A critical zero-day vulnerability in the Tron network’s multisignature mechanism was discovered by dWallet Labs, affecting over $500 million worth of digital assets. The flaw, which allows unauthorized transactions, raises questions about Tron’s reliability and security, but the prompt patch deployment is a positive sign.

Search Results for: Coingecko

USDC’s Move to Arbitrum: Boosting Speed and Reviving Stablecoin’s Future

Circle plans to launch a new native version of USDC on the Arbitrum network, aiming to enhance transaction speed using cross-chain transfer protocols. Amid a changing landscape for stablecoins, this move could help regain market share and adapt to the evolving world of blockchain and cryptocurrencies.

Pepe Coin’s Uncertain Future: Potential Rebound or Continuous Decline?

Pepe Coin price gained 1% in the past 24 hours despite recent declines, with some indicators pointing to renewed growth potential. However, it remains a meme token lacking practical utility. Alternatives like presale tokens, such as ECOTERRA, provide similar opportunities for potential gains.

XRP Surges Past $0.50: Resilience Amidst Market Downturn and Ripple’s Future Prospects

Ripple’s XRP cryptocurrency has broken the $0.50 barrier, witnessing a 13% increase over a single week, generating excitement among investors. With bullish market indicators, increased network activity, and impressive gains, XRP’s resilience emphasizes its promising future. However, thorough research is advised before investing.

Doge Rush: Merging Meme Appeal & Gaming Utility for a High-Potential Cryptocurrency Future

Doge Rush, a new meme coin, merges meme appeal with practical functionality by offering casual games on DogeHub platform, play-to-earn rewards, and NFT integration. Investors can participate in the ongoing initial stage of Doge Rush presale, having substantial potential for success.

DAI’s Shifting Collateral Mix: Decreased USDC Backing and Future Decentralization Prospects

MakerDAO’s DAI stablecoin has reduced its USDC backing from 50% to 23.6%, increasing diversification in its backing assets. As dependency on USDC decreases, DAI’s backing now includes more significant real-world assets, such as U.S. government bonds and stablecoins like GUSD and USDP.

Massive Optimism Token Unlock: Evaluating Market Impact and Future Prospects

The upcoming unlocking of 386 million Optimism (OP) tokens, worth $587 million, on May 31 raises concerns of downward price pressure due to the potential 100% increase in circulating supply. Early-stage investors, including Paradigm and IDEO, currently hold 10,000% gains, which may contribute to significant sell pressure on the OP token.

Ethereum and Lido Finance: Dominating DeFi Revenue Growth But Can They Sustain Momentum?

Ethereum and Lido Finance lead DeFi projects in 30-day revenue growth with 81.9% and 23.8% increases, respectively. Ethereum generated $370.6 million in revenue, claiming the top spot, while Lido Finance ranked third with $6.1 million. This substantial growth prompts questions of sustainability and ongoing momentum in the DeFi landscape.

Crypto Market Rises with Debt Ceiling Deal: Will Fed Policy Meeting Impact the Trend?

The cryptocurrency market, including Bitcoin and Ethereum, experienced a boost alongside the stock market as U.S. lawmakers reach a tentative deal for the federal government’s debt ceiling. The outcome of the upcoming Federal Reserve policy rate meeting may impact the cryptocurrency market’s upward trajectory.

Stablecoin Market Shifts: USDT Reigns Supreme as USDC Fumbles with Regulation

The market dominance of stablecoins has shifted, with Tether’s USDT hitting an all-time high and Circle’s USDC experiencing a downturn. Increased transparency is emphasized for stablecoin reserves, while Tether and Circle reduce banking exposure amid economic uncertainty and increase US Treasury holdings.

Metaverse Property Crash: Exploring Reasons, Future Potential & Investor Confidence

A CoinGecko study revealed virtual land prices in top Metaverses like Otherdeeds, The Sandbox, and Decentraland, depreciated around 90% from their 2022 peak. Despite losses, some believe increased adoption and support from major companies could stabilize the market and attract investors.

Exploring the First BRC-20 Stablecoin: StablyUSD’s Controversial Launch and Implications

The first BRC-20 stablecoin, Stably USD, has been introduced to the Bitcoin ecosystem, sparking debate among prominent figures. Stably, a U.S.-based company, promotes this dollar-backed stablecoin. However, red flags exist, including an unfeasible total supply and discrepancies in registration data. The future of this BRC-20 stablecoin remains uncertain.

DeFi Darling Lybra Finance: Exploring Rapid Growth, LBR Token Surge, and Long-Term Viability

In the world of decentralized finance (DeFi), Lybra Finance’s total value locked (TVL) has surged by 400%, nearing a milestone of $100 million. Built on liquid staking derivatives, Lybra provides a decentralized interest-bearing stablecoin. Its growth can be attributed to factors like Lido Finance’s upgrade, the rise of its native token LBR, and increasing interest from experienced crypto investors.

Exploring Illuvium Overworld: Combining Crypto, Gaming, and NFTs in a Unique Gaming Adventure

Illuvium Overworld, an upcoming sci-fi fantasy video game, combines 3D world exploration and card-based arena gameplay in a single-player role-playing experience. Players navigate with a robot drone and capture Illuvials, Pokémon-like characters, in virtual battle arenas. Developed on Immutable X, Illuvium has released NFTs and its ERC-20 token, ILV, remains a top 150 cryptocurrency.

FTX Reboot Plan: Reviving a Fallen Exchange and Addressing Security Concerns

FTX CEO John J. Ray III is working on a reboot plan for the collapsed crypto exchange, with potential investors and enhanced security measures in mind. Despite many efforts, a concrete path forward remains uncertain, as the crypto community anticipates further developments in the revival plan for FTX 2.0.

Tether’s USDT: Surging Market Cap and Falling Trading Volume – What’s the Catch?

Despite Tether’s USDT stablecoin market cap surging to $83.4 billion, its trading volume has experienced a sharp decline, falling below $10 billion for the first time since March 2019. This trend raises questions about the stablecoin’s actual usage and brings concerns about USDT’s value and lack of audits back to the surface.

Unexpected TORN Token Surge: Reversing Attack or Gigatroll Strategy?

Tornado Cash token (TORN) experienced a 10% increase after a proposal aiming to reverse malicious changes implemented by an attacker. The attacker’s proposal plans to restore governance state, with a good chance of execution. This incident emphasizes the importance of security and vigilance in the blockchain and cryptocurrency industry.

Horizen’s Node Upgrade: Unleashing Sidechain Potential and Addressing Security Concerns

The Horizen network announces a significant node upgrade on June 7, 2023, enhancing its sidechain version 2 and addressing minor bugs. This development enables specialized sidechains like governance-focused or DeFi-focused chains, providing a robust security buffer and showcasing the potential of sidechains in blockchain technology.

Surge in Litecoin’s Popularity: The Ordinals Boom and Its Challenges

The rising interest in Ordinals, similar to NFTs, has led to a surge in Litecoin’s blockchain activity and value. The introduction of Ordinals to Litecoin’s blockchain has garnered significant attention, with over 2.6 million Litecoin Ordinals inscribed. However, potential drawbacks like short-lived popularity and environmental impact warrant scrutiny.

SNX Surges 10% Amid New Synthetix Proposals: Pros, Cons, and Market Impact

Synthetix’s native token, SNX, surged 10% overnight, trading at $2.42. Synthetix, a decentralized derivatives platform on Ethereum and Optimism, enables users to participate in governance and offer staking. This increase follows two Synthetix Improvement Proposals that would introduce eight new markets for synthetic variants of cryptocurrencies, including Pepecoin.

Lido DAO Proposal: Boost LDO Value with Staking, Buybacks & Revenue Sharing – A Balanced Analysis

A proposal submitted by lidomaxi aims to increase Lido’s native governance token, LDO’s utility by introducing staking, buyback programs, an insurance fund for Lido DAO, and a revenue-sharing parameter. This development could potentially revamp LDO, but concerns regarding complexity and impact on other token holders remain.

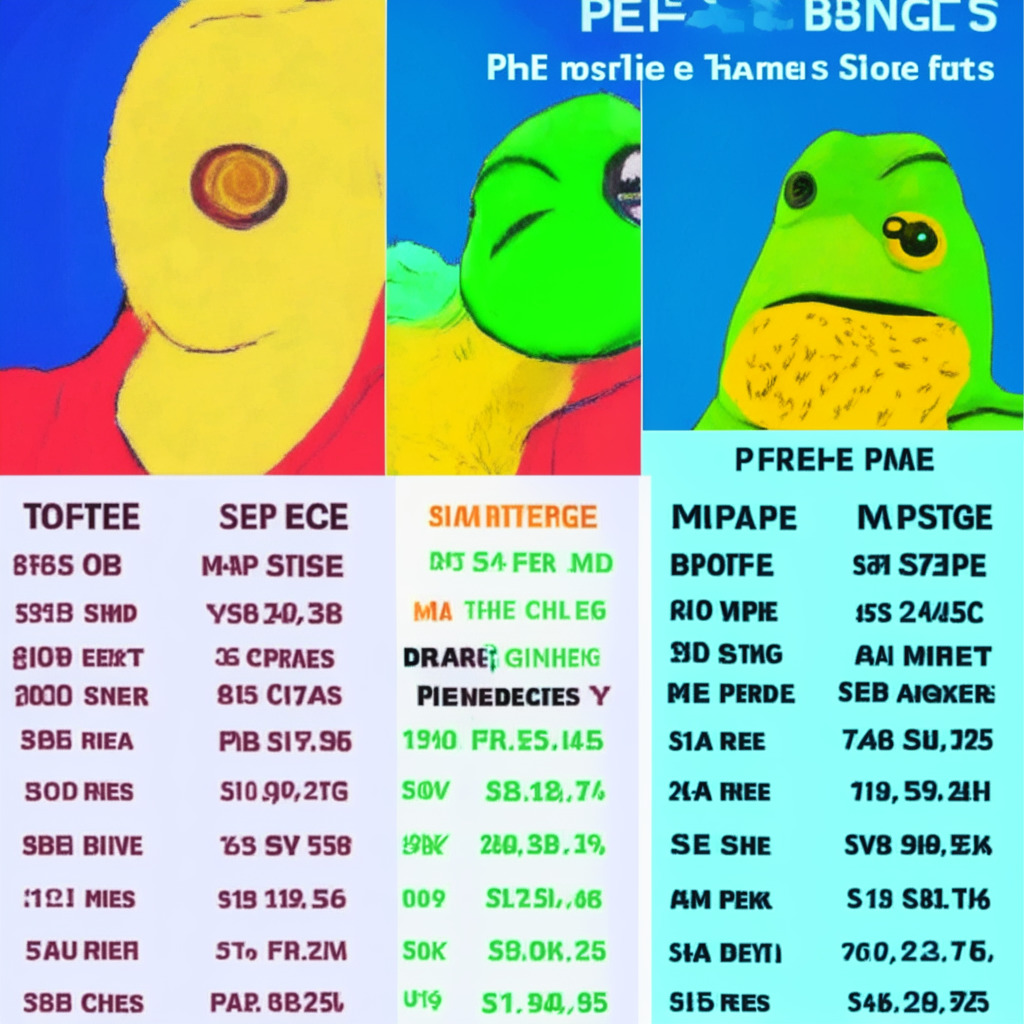

PEPE vs SPONGE: Battle of Meme Tokens and the Quest for Exchange Listings

PEPE, a meme token with a 2,500% growth since April, experiences a 63% drop since its all-time high. Despite the decline, high trading volumes and potential major exchange listings indicate a possible rebound. Traders may shift focus to newer tokens like SpongeBob (SPONGE) with promising gains and listings on prominent exchanges.

Kava 13 Upgrade: Exciting Prospects and Potential Risks in the Crypto Market

Kava’s native token, KAVA, has experienced a 40% increase in value ahead of the upcoming “Kava 13” mainnet upgrade on May 17. The upgrade aims to accelerate transactions and bolster security while launching a new bridge for asset transfers. However, early investors taking profits could lead to price corrections.

Liquid Staking Tokens Defy Bear Market: Analyzing Risks and Rewards in ETH Staking Dominance

Liquid staking tokens like Lido Finance and Rocket Pool defy the bearish crypto market, posting weekly gains of 22.9% and 12.8% as Ethereum staking regains traction. However, users must consider potential risks such as regulatory scrutiny, technological vulnerabilities, and untested projects.

Pepe Coin’s 10% Drop: Potential Recovery or New Altcoins Taking the Lead?

Pepe Coin price dropped 10% in the past 24 hours but surged 6,000% since April 17. Its recovery may depend on additional exchange listings, overall market, and investor sentiment. Meanwhile, AiDoge, an AI-powered meme platform, raised $7.4 million and partnered with SpongeBob token, signaling an unpredictable future for the crypto market.

Reduced SEC Penalty for LBRY: A Blessing or Regulatory Inconsistency in Blockchain?

The SEC reduces its initial $22 million penalty against decentralized content platform LBRY to $111,614, amid LBRY’s lack of funds and near-defunct status. The case raises questions about fairness and consistency in regulatory enforcement within the blockchain industry.

Lido’s v2 Upgrade: A Step Towards Decentralization or Risky Gamble for Ethereum Staking?

Lido is currently voting on its second iteration, v2, on the Ethereum blockchain. The upgrade aims to introduce ETH staking withdrawals and a “Staking Router” for diverse node operator participation, potentially increasing decentralization and expanding Ethereum’s staking ecosystem.

Crypto Meets Sports: Floki Sponsors ITTF Championship, Potential Risks and Rewards

The ITTF partners with Floki, an Elon Musk-inspired cryptocurrency, to sponsor the World Table Tennis Championship Finals. This collaboration marks the first-ever union between table tennis and cryptocurrency, aiming to revolutionize the sport and spearhead its digital transformation while increasing visibility for Floki’s metaverse game, Valhalla.

Meme Coin $SPONGE: Remarkable Growth and Future Challenges in Crypto Market

Meme coin $SPONGE makes a remarkable entrance, listing on Bitget and Gate.io and ranking as the seventh-best gainer in 24 hours. Its impressive performance is attributed to an influx of new buyers, growing popularity, and significant exposure through top-ranked exchanges. Despite doubts, $SPONGE’s potential for further growth is evident with strong industry relationships, a growing community, and partnerships diversifying its presence.

Crypto Market Downtrend: Analyzing Causes and Opportunities Amidst Growing Concerns

The crypto market recently experienced a downtrend, with Bitcoin and Ethereum witnessing substantial declines. Factors such as high transaction fees and lower-than-expected inflation numbers may have contributed to the drop. Investors must consider their risk tolerance and investment strategies to navigate these fluctuations.

Crypto Whales Buy Falling PEPE: Analyzing Memecoin’s Market Plunge and Future Prospects

Despite a recent 56% drop in Pepe (PEPE) memecoin’s price, on-chain data reveals crypto whales, including former tech entrepreneur Jeffrey Huang, continue to buy the token. Researchers at Matrixport linked the price decline to large holders selling their holdings to new retail investors, with Asian traders being a significant driving factor.

Elon Musk’s Tweets: The Double-Edged Sword for Crypto Market Stability and Growth

Elon Musk’s tweet mentioning the NFT Milady from the Milady Maker collection led to a surge in its price, demonstrating his influential position in the crypto ecosystem. However, his actions raise questions about market stability, prudent investments, and potential market manipulation.