in its token mapping of digital assets, aiming to classify tokens based on function and purpose. Assistant Secretary Trevor Power hopes for crypto-specific legislation by 2024, emphasizing that the regulation should be robust, tech-neutral, and principles-based to accommodate future changes.

Belgium Forces Binance to Halt Operations: The Rising Trend of Crypto Regulatory Compliance

Belgium’s Financial Services and Markets Authority (FSMA) has ordered Binance to halt services due to violation of Belgian law by serving local customers from countries outside the EEA. This move seeks to combat money laundering and terrorism financing, with Binance expressing disappointment and ongoing collaboration with regulators.

The Quest for a US Bitcoin Spot ETF: Resilience Amid SEC Rejections and Renewed Hope

Since 2013, the crypto community has pursued elusive spot Bitcoin ETFs. Interest in Bitcoin ETFs has grown globally, with Canada, Brazil, and Dubai embracing them. Despite numerous rejections, the industry remains optimistic, and BlackRock’s recent application has spurred other major companies to apply for Bitcoin spot ETFs, suggesting market resilience and potential for a U.S. Bitcoin ETF.

Chinese Crypto Side Jobs: Legal Risks vs Lucrative Rewards in a Strict Regulatory Environment

A growing number of Chinese citizens are participating in “side jobs” that facilitate crypto transactions, despite government crackdowns. However, China’s Ministry of Public Security warns such activities may constitute assisting IT network fraud, with potential jail sentences and fines for those convicted. Authorities claim money laundering and fraud account for the majority of crypto-related crimes.

XRP Bulls Eye $0.76 Breakout: Pros, Cons, and Market Battles Amid Ripple’s Global Expansion

XRP bulls show enthusiasm with a 6.6% weekly growth, as Ripple gains in-principle approval for a Major Payments Institution License from the Monetary Authority of Singapore. The approval expands customer utilization of Ripple’s crypto-facilitated On-Demand Liquidity (ODL) service.

Crypto Market Soars: Institutional Interest, Bitcoin ETFs, and Future Predictions

The crypto market experienced a significant recovery with Bitcoin and Ethereum prices reaching a six-week high. This surge followed US Federal Reserve Chair Jerome Powell’s testimony and increased institutional interest in the crypto market, including BlackRock iShares’ Bitcoin ETF application.

Alibaba’s New Chairman Sparks Crypto Dreams: Is China Ready to Embrace Web3?

Alibaba appoints crypto-friendly Joseph Tsai as new Chairman amidst restructuring, sparking interest in the crypto community. Tsai is an advocate of cryptocurrencies and digital assets, prompting speculation of Alibaba embracing Web3 and crypto in China. Hong Kong’s recent regulatory framework for crypto shows growing interest in digital assets.

Bitcoin Accumulation Booms Amid Regulatory Risks: What It Means for Investors

Bitcoin is experiencing the fastest accumulation rate in six months, with illiquid entities now holding a record high of 15,207,843 BTC. This growing trend signifies confidence in Bitcoin’s future price, despite macroeconomic uncertainty and regulatory risks. The market appears to be in a period of quiet accumulation, suggesting an undercurrent of demand.

SEC vs Ripple: Lawsuit Impact on Crypto Market, Regulation, and Global Expansion

The SEC’s lawsuit against Ripple raises crucial questions about the future of crypto regulation and its impact on the broader market. As the landscape evolves, companies must adapt, and Ripple’s engagement in the CBDC and payments space, along with its expanding presence in Europe and Latin America, demonstrate its resilience and long-term growth strategy, regardless of the lawsuit’s outcome.

Terra Co-Founder’s Passport Scandal: Legal Lessons for the Crypto Community

The Montenegro Basic Court found Terra co-founder Do Kwon and former CFO Han Chang-joon guilty in a passport forgery case, raising questions on crypto regulation, legal system intersection, and ethical concerns over investment-granted citizenship. The crypto community is urged to prioritize security and operate within regulatory boundaries.

Failed Terra Project’s Legal Fallout: Examining Crypto Fraud Cases & Industry’s Future

Do Kwon, the founder of the failed Terra blockchain project, faces an extended detention in Montenegro amidst South Korea’s extradition request. Kwon is facing eight counts of fraud, including securities, wire, and commodities fraud. The case highlights the potential for similar incidents and raises debates on the balance between market innovation and tighter control to prevent fraud in the crypto space.

Ripple Partners with Colombian Central Bank for CBDC Pilot: Exploring Benefits and Challenges

Ripple partners with Colombia’s central bank and MinTIC to experiment with central bank digital currency (CBDC) technology using Ripple’s CBDC platform. This pilot aims to enhance Colombia’s high-value payment system but doesn’t confirm the country’s intention to launch a CBDC.

Landmark Bill on Crypto Tokens Exemption: Boon or Bane for Securities Laws and Investors?

The McHenry-Thompson draft bill aims to exempt cryptocurrency tokens from securities laws by creating a new asset class labeled “digital assets.” While it gains attention and support, the bill raises concerns regarding regulatory arbitrage and presents challenges reconciling the crypto industry’s goals with existing legislation, causing uncertainties for companies and investors.

Bitcoin Consolidation, SEC Reform Battle, & Global Crypto Shifts: Analyzing Market Effects

Bitcoin enters consolidation phase amidst rising regulatory concerns in the US, with the SEC Stabilization Act proposal aiming to restructure the SEC and dismiss Chairman Gary Gensler. The future of crypto regulation remains uncertain, affecting Bitcoin’s market direction and emphasizing the importance of staying informed on developments and opportunities.

SEC Stabilization Act Impact on Crypto: Market Regulation, Top Investments, and Green Initiatives

The SEC Stabilization Act proposes a significant change to the SEC’s governance structure, potentially promoting clearer oversight for financial markets, including the cryptocurrency sector. Amidst this, cryptocurrencies WSM, MATIC, ECOTERRA, APTOS, YPRED, APT, and LPX are considered strong investments. Projects like yPredict, Ecoterra, and Launchpad XYZ are gaining attention for their innovative solutions in the evolving crypto landscape.

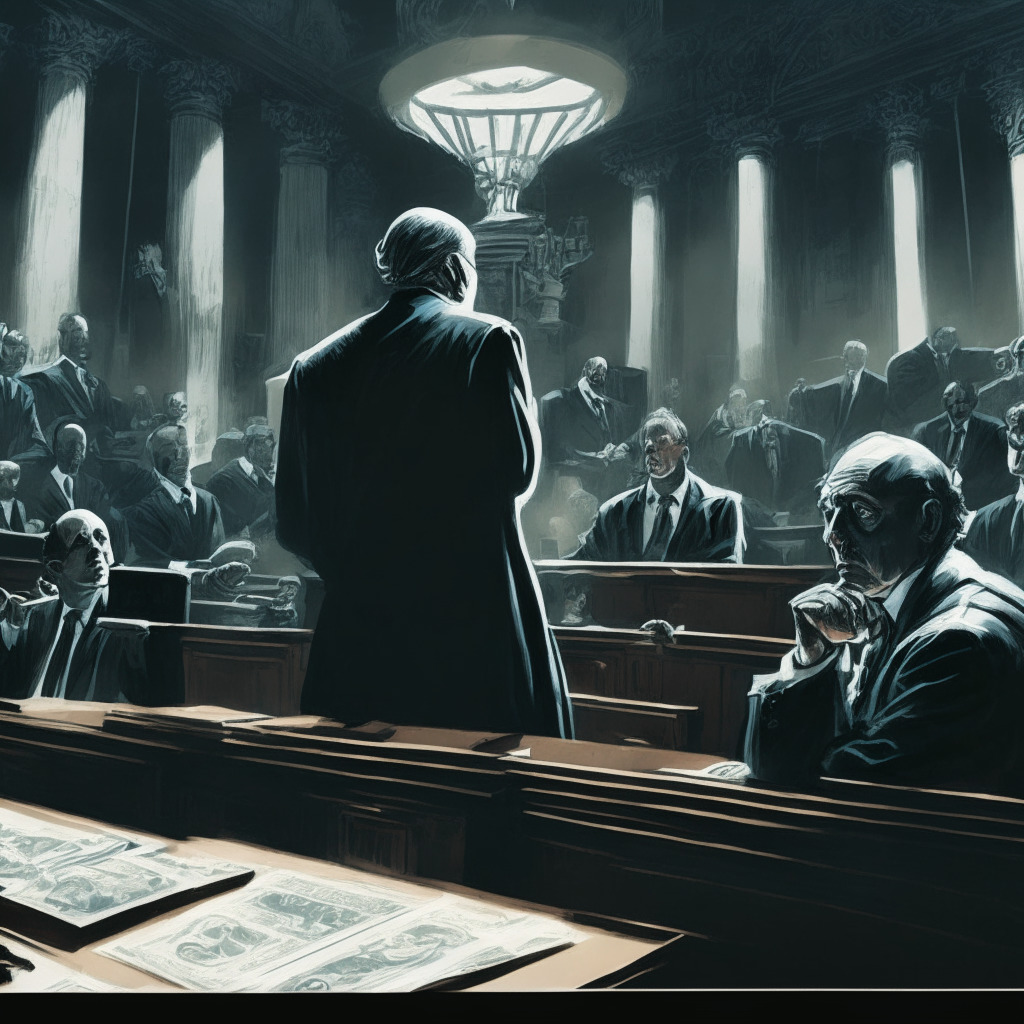

SEC Stabilization Act: Restructuring SEC and Crypto Regulation Controversy Unfolds

Republican congressmen Warren Davidson and Tom Emmer have filed the SEC Stabilization Act, aiming to restructure the SEC and remove Chairman Gary Gensler, citing concerns over his governance of the crypto market. The legislation seeks to provide clearer and more consistent oversight for American investors and the crypto industry, amid concerns of a detrimental impact on the market and potential migration of the industry overseas.

SEC Crackdown on Binance and Coinbase: Boon or Bane for Crypto Innovation and Markets?

Following the SEC’s legal actions against Binance and Coinbase, the total number of labeled crypto-securities reached an estimated 67, encompassing over $100 billion of the market. Amidst this crackdown, trading volume across decentralized exchanges surged by 444%. The SEC’s measures have sparked debate among crypto enthusiasts, affecting the industry’s adaptation to regulatory challenges.

Crypto Firms Boost Legal Hires Amid SEC Scrutiny: Compliance and Blockchain’s Future

Amid increased regulatory scrutiny in the US, crypto companies are emphasizing legal hires, investing in compliance teams, and working with law enforcement to address concerns. This comes after recent SEC lawsuits against Binance and Coinbase, prompting a push for better compliance and potentially leading to improved practices and broader technology adoption.

SEC vs Ripple Lawsuit: How It Affects XRP Price and Future Valuation Debate

The ongoing SEC lawsuit against Ripple has affected XRP’s price growth. A report by Valhil Capital estimates XRP’s fair value between $3.5K and $22K, outnumbering its current trading value. Factors considered in the study include global transaction volume, discount rate, daily transaction value, and economic growth, among others.

SEC Chair’s Tweet Controversy: Gensler, Coinbase Lawsuit, and Crypto Community’s Call for Clarity

A recent tweet by US SEC Chair Gary Gensler addressing the ongoing Coinbase lawsuit omitted crucial context. Twitter fact-checkers added community notes emphasizing that Coinbase had sued the SEC seeking clear guidelines on issues Gensler accused them of failing. This highlights the need for transparent regulations in the rapidly evolving crypto world.

Circle’s MPI License Win: Boost for Singapore’s Crypto Market & Future Challenges

Circle Internet Singapore has been granted a Major Payment Institution license by the Monetary Authority of Singapore, allowing them to offer digital payment token services and money transfer services. This highlights Singapore’s dedication to fostering a supportive environment for blockchain and cryptocurrency technology.

EU’s MiCA Crypto Framework: Roots in French Regulations, Impact on Industry, and Debate on Compliance

The EU’s Markets in Crypto Assets (MiCA) regulatory framework has significant similarities to France’s existing PSAN (Digital Asset Service Provider) regulations, according to Ethereum France President Jerome de Tyche. MiCA aims to standardize crypto regulations across Europe and has received positive reactions from stakeholders and regulators, even being suggested as a model for the US by SEC Commissioner Hester Peirce.

GameStop NFT and Illuvium Partnership: A Game Changer or Risky Move?

GameStop NFT partners with Ethereum blockchain game developer Illuvium to launch a 20,000 NFT collection called “Illuvitars.” This collaboration could increase visibility and credibility in the blockchain gaming space, potentially boosting trading volumes and revenue. However, the volatile NFT market presents uncertain risks.

Meme Coins: The Catalyst for a Crypto Bull Market or Risky Speculation?

Changpeng Zhao, CEO of Binance, views the growing enthusiasm for meme coins as an encouraging sign for the market’s potential resurgence. Meme coins like MEMEVENGERS ($MMVG) show impressive gains and attract investor interest, but caution is urged due to their speculative nature.

Celsius Network’s ETH Staking Strategy: Impact on Validators and Ethereum’s Ecosystem

Celsius Network significantly alters its ETH staking strategy, causing an increased congestion in Ethereum’s validator activation queue. This move involves moving $745 million worth of ETH into staking contracts after redeeming $813 million from Lido Finance, impacting Ethereum’s ecosystem and adding pressure on the network.

Evertas Crypto Insurance Expansion: Boon for Blockchain and Mining Operations

Evertas, a crypto insurance underwriter, has expanded its offerings by increasing coverage limits to $420 million and including mining operation coverage up to $200 million per policy, making it the highest available in the market. The firm aims to provide accessible and comprehensive insurance to the growing blockchain and cryptocurrency sectors.

Huobi Aiming for Hong Kong Crypto License: Pros, Cons, and Regulatory Hurdles

Huobi crypto exchange aims to obtain a crypto trading license in Hong Kong, with potential approval by year-end, according to Huobi advisor Justin Sun. The strategic relocation to Hong Kong positions the company closer to launching Huobi Hong Kong in the city that aims to become a virtual asset hub.

Hong Kong’s Crypto Haven: Opportunities and Challenges in the Blockchain Future

Hong Kong is transforming into a crypto haven, with developments such as launching the CyberDefender Metaverse for public education, lifting its ban on retail crypto trading, and trialing a central bank digital currency. However, the city must ensure safeguards and education to protect its growing crypto community.