The Japanese government announced tax exemptions for crypto issuers, exempting them from paying capital gains taxes on unrealized gains. Aimed at promoting growth in the cryptocurrency sector, this decision supports innovation and encourages crypto startups to remain in Japan, reversing a trend of significant tax burdens that led to an exodus of such startups.

Search Results for: RSI

Bitcoin’s Bull Run Struggle: Japan’s Tax Reform vs $31,000 Double-Top Resistance

The surge in Bitcoin’s price has sparked questions about a new bull market, but the cryptocurrency faces challenges breaking the $31,000 double-top pattern. Japan’s tax rules and the introduction of new Bitcoin ETFs could generate positive sentiment and potentially boost demand for the cryptocurrency.

Bitcoin ETF Surge: Analyzing Institutional Interest, Market Impact, and SEC Challenges

The ProShares’ Bitcoin Strategy ETF (BITO) recorded the highest weekly inflow in over a year as Bitcoin prices crossed $30,000, with investors pumping $65 million into the fund. This surge suggests a growing desire for Bitcoin exposure among institutional investors amidst the ongoing U.S. Bitcoin ETF frenzy.

UAE’s Crypto Boom: Binance Dives In, Balancing Opportunities & Regulatory Risks

The UAE’s friendly stance toward digital assets, regulatory clarity, and eagerness to diversify from fossil fuels make it an appealing global crypto hub. Despite potential regulatory shifts, Binance’s focus on predictability, planning, and budgeting helps it navigate the UAE’s early-stage ecosystem.

South Korean Court Rules Bitcoin Not Money: Impact on Crypto Loans and Global Regulations

The Seoul High Court ruled that Bitcoin is not considered money in a cryptocurrency loan case, raising questions about crypto’s legal status and implications for the industry. This highlights the ongoing debate about cryptocurrencies’ nature, regulation, and role in the global financial system.

Crypto Regulation: Blockchain Australia CEO Urges Balance Over US Approach

Blockchain Australia’s new CEO, Simon Callaghan, urges the Federal Government to adopt a balanced crypto regulatory approach, like the UK, Hong Kong, and Singapore, to foster innovation, economic growth, and ensure consumer protection; criticizing the US’ aggressive regulatory actions.

Navigating the Supervisory Void: The Need for Clear Regulations on Digital Assets and Banking

Federal Reserve Governor Michelle Bowman warns about the “supervisory void” in the digital assets landscape, leaving financial institutions in uncertain territory. She urges global regulators to pay attention to novel banking activities and develop a clear regulatory framework. Lack of clarity risks pushing businesses towards crypto-friendly jurisdictions and may have serious consequences for financial institutions and stability of the digital asset market.

Dogecoin’s Rocky Path to Recovery: Exploring Market Sentiment and Technical Barriers

The Dogecoin price has surged nearly 18% after a recent upswing in buyer accumulation, currently trading at $0.067. However, a downsloping resistance trendline presents a challenge for further recovery. A bullish breakout could potentially lead to a 22% upswing, reaching $0.083, but traders should be cautious and conduct thorough market research before investing.

MetaBirkins NFTs Banned: Blockchain IP Battles and the Fine Line Between Art and Infringement

A Manhattan federal judge permanently barred Mason Rothschild from selling his MetaBirkins NFTs, after finding him guilty of trademark infringement, dilution, and cybersquatting. This legal dispute highlights challenges brands face in protecting intellectual property rights in the evolving NFT space.

Coinbase Share Price: Analyzing Bullish Reversal, 42% Rally Potential, and Key Challenges

The Coinbase share price demonstrates a prominent bullish reversal pattern known as the double bottom, suggesting active accumulation and a potential 42% rally. Despite challenges posed by neckline resistance and EMA indicators, a sustained buying could push the asset price further, backed by an optimistic market outlook.

Bankrupt Celsius, Wintermute, and the Wash Trading Allegations: Trust Issues in Crypto Markets

Creditors of bankrupt lending firm Celsius have amended their lawsuit to include trading firm Wintermute, alleging they assisted Celsius in wash trading. This implicates both firms in improper market making activities, raising questions about transparency, trust, and safety within the blockchain and cryptocurrency markets, potentially emphasizing the need for increased regulation and oversight.

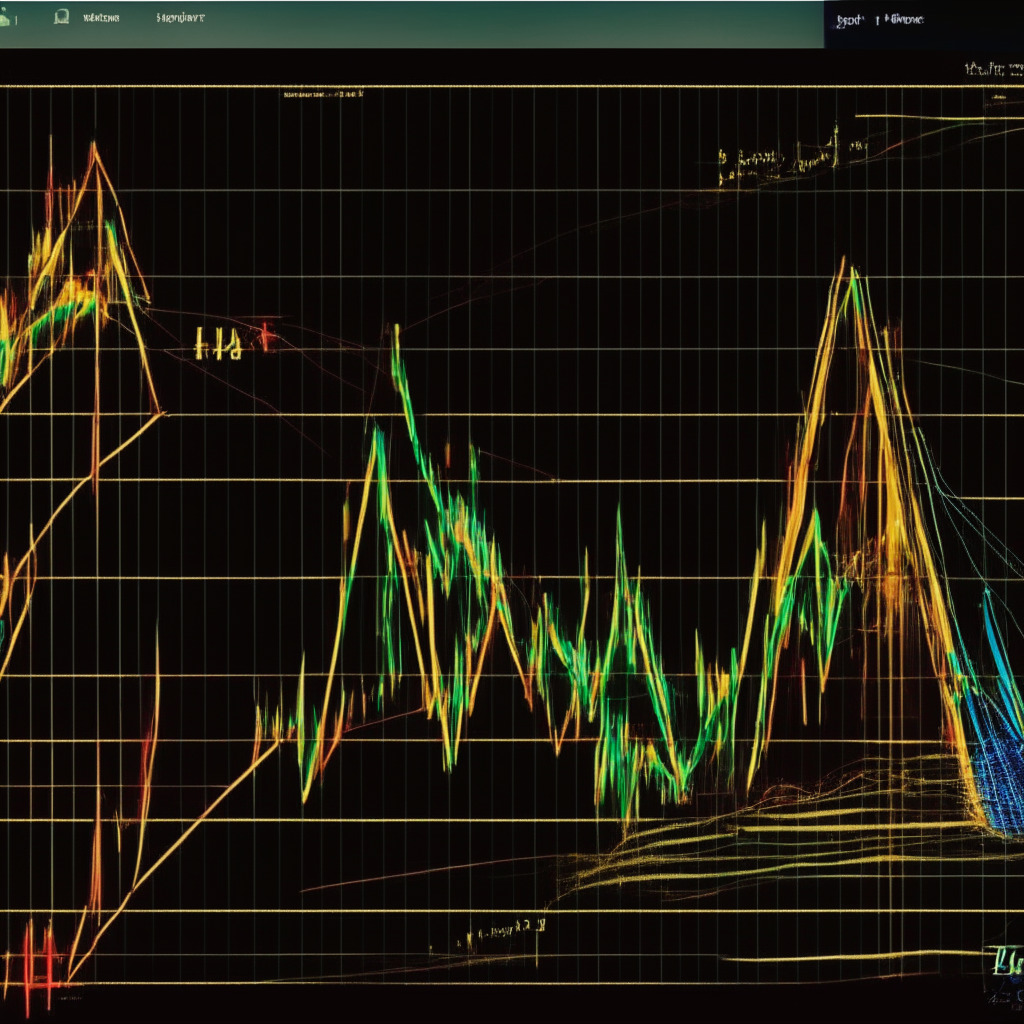

Bitcoin Whales and Market Impact: Tracking Activity for Informed Decisions

Bitcoin experienced a 15% surge reaching $31,250, with a trading volume of $10 billion over the weekend, drawing investors and analysts’ attention. Monitoring whale activity in low-liquidity exchanges could provide valuable insights into market movements. Technical indicators suggest overbought conditions, and the $31,000 level is crucial for Bitcoin’s upward momentum.

Anticipating Ripple Lawsuit Outcome: Market Reactions and Implications for the Crypto Future

The Ripple lawsuit Summary Judgement has generated immense interest, with the final ruling potentially by the end of 2023. Ripple’s management remains optimistic, anticipating a decision by year’s end. As the wait continues, XRP price has recovered significantly, and the lawsuit’s focus shifted to the documents related to the Hinman speech.

Exploring Bitcoin Cash’s 75% Surge: Is Institutional Adoption the Key Driver?

Bitcoin Cash (BCH) experienced a 75% price surge and $1.2 billion trading volume increase after its listing on the EDX exchange, sparking investor interest. The 77% growth in open interest suggests optimism about BCH’s potential institutional adoption, liquidity, market demand, and overall value.

Bitcoin ETF Optimism & Binance Withdrawal Woes: Unfolding Crypto Drama and Future Challenges

The “Great Accumulation” of Bitcoin is underway, potentially boosted by investment giants applying for a Bitcoin spot ETF. Meanwhile, Binance.US faces withdrawal issues, the UK makes progress with crypto adoption, and regulatory stances on stablecoins remain divided. The Atomic Wallet hack also highlights ongoing security concerns in the cryptosphere.

Pepepcoin’s V-Shaped Recovery: Temporary Pullback or Sustainable Rally Ahead?

Pepepcoin’s price has risen 82% amidst a positive crypto market sentiment, showcasing high buying momentum and increasing trading volume. A minor pullback is expected before continuing the prevailing recovery trend, possibly presenting dip opportunities for traders before the resurgence of the recovery rally. Conduct thorough market research before investing.

Shiba Inu Price Surge: Can Bullish Momentum Sustain or Is Correction Imminent?

Shiba Inu price showcased a 23.55% growth during a ten-day upward trajectory, backed by increasing volume. Despite the recent surge, risks remain. A decisive breakout from overhead resistance is key for a sustained recovery rally, while supply pressure could signal an imminent correction wave.

Blockchain vs. AI Fake News: Can Crypto Tech Save the Media Industry?

Blockchain technology could potentially save the media industry from AI-driven fake news by introducing “sign-and-trace” systems for content authentication. This would enable reliable sourcing, validation, and tracking of real news stories, promoting transparency and combating misinformation.

Bitcoin ETF Hopes Fuel Rally: Can Bullish Momentum Sustain or Is a Pullback Imminent?

Bitcoin price experienced a remarkable recovery, rising 25.4% in two weeks, driven by the possibility of a US spot Bitcoin ETF. The rally reflects a bullish momentum, but a minor pullback might occur before continuing the upward trend. Key indicators project a strong bull trend, but investors should consider potential market fluctuations before making decisions.

Crypto World Update: Scandals, Legal Battles, Innovations, and Safety Concerns

This week in crypto, deception and legal battles intertwined with ambitious innovations. Key highlights include Crypto.com’s internal teams trading tokens for profit, Valkyrie Funds filing a Bitcoin ETF application, and global governments exploring digital currency regulations. Safety remains crucial as crypto crime and hacks persist.

Bitcoin’s Bullish Surge: ETFs, Skepticism and Crypto Future Insights

The cryptocurrency market is buzzing as Bitcoin surpasses $31,000, attributed to a Bitcoin ETF and the entry of financial giants like Charles Schwab, Fidelity Digital Assets, and Citadel Securities. However, experts advise caution and close monitoring of key Bitcoin price points due to overbought conditions and potential pullbacks.

AI’s Impact on Translation Industry: Pros, Cons, and Future Developments

AI-powered translation systems like Neural Machine Translation (NMT) are revolutionizing the translation industry by offering speed, efficiency, and continuous improvement. Although concerns regarding limitations persist, advancements in AI technology promise more accurate and contextually appropriate translations in the future.

Trader’s $4M Short on TUSD: Analyzing Stablecoin Stability Amid Issuer Challenges

A trader took a $4m short position on stablecoin TrueUSD (TUSD) after its issuer temporarily halted mints and redemptions through banking partner Prime Trust. This highlights the importance of vigilance among cryptocurrency enthusiasts, as regulatory scrutiny and operational challenges can affect the value and stability of digital assets like TUSD.

NFTs in Cross the Ages: Changing Card Game Dynamics or Unfair Advantage?

Cross the Ages, a free-to-play mobile card game, allows users to mint cards as NFTs on the Immutable X blockchain. With unique mechanics centered around deck-building and strategy, this game offers an NFT-driven gaming experience without sacrificing free gameplay. The game combines NFTs and CCGs, while letting players decide their level of blockchain interaction.

FC Barcelona & World of Women NFT Collaboration: Pros, Cons & Environmental Concerns

FC Barcelona collaborates with NFT collection World of Women to launch the “Empowerment” NFT, inspired by soccer player Alexia Putellas. This partnership highlights the growing adoption of blockchain technology in sports and addresses concerns about environmental impact and representation.

Esports Meets Blockchain: Sparkball’s Future, Pros, Cons & Early Access Buzz

Sparkball, an anticipated esports game, is hosting an Ascension Invitational with a $32,000 prize pool, livestreamed on Twitch, to showcase its competitive experience. Worldspark Studios, the game’s developer, emphasizes entertainment value and plans to introduce crypto features in future updates after establishing its player base.

Revolutionizing AI Imagery: Stability AI’s SDXL v0.9 Takes on Rivals with Ultra-Photorealism

AI startup Stability AI’s latest version of image generator, Stable Diffusion XL (SDXL) v0.9, offers ultra-photorealistic imagery and enhanced response to text-based prompts. The improved model simplifies communication and rivals competitors like MidJourney, reshaping AI-based image generation, design, and marketing.

Bitcoin Rally Above $31K: Can It Withstand Inflation and Recession Threats?

Bitcoin’s rally above $31,000 has raised questions about its ability to hold this level amid economic recession and central bank activity. Inflation concerns persist, but Bitcoin derivatives show modest improvement and investor optimism. External factors, such as regulatory uncertainty and legal issues involving Binance, could impact BTC futures contracts and market sentiment.

XRP’s Bullish Recovery: Can It Break the $0.55 Multi-Month Resistance? Pros & Cons

XRP price broke through the $0.487 resistance level on June 19th, showing bullish recovery. The altcoin’s value hovers around $0.49, with potential to surge 9.6% and retest the substantial $0.55 resistance barrier. An ascending triangle pattern formation strengthens the bullish momentum, but proper market research is essential before investing.

PepeCoin vs Dogecoin: Ultimate Memecoin Battle or Passing Trend in Crypto World?

PepeCoin recently gained prominence in the memecoin sector, challenging Dogecoin’s dominance. With native Ethereum integration and a fixed supply, it shows potential for growth, but it must overcome Dogecoin’s first-mover advantage and network dominance to become a mainstream memecoin contender.

Belgium’s Crackdown on Binance: Balancing Security and Innovation in Crypto Regulations

Belgium’s Financial Services and Markets Authority (FSMA) orders Binance to cease exchange and custody wallet services in Belgium amidst SEC lawsuit. The order aims to comply with European Economic Area regulations and may impact growth and adoption of cryptocurrencies due to stringent regulations.

Cardano’s Recovery Rally: Sustainable Growth or Looming Correction?

Cardano’s recent recovery rally resulted in a 17.6% surge in prices, hitting the psychological barrier of $0.3. The coin’s current price trades at $0.29, wavering below the $0.3 resistance. Investors should carefully consider their moves, taking into account market sentiment and potential buyer sustainability at higher prices.