“Facebook’s Meta invests heavily in the metaverse despite losses, while in the blockchain gaming space, Alchemy: Battle for Ankhos integrates cryptocurrencies and AI. Meanwhile, Ultra, a crypto gaming startup, builds a tournament platform with its blockchain network for the thriving eSports industry.”

Search Results for: EA Sports

Shiba Inu Sheds Meme-coin Label through Blockchain Digital Identity Integration

“Shiba Inu developers plan to integrate digital identity services into all platform applications, enhancing credibility and attracting serious investors. Shifting from a meme coin to a strong blockchain contender, Shiba Inu aims to increase data protection and user control over personal information, thereby enhancing community trust and government respect.”

MicroStrategy’s Unwavering Belief in Bitcoin Amid Uncertain Climate: A Bold Move or Risky Gamble?

MicroStrategy’s co-founder, Michael Saylor, recently reaffirmed his firm’s distinctive commitment to Bitcoin, even amidst fluctuating cryptocurrency market values. Despite the potential impact of spot Bitcoin ETFs, Saylor confirmed the firm’s intention to pursue its Bitcoin acquisition strategy, describing their approach as dynamic and thrilling, much like driving a “sportscar”.

Revving Engines and Digital Assets: How NFTs are Making a Pit Stop in Formula One Racing

Crypto exchange, Kraken, is involving their community in decorating the Williams Racing team’s F1 cars using non-fungible tokens (NFTs). This allows enthusiasts to submit NFT decal candidates and involves a vote for the top 4 NFT submissions to feature in the Austin Grand Prix. Critics argue this dilutes sportsmanship and raises environmental concerns.

Navigating the Swiftly Changing Cryptographic Asset and Blockchain Landscape: Successes, Setbacks, and Security Issues

“The cryptographic asset and blockchain industry continually evolves. Recent developments include banking issues for Hong Kong crypto businesses, digital criminality, varied progress for Binance in Dubai and Nigeria, operational updates at Kraken, central bank digital currency tests in Korea, and a new partnership for Sorare. These highlight the rapid advancement and regulatory challenges in blockchain technology.”

HashPort Bolsters Blockchain Operations with $8.5M Funding: Navigating Regulatory Hurdles and Ensuring Growth Potential

Japanese blockchain developer, HashPort, recently secured $8.5 million funding. The capital will be used to fortify its operations, compliance system, and team development amid evolving global regulations. HashPort’s operations include blockchain consulting and a public chain for nonfungible tokens (NFTs). Their cooperation with Expo 2025 aims to drive the development of digital wallets and digital passports linked to soulbound tokens.

Elon Musk’s Cryptic Cues: Dogecoin & Twitter’s Future or Hype Amid Binance Legal Challenge?

Elon Musk’s Twitter profile update led to speculations that Dogecoin might play a part in Twitter’s future payment infrastructure. It suggests that Dogecoin might give Musk “zero execution risk” and assist global payments. However, experts advise caution amid such speculations and urge to focus on long-term market trends.

Crypto Gaming Revolution: Exciting Opportunities or Overhyped Disruption?

Prominent esports players including Dota 2’s Erik Engel express optimism about the potential of blockchain integration in the gaming industry, seeing it as a way to enhance players’ experiences beyond mere entertainment. However, skepticism persists among some traditional gaming entities, even as others believe that the adoption of blockchain and Web3 technologies in gaming is inevitable and could revolutionize the industry.

Downward Spiral of Rocket Pool’s RPL: Navigating through Price Collapse and Overvaluation Concerns

Rocket Pool’s utility token, RPL, has seen a sharp decline of approximately 7.5% in a single day, earning it the title of the worst-performing cryptocurrency among the top 100 in market cap. Amid bearish predictions, it now teeters on the brink of a potential price collapse. Furthermore, a declining growth rate in market share and lower yield for ETH stakers compared to its competitors add to the concerns about RPL’s future.

Nasdaq’s Withdrawal Shakes the Crypto World: Premising Contenders Emerging Stronger

“Nasdaq’s proposed cryptocurrency custody service has been put on hold due to regulatory ambiguity. The absence of a credible custodian like Nasdaq may impact smaller entities aiming to offer their own services. Meanwhile, cryptocurrencies like Flex Coin, Evil Pepe Coin, Stellar, Burn Kenny, and Cardano show promising signs despite potential risks inherent in a volatile market.”

Blockchains Future: A Tale of Innovation, Regulatory Challenges and Intensified Crypto Adoption

“The future of blockchain technology is promising yet complex, as seen with events like Litecoin’s robust performance, Polygon’s proposed token nomenclature revision, and regulatory challenges worldwide. Developments like Coinbase’s secure messaging system and Google Play’s digital asset integration highlight the merging of conventional institutions with blockchain, while caution remains due to persistent crypto scams.”

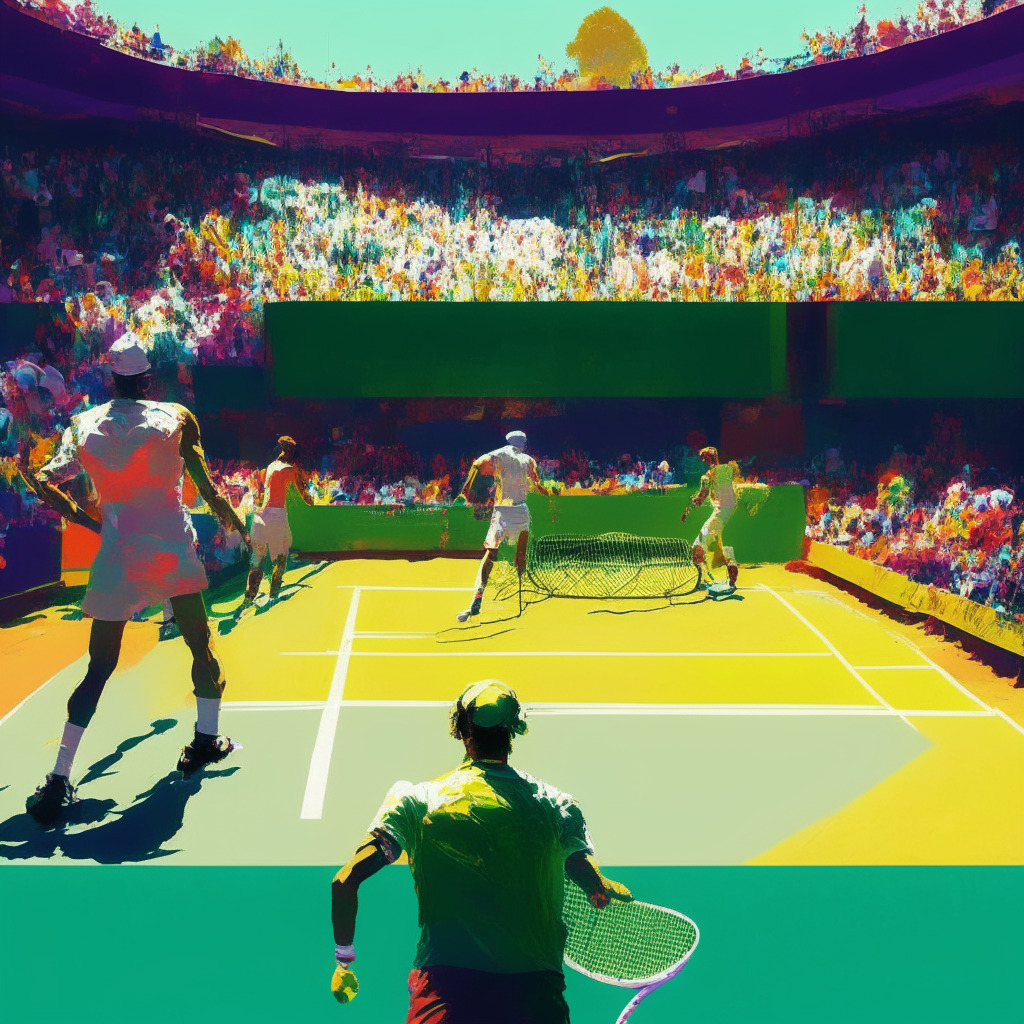

Exploring Wimbledon’s First NFT: Andy Murray’s Career as a Digital Masterpiece

The official Wimbledon non-fungible token (NFT), a unique fusion of sports, digital art and data science, encapsulates 18 years of renowned tennis player Andy Murray’s championship career. This NFT project leverages live data to evolve organically, offering an appealing synchronization of high-performance sports data and aesthetics.

From Bankruptcy to Revival: The Resilience and Struggles of Crypto Lender Voyager Digital

“Voyager Digital, a once bankrupt crypto lender, has witnessed over $250 million outflow since reinstating withdrawals on June 23rd. Despite complications and previous bankruptcy proceedings, current data sets the platform’s total holdings at $176 million in various cryptocurrencies, with an impressive Clean Asset ratio of 96.15%.”

Declining Floor Prices: The BAYC NFT Community’s Challenge and Opportunity

The Bored Ape Yacht Club (BAYC) NFT collection is witnessing a drop in floor price, sparking debates about its value. Despite this, some argue the decreased price could invite new members, emphasizing that an NFT’s value extends beyond its price tag to encompass rarity and cultural significance.

Unveiling the Future of Blockchain: Sega’s Pause, Bitfinex’s Recovery, DAO Halts and Innovations in Bitcoin’s Lightning Network

“Sega withdraws from blockchain gaming to avoid content devaluation. Bitfinex recovers more stolen assets from the 2016 hack. BarnBridge DAO halts all activities due to SEC’s investigation. Lightning Labs introduces tools for AI and Lighting developers. Moreover, AFME calls for DeFi’s inclusion in MiCA regulatory framework.”

Survival of the Fittest: ApeCoin Struggles Versus Chimpzee’s Rise in Crypto Market

The ApeCoin (APE) struggles amidst a dip in the crypto market, failing to break its 21-Day Moving Average and trading around $2.20 per token. NFT market confidence has been affected, with prominent investors expressing unease, particularly with the recently launched Azuki NFT collection. Meanwhile, Chimpzee crypto has gained interest, offering investors potential profits and exclusive perks along with environmental impact, emphasizing both profit and planet preservation.

Swiss Football and Credit Suisse: A New Game in NFTs and Women’s Football Promotion

Credit Suisse in collaboration with Swiss Football Association (SFA) releases a non-fungible token (NFT) collection featuring the Swiss Women’s National Team, aiming to support and promote women’s football. The 756 NFTs are not just digital but offer additional rewards such as meeting players and signed jerseys.

Meme Tokens: Rising Stars or Falling Meteors in the Crypto Universe?

“The success story of Wall Street Memes (WSM) underscores the importance of a robust community for the survival of meme tokens. With over 256,000 Twitter followers, WSM’s proactive promotion and substantial following contrasts with the ill-fated performance of Luck Token (LUCK).”

Navigating the Highs and Lows of NFT’s Uncharted Waters: Developments, Challenges and Future Prospects

“The non-fungible token (NFT) market continues to evolve with challenges and noteworthy developments, such as the Azuki anime-inspired collection controversy and the joint venture of Candy Digital and Palm NFT Studio. Meanwhile, Warner Music Group fosters innovation via a music accelerator program blending music and blockchain. Despite technical hiccups and favoritism allegations, resilient NFT players demonstrate the exciting future of this industry.”

The Candy Digital–Palm NFT Studio Merger: Fast-tracking Licensed NFT Projects or Pushing Cryptocurrencies into Dangerous Territory?

Digital collectibles giant, Candy Digital, and Web3 company, Palm NFT Studio, have unveiled a collaborative merger aimed to enhance digital interactions across varied fields such as sports and entertainment. The merging of these companies hopes to improve fan engagement through the creation of NFTs, providing an expanded platform for brands to connect with fans.

Swiss Freeze $26M in Crypto Linked to Terraform Labs: Regulatory Scrutiny vs Unintended Consequences

Swiss authorities have frozen approximately $26 million in cryptocurrency linked to Terraform Labs, its founder Kwon Do-hyeong, and other company figures in response to US federal prosecutors’ requests. This follows accusations of fraud, securities law violations, and fallout of Terra’s algorithmic stablecoin UST collapse. The case highlights regulatory scrutiny on cryptocurrency and potential consequences like limiting genuine asset holders’ access.

Freezing Crypto Assets: Terraform Labs Case Exposes Global Crackdown vs. Human Rights Concerns

Swiss prosecutors have frozen $26 million in crypto assets and fiat currency related to Terraform Labs and co-founder Do Kwon, following a request from US authorities. The case highlights regulatory efforts to crack down on crypto-related scams and financial crimes, emphasizing the need for regulatory enforcement and justice in the growing crypto market.

Crypto Markets: Gains, Losses, and Stablecoins – Navigating the Volatile Landscape

Cryptocurrency markets exhibit notable volatility, presenting both significant gains and losses. This snapshot highlights the contrasting performance of various digital assets, emphasizing the importance of caution and due diligence when participating in the unpredictable world of digital assets.

Crypto World Update: Scandals, Legal Battles, Innovations, and Safety Concerns

This week in crypto, deception and legal battles intertwined with ambitious innovations. Key highlights include Crypto.com’s internal teams trading tokens for profit, Valkyrie Funds filing a Bitcoin ETF application, and global governments exploring digital currency regulations. Safety remains crucial as crypto crime and hacks persist.

Mixed Results in Crypto Market: Analyzing Gains, Losses, and Investor Perspectives

The cryptocurrency market showcases mixed results, with varied percentage gains and losses of numerous tokens. BTC and Ethereum experienced decent gains, while Ripple’s XRP, AAVE, and Crypto.com Coin saw slight declines. Investors should watch market trends and remain cautious before making financial decisions in the volatile crypto world.

FC Barcelona & World of Women NFT Collaboration: Pros, Cons & Environmental Concerns

FC Barcelona collaborates with NFT collection World of Women to launch the “Empowerment” NFT, inspired by soccer player Alexia Putellas. This partnership highlights the growing adoption of blockchain technology in sports and addresses concerns about environmental impact and representation.

FC Barcelona & World of Women NFT: Empowering Women or Just Hype?

FC Barcelona collaborates with NFT project World of Women for the second release of their “Masterpieces” collection, featuring digital artwork “Empowerment” honoring women’s club captain Alexia Putellas. The partnership aims to grow female representation in sports and celebrate inspirational figures, merging sports, art, and blockchain technology.

Decentralized Chess Game Raises $1.5M: Reinventing Tradition or Diluting Identity?

Anichess, a subsidiary of Animoca Brands, secured $1.5 million seed funding to develop a decentralized chess game, promising a community-driven, free-to-play experience with magical spells and unique strategic layers. The game aims for an alpha launch in 2024, with support from investors including GameFi Ventures, Coin Operated Group, and Bing Ventures.

Wimbledon 2023: AI-Generated Commentary, Tech Innovation vs Traditional Roles

Wimbledon 2023 plans to incorporate AI-generated commentary and player analysis, developed by IBM’s WatsonX technology, to enhance fan engagement and offer insights into key moments across online platforms. However, this raises questions about potential impact on traditional commentary roles and opportunities for human commentators.

Crypto Regulation Wars: Terraform Labs, Stablecoins, and the Battle for Blockchain’s Future

Terraform Labs co-founder and former CFO face prison sentences and extradition due to fraud charges, highlighting challenges and regulatory uncertainties in the cryptocurrency industry. As stablecoins gain traction, striking a balance between fostering innovation and protecting investors is a pressing challenge for global regulators.

Terra Co-Founder’s Passport Scandal: Legal Lessons for the Crypto Community

The Montenegro Basic Court found Terra co-founder Do Kwon and former CFO Han Chang-joon guilty in a passport forgery case, raising questions on crypto regulation, legal system intersection, and ethical concerns over investment-granted citizenship. The crypto community is urged to prioritize security and operate within regulatory boundaries.

Crypto Industry’s Integrity Debated after Terraform Labs Founder Conviction

Terraform Labs founder Do Kwon’s conviction for document forgery highlights the importance of decentralization and regulatory oversight in the crypto industry. This incident raises concerns but also underscores the potential benefits of blockchain technology, emphasizing the need for addressing challenges and instilling greater trust.