Ethereum experienced a 0.4% decrease on Tuesday, unable to maintain its position around $1,900. However, it still holds an 8% gain in the past week. Ethereum staking has seen significant improvement since the Shapella upgrade, indicating investors prefer to hold onto Ethereum rather than keeping tokens on exchanges.

Search Results for: Upside

Reviving Terra Classic: Six Samurai’s Bold Move to Reclaim $580M Ecosystem

Six engineers known as the “Six Samurai” have proposed a revival of the Terra Classic ecosystem, aiming to create independence from its disgraced founder, Do Kwon. Their objectives include providing value during the recovery process and contributing to the Terra Classic blockchain as both developers and long-time community members/investors.

Potential Russian Military Coup: How It Could Impact Crypto Market Amid Ukraine Crisis

Ongoing Ukraine war and potential Russian military coup may impact global markets, including crypto. With Russia’s significant role in oil and gas, a civil war could benefit Bitcoin and altcoin prices as perceived safer assets amid uncertainty.

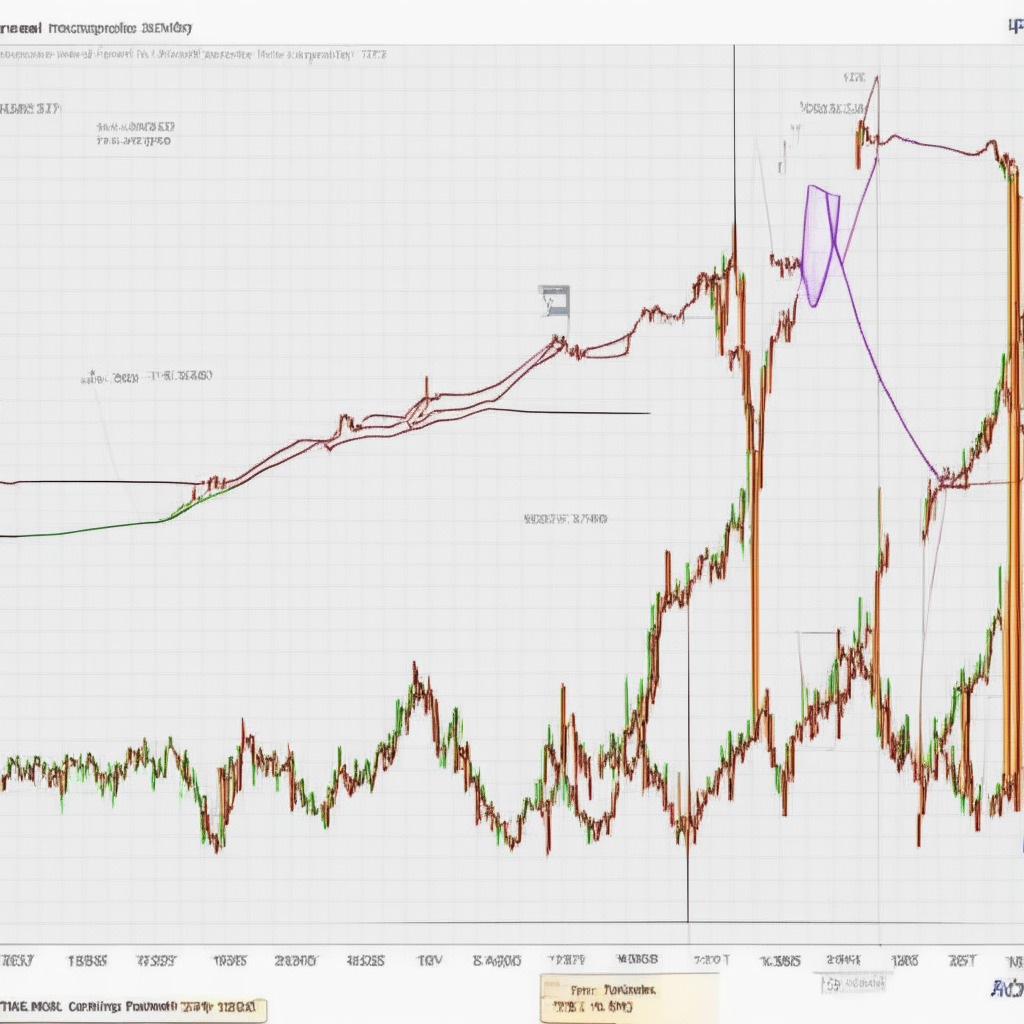

Bitcoin’s $30,000 Struggle: Conflicts Between Optimistic and Cautious Market Predictions

As Bitcoin’s price hovers around $30,000, traders predict its next targets amid market uncertainty. Some traders are optimistic about reaching a yearly high of $31,000, whereas others anticipate a snap drop in value. Market sentiment remains divided as the cryptocurrency industry struggles to determine Bitcoin’s future direction and its impact on other digital assets.

Bitcoin’s $28K Dip: A Golden Entry Point or Par for the Course? Debating Pros & Cons

Bitcoin traders anticipate a potential $28K retracement as BTC price retains 20% gains, with expectations of a modest correction offering lucrative entry points for long positions. The current price performance and volatility align with historical trends, suggesting upcoming dip-buying opportunities.

Upcoming Bitcoin Halving & ETF Approval: Igniting the Next Bull Cycle?

Several factors, including the upcoming Bitcoin halving in 2024, BlackRock’s Bitcoin ETF application, and technical analysis predictions, could potentially ignite the next Bitcoin bull cycle, contributing to new price rallies and market dominance.

Ethereum Price Rally: Analyzing the Resistance Barrier and Potential Breakout Prospects

The Ethereum price recently experienced an 8.5% surge after encountering a crucial support level, reaching a resistance zone of $1775-$1765. However, selling pressure halted the rising momentum, suggesting possible consolidation before a significant recovery rally. JPMorgan recently backed Ethereum, despite some disagreements within the crypto community.

XRP’s Struggles Amid SEC Battle: Examining Ripple’s Uncertain Future and Market Impact

XRP struggles with losses, its upside capped under the 100-day EMA, amidst Ripple’s battle with SEC for regulatory clarity in the US. As price declines, technical indicators may push XRP further into the red, while crucial support at $0.48 is monitored for potential near-term gains.

Bitcoin Recovery Rally: Temporary Growth or Start of a Bull Cycle? Pros and Cons

The Bitcoin fear and greed index at 48%, indicating neutral market sentiment, suggests the recent 5% price recovery rally may be temporary. Observing price behavior at the trendline is essential for determining future prospects, as a reversal may prolong the current downfall, while an upside could allow sustained recovery.

Ethereum’s Future Gets a Boost from Ethscriptions and DeFi Developments

Ethereum saw a weekend price spike reaching $1,769, and despite a small dip, buy signals suggest potential increases. A new protocol, Ethscriptions, enabled users to launch NFTs and other digital assets, generating nearly 30,000 assets in 18 hours. Ethereum’s price may reach above $2,000 if its current support and buy signals hold strong.

Double Bottom Pattern: Will Coinbase Share Price Rebound or Face Strong Resistance?

Coinbase’s COIN price quickly rebounded by 17.4% after a massive gap and seems to be forming a double bottom pattern, signaling a potential recovery and trend reversal. However, strong resistances may challenge this bullish thesis, and investors should closely monitor price action around key levels.

Best Cryptos to Buy Now: WSM, IMX, ECOTERRA & More Amid Market Surge

Bitcoin experiences significant rally with a market cap growth of 3.54% due to BlackRock’s commitment to creating a Bitcoin ETF. With the global crypto market witnessing a 2.47% increase, top cryptos to buy now include WSM, IMX, ECOTERRA, CRV, YPRED, NEO, and SWDTKN.

Arbitrum’s Growth Despite ARB Token Downturn: Analyzing Factors and Future Prospects

Arbitrum’s governance token ARB faces downturn since its airdrop, but ecosystem growth remains healthy. Consistently higher daily active users, gas fees, and transaction count are observed. The upcoming Cancun-Deneb update featuring EIP-4844 and the Arbitrum Foundation’s revenue-sharing plan may impact ARB. Investors should conduct thorough research before making decisions.

Cardano’s Uncertain Future: Price Volatility and Potential Breakout Explained

Cardano displays significant market uncertainty following the heavy sell-off in June. The battle between buyers and sellers may trigger a price range formation between $0.3 and $0.24. High volatility before a potential explosive move raises concerns about Cardano’s future direction.

Spot Bitcoin ETF: Gateway to Mainstream Adoption or Road to Regulatory Hurdles?

Bitcoin’s value fluctuates as BlackRock files paperwork with the SEC proposing the creation of iShares Bitcoin Trust, a spot bitcoin ETF. This development sparks debate within the crypto community over the pros and cons of a spot bitcoin ETF, and its potential for mainstream adoption.

Curve Founder’s Risky Loans Threaten CRV Value: Impending Liquidation and Market Repercussions

Curve DAO’s governance token CRV suffered a 12% drop as founder Michael Egorov took risky loans on Aave, depositing 431 million CRV and borrowing $101.5 million stablecoins. A $107 million liquidation threat looms if CRV falls below $0.37, sparking a proposal to freeze Egorov’s loans and prevent further CRV loans. The negative bets on CRV create an opportunity for a potential quick upside move.

BNB Rebounds: Oversold Status Brings Bullish Hope Amid Bearish Bets and SEC Pressure

BNB price climbed nearly 4% to $253 after bouncing back from a six-month low of $220. This recovery is attributed to its “oversold” status, with the daily relative strength index reaching its lowest since March 2020. An increase in short positions liquidations may also contribute to the price rebound.

BNB’s Regulatory Uncertainty vs. yPredict’s AI-Powered Crypto Trading: Weighing the Risks

Binance Coin experiences a 9% bounce amid an SEC lawsuit, causing uncertainty for investors. Meanwhile, AI-powered platform yPredict’s native $YPRED token gains attention for its groundbreaking technology and promising investment potential.

Jack Dorsey’s $5M Brink Investment: Pioneering Crypto or Risking Stock Stability?

Jack Dorsey has pledged $5M to support the development of the Bitcoin protocol through Brink, showcasing his unwavering commitment to the digital currency’s future potential. However, the cryptocurrency market’s volatility and uncertainty can impact the stocks of companies associated with it, raising concerns among shareholders and investors.

LUNC Price Breakout: Can Bulls Overcome $0.0001 Resistance Amid Terra Classic Upgrade?

The LUNC price recently rebounded from $0.000082 support, breaching the overhead trendline with a bullish breakout. With Terra Classic’s v2.1.1 Parity upgrade proposal passed, LUNC buyers aim to reach a resistance level of $0.000103, potentially driving prices 7-8% higher. Investors should conduct thorough research before making any decisions.

Debunking BNB Price Manipulation Rumors: Binance CEO Clears the Air

Binance CEO CZ Zhao refutes rumors that the crypto exchange has been offloading Bitcoin to maintain BNB prices, stating they’ve neither sold BTC nor BNB. The allegations by Crypto Twitter users led to debate, but CoinGecko data shows a positive trend for BNB and minimal declines for BTC. Transparency and reliable information are essential in the highly speculative crypto community.

Bitcoin’s Struggle with $25K Resistance Amid Economic and Regulatory Uncertainty

Bitcoin’s narrow trading range has investors closely monitoring futures contract premiums and hedging costs, amid uncertainties regarding the Federal Reserve interest rate decision, US Treasury issuances, and the crypto regulatory environment. The recession risk for the U.S. economy further dampens demand for risk-on assets like Bitcoin.

Crypto Markets Uncertainty: Fed Interest Rate Decision vs. Regulatory Challenges

While stocks rally ahead of the Federal Reserve’s interest rate decision, crypto markets face a different story. The lackluster bitcoin response, upcoming Fed decisions, regulatory lawsuits, and tightened profit margins for miners have led to negative investor sentiment, impacting the crypto market’s future.

Bitcoin’s Uncertain Week: Examining Market Volatility, Legal Battles, and Potential Growth

Bitcoin enters an uncertain week with support below $26,000, influenced by legal battles in the US. Key factors to watch include US macroeconomic data, SEC conflicts with exchanges, and legal proceedings involving Coinbase and Binance. Despite the precarious situation, Bitcoin’s strong network fundamentals and potential macro shifts present opportunities for recovery and growth.

Bitcoin Whales Accumulate Amid Dominance Shift: Analyzing Market Trends and Risks

Bitcoin whales accumulated nearly 60,000 BTC during a recent 10% price correction, according to a report by Santiment. As altcoins experience market turbulence, Bitcoin’s dominance reaches 50% for the first time since April 2021, suggesting bear market characteristics and investors shifting funds into safe-haven large-cap coins.

Crypto.com Exits US Institutional Market: Focus on Retail or Lost Opportunity?

Crypto.com is discontinuing its services for institutional clients in the U.S. due to limited demand, while retail investors remain unaffected. This move highlights the challenges crypto exchanges face in navigating evolving market dynamics and complex regulatory frameworks surrounding the industry.

Ripple Navigates SEC Challenges: XRP’s Potential Breakthrough and yPredict’s AI Trading Edge

Amid turbulent crypto markets and SEC enforcement actions, Ripple (XRP) is positioning itself for a potential positive outcome in its ongoing legal battle. With strong technical structure and developments in the SEC vs. Ripple case, XRP could experience an upside move soon, making it an attractive entry point for investors. Utilizing innovative AI-powered trading platforms like yPredict($YPRED) can offer traders a competitive edge in the increasingly complex crypto trading landscape.

Bitcoin’s Struggle at $27,000: Regulatory Scrutiny and Global Economic Crisis Impact

Bitcoin price nears $27,000 but faces challenges from stricter regulatory scrutiny following FTX’s bankruptcy and a global economic crisis. Bitcoin derivatives markets indicate low probability of breaking above $27,500, suggesting a bearish market structure and a likely $25,500 support retest.

Bitcoin’s Reaction to Softening US Labor Market and SEC’s Crypto Crackdown

The cryptocurrency market saw a surge as Bitcoin rose to over $26,800, possibly due to weaker US labor market data. However, SEC Chairman Gary Gensler’s criticism of the crypto industry erased most gains. Bitcoin’s future may be influenced by evolving regulations and shifting macroeconomic factors.

SEC Labels Solana as Unregistered Security: The Battle for Sustainability in Crypto

The SEC has labeled Solana (SOL) as an unregistered security, leading to an uncertain future and impacting the crypto market. In response, investors are exploring alternatives like Ecoterra, an environmentally-focused project with a unique Recycle-to-Earn mechanism and commitment to sustainability.

Ethereum’s Future Amidst SEC Lawsuits: Navigating Challenges with AI-Powered Trading

Ethereum faces uncertainty amidst discussions on regulatory clarity and potential security classification, impacting its short-term price predictions. In response, retail investors can consider yPredict, an AI-powered crypto trading platform offering real-time signals and insights to navigate the volatile market.

Shiba Inu’s Bearish Trends and Opportunities in Crypto Presales: Diversifying Portfolios

Shiba Inu price predictions remain bearish despite increased trading activity and ecosystem upgrades like Shibarium and SHIB: The Metaverse. Investors seeking high-risk-high-reward opportunities may consider participating in presales of promising projects, like AI-powered platform yPredict.