Valkyrie Funds LLC has received approval to incorporate Ethereum futures into their Bitcoin futures exchange-traded fund (ETF), marking a significant shift in the crypto market. This move potentially paves the way for firms like VanEck and ProShares to launch dedicated Ethereum futures ETFs. The impact on Ethereum prices is already noticeable with a 6% increase this week.

Search Results for: BIT

SEC’s Bitcoin ETF Decision Delay: A Strategic Extender or Investor Protector?

The U.S. Securities and Exchange Commission (SEC) has postponed ruling on applications for spot Bitcoin exchange-traded funds (ETFs), including from big players like BlackRock and Invesco. This delay coincides with the possible U.S. government shutdown and its impact on SEC’s operations. Despite pointed SEC caution due to investor protection concerns, industry optimism for a Bitcoin ETF approval is rising.

Court Overrules SEC’s Dismissal on Bitcoin ETF: A New Dawn for Grayscale or a Risky Bet?

A US federal judge recently overturned the SEC’s dismissal of Grayscale’s proposal to convert its Bitcoin Trust (GBTC) into an ETF, causing ripple effects in the crypto market. Analysts project a 75% likelihood of spot Bitcoin ETF acceptance in 2023. This may lead to substantial consequences for the crypto market, potentially boosting Bitcoin price and possibly paving way for Ethereum’s approval.

Unraveling the Myth: Why Bitcoin Miners Sell off their Daily Mining Rewards

“Bitcoin miners sell their daily BTC rewards not due to market distress, but as part of a strategic approach to drive costs down, enhance operational efficiency, and stabilize profits. Strategies are shaped more by managing operational risks, fueling growth, and tactically responding to crypto market fluctuation rather than signals of distress.”

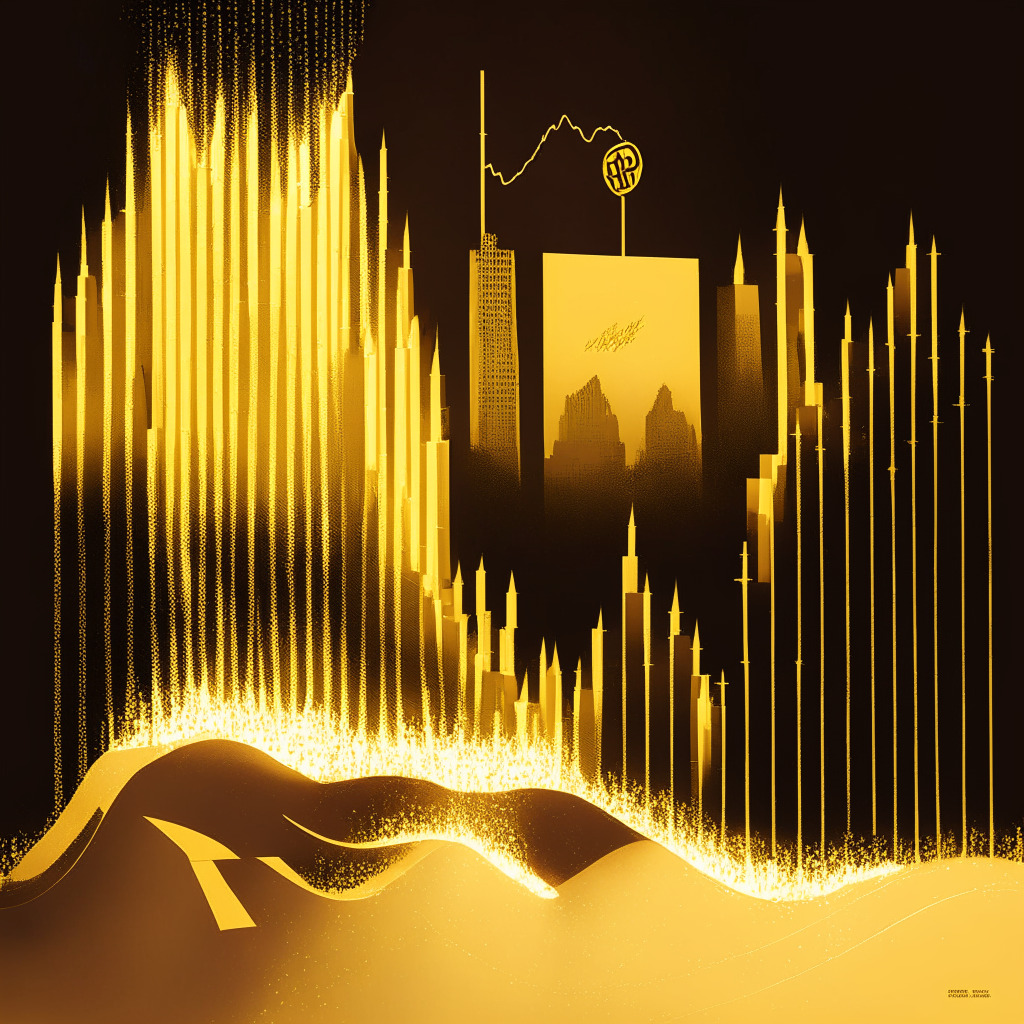

Riding the Bitcoin Bull: A Deep Dive into Market Trends and Emerging Alternatives

“Bitcoin continues to dominate the digital asset sphere, recently surpassing the $27,000 mark and boosting trading volume by 78%. Its resurgence, backed by a trading volume of nearly $14 billion and a market capitalization of approximately $530 billion, solidifies Bitcoin’s top position in the crypto market. Bitcoin Minetrix (BTCMTX) presents a compelling new presale opportunity with attractive annual yield and rewards system.”

Bitcoin’s Bullish Outlook: Institutional Interest and Decreasing Availability on Exchanges

“Bitcoin’s 3% rise past the $27,300 mark is attributed to the plunging supply of Bitcoin on exchanges. This dwindling supply signals traders’ confidence in Bitcoin’s potential for long-term holding, while institutional interest continues to grow. However, the market remains predominantly fearful according to the Fear & Greed Index.”

Bitcoin’s Big Break or Breaking Point? Analyzing the Future of Cryptosphere Amid New Market Highs

“Bitcoin notched a new weekly high of $26,823 on Sep. 28, potentially influenced by the latest U.S. macroeconomic data. While economic indicators lend optimism, analysts urge caution, maintaining that Bitcoin could yet face retractions. The cryptocurrency world eagerly awaits cues from the Federal Reserve Chair.”

Riding the Crypto Wave: Bitcoin Cash’s Rising Tide and the Future of Tokenized Mining Platforms

“Bitcoin Cash (BCH) has registered a significant 1.5% gain within 24 hours, and 12% in a week, showing a noticeable shift in whale investors. The crypto’s trading volume skyrocketed from $70 million to nearly $500 million, signaling BCH’s continued upward trajectory with significant buying interest.”

Bitcoin Halving 2024: Boon or Bane for Miners, and the Ripple Effects on the Blockchain Ecosystem

“Blockchain technology continues to break boundaries as it evolves at a rapid pace. Despite the uncertainty of the upcoming Bitcoin halving event in 2024, the resilience and adaptability of blockchain remain indisputable, making its future exciting.”

Marathon Digital’s Mining Misstep: An Unexpected Validator of Bitcoin’s Security or a Wake Up Call?

Marathon Digital recently confessed to mining an invalid block during an operation enhancement experiment, which triggered concerns in the cryptocurrency community. Despite this, Bitcoin’s correction of the error highlighted the strength of its security systems. Marathon remains undeterred, continuing to focus on efficiency initiatives, amid a 134% year-on-year rise in mining efficiency and improved revenues.

Riding the Bitcoin Roller Coaster: An Analysis of the Volatile Crypto Market

“Bitcoin’s current price reflects a 70% gain after a November 2022 bottom. However, Fibonacci fractal analysis suggests a potential crash to $21,500. On the other hand, Bitcoin’s Coin Day Destroyed metric suggests a trend for hodling among investors, creating a mixed outlook.”

Bitcoin ETFs: A Step into the Future or a Regulatory Quagmire?

“Both sides of the Congress are urging the SEC to approve Bitcoin ETFs, stressing the need to balance investor protection and allowing innovation. However, the SEC has delayed its decision, raising concerns. The article also highlights Bitcoin price prediction and mentions 15 alternative cryptocurrencies to watch in 2023.”

Beacon or Blunder: Analyzing Marathon’s Invalid Bitcoin Block Mining Experiment

In a recent development, Bitcoin mining company, Marathon Digital, admitted to creating an invalid Bitcoin block, purportedly as part of an experimental operational optimization. While this initially raised concerns over potential vulnerabilities within Bitcoin’s network, it notably showcased Bitcoin’s robust security, which efficiently neutralized the invalid block.

The Bittersweet Symphony of Blockchain and Gaming: Capabilities, Challenges, and Future Implications

“Minecraft’s Bitcoin-friendly server, Satlantis, had to remove its play-to-earn features due to pressure from game developer Mojang, disappointing the gaming community. Despite this, Satlantis remains operational and seeks alternative platforms for innovation. Concurrently, Apple’s new gaming-friendly iPhone models face NFT app regulation hurdles.”

Balancing Act: Bitcoin Stability Amid Market Tumult and the Potential Perils of Crypto Presales

“Despite a tumbling stock market, Bitcoin maintained a stable value, making some analysts wary about future cryptocurrency market trends. While some view this calm as a slump, others perceive it as a pre-storm silence with riskier assets, including cryptocurrencies, potentially facing intensified pressure due to high interest rate concerns.”

Bitcoin’s Bullish Future and the Emerging Role of Staking Ventures Like Bitcoin Minetrix

“Bitcoin continues to reign supreme, with a bullish technical bias as long as it stays over the $26,000 support level. However, falling below could trigger a slide towards lower support. Additionally, Bitcoin Minetrix, a stake-to-mine venture, is democratizing the mining process, making BTC rewards more accessible.”

High Interest Rates and Bitcoin Performance: Unraveling Market Reactions and Divergence

“In the wake of Federal Reserve’s decision to maintain high interest rates, a divergence between the S&P 500 and Bitcoin has become apparent. This indicates that Bitcoin and other cryptocurrencies may march to their own drumbeat, influenced by factors like regulatory tweaks, attacks resilience and monetary policy predictability, potentially outperforming the S&P 500 in the future.”

Kiyosaki’s Predictions: Citibank’s Blockchain Foray and its Impact on Bitcoin and the US Dollar

“Citibank introduces Citi Token Services, harnessing blockchain technology for easier cross-border transactions. Robert Kiyosaki speculates this might affect both the US dollar and Bitcoin. Rationalizing, some suggest this could intensify cryptocurrency acceptance due to blockchain’s increasing legitimacy among mainstream financial institutions.”

Bitcoin’s Volatility: Can Smaller Yield-Bearing Platforms Balance the Risk?

Bitcoin’s price volatility is prompting investors to explore alternative coins like Bitcoin Minetrix which features stake-to-mine, yielding potential income while mitigating capital risk. However, potential issues at Binance exchange could negatively impact Bitcoin prices, emphasizing the importance of diversification in blockchain investments.

Unraveling Bitcoin Mining: Environmental Hazard or Green Energy Catalyst?

“Fascinating revelations suggest that Bitcoin mining now leads as the most sustainably-powered global industry, with over half of its energy from renewable sources. Despite criticism, research shows a 38% increase in sustainable energy adoption, surpassing other sectors, including banking.”

Bitcoin’s Balancing Act: A Sudden Surge to $30,000 and the Need for Vigilance

The cryptocurrency market is seeing a price trajectory rise, with one analyst projecting Bitcoin to reach $30,000 in October. The ongoing bullish sentiment is driving analysts to predict a potential breakout. However, risks remain due to market volatility, underpinning the importance of thorough research before making investment decisions.

Unveiling AirBit Club: Tale of a Cryptocurrency Ponzi Scheme with a $100M Penalty

“Pablo Renato Rodriguez, co-founder of the crypto-based pyramid scheme AirBit Club, received a 12-year prison sentence for masterminding a multilevel marketing club falsely promising revenue through crypto mining and trading, essentially exploiting investors.”

Bitcoin Ordinals, the Invisible Friend or Foe? Unraveling their Impact on Network Congestion and Market Dynamics

“Ordinals, a method of registering digital content on the Bitcoin network, are seen as disruptive by some. However, analytics firm Glassnode finds little proof that they’re causing network congestion. Despite concerns, these bitcoin ‘pocket fillers’ seem to coexist with other money transfers, leveraging cheap block space without greatly impacting transfer volumes.”

Bitcoin Market Uncertainty: SEC’s Decision Impact & Prospective Blockchain Future

Bitcoin’s slight dip in value, resulting from the SEC’s postponement on Ark 21Shares Spot Bitcoin ETF verdict, is causing a market-wide slowdown. However, Bitcoin’s blockchain’s achievement of over 900 million transactions and Microstrategy’s investment have revitalized the market. Additionally, an upliftment of interest rates by the Federal Reserve may provide a promising outlook on Bitcoin’s future.

Bitcoin Ordinals: Evaluating Impact on Network Efficiency Amid Rising Concerns

“The recent rise of Bitcoin Ordinals, a data inscription system, has raised concerns about network clogging and its impact on higher-value transactions. Contrary to this belief, a report by Glassnode found that inscriptions only occupy a fifth of Bitcoin’s transaction fees, indicating efficient blockspace use rather than significant displacement. However, Bitcoin Ordinals have amplified the demand for blockspace and operation costs for miners, potentially challenging miners’ profitability.”

Navigating SEC Delays and Approvals: The Future of Bitcoin ETFs

“The U.S. SEC has postponed a decision on the proposed ARK 21Shares spot Bitcoin ETF until January 10th, indicating the need for meticulous scrutiny of the suggested rule modification. The SEC’s deferral also affects other applications, suggesting a potential cascade of delays for spot Bitcoin funds.”

Bitcoin’s Bull and Bear Struggle: Decoding Trends & Future Market Predictions

“Bitcoin’s price may see a potential rise to $27,500 if it can cleanly overcome the $26,700 obstacle. Nonetheless, failure to clear this hurdle may divert Bitcoin to lower levels like $25,400, or $25,000. Keep updated on digital assets and conduct thorough, independent research before investment.”

Pros and Cons of the SEC’s Extended Review Period on ARK 21Shares’ Bitcoin ETF Proposal

The Securities and Exchange Commission (SEC) has delayed its decision on a BTC ETF from ARK 21Shares till January. This delay raises questions about when crypto ETF approvals will arrive in the US. Despite increasing interests, no spot BTC ETF has been approved yet. Members of Congress urged the SEC to approve Bitcoin ETFs, arguing against discrimination on spot bitcoin traded products. The crypto community eagerly awaits the SEC’s final decision, marking January 10, 2023, in their calendars.

Navigating Tides: Bitcoin’s Resilience Amid Stock Market Downfall and Rising US Yields

“Bitcoin appears unfazed by a downside in the US stock market, trading in the $26,200s, a 17% drop from July’s high. Factors like the upcoming halving and potential Bitcoin ETF approvals are maintaining Bitcoin’s price. However, rising US bond yields and the strength of the US Dollar may reflect an impending dip back towards the $20,000 mark.”

Securing Bitcoin ETFs: Bitwise’s Renewed Struggle Against SEC’s Technical Hurdles

Bitwise Asset Management has amended its Bitcoin ETF application, now including evidence countering the SEC’s argument against using the CME BTC futures market for surveillance-sharing. Despite being a positive step, it’s uncertain if these changes will satisfy the SEC’s regulatory requirements.

Unraveling the Threads: The Dynamic Between Bitcoin Price and US Treasury Yields

“The intricate relationship between Bitcoin price and U.S. Treasury yields has been discussed with Bitcoin halvings often paralleling “relative local lows” in the 10-year Treasury yield. However, this correlation might not necessarily be a causal link. The dynamics driving Bitcoin’s price could be influenced more complexly, possibly by a shift towards riskier assets rather than trends in Treasury yields.”

Bitcoin vs. Bitcoin Minetrix: A New Contender in the Crypto Mining Arena

“Bitcoin Minetrix ($BTCMTX), offers a decentralized mining solution based on cloud computing where stakers earn credits for Bitcoin mining. Utilizing Ethereum’s secured smart contract platform, it helps reduce costs and automatically manages user allocations. Despite the enticing benefits, potential investors must consider market state and the ever-evolving crypto landscape.”