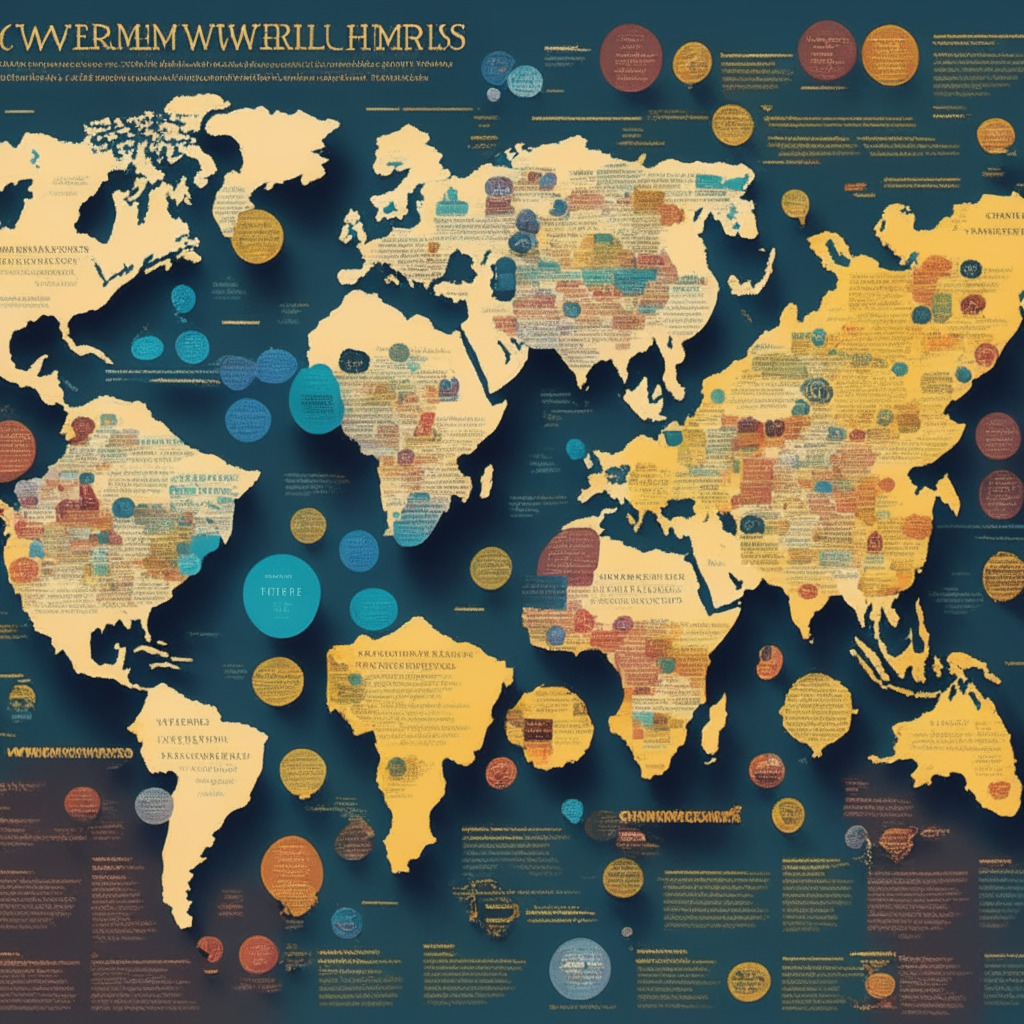

Recent global legislative actions are intensifying cryptocurrency regulation discussions. Hong Kong is focusing on regulated exchanges to decrease fraud-related investor losses, Thailand is taxing overseas crypto profits, Brazil is advocating for digital assets protection, and the U.K. and U.S. are developing bills targeting illegal crypto use and curtailing Central Bank Digital Currencies respectively. Regulatory changes highlight the balance between encouraging financial innovation and protecting citizens.

Search Results for: European Central Bank

Coinbase Obtain AML Compliance in Spain: Striking Balance between Global Expansion and Regulatory Challenges

Coinbase has secured an Anti-Money Laundering compliance registration from Spain’s central bank, enabling crypto services in the country. As Coinbase expands globally, it faces possible complications from varying regulatory frameworks and is urged to prioritize asset security as skeptical holders consider withdrawing assets.

Navigating the Storm: EU’s MiCA and the Future of Stablecoins in Europe

“The European Union’s upcoming Markets in Crypto Assets (MiCA) regulation has raised concerns about the potential delisting of all stablecoins in Europe by June 30. MiCA aims to streamline processes and enhance oversight. However, its provisions concerning stablecoins are causing apprehension, especially as they seem to contradict the aspirations of many issuers for decentralization.”

Binance’s Stablecoin Delisting: A Regulatory Avalanche or Necessary Compliance Step?

“Binance plans to delist all stablecoins from its European platform by June 2024, complying with Europe’s tight regulation. The move, following the passing of Europe’s crypto regulation law, MiCA, could significantly impact the European crypto market. Meanwhile, the U.S. grapples with its digital currency dilemma, revealing distinct attitudes towards financial digitization.”

Binance’s Plan to Delist Stablecoins in Europe: A Critical Look at Regulatory Compliance and Market Impact

“Binance, a key cryptocurrency exchange, plans to delist all stablecoins for the European market by June 2024, in adherence to the Markets in Crypto Assets (MiCA) law. This move, expected to impact significantly on Europe’s market, reflects the potential disruptions regulatory changes can cause. Meanwhile, the U.S. resists implementing a Central Bank Digital Currency (CBDC), despite other countries’ pursuits of national digital currency.”

Regulating Crypto and AI: Balancing Technological Innovation with Global Cooperation

“The G20 nations emphasize the need for responsible growth and use of AI, recognizing the potential of crypto assets and digital currencies in fostering a digital world. They propose a global crypto framework to navigate challenges like data protection, potential biases, and human oversight, advocating for a more homogeneous approach in the disjointed global landscape.”

Coinbase’s New Expansion: A Strategic Move or Industry Pressure?

Coinbase, a top crypto exchange, aims to expand to non-U.S. markets, prioritizing countries with clearer crypto regulations. The company’s strategy includes acquiring licenses, setting operations, and registering in these markets. It points to a lack of crypto-forward regulation in the U.S., potentially impacting its influence in the crypto field.

Redefining Value: The Digital Frontier of Tokenized Real-World Assets

“Tokenized real-world assets are becoming mainstream with firms like Coinbase, Circle, and Aave forming the Tokenized Asset Coalition to promote the transition to decentralized finance. Predictions estimate tokenized assets reaching $16 trillion by 2030. Meanwhile, key financial entities globally are considering or offering crypto-related services, signifying a pivotal switch in financial systems.”

Asset Managers Unfazed by Volatile Cryptocurrency Markets: Survey Reveals Bold Predictions

Despite the uncertain regulatory environment and sluggish cryptocurrency markets, nearly 50% of American and European asset managers surveyed by Coalition Greenwich and Amberdata are active in digital assets. The survey reveals optimism in the industry’s future, with 40% expecting 11% annual growth and 25% of firms having a distinct digital assets strategy. Potential opportunities are seen in ETFs, tokenized securities, and centralized exchanges.

Nigeria Surpasses U.S in Crypto Knowledge and Adoption: A New Frontier or Regulatory Challenge?

The report by YouGov and ConsenSys confirms Nigeria’s emergence as a leading crypto-savvy nation, beating the US and several European countries in digital asset knowledge and intended investment interest. With a crypto awareness of 99% among Nigerians, up to 70% comprehend the value and mechanisms of blockchain technology. A significant 90% of participants expressed pan to invest in digital assets within the year, despite the national bank’s unclear stance on crypto.

Navigating MiCA: The EU’s Attempt at Blockchain Regulation and Its Impact on Crypto

The MiCA guidelines in the EU propose stricter regulations for crypto service providers and clampdown on market manipulation. However, they lack consideration for decentralized finance and central bank digital currencies. Moreover, they enforce a low reporting threshold eroding privacy rights, and require official approval for launching tokens, potentially inhibiting the development of new projects.

A Rollercoaster Crypto Week: Triumphs, Tribulations, and the Quest for Unchartered Territories

“In a dynamic crypto week marked by revenue surges, privacy breaches, and promising tech advancements, we also see virtual activism in Metaverse, innovative crypto-related services, and increasing institutional embrace of digital assets. However, challenges persist with regulatory complexities and cyber threats.”

U.S. Government Debt Downgrade: A Storm Ahead for Bitcoin or A Silver Lining?

The U.S. Government’s debt downgrade by Fitch Ratings may impact the digital investment market, including Bitcoin. Investors are being driven from traditional assets into safer short-term instruments. Amidst this uncertainty, the potential lies for investors to shift towards decentralized avenues like cryptocurrencies.

Dwindling Interest in Cryptocurrency: Unraveling Latvia’s Crypto Conundrum

Crypto asset involvement in Latvia has dropped by 50% last year according to Latvijas Banka, the central bank. The drop is attributed to factors such as fraud, insolvency concerns, political factors, and mismanaged investments. Despite the decline, retail crypto payments in Latvia “continue to prevail”.

Navigating the Dutch Regulatory Landscape: Successes and Challenges for Crypto Platforms

“Crypto.com secures registration approval with the Dutch central bank, De Nederlandsche Bank (DNB), joining 36 other crypto businesses in the country. The approval highlights Crypto.com’s commitment to compliance and allows it to offer exchange and custodial services. Other platforms, like Binance, face rejection from the Dutch market due to regulatory uncertainties.”

Navigating the Crypto Future: Canada’s Approach to Regulating Blockchain and Crypto Assets

“Canadian financial regulators have proposed capital plans for banks and insurers dealing with crypto assets, inspired by the Basel Committee’s suggestions. This could foster a more harmonious relationship between traditional finance and blockchain innovations, while maintaining financial stability and recognizing cryptocurrencies as legitimate financial assets.”

The Digital Ruble Takes Center Stage: Potential Lifeline or Invasion of Financial Privacy?

“Vladimir Putin has signed the Digital Ruble Bill into law, enabling Russia’s Central Bank to launch its own digital currency. The digital Ruble, a Central Bank Digital Currency (CBDC), can serve as both a tool against international sanctions and a means of monitoring governmental expenditure on social projects. However, there are concerns it could be used to control citizens’ spending.”

Stablecoins: A Tethered Threat or Necessary Innovation? Unwinding the Global Debate

“Stablecoins potentially infringe on nations’ policy sovereignty and present more benefits to robust economies like the US and Europe. They pose an economic and socio-political challenge, and also risk amplifying the dollar’s power. International sentiment points towards a need for stricter stablecoin regulation to ensure financial stability.”

Will Crypto Follow the Internet’s Adoption Trajectory? A Realistic Examination

Crypto’s adoption rate, akin to the internet in the ’90s, could see it reaching 5 to 6 billion users by 2047. However, considering adoption rates of other financial technologies, crypto may face significant barriers, potentially reaching only 2-3 billion users.

Navigating the MiCA Legislation: Impacts on Private Stablecoins and the Future of Crypto Regulation

The European Union enacted the Markets in Crypto-Assets (MiCA) legislation, sparking controversy with a daily 200 million euros transaction cap for private stablecoins. This is meant to protect investors from large-scale stablecoin failures which could impact traditional financial systems. However, critics argue it could stifle innovation within the crypto landscape.

Week in Review: FTX Splash, Binance Moves & Global Crypto Legal Twists

“This week in crypto was marked by major exchange operations, regulatory challenges, and shifts in nations’ attitudes towards digital assets. Developments included FTX’s plans to reopen, Binance’s regulatory issues, MicroStrategy’s portfolio growth, potential CBDC launches, and varied legal positions on crypto worldwide. These events highlight the rapidly evolving crypto landscape.”

Wirex and Cryptopay Outages: A Warning for Crypto Payment Services in EEA

Lithuania’s central bank has revoked UAB PayrNet’s license, causing potential card outages for crypto payment service Wirex in the European Economic Area. This highlights the need for proper licensing and compliance within the payment ecosystem and serves as a warning to other crypto payment companies.

Crypto.com Gains VASP Registration in Spain: Analyzing Benefits and Drawbacks

Crypto.com received a Virtual Asset Service Provider (VASP) registration from the Bank of Spain, enabling it to offer products and services in the country. This milestone follows a compliance review with Anti-Money Laundering Directive (AMLD) and other financial crimes laws required for MiCA-based VASP licenses. Increased regulations anticipate a more transparent, trustworthy, and robust crypto market.

Spain Embraces Crypto.com: Balancing Regulation and Innovation in the EU Crypto Market

Spain registers Crypto.com as a virtual asset service provider under the Bank of Spain, demonstrating its commitment to creating a regulator-friendly environment for cryptocurrency-related ventures, while protecting users and supervising crypto trading activities.

EU Debit Card Provider Cryptopay’s Setback: Navigating License Revocation & User Impact

Cryptopay users face potential disruptions as UAB PayrNet, a licensed Electronic Money Institution in Lithuania, loses its EMI license. The situation highlights the vulnerability of cryptocurrency companies to regulatory changes and the importance of financial safety for users and companies in this rapidly-evolving landscape.

Bitcoin Surpasses $30,000: Factors Influencing the Rally and Future Predictions

Bitcoin surpasses $30,000 threshold for the second time this year, with altcoins like Stacks showing impressive gains. Institutional participation, such as BlackRock’s ETF application and CACEIS Bank’s crypto custody services, indicates a possible shift in traditional finance’s approach to digital assets, fueling optimism for the future of cryptocurrencies.

SEC vs Binance.US Showdown: Unearthing Past Statements and Facing New Legislation

The U.S. SEC’s intention to freeze Binance.US’s assets faced a setback as Judge Amy Berman Jackson advised bilateral negotiations. Meanwhile, HKMA urges banks to accept crypto exchanges as clients, and the European Parliament passes the EU Artificial Intelligence Act, impacting governance of AI technologies.

Digital Euro vs Cash Sovereignty: Slovakia’s Stand Sparks Global CBDC Debate

Slovakia amends its constitution to include the right to use cash amid the European Union’s exploration of a central bank digital currency (CBDC). While the digital euro offers potential benefits like financial inclusion and streamlined transactions, critics raise concerns about centralization, privacy, and disruption of traditional banking models.

EU’s Digital Euro Delay: Assessing Privacy, Security, and Economic Impact

The digital euro project faces a setback as its draft bill publication gets delayed due to undisclosed reasons. The EU finance ministers emphasize the need for a clear narrative on the digital currency’s added value and potential impact. Meanwhile, concerns about privacy, security, and potential illicit activities loom large among skeptics.

Crypto Regulation Migration: Boon or Bane for the Industry and Investors?

The recent crackdown on crypto regulations in the US has led to alternative locations like the European Union, the United Kingdom, Switzerland, Hong Kong, and the United Arab Emirates adopting more crypto-friendly regulations. However, a Wall Street Journal article cautioned that lenient regulations might only persist until a major scandal triggers stricter rules, impacting investors and the industry’s long-term viability.

Binance’s Dutch Exit: Impact on Crypto Ecosystem and the Struggle for Legitimacy

Binance exits the Dutch market after failing to secure a virtual asset service provider license, halting new user registrations and ceasing trading on July 17. This raises questions about the broader impact of increased regulatory scrutiny on the crypto space and signifies a shift in the struggle for greater crypto acceptance and legitimacy.

Crypto Market Volatility: Impact of Fed Policy, CBDCs, and Exchange Crackdowns

Cryptocurrencies experienced significant declines, with Bitcoin dropping below $25,000 and altcoins like MATIC and ADA falling up to 9%. This comes after the Federal Reserve’s policy decision to suspend rate hikes, yet signaled further monetary tightening. Meanwhile, the European Commission plans to propose a draft law affecting digital euro operations, and Binance Smart Chain faces challenges as total value locked drops to its lowest since March 2021. These events reflect the crypto space’s volatility and uncertainty, with ongoing debates on CBDCs, regulatory actions, and global economic influences impacting its future.