Senator Elizabeth Warren highlighted a connection between cryptocurrency payments and China-based firms supplying fentanyl precursors, raising concerns on the need for effective cryptocurrency regulations. Critics argue that imposing more regulations might hinder the growth and innovation of blockchain technology. Senator Warren plans to reintroduce legislation addressing the regulatory gaps related to illicit cryptocurrency use while safeguarding potential innovations in finance.

Search Results for: U.S

Crypto Divide in 2024 US Presidential Election: DeSantis vs Biden on Bitcoin & CBDCs

Digital assets are becoming a significant topic in the 2024 U.S. presidential election, with Florida Gov. Ron DeSantis championing a pro-crypto stance while critics accuse the Biden administration of hindering crypto growth and advocating for CBDCs. The debate’s potential influence on the election is still uncertain.

Fusion Digital Assets Launch: New Era for Crypto Adoption or Stifled Innovation?

TP ICAP’s Fusion Digital Assets marketplace goes live, marking a significant moment in cryptocurrency history. The platform brings crypto to more institutional investors, offering familiar infrastructure and strict governance. However, added complexities and regulations may impact innovation and growth in the crypto landscape.

Circle Ditches US Treasury Bonds for USDC: A Wise Move amid Debt Ceiling Showdown?

In response to potential market turbulence due to the U.S. debt ceiling showdown, Circle Internet Financial has divested from U.S. Treasury bonds, backing its USD Coin (USDC) with overnight repurchase agreements instead. This strategic move aims to protect the USDC stablecoin from potential bond market disruptions as lawmakers scramble to avoid a government default. The effectiveness of this strategy remains uncertain.

Cryptocurrency, Fentanyl Trade, and Balancing Regulation: An In-Depth Analysis

Senator Elizabeth Warren highlights the connection between cryptocurrency and the Chinese fentanyl trade, proposing the Digital Asset Anti-Money Laundering Act to halt such transactions. Striking a balance between security and innovation is crucial in regulating the blockchain and digital asset sector.

Surge in US Job Openings May Prompt Rate Hike: Implications for the Crypto Market

U.S. job openings rose unexpectedly in April, surpassing economists’ expectations and showing a solid labor market recovery. The Federal Reserve may consider raising interest rates in June, potentially impacting both equities and the crypto market.

Balancing AI Regulation and Innovation: The Urgent Need for a Voluntary Code of Conduct

The EU-U.S Trade and Technology Council meeting emphasized the need for a voluntary code of conduct in AI development and implementation, as the EU AI Act is years away from being effective. Such a code could balance ethical, safety concerns and innovation, while comprehensive regulations are developed.

Binance Layoffs: Restructuring Move or Result of Regulatory Challenges?

Binance, the world’s largest crypto exchange, is reportedly laying off around 20% of its workforce, affecting nearly 1,600 employees. The restructuring could be due to recent market conditions and the organization’s continued expansion. Official confirmation and potential implications of this move remain uncertain.

Yuan Depreciation vs Dollar Strength: Impact on Bitcoin and Global Crypto Markets

China’s yuan (CNY) experienced a 2.7% depreciation against the U.S. dollar (USD) this month, historically considered bullish for alternative assets like bitcoin and gold. However, the strengthening U.S. dollar could lead to continued monetary tightening worldwide, posing a headwind for risk assets, including cryptocurrencies.

XRP Surges Past $0.50: Resilience Amidst Market Downturn and Ripple’s Future Prospects

Ripple’s XRP cryptocurrency has broken the $0.50 barrier, witnessing a 13% increase over a single week, generating excitement among investors. With bullish market indicators, increased network activity, and impressive gains, XRP’s resilience emphasizes its promising future. However, thorough research is advised before investing.

Binance CEO on Lightning Network, Mining, and Global Crypto Regulations

Binance CEO Changpeng “CZ” Zhao discusses the importance of Lightning Network integration for crypto exchanges, mining operations, regulatory challenges, and the need for investors to research before investing in meme coins, NFTs, or metaverse projects. Favorable crypto regulations cited in UAE and Hong Kong.

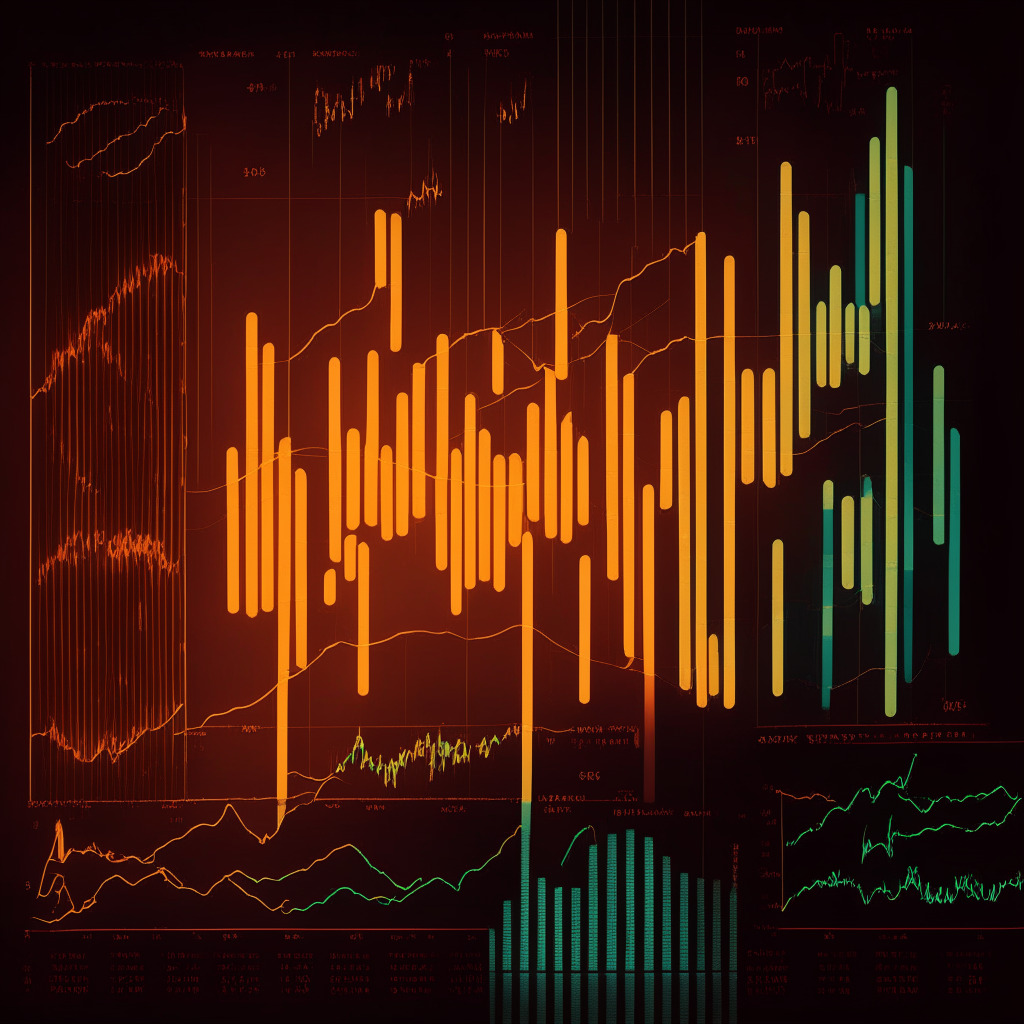

Cryptocurrency Turmoil: Navigating Regulatory Shifts and Unexpected Market Surges

Cryptocurrencies face a bear market due to Federal Reserve’s tightening monetary policies, causing Bitcoin to drop 3% within 24 hours. Meanwhile, the CFTC issues warnings for companies to counter risks in clearing digital asset transactions, and XRP sees an 8% increase in value amid settlement speculations in the SEC/Ripple legal case.

DOJ May Drop Charges Against Ex-FTX CEO: A Win for Crypto or Loophole for Criminals?

The U.S. DOJ might drop charges against former FTX CEO Sam Bankman-Fried due to potential violations of the extradition agreement with the Bahamas. This highlights complexities and challenges in balancing crypto innovation with safety and regulations across global jurisdictions.

Privacy Coins Face Regulatory Challenges: Binance Disables Trading in France

Binance’s decision to disable trading of privacy coins like XMR, ZEC, and DASH in France due to local regulatory requirements highlights the ongoing regulatory challenges faced by the crypto industry. The future of privacy coins remains uncertain, as increased scrutiny may impact their growth and technologies.

IRS Power to Access Crypto Exchange Records: Balancing Privacy and Regulation

A recent ruling by a federal judge in New Hampshire raises concerns about the IRS’s power to access financial records from crypto exchanges, spotlighting the ongoing tension between individual privacy and authorities’ efforts to regulate the crypto space. The case calls for continued debates on striking a balance between harnessing new technologies and protecting individual rights.

XDC Network and SBI VC Trade: Bridging Blockchain and Japanese Trade Finance Market

The XDC Network is partnering with SBI VC Trade to expand its presence in the Japanese market and enhance the trading experience. This collaboration aims to streamline the trade finance sector by improving transparency, traceability, and cost reduction while fostering blockchain adoption in the international trade and finance industries.

Navigating Crypto Amid Federal Reserve’s Liquidity Tightening and Debt Ceiling Debates

Crypto enthusiasts should note Cleveland Fed President Loretta Mester’s support for liquidity tightening and consistent interest rate policy, as her comments impacted Bitcoin’s value. The market’s response demonstrates the significance of global economic events and Federal Reserve policy decisions on the cryptocurrency landscape.

Coinbase CEO Warns US Restrictions May Benefit Adversary Nations: Striking the Crypto Balance

Coinbase CEO Brian Armstrong warns that restrictive crypto policies in the U.S. could benefit adversary nations like China, potentially costing the U.S. its financial leadership. Armstrong urges policymakers to recognize crypto’s potential in revolutionizing various sectors while providing regulatory clarity to protect consumers and maintain global competitiveness.

Crypto Market Volatility in 2023: Exploring Causes, Remedies, and the Rise of Ether

In 2023, heightened crypto market volatility is driven by factors like US debt ceiling negotiations, Asian regulatory shifts, and Turkey’s political landscape. Ether’s deflationary stance weakens its correlation to Bitcoin, possibly marking a long-term regime change in supply-demand economics between the two digital assets.

Debt Ceiling Deal Impact on Bitcoin: Crypto Market Reaction & Future Outlook

Bitcoin steadied after dropping below $28,000 due to progress on a debt ceiling deal, while government debt may prove favorable for the crypto market. Analysts suggest bitcoin’s resilience amid monetary tightening could be due to factors like store-of-value, NFTs, and supply/demand dynamics.

Balancing Blockchain Anonymity and Legal Investigations: Pros, Cons & Conflicts

Researchers from Friedrich-Alexander-Universität Erlangen-Nürnberg propose a standard framework containing five argumentative schemes for validating deanonymized data on the Bitcoin blockchain. This aims to balance protecting suspects’ rights and aiding investigators by providing transparent, analytically sound court proceedings and ensuring fair law application. The findings are potentially applicable beyond German and United States legal systems.

CFTC Advisory on Digital Assets: Balancing Innovation and Compliance in Blockchain Future

The CFTC issued a staff advisory to derivatives clearing organizations, emphasizing compliance in areas related to digital assets: system safeguards, conflicts of interest, and physical deliveries. These concerns highlight the balance between fostering innovation in the digital asset space, and protecting investors and businesses. Regulators’ efforts contribute to a more secure and sustainable ecosystem for digital assets.

US Debt Ceiling Chaos Spurs Diversification into Cryptos: Analyzing WSM, QNT, and More

Amid uncertainty over the US debt ceiling, market participants explore diversification into cryptocurrencies such as WSM, QNT, ECOTERRA, INJ, YPRED, LDO, and DLANCE. Enthusiasts consider the environmentally-focused web3 initiative, Ecoterra, an integral part of the global climate change strategy.

ProShares Bitcoin ETF vs BTC: Is Contango Bleed Impacting Performance?

ProShares’ Bitcoin Strategy ETF (BITO) has underperformed compared to bitcoin’s performance this year, due to its futures-based structure and contango bleed. This highlights the limitations of futures-based ETFs and calls for the approval of direct BTC spot ETFs for better investor gains.

Dropping Charges against Ex-FTX CEO: Bahamas’ Role & Extradition Treaty Implications

U.S. prosecutors may drop some charges against former FTX CEO Sam Bankman-Fried, depending on the Bahamas government’s stance. The defense argues certain charges violate the extradition treaty between the U.S. and Bahamas. Prosecutors seek a waiver from the Bahamas to try Bankman-Fried for three of the four contested charges.

Surge in Republican Opposition to CBDCs: Privacy Concerns vs Financial Inclusion Benefits

Recent opposition from Republican lawmakers to a central bank digital currency (CBDC) raises concerns over government surveillance and privacy threats, as they argue a digital dollar could grant federal officials unprecedented access to individuals’ financial data. The future of the Federal Reserve’s potential pilot program remains uncertain amid intensified debate surrounding CBDCs.

El Salvador’s Bitcoin Experiment: A Landmark Move or Destined to Fade Away?

El Salvador made history by adopting Bitcoin as legal tender, aiming to mitigate negative impacts of being tied to the U.S. central bank. Facing challenges like skepticism and fluctuating prices, the country’s Bitcoin experiment has inspired others but leaves its future undetermined.

Independent Examiner Debate in FTX Bankruptcy: Legal Dispute, Costs & Implications

A U.S. District Judge referred a motion concerning the appointment of an independent examiner for FTX’s bankruptcy to an appellate court. The case raises questions about the need for an independent examiner in crypto exchange bankruptcies, potential costs, and implications for future similar cases.

The SEC, Cryptocurrencies as Securities & Blockchain’s Future: Debating Pros and Cons

The SEC recently settled charges with former Coinbase product manager Ishan Wahi and his brother Nikhil Wahi for insider trading on certain cryptocurrencies. The case raises questions about classifying cryptocurrencies as securities and calls for clear regulatory guidelines to balance addressing potential issues and fostering innovation in the rapidly evolving crypto market.

FTX Bankruptcy Case Heads to Higher Court: Financial Burden vs Need for Transparency

A Delaware District Judge has referred the FTX bankruptcy case to the US Third Circuit Court of Appeals. Despite concerns about potential financial burdens, an independent investigator may be appointed to maintain transparency and fairness, and reveal any malfeasance that led to the collapse.

CFTC’s Crypto Advisory: Balancing Opportunities with Growing Risks in Digital Asset Transactions

The CFTC urges firms to exercise caution and mitigate potential risks in clearing digital asset transactions, addressing novel risks in the expanding crypto market. The advisory highlights concerns such as conflicts of interest, cyber threats, and managing the physical delivery of digital assets.

Tether’s Sustainable Bitcoin Mining in Uruguay: Eco-Friendly Move or Shaky Investment?

Tether is venturing into sustainable Bitcoin mining in Uruguay, focusing on environmentally friendly operations. With over 98% renewable energy generation, the country offers a unique opportunity for greener crypto mining. Tether’s commitment aims to minimize ecological footprints and uphold the security and integrity of the Bitcoin network.