“IBM Consulting offers insights on the successful implementation of a digital euro, emphasizing simplicity for initial adoption, integrating payment intermediaries’ needs, standardizing APIs for seamless integration, and valuing blockchain’s significant benefits. Resilience, transparency, security, and regulatory clarity are the key concerns for an increasingly digital economy.”

- Kennedy’s Bold Crypto Agenda: An Independent Run for Presidency Powered by Bitcoin

- OK Group’s Rebranding: Power Consolidation or Crypto Evolution?

- The Fall of FTX’s Sam Bankman-Fried: A Cautionary Tale or Web3 Symbol’s Downfall?

- Crucial Crypto Updates: The Bitcoin Slump, Crypto Aid Israel and The Rise of BitVM

- RFK Jr’s Pro-Crypto Presidential Run: Redefining America’s Financial Future and Political Landscape

- Unraveling Ripple’s Future: Implications of CFO’s Sudden Exit on Crypto Landscape

- Unveiling the Crypto Controversy: Accountability Amidst Progress, from Bankman-Fried to Future Prospects

- Blockchain Aid: A Lifeline in Humanitarian Crises or a Cybersecurity Challenge?

- Bitmain’s Struggle but Hive’s Triumph: A Tale of Two Bitcoin ASIC Companies

- Unraveling the AnubisDAO Saga: Accountability Challenges and Transparency Paradoxes in Crypto

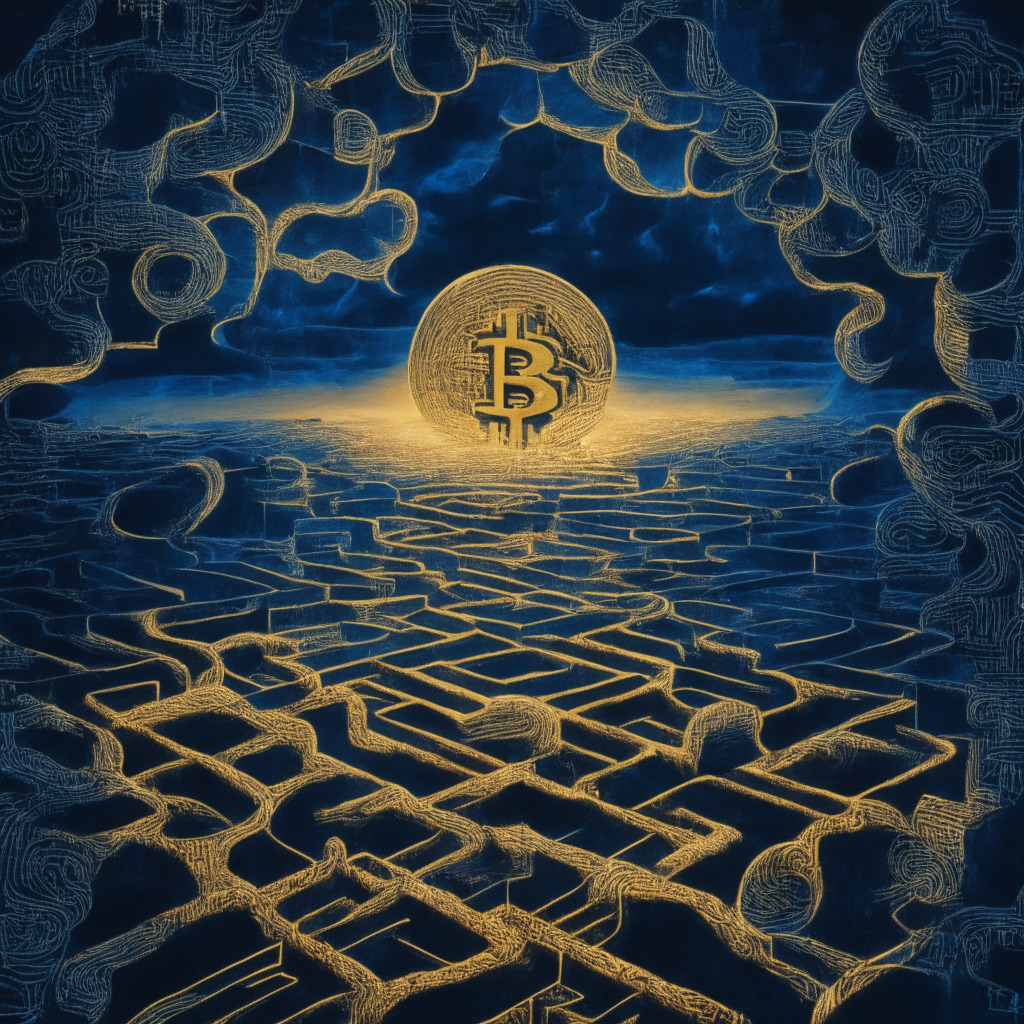

Habitual Delays on Bitcoin ETFs: The SEC’s Calculated Cautious Approach and its Impact on the Crypto Future

“The U.S. SEC has delayed decisions on Bitcoin ETF applications from several firms, requiring another 45 days minimum for further investigation. This triggers concerns about a longer wait for Bitcoin ETF authorizations, possibly as late as 2024.”

SEC Delays in Approving Bitcoin ETFs: Cautious Approach or Stifling Crypto Adoption?

“The U.S. SEC has delayed BlackRock’s application for a Bitcoin-backed ETF, indicating regulatory complexities associated with cryptocurrencies. An approval could enable traditional investors to access Bitcoin markets without direct exposure, potentially increasing adoption and liquidity. Rejection, however, could hinder investment.”

SEC Delays Bitcoin ETF Decisions: Cautious Maneuvers or Hindrance to Crypto Progress?

The U.S. Securities and Exchange Commission (SEC) recently extended the review period for Bitcoin ETF applications from six companies by 45 days, stirring anticipation in the crypto community. This move typifies the SEC’s consistent, cautious approach to digital assets, often resulting in procedural delays.

Navigating the Crypto Coaster: The Impact of Economic Events on Bitcoin’s Trajectory

“Bitcoin’s price fluctuates around $26,164 with a trading volume of $18 billion. Despite a recent 4% drop, Bitcoin stays unshaken at its zenith on CoinMarketCap with a live market cap of $509 billion. Watch for Bitcoin’s trajectory amid US Department of Labor’s encouraging employment figures.”

Leveraging the Crypto Winter: The Dawn of Tokenization and a Programmable Web3 Economy

“The future of Web3 technology lies in tokenizing real-world assets (RWAs), potentially unlocking the next crypto surge. Blockchain is already being used by financial institutions for RWA tokenization, creating transparent transactions while reducing intermediaries. However, challenges remain in bridging the physical-digital divide.”

MakerDAO’s Counter-Market Surge: A Profitable Anomaly or a Dangerous Catch?

Despite the downturn in cryptocurrency prices, Maker (MKR) saw a significant rise due to modifications made to its lending rates in its core strategy. This reflects in MakerDAO’s recent bounce back to profitability, contrasted by a crypto market drop. The platform also launched a token buyback plan, boosting investor profits. Nevertheless, caution in investing practices is advised due to the unpredictable nature of the crypto space.

Unwrapping Amazon Prime’s Blockchain Gaming Play: Riding the NFT Wave or Hitting an Iceberg?

Amazon Prime is offering its subscribers free gaming NFTs through the Prime gaming portal. These include distinctive skins and playable characters, allowing users to explore the blend of gaming and crypto technology. However, the market’s response to these corporate blockchain efforts remains largely skeptical due to environmental concerns and scamming risks.

SEC’s Postponed Verdict on Bitcoin ETFs: A Blow to Cryptocurrency Market or a Needed Pause for Transparency?

The U.S. SEC has postponed decisions on spot bitcoin ETF submissions from WisdomTree and Invesco Galaxy, leading to a 4.1% dip in Bitcoin’s value. Pioneers like BlackRock and Wise Origin rally for the bitcoin ETF, suggesting that it would offer better retail investment opportunities. However, SEC’s ambiguity and lack of expected verdict have provoked questions about the regulator’s role in the evolving cryptocurrency landscape.

Bitcoin ETFs and Crypto ATMs: The Balancing Act of SEC Regulations in the Crypto World

“The United States Securities and Exchange Commission (SEC) is delaying its decision on applications for a spot Bitcoin ETF from institutional giants. Additionally, the crypto ATM industry is under scrutiny for alleged illegal behavior and high usage fees, while facilitating convenience and anonymity. Regulatory development is vital for the industry’s well-being and participant safety.”

The Balancing Act: Crypto ATMs Between Accessibility and Accountability

The crypto ATM industry in the U.S is expanding despite concerns about illegal activities, according to the Federal Reserve Bank of Kansas City. While these ATMs cater to cash users and provide convenience, their high fees and potential for facilitating scams pose significant risks. Effective regulation is necessary to balance industry growth and user protection.

Blockchain Upgrades: StarkWare Quantum Leap’s Fallout and Fascination

“StarkWare, the firm behind Ethereum scaling solution Starknet, recently announced its decision to release an estimated $550,000 worth of cryptocurrency caught in a system upgrade. This highlights the complexity and potential vulnerability within the swift progress and innovation of the blockchain ecosystem.”

Blockchain Future: SWIFT’s Masterstroke with Chainlink for Secure Financial Interoperability

“SWIFT has plans to use Chainlink’s Cross-Chain Interoperability Protocol to connect multiple networks, thereby creating a unique financial system for users. The importance of interoperability is fundamental in today’s digital financial system, where increasing blockchains and tokenization could cause fragmentation. With SWIFT’s strategy, the aim is to make investing more inclusive and affordable.”

Crypto Campaign Donations: Revolutionizing Political Funding or Publicity Stunt?

“Crypto campaign donations are gaining traction in the political arena, with key figures including Florida Governor, Ron DeSantis, considering their acceptance. Yet, concerns over their implications prompt considerations for regulations and possible contribution limitations.”

Chicago Mercantile Exchange’s Growing Influence on Bitcoin Futures: Promising or Overrated?

“Chicago Mercantile Exchange (CME) has played a key role in the Bitcoin futures market, amassing an impressive $5.45 billion open interest by October 2021. However, despite this surge, its pricing dynamics and volumes differ significantly from other crypto exchanges, making its position somewhat skewed when reflecting the overall crypto market. These differences also impact CME’s pricing, hindering its ability to accurately mirror Bitcoin’s price movements on other exchanges.”

Navigating the Paradox of Worldcoin: Advancing Digital Identification vs Privacy Concerns

Worldcoin, a blockchain venture, recently enrolled over 9500 users in Argentina in one day. The project uses the users’ irises to verify their humanity, to combat AI programs mimicking human interaction. Despite criticisms concerning data privacy, sign-ups continue to surge worldwide. Interestingly, this project presents a paradox when examining technology, balancing digital identity verification against potential privacy compromises.

Bitcoin’s Vulnerability or Resilience: The Market’s Verdict Amidst Altcoin Successes and Blockchain Innovations

“Bitcoin has regained its position on the 200-day exponential moving average but shows signs of potential vulnerability. Several altcoins, including DACT, SILKROAD, and BS, demostrate impressive upward momentum, hinting bullish outlook. Investors in the evolving blockchain landscape must effectively balance risk and reward in their cryptocurrency journey.”

Ex-FTX CEO’s Legal Orchestra: Defense Preparation vs Detainment Standards

Ex-CEO of FTX, Sam Bankman-Fried, is caught in a legal battle with his defense attorneys’ appeals for temporary release being rejected by the court. This debate exposes a complex tug-of-war between comprehensive defense rights and the consideration of detainment standards and charges weights.

Exploring Chimpzee: Fusing Crypto Earnings with Climate Action & Its Future Prospects

“Chimpzee, a green initiative crypto project, has garnered impressive support, crossing the $1.25M mark in their presale wave. Utilizing blockchain technology, it incentivizes climate action through rewards. It balances monetary gains with environmental impact, potentially inspiring collective action towards a healthier world.”

Swimming Against the Current: Bitcoin as a Lifeboat in a Sinking Financial System

“Bitcoin advocate, Luke Broyles, has moved away from traditional investment routes, putting faith in Bitcoin despite its recent value drops. His belief that many sectors like real estate and stocks are overvalued signifies a shift in investment thinking towards cryptocurrency.”

Worldcoin: Decentralizing Digital Identity or Invading Privacy?

“Worldcoin, despite controversies, showcases a potentially groundbreaking use of blockchain: creating an immutable, biometrically authenticated digital identity. While the project faces both ethical dilemmas and security concerns, its potential in revolutionizing finance, political systems, and social structures cannot be overlooked. A critical question remains: trusting a private entity with our digital identities.”

Financial Giants Reinforcing Bitcoin’s Legitimacy: A Mixed Blessing?

“BlackRock, Fidelity Investments and VanEck’s applications for Bitcoin ETFs imply a strategic operation enhancing Bitcoin’s credibility and shifting its perception as a separate digital asset class. However, Bitcoin’s mainstream proximity might invite regulatory issues. Despite potential market shocks, Bitcoin transforms from a casual curiosity into a serious financial player due to these changes.”

Grayscale Court Victory: A Landmark for US Crypto Industry or SEC Overreach?

Republican Presidential candidate Vivek Ramaswamy perceives Grayscale Investments’ recent courtroom victory over the SEC as a critical defense for blockchain and Bitcoin innovation in the U.S. He plans to rollback federal regulations that hinder the growth of crypto markets if they don’t meet Supreme Court tests, while criticizing the contentious approach of regulation by enforcement preferred by the SEC.

Unveiling the Crypto Conundrum: Rising Popularity Amidst Alarming Security Breaches

The surge in cryptocurrency popularity carries risks, as $16 million worth crypto was lost due to hacks in August alone. Alarmingly, the losses expanded to $23.4 million, including fraud. These incidents targeted decentralized finance (DeFi) protocols across various blockchains, highlighting the need for improved security measures. The path to DeFi, while promising, remains fraught with risks.

Navigating the Labyrinth of Bitcoin: An Asset Worth Understanding

“Bitcoin is the best performing asset for seven out of the last ten years, yet wealth advisors are still reluctant to support investments in this asset class. While Bitcoin’s predictable, finite supply can provide a buffer against inflation, its frequent value fluctuations present challenges. Nonetheless, it is a robust construct that can drastically reshape monetary transactions, making it an intriguing asset to watch.”

Declining Bitcoin Presence on Exchanges: Indication of Changing Trade Dynamics or Signal of Caution?

“Bitcoin (BTC) holdings on centralized exchanges have decreased by 4%, reflecting a growing trend of traders using private wallets. This shift may mitigate massive sell-offs, but also raises concerns for new users dependent on exchanges. Recent security breaches have foregrounded the need for self-custody measures, as the crypto market undergoes a key metamorphosis.”

Gemini Challenges Genesis’ Bankruptcy Resolution – Doubts Over Debt Assurances Roil Crypto Markets

Crypto exchange Gemini objects against Genesis’ bankruptcy resolution proposal, arguing it lacks detail and adequate assurances to major debtors. This comes after Gemini took legal action against DCG for non-payment of debts. Gemini and other creditors demand transparency and effective solutions in this complex bankruptcy case.

Exploring the Benefits and Risks of Nexo’s Crypto Mastercard for EEA Citizens

Bulgarian platform Nexo launches a crypto Mastercard for European Economic Area (EEA) citizens to spend stablecoins globally via 100 million merchant terminals. The card also offers annual interest on stored balances, cashback, and credit line usage perks. However, Nexo recently faced legal issues in Bulgaria, raising concerns about its corporate governance. Further, earning potential is tied closely to the volatile crypto market.

Bull or Bear Market of Bitcoin: Clash of Interpretations & Investment Implications

“The debate whether Bitcoin is in its ‘longest bear market’ presents contrasting views. While some focus on BTC’s value barely touching 50% of its peak, others argue that Bitcoin is continuously in a bull market since 2019. These interpretations significantly impact market predictions and strategies, depending on the investor’s risk tolerance and timeframe.”

Binance Japan’s Ambitious Plan to Triple Token Offerings: A Progressive Leap or Risky Move?

“Binance Japan aims to significantly increase its token offerings by introducing a minimum of 100 tokens, threefold its current selection. They plan to achieve this through robust selection strategies and partnerships with market makers. This move aims to support Japan’s ever-evolving cryptocurrency landscape and a sustainable Web3 ecosystem in the country.”

Web3 Gaming Breakthrough: Zynga’s Exciting Foray and Emerging Challenges

“Zynga, a mobile gaming giant, takes a leap into Web3 gaming with the introduction of ZW3 and Sugartown. However, as highlighted at Istanbul Blockchain Week 2023, there are concerns about the adoption and mechanics of Web3 games despite the promising prospects.”

Court Ruling Throws Crypto Sphere into Disarray: ETH and BTC as Commodity vs Security

A New York district court dismissed a lawsuit against Uniswap, ruling that BTC and ETH are commodities, not securities. The court defended the decentralized nature of Uniswap, stating the investors’ claims would be better addressed to Congress, not the court. This ruling may influence future lawsuits against decentralized protocols.