“Dubai’s Illuminati Capital is investing $50 million in early-stage blockchain and Web3 gaming startups. Relying on Blockchain expertise and finance acumen, the venture fund aims to operate as partners, with a unique investment strategy to actively assist companies. However, their foray into the unpredictable world of Web3 gaming presents potential risks and rewards.”

Search Results for: Pi Network

Coinbase’s New Wave: Base Network and the Debate on Blockchain Adoption Necessity

Coinbase’s layer-2 blockchain network, Base, has seen a remarkable increase in users since its launch, with 30% reportedly being newcomers to blockchain. Despite skepticism, Base presents a promising conduit for users into Web3 protocols because of Coinbase’s huge user base. The readiness of such networks may pose risks to new adopters due to their inherent complexity and potential risks. The necessity of digital currencies is called into question, particularly in regions with a well-established banking system.

BNB Chain’s Pioneering Security Updates: Exploring the Potential Impact of Plato and Hertz Upgrades

“BNB Chain is set for an upgrade to boost security infrastructure and ensure compatibility with other EVM blockchain networks. Known as the Plato upgrade, it introduces BEP-126 to implement a rapid finality mechanism to prevent block reverts and chain reorganization for better trust and system efficiency. Another upgrade, the Hertz hard fork, is aimed at keeping BNB Chain updated with the latest Ethereum developments.”

Binance Preparing to List SEI Network’s Native Token: A Glimpse into Pre-Listing Futures Market

“Binance is preparing to list SEI Network’s native token, SEI, on Aug. 15. Implementing pre-listing futures alongside this, according to Aevo’s CEO, will enhance price discovery. SEI’s early valuation is set at 26 cents per token, leading to a market cap close to $486 million, pushing it into the top 100 cryptocurrencies.”

Grimes, NFTs and the Power of Web3: How the Digital Revolution is Reshaping the Creative Arts

“Musician Grimes leveraged non-fungible tokens (NFTs) to earn more than her career music earnings, auctioning her “War Nymph” NFT collection for $6 million. She remains optimistic about NFTs and Web3 technology’s potential to revolutionize creative production and financial compensation.”

Coinbase’s New Blockchain Adventure: Pioneering Success or Icarian Flight?

U.S. crypto exchange Coinbase is set for the launch of its new Base blockchain, a ‘layer 2’ platform built on Ethereum. With $133 million already locked into the base network, Coinbase aims to promote blockchain accessibility and innovation. The firm faces regulatory and user-safety challenges, but remains committed to creating trusted experiences for users and fostering global decentralization.

Forta Network Amplifies Scam Detection: A Leap Forward or a Perpetual Tightrope Walk?

“Forta Network has enhanced its scam detection services by expanding its threat focus and incorporating malicious URL data. The service employs real-time threat detection across seven Ethereum Virtual Machine chains, and uses predictive techniques and new smart contract scanners to identify potential crypto threats.”

Unmoved Bitcoin ushers Attention to Emerging Altcoins: Exploring potentials and Pitfalls

PayPal launched its own stablecoin, PayPal USD (PYUSD), yet Bitcoin’s price remains steady. Potential crypto market outliers like XDC Network, Wall Street Memes Token, Kaspa, XRP20, and Algorand are gaining attention due to their sturdy fundamentals and promising technical analysis. Still, as the crypto market’s unpredictable nature is undeniable, investors should proceed with caution.

Exploring the The Rise of Cardano Amid Key Network Upgrades and Market Flux

“Cardano network activity has surged, reflected by a rise in transactions and technical improvements. Despite a dip in active daily users, the ratio of transactions to active addresses is increasing, implying more active users. Key upgrades, including provision for Ethereum Virtual Machine smart contracts, could potentially boost token prices and expand the Cardano ecosystem’s utility.”

Uncovering the Shadows in Crypto: How Alameda Research’s Tokens Witnessed Suspicious Price Surge

“Tokens tied to Alameda Research saw a 30% rise in value after being listed on the now-defunct exchange FTX. This was allegedly aided by suspicious Twitter activity suggestive of market manipulation. The Network Contagion Research Institute report calls for more scrutiny and regulation in crypto markets to prevent potential inauthentic activity aiming to artificially inflate market values.”

Blockchain Meets Soccer: Game4Ukraine’s Metaverse Journey and Potential Pitfalls

“Ukrainian President Volodymyr Zelenskyy announces Game4Ukraine, a charity soccer event witnessed worldwide and extended to a metaverse watch party. The event also involves selling customizable jersey non-fungible tokens (NFTs) to raise funds. However, concerns emerge about the accessibility and complexity of cryptotechnology.”

Crypto Conundrum: China’s Unofficial Crypto Boom Despite Ban and Its Impact on Binance

Despite China’s ban on cryptocurrencies in September 2021, Chinese traders reportedly facilitated $90 billion worth of crypto trades on Binance in one month this year, accounting for one-fifth of Binance’s global volume. These trades are enabled through virtual private networks, allowing users to bypass censorship. However, this situation could escalate Binance’s regulatory challenges in the U.S. despite its growing popularity in the Chinese market.

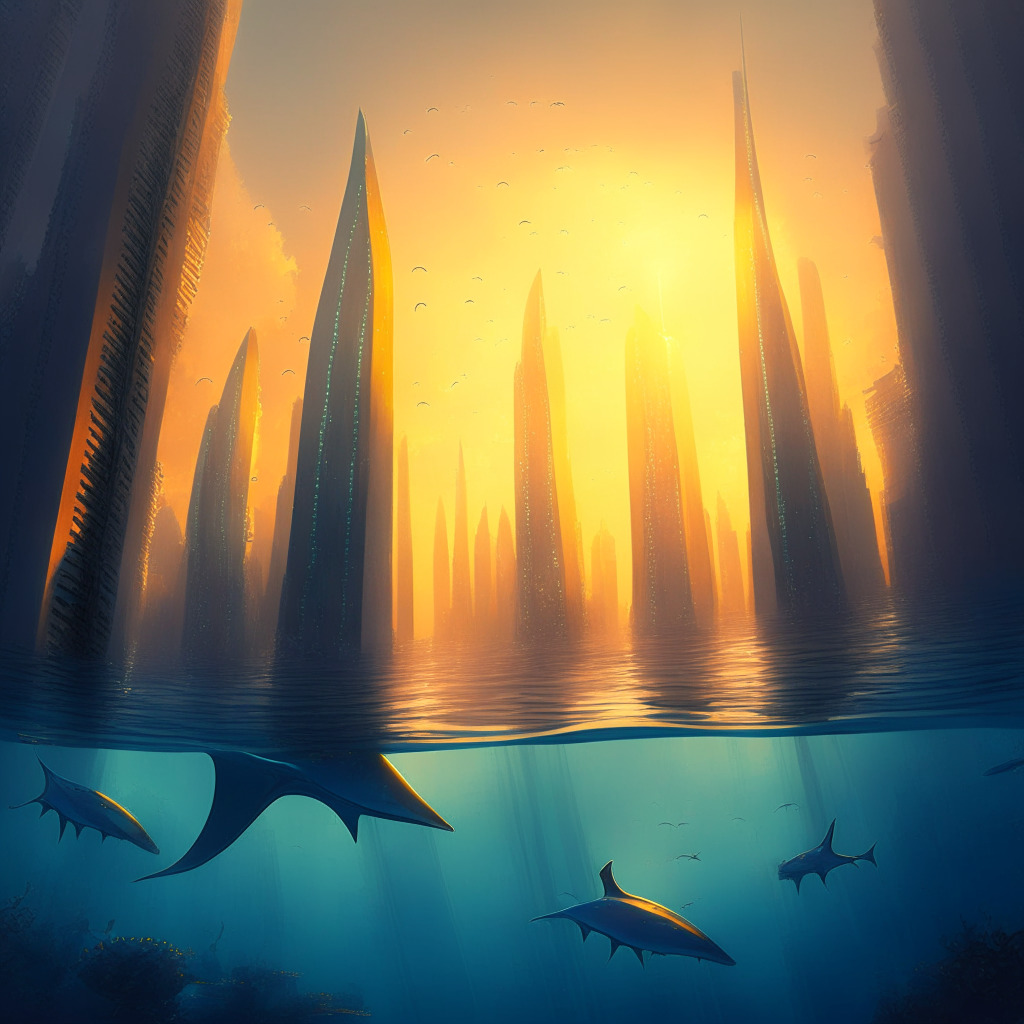

Navigating the Stormy Seas of Digital Assets: Promising Advances and Regulatory Pitfalls

“The digital assets landscape is dynamic, but not insulated from regulatory scrutiny. Despite substantial backing, some ventures like Nifty’s struggle, while partnerships like Tel Aviv Stock Exchange and Fireblocks demonstrate promising blockchain confidence. However, the translation of tech potential to market reality presents challenges.”

Surge in XDC Network’s Value: An Apt Investment or Overbought Anomaly?

“Enterprise-focused blockchain, XDC Network experienced an exciting +100% price surge recently. Despite a slight 24-hour decrease and hints of overbuying, its upside potential remains strong. Meanwhile, new digital token Shibie, a fusion of pop-culture elements, appears set to redefine the meme coin space, boasting ambitious plans and a broadening reach, despite market risks.”

The Lifeline of Dogecoin: How Litecoin’s Network Security Saved the Meme Cryptocurrency

“Charlie Lee, creator of the Litecoin blockchain, helped rescue Dogecoin in 2014 with a “merged mining” agreement, effectively utilizing Litecoin’s network security. This historical connection between Litecoin, Bitcoin, and Dogecoin illustrates how “proof-of-work” systems mutually secure each network, adapting in crises – a core attribute of cryptocurrency markets.”

Advancing Bitcoin Payments: The Future of Lightning Network and Its Impact on Crypto Exchanges

“Influential figures discuss the potential of Bitcoin’s Lightning Network (L2). CEO of Coinbase, Brian Armstrong, shares ventures for incorporating L2 into their platforms, enhancing Bitcoin scalability, security, and transaction speed. L2 promises profound benefits such as low-cost transactions, faster payment settlements, and user anonymity.”

Cardano’s Under-Evaluation Supposition: Will ADA Rally or should we Pivot to XRP20?

“Cardano’s price has gently climbed, rising 24% since the start of 2023. There are signs of a possible imminent rally and the altcoin’s undervaluation could mean the rally is overdue. Cardano’s successful Mithril update and an increase in apps suggest the blockchain has growth potential in the coming years.”

Bitcoin Lightning Network: Coinbase’s Game Changer or Risky Adventure?

Coinbase, a leading cryptocurrency trading platform, plans to incorporate Bitcoin’s Lightning Network to its services. This innovative second layer for Bitcoin transactions leverages micropayment channels to accelerate transaction speeds and reduce costs, potentially transforming Bitcoin as a payment method. However, security concerns and technical challenges lie ahead.

Smart Contracts: Champion of Blockchain or Hint of Vulnerability?

While smart contracts have transformative power in the blockchain and cryptocurrency world, concerns are growing about their potential to stall or fail. Issues like lack of Bitcoin support, connection to mainstream finance, and hacking risks necessitate considering alternatives or critical adjustments to maximize their value and ensure security.

Risky Profits and Rival Allegations: A Base Layer 2 Network Exploration

The Base network, a testnet built by Coinbase, is witnessing substantial profits through potentially risky trades, one example being the “bald” token (BALD). Market successes hint at high investor trust, but the crypto market’s volatility, coupled with practices like ‘calls,’ raises concerns about the sustainability of such investments. Market liquidity is increasing but there are obstacles, including the unidirectional flow of funds. The uncertain dynamic illustrates the definitive risks of the crypto landscape.

Legal Battles Heat Up: EOS Network Foundation Plans Lawsuit against Block.one

The EOS Network Foundation gears up for a lawsuit against Block.one for failing to invest $1 billion from its 2018 $4.1 billion raise, causing complications for the EOS community. Despite the risks of litigation, this prompts a broader conversation about compensatory justice in cryptocurrency.

The Unraveling of Hector Network: Decentralization Predicament and the Illusion of Quick Exits

The formerly $100 million treasury of stablecoin project, Hector Network, has collapsed to $16m following the Multichain bridge’s demise. The DAO’s liquidation process is causing community frustration given its complexity and projected 6 to 12-month timeframe. Hector’s endeavors beyond stablecoin, including a token launchpad and NFT marketplace, might have diluted its focus and deepened the treasury situation.

Cosmos: Shaping the Future of Blockchain or Becoming Obsolete in the Process?

“Despite a promising start, recent times have not been favorable for Cosmos. Developers veered away after the catastrophic crash of Terra, and substantial liquidity drop deterred integration of apps into the Cosmos ecosystem. Severe community management issues and the emergent competition from blockchain-in-a-box projects have triggered uncertainties about Cosmos’s future and identity.”

Ramp Network’s Bold Advance into Latin America: A Crypto Revolution or Risky Endeavor?

“Ramp Network, a startup providing payment infrastructure, aims to offer its software development kit to clients in Latin America, starting with its recent establishment in Brazil. This comes after regulatory breakthroughs, aiming to potentially reshape the region’s economic landscape with crypto integration.”

Reshaping Crypto Exchanges: EDX Markets’ Venture with Talos and its Potential Impact on Institutional Crypto Trading

The partnership between EDX Markets, a non-custodial platform backed by Wall Street players and Talos, a digital assets trading technology provider, redefines the crypto exchange world. EDX Markets, by integrating Talos’ vast network, bolsters its trading capabilities and reputation while providing a transparent, safe, and efficient trading experience for institutional investors venturing into crypto.

Sui Network’s Struggle and Rise of $EVILPEPE: Analyzing Crypto Market Dynamics

“Sui Network, a rising contender to Solana, faces repeated downward price shifts, the most recent a -2.1% drop. Despite hints at possible positive movement, the bearish trend gives it a precarious risk-reward profile. In contrast, $EVILPEPE Coin, from creators of Thug Life Token and SpongeBob, shows promising growth prospects, ignited by social media and influencer promotion. However, the volatile crypto market calls for informed caution.”

Flashbots Secures Massive Funding: A Tipping Point for Ethereum or a Risky Gamble?

Flashbots, the Ethereum-focused R&D startup, gathered $60 million in a Series B funding round to boost the future of a decentrizable network. Their project, SUAVE, aims to counter challenges posed by the Maximum Extractable Value (MEV) and provide cheaper, more private transactions. Yet, the scale of the raised funding brings both excitement and anxiety within the crypto-community regarding Flashbots’ ability to handle the MEV issue.

Cross-Chain Token Standard: A New Frontier in Cryptocurrency Security or a Potential Pitfall?

“Connext and Alchemix have launched a new cross-chain token standard ‘xERC-20’ designed to enhance security and limit bridge exploit losses. This standard allows token issuers to maintain a record of bridges and control the number of tokens each bridge can mint, aiming to protect end-users from suffering losses. However, it doesn’t escape criticisms related to bridge security and the differentiation of ‘official’ and ‘unofficial’ tokens.”

Venture Capital Boom in the Crypto Industry Amidst its Chilled Winter

“Last week observed a striking $201.4 million venture capital infusion into digital currency firms, exemplifying the resilience of crypto industry despite challenges. Investments focused on innovative technologies such as zero-knowledge proofs. However, the volatility marked by tokens like RDNT reminds of the persistent risks.”

Manta Network’s Record-breaking Valuation: Revolutionizing DeFi Through Privacy and Anonymity

“Manta Network, backed by P0x, has reached a valuation of $500M after a recent funding round. This funding aims to boost scalability and user base, and increase overall utility. P0x revealed plans to launch Manta Pacific, featuring decentralized applications (dApps) enabled by zero-knowledge (ZK) technology, enhancing privacy and security in the DeFi community.”

Futureverse Secures $54M in Funding: Reshaping Metaverse with Partnerships and AI Innovation

“With an impressive $54 million funding round led by 10T Holdings and Ripple, Futureverse aims to revolutionize the metaverse landscape through advanced AI content generation tools. The company’s partnership with Ripple for redefining metaverse applications adds to their ambition.”

Crypto Pioneer Treads Volatile Waters: The Journey of KIN and the Birth of Code Wallet

The minimalist crypto wallet Code, backed by the former CEO of Kik, has launched its Solana-based application focusing on the KIN cryptocurrency. Despite regulatory challenges, Code’s founder believes it offers potential for adoption due to its clearance for U.S trading. Confidently advocating for ‘digital paper cash’, it also allows transactions during network outages. However, its success relies heavily on KIN’s acceptance as a legitimate payment method, a venture that comes with risks due to price volatility.