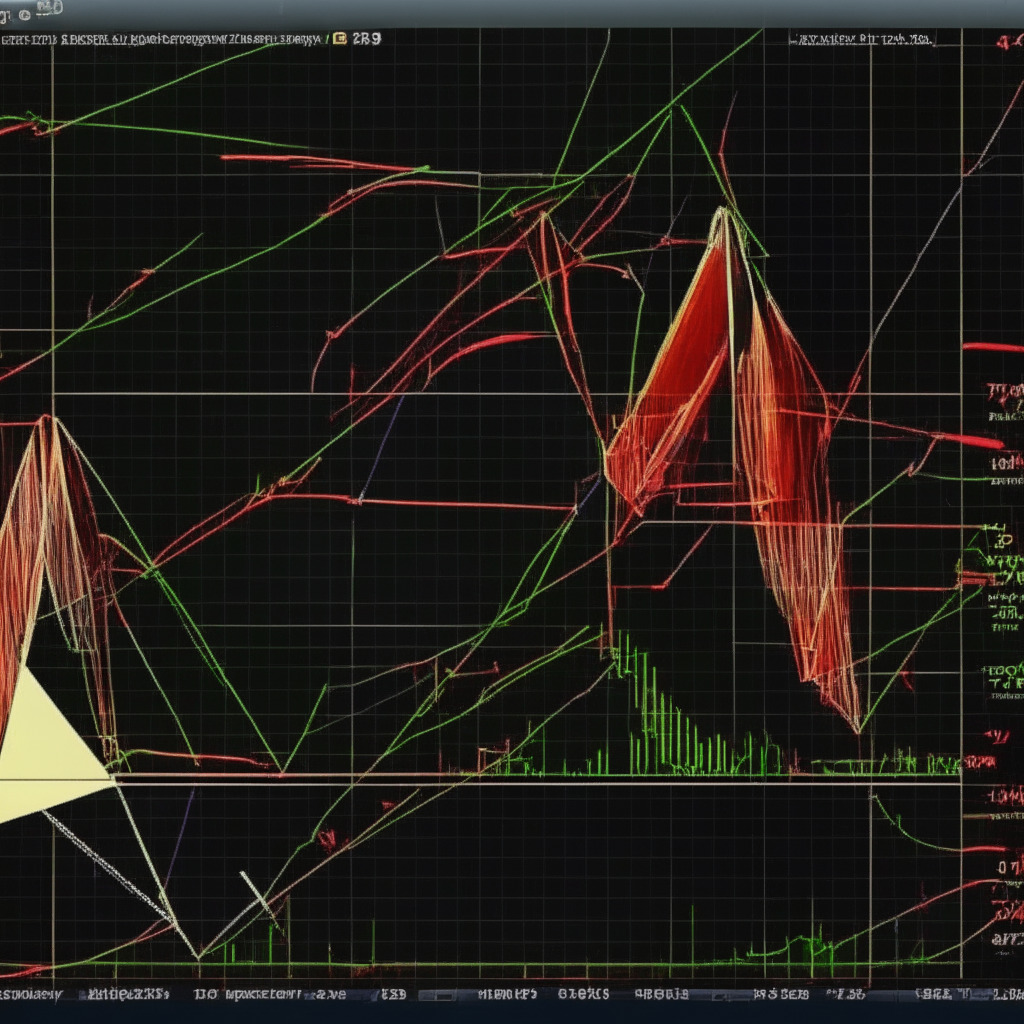

BNB’s value experienced a 28.5% drop amid Binance’s legal dispute and recent altcoin crash, breaking a symmetrical triangle pattern suggesting a continued downward trajectory. With selling pressure intensifying, BNB’s price might decline to $182.5, putting it at significant risk for further decrease.

Search Results for: Binance U.S.

Binance.US and SEC Compromise Saga: Balancing Investor Protection and Crypto Innovation

The SEC and Binance.US work towards a compromise to avoid freezing the exchange’s assets, following Judge Amy Berman Jackson’s order. The outcome could set a precedent for future interactions between regulators and cryptocurrency-based businesses, affecting the digital asset market and investor confidence. Cooperation and negotiation are crucial for striking a balance between safeguarding investors and fostering innovation in the cryptocurrency sector.

SEC vs Binance: Asset Freeze Debate & Crypto Asset vs Security Classification

A U.S. federal judge denies a temporary restraining order against Binance and Binance.US, allowing them to continue operating while negotiating restrictions with the SEC. The SEC sued the companies and founder Changpeng “CZ” Zhao for allegedly operating as unregistered securities entities and granting Zhao access to Binance.US customer assets.

Binance & Binance.US Battle SEC Lawsuit: The Fate of Crypto Regulations and Industry

Binance and Binance.US face the SEC in court over a proposed temporary restraining order, which they claim could threaten their businesses’ survival. Meanwhile, Ripple’s ongoing SEC lawsuit offers insights into the regulator’s deliberative process. The outcomes of these cases will significantly influence the future of cryptocurrency regulations and the industry’s landscape.

Easing SEC Restrictions on Binance.US: Striking a Balance Between Regulation and Innovation

The SEC and BAM Trading (Binance’s U.S. arm) have filed a request for a consent order aiming to ease asset restrictions. The primary condition is that Binance cannot make payments or transfer assets to benefit any Binance entity or individual, including CEO Changpeng Zhao. This order highlights the evolving relationship between regulatory bodies and the cryptocurrency industry, balancing regulation and innovation.

Binance.US Fights SEC Claims: The Impact on Crypto Industry and Investors

Binance.US defends against SEC’s claims, arguing that the emergency motion for a temporary restraining order would harm its business and customers. The crypto exchange refutes SEC’s view of cryptocurrencies as securities and highlights its cooperation with ongoing investigations; meanwhile, SEC seeks investor protection.

Binance US vs. SEC: The Clash that Could Shape Crypto Regulation and Innovation

Binance US faces 13 serious charges from the SEC, including operating unregistered exchanges and misrepresenting trading controls. They’ve tapped a high-profile legal team, led by former SEC Division of Enforcement co-director George Canellos. The case raises concerns about striking the right balance between investor security and fostering growth in the blockchain and crypto industries.

Binance.US vs SEC: Fund Freeze Debate & Implications for Crypto Industry

Binance.US argues that the SEC’s attempt to freeze its funds is “draconian and unduly burdensome,” in response to allegations of operating as an unregistered securities exchange, broker, and clearinghouse. As the legal battle unfolds, both parties raise valid concerns, and the outcome may significantly impact the crypto industry’s regulatory environment.

Legal Battles for Binance: Will Crypto Industry Emerge Stronger or Succumb to Regulation?

The U.S. DOJ may file criminal charges against Binance and its executives, according to former SEC Chief Executive John Read Stark. Allegations include fraud, deception of law, and money laundering. The situation emphasizes the need for stricter compliance, transparency, and increased scrutiny within the crypto industry.

SEC Crackdown on Binance and Coinbase: Boon or Bane for Crypto Innovation and Markets?

Following the SEC’s legal actions against Binance and Coinbase, the total number of labeled crypto-securities reached an estimated 67, encompassing over $100 billion of the market. Amidst this crackdown, trading volume across decentralized exchanges surged by 444%. The SEC’s measures have sparked debate among crypto enthusiasts, affecting the industry’s adaptation to regulatory challenges.

SEC Crackdown on Binance and Coinbase: Navigating the High-Stakes Regulatory Battle

Crypto markets faced a downturn following SEC’s enforcement actions against Binance and Coinbase for allegedly operating as unregistered securities exchanges, impacting major cryptocurrencies. Amid growing tensions between regulators and the crypto community, the uncertain future of regulatory action in the industry raises concerns about the balance between stability and stifling innovation.

Decoding AUM in Crypto Exchanges: Binance CEO Addresses Skewed Data & Market Fluctuations

Binance CEO Changpeng “CZ” Zhao highlights the importance of understanding the difference between crypto price drops and actual outflows in measuring Asset Under Management (AUM). He emphasizes that market fluctuations and the methodology adopted by third-party analysis firms can create misleading representations of asset movements, urging crypto enthusiasts to conduct thorough research before investing.

Binance Faces Legal Challenges: Impact on Nigeria’s Crypto Market and Regulatory Future

Nigeria’s SEC deems Binance illegal, following a lawsuit by the U.S. SEC. This impacts one of Africa’s most prominent crypto hubs, as the Middle East and North Africa region leads in crypto adoption. New regulations aim to ensure a secure environment for digital asset use amid rapid growth.

Binance Nigeria Shutdown: A Precedent for Crypto Regulation or Growth Hindrance?

The Nigerian SEC ordered an immediate halt of Binance’s Nigerian unit’s operations, citing its unregistered and unregulated status. This action raises questions about further regulatory actions against other crypto-related businesses in Nigeria and highlights the regulatory uncertainty surrounding the country’s crypto industry.

SEC Lawsuits Trigger $4 Billion Exodus from Binance and Coinbase: Analyzing Impacts and Responses

The SEC has filed lawsuits against Binance, Binance.US, and Coinbase, triggering an exodus of around $4 billion in deposits. Blockchain analytics firms Nansen and Glassnode recorded combined net outflows of $3.1 billion via Ethereum and $864 million in bitcoin. The regulatory clampdown led to mass withdrawals from the exchanges, unsettling the cryptocurrency market and causing substantial declines in tokens categorized as securities within the lawsuits.

SEC Summer Crackdown on Binance & Coinbase: Legal Clarity or Market Fiasco?

The SEC has targeted Binance and Coinbase in its recent crypto crackdown, resulting in 13 charges against Binance and accusations of unregistered securities offerings against Coinbase. Despite ongoing uncertainty, these events may bring desired legal clarity to the industry.

SEC’s Pursuit of Binance & CZ: Impact on Crypto Exchange Transparency and Regulation Battle

The SEC seeks alternative means to serve legal papers to Binance and CEO Changpeng Zhao due to their elusive locations. Amid a 136-page lawsuit containing accusations of securities violations and market manipulation, the situation raises concerns about large cryptocurrency exchanges’ transparency and highlights the need for a regulatory framework.

Binance Coin: Navigating Legal Woes, Triangle Pattern & Potential 20% Growth Opportunity

Binance Coin (BNB) faces selling pressure as the SEC takes legal action against the crypto exchange, causing a 17.5% drop in market value. However, the support level aligns with the triangle pattern’s trendline, signaling potential accumulation and a possible bullish reversal. Watch for market conditions and conduct thorough research before investing.

Ethereum’s Future Amid SEC Actions Against Binance and Coinbase: A Market Analysis

The Ethereum fear and greed index stands at 49%, reflecting a neutral sentiment amid recent SEC actions against Binance and Coinbase. The Ethereum price remains bullish long-term, supported by a rising trendline. However, sideways trends may continue in the near future.

Binance.US Shifts to All-Crypto Exchange: Balancing Compliance and Innovation in Blockchain

Binance.US temporarily transitions to an all-crypto exchange amid SEC pressures, suspending USD deposits and de-listing USD-based trading pairs. Meanwhile, BitGo acquires crypto custody specialist Prime Trust, and Coinbase faces potential devaluation due to regulatory challenges and weak trading volumes. The future of blockchain and cryptocurrency sectors remains uncertain amid regulatory hurdles and the need for investor protection.

Bitcoin Price Dip on Binance.US: Traders Scramble as SEC Freezes Assets

Bitcoin experienced a price dip on Binance.US after announcing plans to transition into a crypto-only platform starting June 13. Traders are urgently liquidating assets due to concerns over halted USD withdrawals, while Binance.US faces the challenge of rebuilding trust and regaining market share.

Binance.US Suspends Dollar Deposits: Regulatory Pressure vs. Stifling Innovation Debate

Binance.US suspends dollar deposits and plans to become a crypto-only exchange amidst increasing pressure from the SEC and alleged violations of U.S. securities laws. The decision raises concerns about overreaching regulation stifling innovation and limiting digital asset sector growth.

Binance.US Shift to All-Crypto Exchange: Balancing Innovation and Regulation in Crypto

Binance.US, transitioning to an all-crypto exchange due to SEC pressure, highlights the ongoing conflict between innovation and regulation in the cryptocurrency and blockchain industry. Striking a balance between the two while nurturing future growth remains the shared responsibility of the crypto community and regulators.

Binance.US Suspends USD Deposits: Compliance Move or Cause for Concern?

Binance.US suspends USD deposits and warns of fiat withdrawal pause, citing protection from SEC’s “extremely aggressive and intimidating tactics.” Transitioning to a crypto-only exchange, the move raises questions about regulatory challenges and accessibility for users converting fiat currencies.

AliExpress NFT Mystery, Binance Lawsuit & Hong Kong’s Web3 Boom: Crypto’s Mixed Landscape

AliExpress partnered with Web3 developer The Moment3! for shopping-themed NFTs, but the announcement was deleted shortly after, raising concerns about NFTs’ future in China. Meanwhile, Hong Kong shows increasing demand for Web3 professionals, with pro-Web3 regulations attracting attention.

Binance Leaked Chat Logs: The Perils of Internal Communication and Crypto Industry Ethics

Binance CEO Changpeng Zhao warns employees about the potential consequences of their internal communication, following leaked chat logs used as evidence in an SEC lawsuit against the firm. The logs revealed discussions of questionable tactics and prompted CZ to remind staff that their conversations could end up in court or online.

Senators Call for Binance Investigation: Regulatory Oversight or Stifling Innovation?

Senators Elizabeth Warren and Chris Van Hollen called on the DOJ to investigate Binance and Binance.US for allegedly misleading Congress. Amid increased government pressure, discussions around the future of cryptocurrencies and necessary regulations continue, highlighting the importance of balancing regulatory oversight and innovation.

Cathie Wood on SEC Actions: Coinbase May Emerge Stronger, Binance Faces Tougher Fight

Top investor Cathie Wood comments on the SEC’s actions against Coinbase and Binance, highlighting the difference in case severity and suggesting that the crackdown could ultimately benefit Coinbase. Wood emphasizes the importance of understanding the nuances and complexities of each case, while also discussing the impact of AI and other innovative technologies on the future of digital asset exchanges.

Binance’s Billion-Dollar Transactions: Financial Misconduct or BUSD Conversion Debate

An SEC filing reveals Binance allegedly moved billions in customer funds through Signature Bank and Silvergate Bank, with billions of dollars paid to Paxos Trust Company. Binance denies mixing client funds with corporate funds and claims the funds involved USD to BUSD conversions within customers’ accounts.

SEC Lawsuits Against Binance & Coinbase: Impact on Crypto Regulation and Future Markets

The U.S. SEC filed lawsuits against Binance and Coinbase, which may define cryptocurrency regulation in the U.S. Both companies argue against regulation by enforcement, with the key issue being whether listed cryptocurrencies are securities. The cases demonstrate the ongoing struggle between crypto exchanges and regulatory authorities, emphasizing the need for clear guidance.

BNB Market Cap Plummets Amid SEC Lawsuit: How Low Can Binance’s Token Go?

BNB’s market capitalization dropped by $7 billion since the SEC filed a lawsuit against Binance, causing concerns about the token’s price future. Technical analysis suggests a short-term bounce, but BNB could potentially fall to around $180 in 2023 due to ongoing Binance-SEC battles.

Binance-US Controversy: Senators Call for DOJ Investigation, Impact on Crypto Industry

Senate Democrats Elizabeth Warren and Chris Van Hollen call for a U.S. Department of Justice investigation into Binance over alleged false statements and the questionable independence of Binance.US. The outcome could impact the crypto ecosystem’s progress, trust in exchanges, and regulatory actions.