“A 404 error on a prominent cryptocurrency news site could foster skepticism about the stability of the tech domain. Missteps will occur, but it’s by overcoming these challenges that a robust and efficient decentralized financial landscape can evolve.”

Search Results for: Tabi

Navigating the Crypto Marketplace: Striking Balance between Blue-chip Stability and Meme-coin Volatility

“July’s US Producer Price Index inflation statistics reveal minor outstripping of prospects in the crypto marketplace. However, front-running digital assets Bitcoin and Ethereum’s performances have remained stagnant; traders anticipate updates on Bitcoin ETF bids and US control. Also, volatile meme-coin sectors offer fast return opportunities, yet with higher risk and lower liquidity.”

Inflation Data Impact on Crypto Markets: Stablecoins as a Stabilizer vs Small Cap Coin Volatility

“The cryptosphere is experiencing market anxiety due to the U.S Consumer Price Index inflation data, impacting market dynamics significantly. While Bitcoin and Ethereum display positive trading bias, failure to surpass resistance levels evidences concern. Market stabilization is being supported by optimism around Paypal’s stablecoin, which could simplify fiat to crypto exchange.”

Bridging the Haven: Crypto’s Prospective Surge amidst Financial Instability

“Cryptocurrencies like XRP and Solana are leading a progressive momentum in trading. Crypto casino Rollbit plans to buy and incinerate its tokens, while Unibot experiences a rise due to positive social sentiment. Reddit-based moon tokens also record growth amid banking instability concerns. Notwithstanding, the unpredictability of crypto markets necessitates investor prudence.”

Disney’s AI Adoption: Cutting-edge Profitability or Threat to Job Security?

Disney has reportedly established an AI task force to explore its integration into various operations, potentially lowering production costs and enhancing customer support. Critics, however, are concerned about the impact of AI adoption on job security and personal privacy.

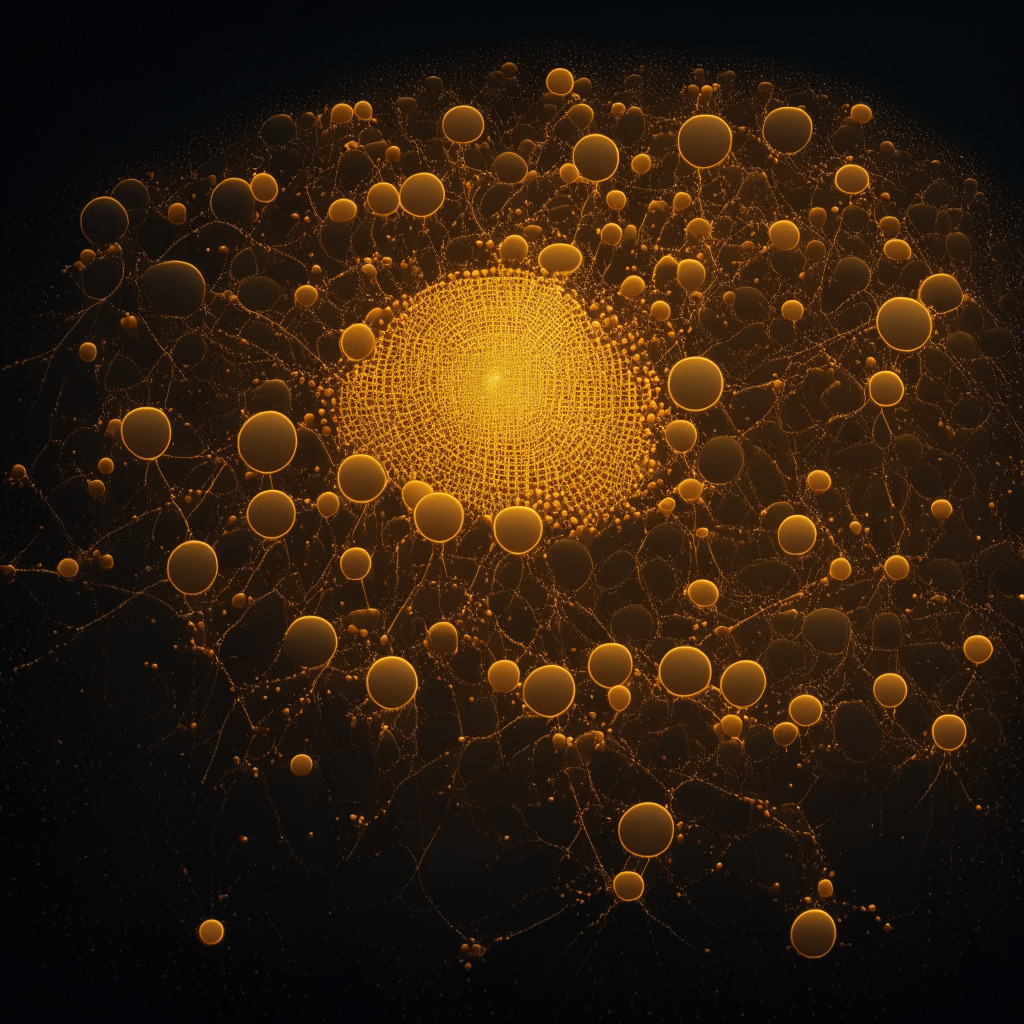

Long-term Bitcoin Holders: Guardians of Stability or Harbingers of a Volatility Crisis?

Crypto analytics firm Glassnode reveals that Bitcoin long-term holders now control a historic 14.599 million BTC, accounting for 75% of the circulating Bitcoin. This shift towards long-term holding, contributing to massively reduced price volatility, signals a significant change in Bitcoin’s dynamics.

Stablecoins in the UK: Balance between Consumer Protection and Systemic Stability

“The future of UK’s stablecoins appears secure following the Bank of England’s intent to establish a systemic stablecoin regime, jointly overseen by the BoE and the Financial Conduct Authority. Recent developments include an extended accountability framework and considerations towards insolvency cases. However, concerns surround potentially favouring the return of customer funds over service continuity.”

Navigating The Storm: Unpredictability and Unrest in the Cryptocurrency Market

Cryptocurrency markets are exhibiting considerable unpredictability, with bulls struggling to keep BTC above $29,000, indicating weak demand at higher levels. Market speculators forecast a potential for increased selling pressures, but remain hopeful for a Bitcoin rally before its 2024 halving.

XRP’s Decline Reflects Crypto Market Instability Amid Legal Disputes and New Partnerships

“XRP price dropped by 3.4% in a quiet crypto market, hinging on Ripple’s legal tussle with the SEC and fluctuating technical indicators. Despite potential losses, partnerships and stablecoin trials give XRP recovery chances. Ethereum-based XRP20, offering income opportunities, might engage XRP-awaiting traders.”

The Coinbase vs SEC Showdown: Ripple Effects on Crypto Bets, New Hopes, and Instabilities

The crypto market faces uncertainty due to an ongoing lawsuit between Coinbase and the SEC, but certain cryptocurrencies such as GMX, Cowabunga, XDC Network, Chimpzee, and Injective display promising trends. However, given the high-risk nature of crypto assets, careful investment is advised.

FTX Founder’s Legal Battle: Dodging Accountability or Defending Reputation?

The U.S. DOJ accuses FTX’s founder, Sam Bankman-Fried, of disclosing a personal diary to manipulate a narrative in his favor. His defense, while suggesting safeguards for his reputation, has been criticized for possibly obscuring the truth. This case might influence future crypto market oversight approaches.

Robinhood Achieves Profitability Amidst Shrinking Crypto Revenue: A Cause for Alarm?

“Robinhood achieved profitability for the first time in Q2 2023, according to its quarterly report. However, it experienced a declining revenue trend, with its crypto transaction profits shrinking by 18% to $31 million. Despite this, the company managed to record a net income of $25 million.”

Unraveling Robinhood’s Q2 Earnings: Crypto’s Volatility vs Stability

“Online trading platform Robinhood reported a Q2 crypto trading revenue of $31 million, an 18% decline from Q1, indicating the volatile nature of the crypto market. Despite market fluctuations, Robinhood’s assets remained steady at $11.5 million. The future of Robinhood, like the crypto market, stands at an intriguing crossroads.”

Potential DOJ Binance Fraud Allegations: A Tug-of-War Between Justice and Crypto Stability

The U.S. Department of Justice (DOJ) is reportedly considering charging crypto exchange Binance with fraud allegations, sending ripples of concern through the blockchain community. This highlights ongoing skepticism around the authenticity and security of blockchain technology and crypto markets, yet also underscores the system’s internal checks and balances against misleading and fraud.

Beeple Buying CryptoPunk #4953: Unpredictability of NFT Value and the Changing Dynamics in the Market

Renowned NFT artist Beeple recently made headlines by purchasing CryptoPunk #4953 for approximately 113.7 ETH or $208,000, marking his first entry into acquiring a profile-picture NFT. This move from creation to collecting signifies a potential shift in the NFT landscape.

India’s Place in Outlining International Crypto Regulations: Innovation or Instability?

India, currently leading the G20, reveals strategic notes on cryptocurrencies in preparation for global regulations. The initiative, involving cooperation from IMF and FSB, marks India proposing rules for crypto. The gist, expected in August, aims to highlight potential risks of the crypto world in emerging markets.

Presidential Hopeful’s Take on Bitcoin: Asset, but Not Dollar Stabilizer

Republican Presidential candidate Vivek Ramaswamy, while expressing fondness for Bitcoin, would not consider it as a component to stabilize the U.S. dollar. He believes the U.S. Federal Reserve should focus on maintaining dollar stability against traditional commodities.

Unraveling DeFi Instability: Curve Founder’s Actions as Catalyst for Market Risks

Michael Egorov, founder of Curve Finance, destabilized on-chain lending markets by leveraging his CRV holdings for large token loans, potentially triggering a wide-scale liquidation and distressing debts within the DeFi ecosystem. The situation underscores the importance of robust response strategies in the decentralized finance world.

Navigating Debt Crisis: How Curve Creator’s New Liquidity Pool Could Stabilize CRV Tokens

Michael Egorov, creator of Curve, has introduced a new liquidity pool, crvUSD/fFRAX, on his decentralized exchange to mitigate potential debt crisis and repay a curve token (CRV)-backed loan. The pool, bolstered with 100,000 CRV rewards, is aimed at decreasing the utilization rate to prevent unsustainable interest charges, attracting more liquidity into the system and providing respite from daunting debt levels.

Crypto Market Stability vs Lending Protocol Risk: A Tale of Two Worlds Unraveling in Summer Heat

“Major cryptocurrencies Bitcoin and Ether appear stable despite market turmoil. Contrarily, a significant blow threatens lending protocols, especially the CRV token linked to Curve Finance’s DAO. The founder’s position drifts towards liquidation, leading to possible cascades of liquidations and a flood of assets into the market.”

Steady Amid the Storm: Bitcoin’s Stability in Turbulent DeFi Times

“The Bitcoin community observes the currency’s steady performance around $29,183, amidst upheaval in the DeFi space, including a $24M exploit of Curve Finance. Analysts anticipate potential breakout patterns, with metrics suggesting promising buying opportunities if Bitcoin surpasses the $29,500 price point.”

Elon Musk’s Conundrum: Entrepreneurial Genius vs. Volatile Unpredictability in the Crypto Realm

“Musk’s unpredictable leadership style at Twitter, also known as X, has created a disruptive environment. Despite his disregard for empathy and preference for public sentiment over expertise, his innovation has been instrumental in financial features and integration with Dogecoin. However, this maverick approach leaves people unsure about the company’s long-term viability.”

Neutral Stance of Bitcoin Whales: Indicating Crypto Market Stability or Prolonged Inactivity?

“Bitcoin remains steady over $29.2K, with activity from Bitcoin ‘whales’ remaining stagnant. Crypto markets are perceived resilient, unaffected by macroeconomic factors like rate hikes or inflation. However, return to ‘bull market conditions’ may not occur until 2024, says Brent Xu, CEO of Umee.”

Crypto Vs Stocks: Comparing Market Performance Amid Unpredictability

Despite a 76% rally this year, Bitcoin’s growth recently declined, struggling to outpace stocks. Legal pressures on leading crypto businesses and the flourishing AI industry cause crypto to fall behind. However, crypto shows some resilience, with a slight market recovery after favorable events.

Dogecoin’s Unexpected Surge: Twitter Rebranding Effects and Market Instability Ahead

“Dogecoin (DOGE) recently experienced a 10% hike, seemingly due to trading activity on South Korean exchange UpBit. Speculation surrounding Twitter’s rebranding to the app X accepting DOGE payments seems to fuel the surge. However, these developments pose questions about stability in the volatile crypto market.”

The Future of Blockchain: Balancing Innovation with Stability and Security

“China’s mobile payment giants, WeChat Pay and Alipay, have abolished the requirement of a local bank account for foreign visitors, enabling international credit cards. Meanwhile, royalty volumes for NFTs on the Ethereum Blockchain have significantly dipped, causing concerns about their sustainability. Banks in Korea are exploring CD tokens as a stable alternative. Crypto wallet, Zengo introduced a premium subscription, and discussions on security vulnerabilities in crypto are ongoing.”

Soaring Bitcoin ‘HODLing’: A Promising Stability or a Price Swing Trap?

“Long-term Bitcoin holders, also known as “HODLers”, hold three-fourths of the entire circulating supply, with an accumulated increment of 62,882 BTC this month, says blockchain analytics firm Glassnode. The surge represents limited liquidity, implying a decreased sell-side pressure, but also potentially increasing price volatility.”

Unraveling Bitcoin’s Downtrend: Legal Disputes, Block Halving and Price Instability

The recent dip in Bitcoin’s trading volume is raising questions on the impact on its future prices. UK court’s verdict favoring Craig Wright’s copyright claim on Bitcoin file format potentially threatens open-source software development, thus affecting Bitcoin prices. Upcoming Bitcoin halving event also adds to price speculations.

Regulatory Uncertainty, DeFi Accountability, and Cryptocurrency-backed Dollar: A Crypto Crossroads

Regulation discussions remain a pressing issue in the cryptocurrency space. With the SEC undecided on Ripple’s ruling, a newly-introduced U.S Senate bill targeting decentralized finance (DeFi), and proposals of Bitcoin being utilized to strengthen the U.S dollar, the future of cryptocurrency is fascinatingly unpredictable.

Unpacking the Success of ProShares Bitcoin Strategy Fund Amid Market Unpredictability

The ProShares Bitcoin Strategy Fund, a pioneer ETF, allows investors to gain bitcoin exposure without owning the cryptocurrency. Contrary to early predictions of underperformance, the fund has closely tracked bitcoin’s price, potentially negating perceived risks of such ETFs.

Cryptocurrency Market: Navigating the Storm Amid Bitcoin’s Price Instability and Fear Index

Bitcoin’s price struggles around $30K, reflecting apprehension in the market. External factors like Elon Musk’s comments and a strengthening dollar impact both Bitcoin and the wider crypto market. Additionally, other key cryptos experience a downward trend, except LINK from Chainlink due to an interoperability protocol release. This uncertain climate highlights an interesting interplay between traditional and digital financial worlds.

Ethena’s $6M Funding Success Sets Stage for Stablecoin & Bond Launch: Assessing Stability & Risks

Portuguese crypto startup, Ethena, secured $6 million in seed funding for its upcoming stablecoin and bond asset launch. Ethena’s notable funders include Dragonfly, Arthur Hayes, and major industry players like BitMEX and Gemini. The stablecoin, named USDe, promises to maintain stability, with a focus on decentralization and capital efficiency.