The cryptocurrency market saw a surge as Bitcoin rose to over $26,800, possibly due to weaker US labor market data. However, SEC Chairman Gary Gensler’s criticism of the crypto industry erased most gains. Bitcoin’s future may be influenced by evolving regulations and shifting macroeconomic factors.

Search Results for: Brian Armstrong

Gary Gensler’s SEC Stance: Crypto Regulation Divide and the Quest for Innovation Balance

SEC Chair Gary Gensler dismisses the notion that crypto assets and exchanges are special, emphasizing the importance of following established financial regulations. The crypto community seeks a balance between regulatory oversight and fostering innovation, stressing the need for a regulatory environment that supports the industry’s rapid growth without compromising investor protection.

Eastward Shift: Analyzing Bitcoin’s Migration from US to Asia and Its Global Impact

Recent research by Glassnode reveals a significant shift in Bitcoin ownership distribution, with a 10% decrease in supply held by US entities and an increase in Asian market dominance. This migration of Bitcoin occurs amid the evolving geopolitical landscape surrounding cryptocurrencies, as stricter regulations impact the US and Asia gains more influence in the market.

SEC Lawsuits Against Binance & Coinbase: Impact on Crypto Regulation and Future Markets

The U.S. SEC filed lawsuits against Binance and Coinbase, which may define cryptocurrency regulation in the U.S. Both companies argue against regulation by enforcement, with the key issue being whether listed cryptocurrencies are securities. The cases demonstrate the ongoing struggle between crypto exchanges and regulatory authorities, emphasizing the need for clear guidance.

SEC Lawsuits Impact Crypto Prices: Untangling Regulatory Complexities in the US Market

Major cryptocurrencies face sharp declines due to U.S. SEC lawsuits against Binance and Coinbase, while Bitcoin remains a relative safe haven. As the cryptocurrency market navigates a complex regulatory landscape, the future of the industry and its stakeholders hangs in the balance.

NFT Collection Unites Crypto Community for Sensible US Regulations: Pros, Cons & Main Conflict

The ‘Stand with Crypto’ NFT collection unites the crypto community in advocating for sensible US cryptocurrency policies. Encouraging pro-crypto changes in all 435 Congressional Districts, the campaign promotes innovation, protects jobs, and educates Americans on cryptocurrency, aiming for a significant impact on the regulatory landscape.

Binance’s Legal Issues: A Blessing in Disguise for Coinbase and Crypto Market? Pros and Cons

Ark Investments founder Cathie Wood claims that Binance’s legal issues in the US could be favorable for Coinbase, as it eradicates competition. Wood believes increased regulatory scrutiny on Binance will ultimately benefit Coinbase in the long term.

SEC Lawsuits Shake Crypto Industry: Examining Stand with Crypto NFT & Impact on Advocacy

The SEC’s legal action against Binance and Coinbase has intensified concerns over regulation in the crypto industry. In response, the Stand with Crypto movement was created utilizing NFTs on the Zora platform, advocating for regulatory clarity despite criticisms of virtue-signaling.

Coinbase Staking Continues Amid Lawsuits: Confident Move or Risky Gamble?

Coinbase continues to operate its crypto staking service amidst lawsuits with state and federal regulators, aiming to diversify revenue beyond transaction fees. The decision has sparked debate on its potential risks and long-term implications for the crypto landscape.

Binance vs Coinbase Lawsuits: Debating Crypto Securities, Regulations, and Legal Battles

The SEC filed lawsuits against Binance and Coinbase, focusing on registration violations, fraud, and market manipulation allegations. Both exchanges disagree with the claims, and the legal battles may center on digital asset classification as securities, making compliance crucial for future operations.

SEC Lawsuits Against Binance and Coinbase: Cramer’s Criticisms and Crypto Market Reactions

The SEC’s lawsuits against Binance and Coinbase have generated debate among market observers and crypto enthusiasts, with Jim Cramer’s criticism and exchange management’s response adding fuel to the fire. The outcome of these legal proceedings will significantly impact the broader cryptocurrency ecosystem.

Battle of the Giants: Analyzing SEC’s Actions Against Binance & Coinbase, Unveiling the Industry’s Resolve

The SEC recently filed charges against Binance and Coinbase, seeking clarity on crypto rules and guidelines. Key differences in the lawsuits raise questions about case severity and potential consequences for each company. Stakeholders’ determination and unity in seeking clearer regulations will propel the industry forward, with lawsuit outcomes possibly setting precedence for the market’s future trajectory.

Crypto Market Rocked: Binance & Coinbase Face SEC Lawsuits, $600M Negative Net Outflows

The SEC’s lawsuits against Binance and Coinbase, accusing them of unregistered offers and sales of securities and operating as an unregistered broker, have resulted in $600 million in negative net outflows for both exchanges. This development raises questions about the future of crypto exchanges, regulation, and the global crypto market’s direction.

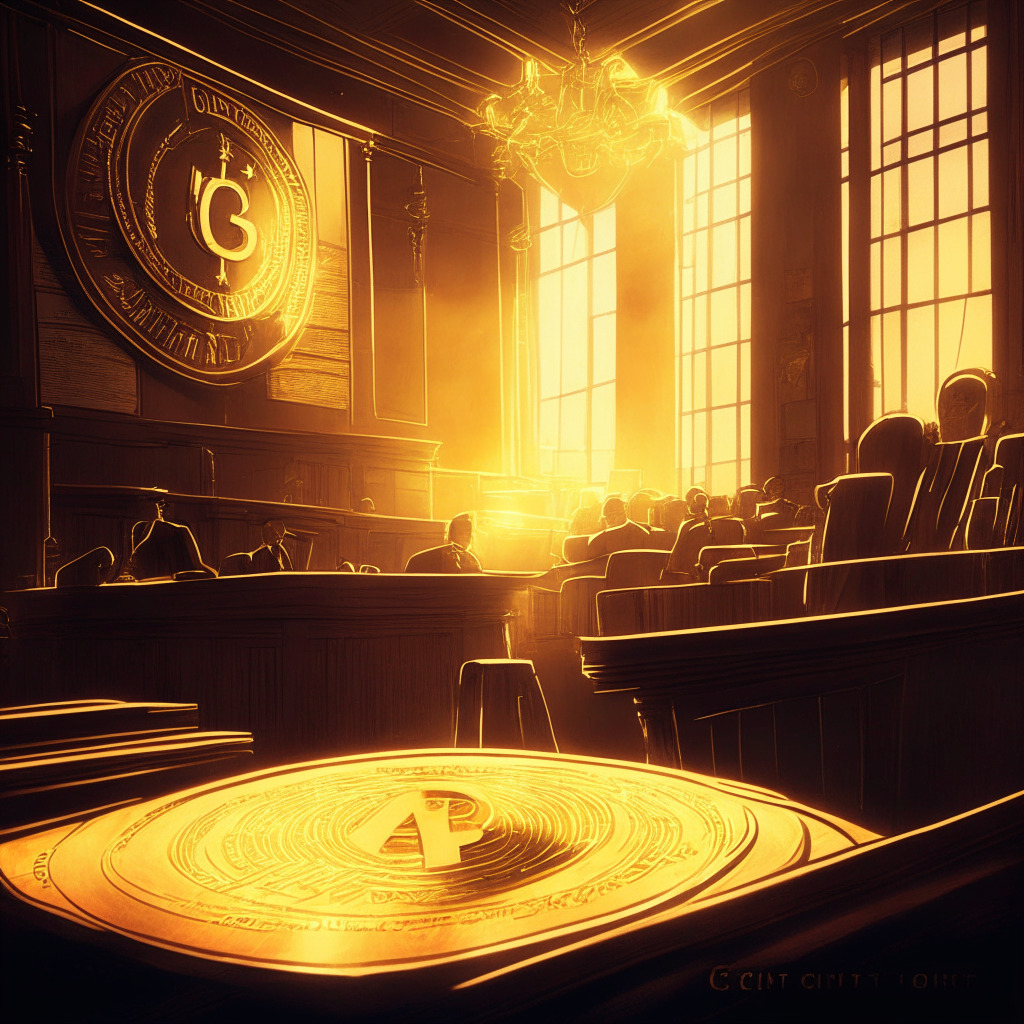

SEC vs. Coinbase: The Battle for Crypto Regulation Clarity and Its Impact on the Future

A U.S. court orders the SEC to clarify its stance on crypto exchange Coinbase’s rulemaking petition within seven days, amidst escalating legal battles. The ongoing conflict highlights the need for clear regulations within the growing cryptocurrency industry to protect investors while fostering innovation and growth.

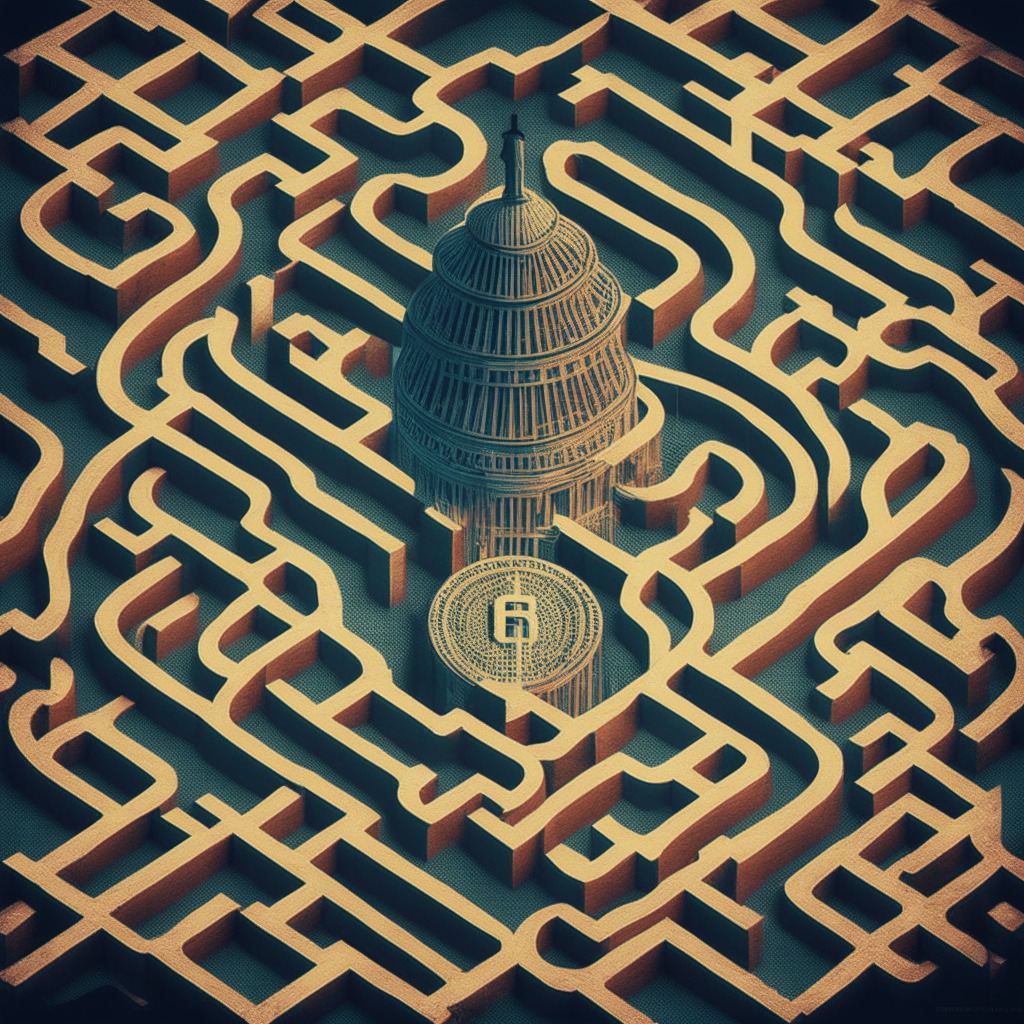

Navigating the Regulatory Labyrinth: Crypto Exchanges Face SEC Crackdown and Uncertainty

The cryptocurrency regulations landscape is evolving rapidly, as seen in recent legal actions against exchanges Coinbase and Binance by the US SEC. Unclear guidelines leave businesses navigating complex regulations, highlighting the need for clear frameworks to balance innovation and compliance in the blockchain and cryptocurrency industry.

SEC Actions Against Exchanges: Analyzing the Impact on Crypto Companies’ US Operations

The SEC’s actions against crypto firms like Coinbase and Binance have sparked debates on the future of these companies in the U.S. Some argue that regulatory pressures will bring clarity and benefit businesses, while others believe challenges could force firms to focus on more accessible jurisdictions, leaving smaller players behind.

Coinbase and SEC Clash: Analyzing Regulatory Frameworks and the Future of Crypto Oversight

Coinbase Chief Legal Officer Paul Grewal urged Congress to adopt a draft bill outlining a regulatory framework for cryptocurrency transactions, following a lawsuit by the SEC against the company. Grewal criticized the SEC’s enforcement-only approach, instead advocating for transparent legislation applied equally to all. The proposed bill aims to classify digital assets and determine regulatory authority.

Coinbase vs SEC: Lawsuit Sets Stage for Crypto Securities Clarity & Future Regulations

The SEC’s lawsuit against Coinbase alleges that the exchange operates as a securities exchange, broker-dealership, and clearing house without registration, involving 13 cryptocurrencies classified as securities. The case outcome will set a precedent, shaping future regulations for the rapidly growing crypto sector.

Elon Musk’s Dogecoin Endorsement: Calculated Risk or Disregarding Crypto’s Future?

Elon Musk promoted Dogecoin to his 142.3 million Twitter followers amid a conversation on focusing on Bitcoin and dismissing altcoins. With the SEC’s recent securities designation affecting altcoin sentiment, Musk’s support and new memecoins entering the market may influence Dogecoin’s future performance.

SEC Lawsuits Shake Coinbase and Binance: Analyzing the Future of Crypto Exchanges Amid Regulation

Coinbase shares dropped over 18% as the SEC filed a lawsuit accusing the leading US cryptocurrency exchange of violating securities laws. The action follows similar charges against Binance and marks an increased crackdown on the digital assets industry. The SEC’s case may impact Coinbase’s efforts to diversify revenue sources through staking products.

SEC vs. Binance: Balancing Consumer Protection and Crypto Innovation

The SEC has announced charges against Binance, alleging unregistered securities trading and violating securities laws, causing a market ripple effect. This raises concerns about future scrutiny of other cryptocurrencies while highlighting the blurred line between regulation and innovation in the crypto industry.

Bitcoin Breakout and Regulatory Clarity: Balancing Innovation, Growth, and Global Competition

Bitcoin’s recent breakout highlights the importance of regulatory clarity for its continued success. Strict US crypto regulations push innovation elsewhere, while countries like the UK, UAE, Brazil, Japan, EU, Australia, and Singapore establish their own cryptocurrency centers. Achieving regulatory clarity can support innovation, industry growth, and mitigate risks, maintaining the US as a global leader in cryptocurrency innovation.

Ripple Effects of FTX Collapse: Analyzing Industry and Regulatory Impacts

FTX’s collapse led to a ripple effect on crypto companies like Silvergate Bank, BlockFi, and Genesis Global Capital, debanked crypto firms, and a regulatory crackdown. Binance considers boosting compliance, while Tether plans sustainable BTC mining in Uruguay. Nvidia, Microsoft, and other tech companies advance AI technology and NFT marketplace, Tabi raises $10 million for gaming ecosystem development.

Binance: Workforce Optimization for Maximum Efficiency amid Layoffs and Continued Hiring

Binance is meticulously examining its staff and resources allocation, prioritizing talent density to maintain flexibility and dynamism. The company plans to fill hundreds of open positions despite reports of layoffs. These efforts aim to refine and optimize Binance’s workforce, reflecting confidence in the future growth of the exchange and the crypto industry.

HKMA and CBUAE Collab on Virtual Assets: Boosting Fintech and Challenging US Hegemony

The Hong Kong Monetary Authority (HKMA) and the Central Bank of the United Arab Emirates (CBUAE) collaborate on virtual asset regulations and developments, aiming to strengthen cooperation, promote fintech initiatives, and improve cross-border trade settlement. This partnership coincides with Hong Kong’s Securities and Futures Commission allowing virtual asset service providers to cater to retail investors.

Crypto Market Turmoil: Fake News Impact, Sensible Regulation, and Celebrities in Legal Battles

The crypto market’s recent brief drop due to a fake news incident highlights the need for sensible regulation and market stability. As countries like Germany and Ireland engage in productive discussions with crypto leaders, the industry is moving towards a more stable and inclusive future. Continuous evolving conversations around regulation and open dialogues are essential for the thriving of the crypto industry.

Coinbase’s Global Expansion: Can US Regulators Keep Up and Maintain Competitive Edge?

Coinbase navigates international expansion amidst US regulatory challenges, praising European Union and United Kingdom for their comprehensive approach to crypto regulation. Its aggressive global expansion highlights the need for US regulators to adopt a more proactive approach towards crypto regulation.

Asian Markets Open: Bitcoin in Red Amid Debt Ceiling Woes and Crypto Regulation Uncertainty

Bitcoin dips below $26,500 support amid debt ceiling stalemate, inflation, and crypto regulatory concerns. Ether and major cryptos also decline, while experts highlight shifting market risks and the convergence of crypto and traditional finance regulations.

Strike’s El Salvador Move: Growth or US Regulatory Uncertainty Escape?

Strike establishes its international headquarters in El Salvador, highlighting the country’s friendly crypto atmosphere compared to the uncertain regulatory climate in the United States. The move showcases the importance of a favorable regulatory environment for the growth of the global crypto ecosystem.

Coinbase’s TV Ad Campaign: Shifting Crypto’s Narrative and Challenging Preconceptions

Coinbase’s upcoming ad campaign aims to showcase cryptocurrencies’ potential to modernize the financial system and promote economic freedom. By targeting Washington DC, the campaign will address negative perceptions often associated with crypto and demonstrate its broader applicability.

Coinbase One Global Expansion: Zero-Fee Trading Boon or Revenue Risk for the Exchange?

Coinbase expands its zero-fee subscription service, Coinbase One, to the U.K., Germany, and Ireland, offering reduced trading fees and higher staking rewards. Despite potential revenue impact, the company aims for global market dominance across 35 countries, amidst regulatory uncertainty.

MicroStrategy vs Coinbase: A Safer Bet Amid Regulatory Pressures and Market Performance

MicroStrategy, the largest public holder of Bitcoin, is considered a safer investment compared to Coinbase due to ongoing regulatory issues faced by Coinbase. With the SEC increasing scrutiny on the crypto sector, MicroStrategy’s shares have outperformed Coinbase, providing an “attractive alternative” amid regulatory pressures.