Binance withdraws from the Dutch market following a failed attempt to secure a VASP license. The exchange faces increasing regulatory challenges, including allegations from the US SEC. Amidst an evolving regulatory landscape, crypto exchanges must adapt and ensure compliance to endure in various markets.

Search Results for: France

Defamation Lawsuit in Crypto Space: Balancing Free Speech and Accountability

In this legal battle between on-chain sleuth ZachXBT and NFT mogul MachiBigBrother, the case raises essential questions regarding the boundaries of free speech, accountability, and power dynamics in the blockchain and cryptocurrency world. The situation highlights the need for accuracy, evidence-based information, and upholding principles of truth-seeking and free speech.

Digital Asset Recovery Amidst Regulatory Pressures: Analyzing Market Resilience and Risks

The digital asset market experienced recovery this week, with Bitcoin surpassing $25,906 amid ongoing regulatory pressures and continued resilience of Ethereum, XRP, BNB, and other cryptocurrencies. Traders remain optimistic but should consider potential risks before investing.

Binance Under Fire: Money Laundering Allegations and Regulatory Challenges Explained

The Paris public prosecutor’s office is investigating Binance for “acts of aggravated money laundering” and “alleged illegal provision of digital asset services.” Binance faces regulatory pressure in Europe and the US, highlighting the need for stricter regulations and challenges in ensuring transparency and compliance.

Bank of England Inches Towards CBDC: Exploring Pros, Cons, and Privacy Concerns of Britcoin

The Bank of England and the BIS completed a yearlong project, Rosalind, exploring the practicality and potential benefits of a Central Bank Digital Currency (CBDC). Findings suggest CBDCs could expedite person-to-person payments, enable innovative financial products, and reduce fraud, paving the way for the Digital Pound, informally known as “Britcoin.”

Blockchain and Cryptocurrency: Revolutionizing Industries Amidst Controversy and Challenges

In the ever-evolving world of blockchain and cryptocurrencies, the decentralized nature brings advantages like transparency, security, and reduced fraud but also presents challenges like lack of regulation and criminal exploitation. As digital assets grow, staying informed, objective, and observant is crucial for enthusiasts, investors, and users.

Binance’s Dutch Exit: Impact on Crypto Ecosystem and the Struggle for Legitimacy

Binance exits the Dutch market after failing to secure a virtual asset service provider license, halting new user registrations and ceasing trading on July 17. This raises questions about the broader impact of increased regulatory scrutiny on the crypto space and signifies a shift in the struggle for greater crypto acceptance and legitimacy.

Binance’s Legal Woes: A Dive into Crypto’s Regulatory Challenges and the Balancing Act Ahead

Binance faces investigation in France over allegations of illegal digital asset services and aggravated money laundering. This situation emphasizes the increasingly complex regulatory landscape for cryptocurrencies, highlighting the need for balancing innovation and compliance in the industry.

Young Crypto Influencer’s Rise and the Potential Shift of the Global Market to Europe

Owen Simonin, a.k.a Hasheur, educates the French population about cryptocurrencies through his popular YouTube channel with over 624,000 subscribers. He believes France and Europe can play a crucial role in the global crypto market, amidst recent crackdowns by US regulators.

Binance Exits Netherlands: Regulatory Hurdles and the Future of Crypto Compliance

Binance is exiting the Netherlands due to challenges in registering as a virtual asset service provider in EU countries. Netherlands-based customers were informed that crypto deposits will be disabled starting next month, with trade and staking of non-fungible tokens blocked from July 12.

Dubai: The Emerging Epicenter of Crypto Innovation and Regulation

OKX Middle East receives an MVP Preparatory license from Dubai Virtual Assets Regulatory Authority, preparing for its license to become operational. The exchange plans to offer spot, derivatives, and fiat services, and recognizes Dubai’s comprehensive regulation standards as crucial to their regional strategy.

Generative AI Impact: Accelerated Automation and Economic Growth vs. Ethical Concerns

A McKinsey & Co. report predicts that by 2045, generative AI may fully automate 50% of today’s work activities, including decision-making and management, with 75% value creation in customer service, marketing, software engineering, and R&D. Adoption rates will differ globally and raise concerns over fake news, information manipulation, and ethical issues.

French Digital Asset Mediation Surge: Balancing Progress, Disputes, and Market Safety

According to the French stock market regulator AMF’s annual report, digital asset-related mediations and registered digital asset service providers (DASPs) significantly increased in 2022. This growth could indicate increased industry adoption but also raises concerns about potential disputes and the need for stronger oversight.

Binance Withdraws from Cyprus: MiCA Compliance and the Future of Crypto Exchanges

Binance, the world’s largest cryptocurrency exchange, is withdrawing from Cyprus ahead of the EU’s Markets in Crypto Assets (MiCA) legislation in 2022. The company plans to focus on regulated entities in countries like France, Italy, and Spain, aligning its business with MiCA to ensure compliance. Tightened regulations and recent legal challenges may prompt a shift in the crypto landscape, emphasizing regulatory compliance.

BCB-Sutor Bank Deal Termination: Pros, Cons, and Future of Crypto-Banking Relations

BCB Group’s plan to acquire century-old Sutor Bank was terminated due to regulatory delays and market conditions. The company will now focus on its Europe-wide strategy through its e-money license in France, demonstrating the challenges of navigating the evolving relationship between the cryptocurrency and banking sectors amid changing regulations.

European Access to Lido DAO ETP: Exciting Opportunity or High-Risk Gamble?

Swiss-based 21Shares introduces a new crypto exchange-traded product (ETP), offering exposure to Lido DAO, a leader in the liquid-staking ecosystem. Available in 22 European Union countries, the ETP carries substantial risks and is classified as the highest risk class, demanding investor caution.

Cryptocurrency Advertising: Striking a Balance Between Innovation and Consumer Protection

BEUC, a group of European consumer organizations, calls for stricter policies on crypto advertising and influencer promotions on social media platforms. The European Union’s Markets in Crypto Assets regulation and Digital Services Act aim to address unfair practices and protect consumers from potential financial losses related to crypto scams.

Balancing Crypto Ads: Protecting Consumers vs Fostering Transparency and Education

The European Consumer Organisation’s report emphasizes the risks associated with cryptocurrencies and criticizes social media platforms for allowing misleading ads. It calls for stricter policies on crypto promotion, highlighting the importance of implementing responsible advertising practices and fostering transparency in the industry to ensure informed decision-making for consumers.

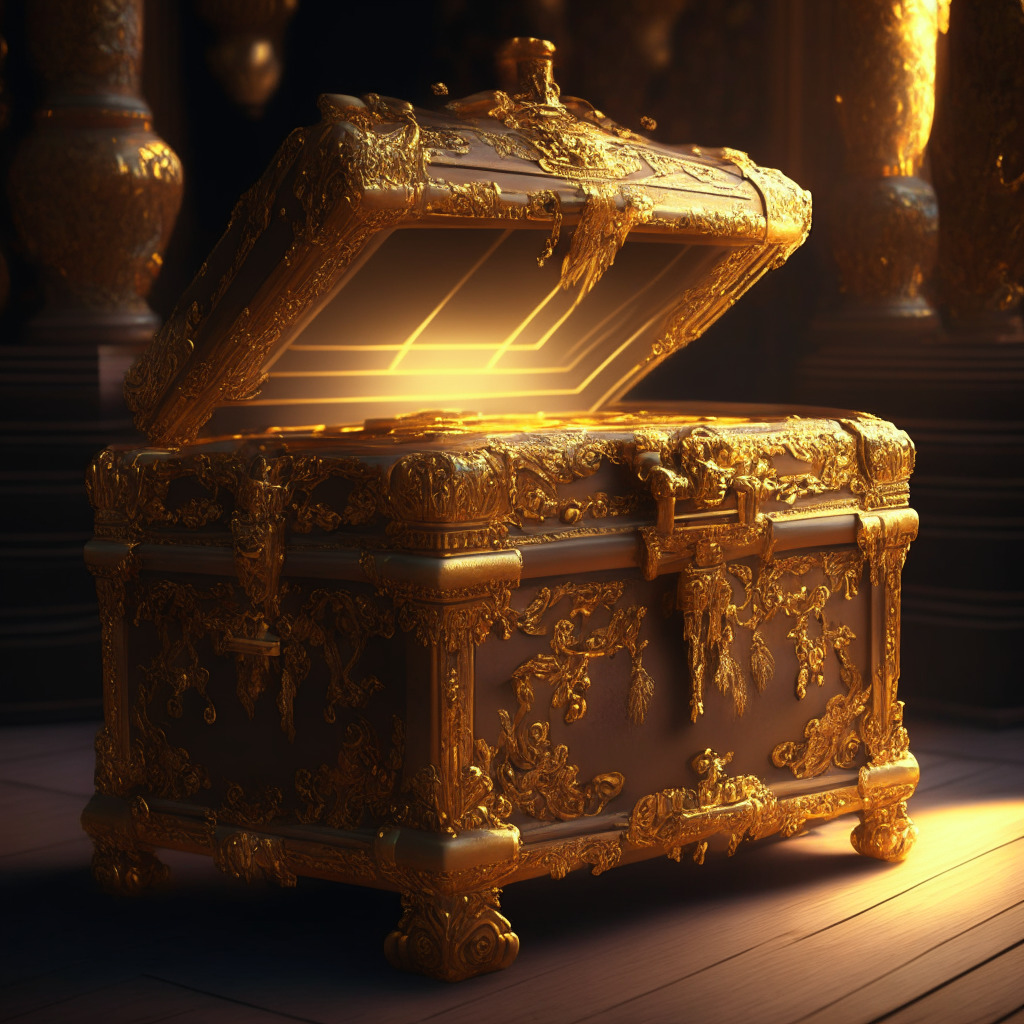

Louis Vuitton Enters NFT Space: Fashion Meets Blockchain for Authenticity and Exclusivity

Louis Vuitton reveals its first NFT collection, “Treasure Trunks”, as physical-digital collectibles. Priced at $42,000 each, the trunks are access passes for future products, experiences, and an NFT community. With focus on authenticity and traceability, they represent Louis Vuitton’s latest venture into blockchain technology.

Louis Vuitton’s $41K NFT Treasure Trunks: Luxury Exclusivity vs Blockchain’s Inclusive Potential

Louis Vuitton is launching “Treasure Trunks,” a limited series of soulbound NFTs priced at $41,712, offering unique products and experiences for high-level clientele. The collection is part of the ongoing “Via” program, which focuses on exclusive access for high-spending customers. This trend raises questions on whether luxury brands are embracing blockchain’s true potential or catering only to the elite.

Louis Vuitton’s Via Treasure Trunks: Luxury NFTs Meet Blockchain Limitations

Louis Vuitton’s Via Treasure Trunks collection introduces physical-linked NFTs in the luxury retail industry. By purchasing these exclusive digital trunks, customers gain access to future products, immersive events, and the brand’s growing blockchain initiatives. However, the non-transferable nature of these NFTs raises questions about resale potential and broad market impact.

EU’s MiCA Crypto Framework: Roots in French Regulations, Impact on Industry, and Debate on Compliance

The EU’s Markets in Crypto Assets (MiCA) regulatory framework has significant similarities to France’s existing PSAN (Digital Asset Service Provider) regulations, according to Ethereum France President Jerome de Tyche. MiCA aims to standardize crypto regulations across Europe and has received positive reactions from stakeholders and regulators, even being suggested as a model for the US by SEC Commissioner Hester Peirce.

Agoria Rewards Fans with Royalties: NFTs Changing the Music Industry Dynamics

French DJ and NFT artist Agoria collaborates with blockchain-based music platform Bolero to offer fans a shared stake in royalties from his upcoming record. Utilizing Bolero’s “Song Shares” feature, fans holding the NFT-based song can earn rewards, potentially transforming the dynamics of the music industry by providing artists more direct compensation.

Binance Privacy Coin Delist: Overreaction or Regulatory Compliance Necessity?

Binance recently delisted privacy coins like Monero and ZCash in several countries, raising concerns. Privacy coins can comply with regulations and provide user adoption benefits. Exchanges should collaborate with regulators to maintain privacy while ensuring legal compliance, instead of banning privacy coins without obligation.

AI vs. Human Governance: Debating Regulatory Efforts and Crypto Restrictions Worldwide

AI experts sign an open statement highlighting the need for mitigating extinction risks from AI, as global regulatory efforts increase. Binance restricts privacy tokens trading in four European countries, while the MiCA cryptocurrency regulatory framework is signed into law.

Elon Musk’s Dogecoin Lawsuit, AI Chat with Satoshi, and Crypto’s Regulatory Landscape

The article discusses a lawsuit against Elon Musk for alleged insider trading of Dogecoin, the development of a Satoshi Nakamoto AI chatbot, Binance CEO’s thoughts on acquiring a bank, and Crypto.com’s payment institution license in Singapore.

Creating the Ultimate Crypto-Friendly Bank: Overcoming Challenges and Seizing Opportunities

Santiago R. Santos recently proposed building a new “crypto-friendly bank” to fill the void left by the collapses of major crypto-friendly banks. Despite challenges, Santos envisions assembling a team, guided by his experience from the crypto and traditional finance worlds, to create a bank servicing individuals, businesses, and institutions in the ever-growing crypto industry.

Binance Delists Privacy Coins in EU Countries: Balancing Anonymity and Regulation

Binance plans to delist privacy coins like Zcash, Monero, and Dash for users in Spain, France, Italy, and Poland starting June 26, 2023, due to local regulations. The move highlights the delicate balance between ensuring individual privacy and complying with regulatory frameworks in the crypto market.

Crypto.com Gains Major Payment License in Singapore: Analyzing Pros and Cons for the Market

Singapore-based cryptocurrency exchange, Crypto.com, has been granted a Major Payment Institution (MPI) license for Digital Payment Token (DPT) services by the Monetary Authority of Singapore (MAS). This achievement bolsters its credibility and demonstrates the maturing nature of the crypto market, promoting market stability and growth.

Debt Ceiling Negotiations and Cryptocurrency: Seeking the Perfect Balance

The House of Representatives votes on postponing the debt ceiling until 2025 through the Fiscal Responsibility Act of 2023. This bipartisan agreement will impose limits on discretionary spending, but its impact on growth, innovation and the cryptocurrency sector requires a delicate balance between fiscal responsibility and flexibility.

Outdated SEC Framework: How Crypto Evolution Demands Comprehensive Legal Guidance

The SEC’s reliance on an outdated 2019 document for crypto regulation leaves market participants in obscurity, highlighting the need for an updated framework reflecting the rapidly evolving crypto landscape. As countries adapt to digital assets, the SEC must address cryptocurrencies’ unique characteristics by providing clear and comprehensive regulations.

Merging Web2 and Web3: Revolutionizing Content Consumption & Earning Crypto

Web3, the next stage of the internet, promises to revolutionize industries like finance and entertainment through blockchain technology. MyCo, a Dubai-based streaming platform, aims to combine Web2 and Web3 for maximum benefits, rewarding users with cryptocurrency for content consumption and forging partnerships with established media organizations to create a sustainable content distribution landscape.