“Influencers Ricky “FaZe Banks” Bengston, Nordan “FaZe Rain” Shat, and Matthew “Nadeshot” Haag are leveraging Friend.tech, a social token platform on the Base network. The platform enables users to trade “keys” tied to their Twitter accounts for exclusive access to group chats, earning a percent of sale in ETH. The platform has seen 1.1 million keys traded in over 935,000 transactions.”

Search Results for: Uphold

Decoding Ethereum Layer-2 Networks: Coinbase’s Pivot, Shibarium’s Revamp, and Solana’s Resurgence

The blockchain realm witnesses escalating discussions about secondary “layer-2” networks built atop Ethereum using “zero-knowledge” cryptography. Meanwhile, Coinbase pioneers blockchain education by operating its own blockchain, Shibarium aims to resolve network issues, and Solana recovers after significant setbacks while Terra falls victim to hackers.

Bouncing Back or Going Bust: Deciphering Ethereum’s Market Dip amidst SpaceX Rumors and SONIK’s Arrival

“Despite a recent 10% fall, Ethereum’s strong fundamentals and upcoming launches of the Holesky testnet and Dencun upgrade present a profitable investment opportunity. Meanwhile, newer tokens like Sonik Coin offer prospects to outperform traditional markets, while reminding investors of inherent risks in the crypto world.”

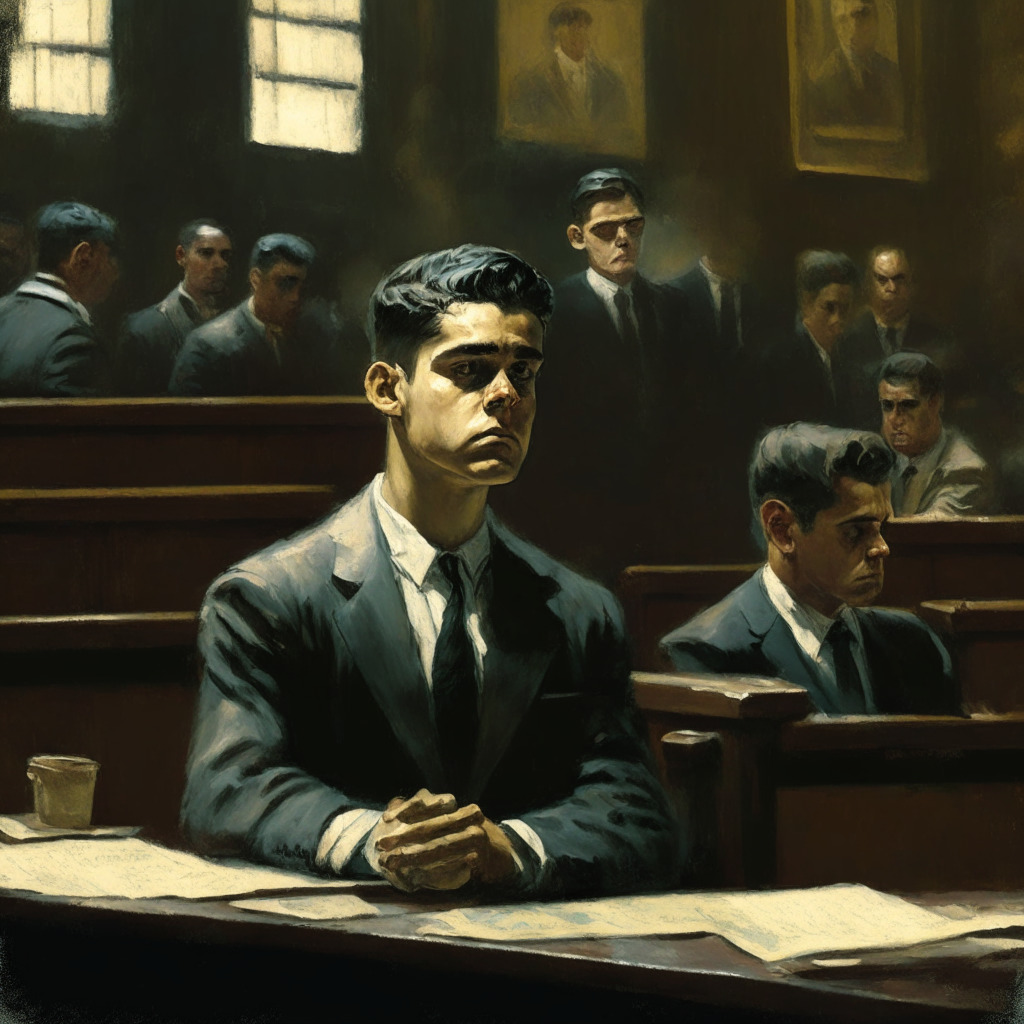

Navigating the Tightrope: Rising Crypto Regulations vs. Innovation in the Wake of the Bankman-Fried Saga

Former FTX CEO, Sam Bankman-Fried faces multiple fraud charges, currently under stricter regulations. Pending trials, he’s granted a one-time concession for a meeting outside jail. The saga points to the larger issue of regulatory impacts on crypto firms like Coinbase and Circle globally.

Navigating Bitcoin’s Dance with US Inflation-Adjusted Bond Yield: Unraveling Market Movements

“Recent market analysis shows Bitcoin and the U.S. inflation-adjusted bond yield showing the strongest negative correlation in four months. This dynamic suggests that traditional finance and macro influences on Bitcoin’s price movement are audible once more. This trend showcases the influence of real yields on high risk alternatives such as technology stocks and cryptocurrencies.”

Exploring China’s Digital ID Proposal: The Implications for Anonymity and Privacy in the Metaverse

“China proposes to extend their social credit system into the Metaverse using a digital ID for users, aimed at upholding order by storing and sharing user data with authorities. However, concerns about maintaining anonymity and privacy challenge such proposals, necessitating a balance between order and user rights.”

Navigating the Tumultuous Seas of XRP: A Tale of Lawsuits, Market Volatility, and Rising Adoption

XRP’s value has stabilized around $0.50, amidst ongoing legal proceedings with the SEC. Despite this, adoption of XRP is increasing, with companies like MoneyGram planning to utilize it for cross-border transactions. However, SEC’s continued appeal creates potential volatility.

Yuga Labs Departs from OpenSea: Stand for NFT Creator Royalties Splits Community

“In response to OpenSea’s royalty model alterations and removal of the Operator Filter, Yuga Labs, behind the Bored Ape Yacht Club (BAYC), plans to phase-out OpenSea’s Seaport functionality by February 2024, reinforcing commitment to creator royalties.”

Unraveling the Luthra-Bitget Feud: A Tug of War Between User Rights and Exchange Protocols

“A prominent crypto influencer, Evan Luthra, is suing Bitget cryptocurrency exchange for freezing his account and blocking access to $200,000. Bitget alleges market manipulation with Luthra’s account associated with the newly listed REELT token. This highlights the complexity of maintaining market integrity, user rights, and trust within the unregulated crypto industry.”

Orica: A Glimpse into the Twisting Paths of NFTs and Blockchain Philanthropy

“Orica, an NFT marketplace, promised transformative projects but faced setbacks with founders going off-grid and the marketplace going offline, leading to investor uncertainty. Despite problems, the platform achieved some charitable goals before going dark. This case highlights the volatility and unpredictability of cryptocurrency and blockchain projects.”

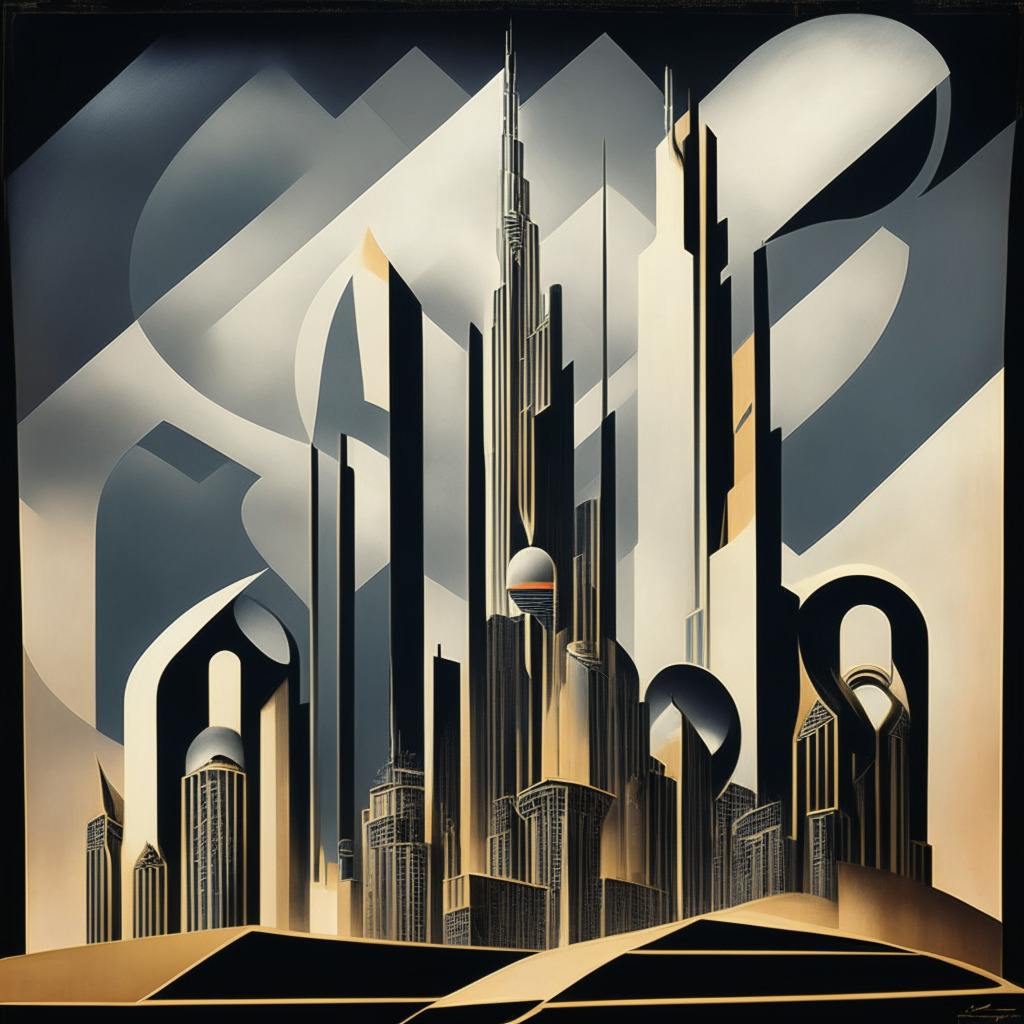

Dubai’s VARA Slaps $2.7 Million Fine on OPNX: A Call for Better Crypto Market Standards?

In a move to uphold industry standards, Dubai’s Virtual Assets Regulatory Authority (VARA) fined the co-founders of 3AC’s new crypto exchange venture, OPNX, $2.7m over a market offense. Absolution isn’t only debt-settling but respecting regulatory frameworks, with unpersistence risking further penalties and marketing the destination of the crypto ecosystem.

Digital Energy Council: Sustaining Crypto Mining and Shaping Policymaking in Digital Assets

The Digital Energy Council, a group dedicated to cryptocurrency miners, has been introduced as a crucial intermediary for discussions about crypto mining sustainability, and policy advancement with Washington-based policymakers. This initiative prioritizes miners’ interests while ensuring compliance with U.S. energy laws, aiming to promote responsible energy development and national security.

The Rise of Crypto Regulation in UAE: Opportunities and Challenges Unveiled

The Abu Dhabi-based virtual assets firm, M2, has received financial services permission from the Financial Services Regulatory Authority of the Abu Dhabi Global Market, enabling both retail and institutional clients in the UAE to buy, sell and hold virtual assets like Bitcoin and Ethereum. The M2 platform’s launch in 2023 will also allow UAE users to purchase cryptocurrencies with fiat money. However, the platform’s safety measures for asset custody raise concerns about cybersecurity.

Crypto Miners Unite: The Digital Energy Council Paves Way Amid Regulatory Tumult

The Digital Energy Council, an alliance of crypto miners, is seeking to influence U.S. policy for friendlier laws on sustainable energy development and grid resilience. However, their goals clash with the Biden administration’s stance, including a proposed 30% tax on mining operations for environmental concerns.

Decrypting Privacy: Navigating the Complexities of Blockchain and Cryptocurrency Security

“The rise of blockchain technology has revolutionized financial transactions but also raises privacy concerns. Transactions are logged on public ledgers, implying transactions can be traced back to specific addresses. Strategies for maintaining privacy include using encryption tools, maintaining wallet anonymity, and exploring privacy-focused cryptocurrencies, also considering DeFi platform exposures.”

Legal Turbulence in Crypto Sphere: Navigating Regulatory Challenges Amidst Swirling Controversies

Navigating through the complex labyrinth of regulatory challenges in the blockchain and crypto world, we see important incidents arising, such as a $100M lawsuit against a Filecoin mining service in China, over alleged pyramid scheme fraud. This emphasis on the need for comprehensive regulations in the crypto sector to maintain market integrity and protect investors.

Leveraging China’s Digital Yuan for Green Financing: Pros, Cons, and Future Potentials

Zhongshan Jewelly Optoelectronics Technology, a Guangdong-based firm, has secured over $276,000 from China’s first digital yuan-powered green finance loan. Using the digital yuan offers cost-effective, efficiency for enterprises, with real-time fund transfer and no incurring handling and service fees. Meanwhile, its traceability can prevent misappropriation of green funding loans.

FTX Founder Sam Bankman-Fried’s Legal Duel: Ethics, Law, and the Crypto Future

“FTX founder Sam Bankman-Fried faces serious charges including securities fraud, wire fraud, and money laundering. Allegations of bond violation and witness tampering are under scrutiny. His troublesome situation serves as a stark reminder of the importance of upholding rules and integrity in the ever-evolving crypto industry.”

Navigating Innovation and Regulation in Crypto – A Global Odyssey

“The Argentine Agency for Access to Public Information is investigating Worldcoin’s data collection practices; Canadian authorities aim to improve storage of seized digital assets including NFTs; Coinrule recently launched its Marketplace driven by Generative Models. This crypto evolution requires a balance between innovation and regulation.”

Navigating the Regulatory Waves: Binance’s Taiwan Strategy for Anti-Money Laundering Compliance

“Binance, the world’s largest digital currency exchange, is taking steps towards Anti-Money Laundering compliance in Taiwan as it navigates the emerging regulatory landscape. The Taiwanese cryptocurrency industry’s new AML guidelines are opening opportunities for Binance’s expansion, despite recent regulatory challenges in the United States and Europe.”

Bitcoin’s Uncertain Future: A Tug-of-War at $29.3K and Visa’s Game-Changing Move

“The future of Bitcoin remains uncertain, with bulls and bears fighting for market control around the crucial $29,700 mark. Meanwhile, Visa’s attempt to lessen friction for blockchain users could revolutionize cryptocurrency wallets, allowing onsite gas fees to be paid with Visa debit cards.”

Navigating the Thin Line: Bittrex Settlement Sparks Decisive Debate on Blockchain Regulations

The SEC has settled with cryptocurrency platform Bittrex and ex-CEO, William Shihara, for running an unregistered exchange. Critics argue regulations could inhibit blockchain technology’s growth, but such rules help prevent scams and foster trust in the crypto ecosystem.

Stablecoins: The Potential Lifeline for US Dollar’s Global Dominance and The Challenge of Regulation

Stablecoins could potentially retain the global dominance of the U.S. dollar, countering “de-dollarization”. The authors express that with proper regulatory frameworks, stablecoins could reestablish the U.S. dollar’s role in international trade and provide relief for hyperinflation-affected economies.

Emergence of Regulated Crypto Exchanges: Boon or Bane for the Crypto Industry?

“Blockchain.com has been granted a major payment institution license by the Monetary Authority of Singapore, permitting it to offer regulated digital payment token services to international clients. This reflects Singapore’s ongoing support for crypto companies, contributing to discussions about the impact of increasing regulatory controls on crypto’s foundational values and innovation.”

The Crushing Uncertainty: Crypto’s Struggle with Regulators and the Future of Digital Assets

“A significant episode in China underlined the persistent uncertainty around cryptocurrency’s legal status. A man lending Bitcoin faced an unsympathetic legal system when the borrower defaulted. The court ruled Bitcoin, as a digital commodity, doesn’t hold the same legal status as fiat currencies, therefore, can’t be subject to legal enforcement or compensation.”

$67.3 Million Claim against FTX: Investor Trust, Crypto Volatility And the Complex Universe of Blockchain

Matthew Graham of Sino Global Capital files a $67.3 million claim against FTX Trading Ltd on behalf of Sino’s Liquid Value fund. The fund, created in collaboration with Sam Bankman-Fried, was aiming to raise $200 million, primarily from high net worth individuals. With FTX a key investor, the situation turned tumultuous after FTX’s collapse, highlighting the volatility inherent in the crypto market.

Downplayed US Credit Rating: Cryptocurrency as a Potential Game-Changer in the Dollar-Dominated Debt Market

“This article discusses the potential disruption Bitcoin and cryptocurrencies could pose to traditional money systems; highlighting the influence of Bitcoin in strengthening citizens’ financial rights. Simultaneously, the rising popularity of central bank digital currencies (CBDCs) could trigger a massive financial transformation, pressuring the US to embrace these emerging monetary systems.”

Unearthing the Future: The Bold Vision and Risks in Futureverse’s $50M Venture Fund Launch

Shara Senderoff and Aaron McDonald, co-founders of Futureverse, have launched a $50 million venture fund “Born Ready,” hoping to invest in potential-oozing tech companies that can collaborate with Futureverse or the metaverse blockchain, The Root Network. Despite the risk-laden nature of emerging technologies, the firm upholds an unwavering belief in unexplored tech frontiers.

Radicals in Blockchain: Reimagining The Commons with Cryptocurrency

“Dávila recently authored ‘Blockchain Radicals: How Capitalism Ruined Crypto and How to Fix It,’ a book that explores blockchain’s role in organizing non-state social and economic alliances. He upholds crypto’s potential to redefine and rejuvenate ‘the commons’ and advocates for broader understanding of the endless possibilities that crypto offers.”

Unraveling the BALD Token Puzzle: Alameda, Market Chaos and the Tangled Web of Crypto

“The BALD token controversy shows complexities of the blockchain markets. The token’s price rally and subsequent liquidity decoupling raise eyebrows. Links suggest involvement of Alameda Research wallets, but concrete evidence is lacking. This situation underscored the critical need for increased crypto transparency, accountability, and regulation.”

Navigating the Tempest: The SEC, Richard Heart, and Allegations of Crypto Deception

The U.S. Securities and Exchange Commission (SEC) is pressing charges against Richard Heart, the backer of projects Hex, PulseChain and PulseX, accusing him of fraudulent practices. Heart allegedly recycled investment funds during Hex’s inception phase, effectively inflating initial investment, attracting more victims, and misleading investors with a fictitious “staking” program. This serves as a warning to evaluate the underlying technology and financial models of investment targets.

Litecoin’s Halving Event: Advantages, Drawbacks, and the Impact on Cryptocurrency Landscape

“Litecoin, a Bitcoin derivative, recently executed its third halving event, cutting block subsidy, a miners incentive, from 12.5 LTC to 6.25 LTC. Although some miners anticipated this, detractors worry it could negatively affect enthusiasm due to reduced rewards.”