As BTC continues its upward journey, factors such as regulatory updates, institutional adoption, and market sentiment may shape its future. With upcoming USD events, investors should exercise caution during fluctuations. Key technical indicators suggest a neutral position; however, Bitcoin’s decisive close above or below specific levels will determine its next move.

Search Results for: RSI

XRP Price Prediction: Bearish Momentum or Bullish Breakout? Examining Key Factors

The XRP price experienced a 2.5% intraday loss amid market uncertainty, showing a bearish evening star candle pattern. A possible 18% drop to the $0.38 support trendline might occur if bearish momentum persists. However, a breakout from the channel pattern’s upper trendline could signal an uptrend continuation. It’s essential for investors to conduct thorough research and be aware of potential risks in the volatile cryptocurrency market.

Morgan Stanley Suggests Bitcoin Top Amid Rise of Meme Coins and Uniswap Listings

Morgan Stanley suggests Bitcoin’s dominance is under threat as investors diversify into newer cryptocurrencies on decentralized exchanges like Uniswap, particularly speculative meme coins. Bitcoin’s price shows an inverse relationship with the pace of new token listings, and increasing interest in short-term price speculation of newer cryptocurrencies may further impact Bitcoin’s position in the market.

Pepecoin’s Struggle to Break Resistance: Analyzing Upside and Downside Potential

Pepecoin, the frog-themed memecoin, faces significant selling pressure amidst market uncertainty. Despite an 11% intraday growth on May 20th, the resistance trendline remains unbreached, indicating sellers’ ongoing defense. With Pepecoin trading at $0.00000173, a sideways move between resistance and $0.0000016 support is likely. However, a breakout from overhead resistance could initiate a recovery cycle.

G7 Summit, Biden’s Disapproval & Crypto: Debating Tax & Regulation in Uncertain Times

During the G7 summit, President Biden criticized a debt deal for protecting wealthy tax cheats and crypto traders, while US Treasury Secretary Janet Yellen warned of catastrophic consequences if an agreement isn’t reached. This highlights ongoing tensions between supporting the expanding crypto market and ensuring fair responsibility, as the US debt ceiling deadline approaches and the future of crypto regulation remains uncertain.

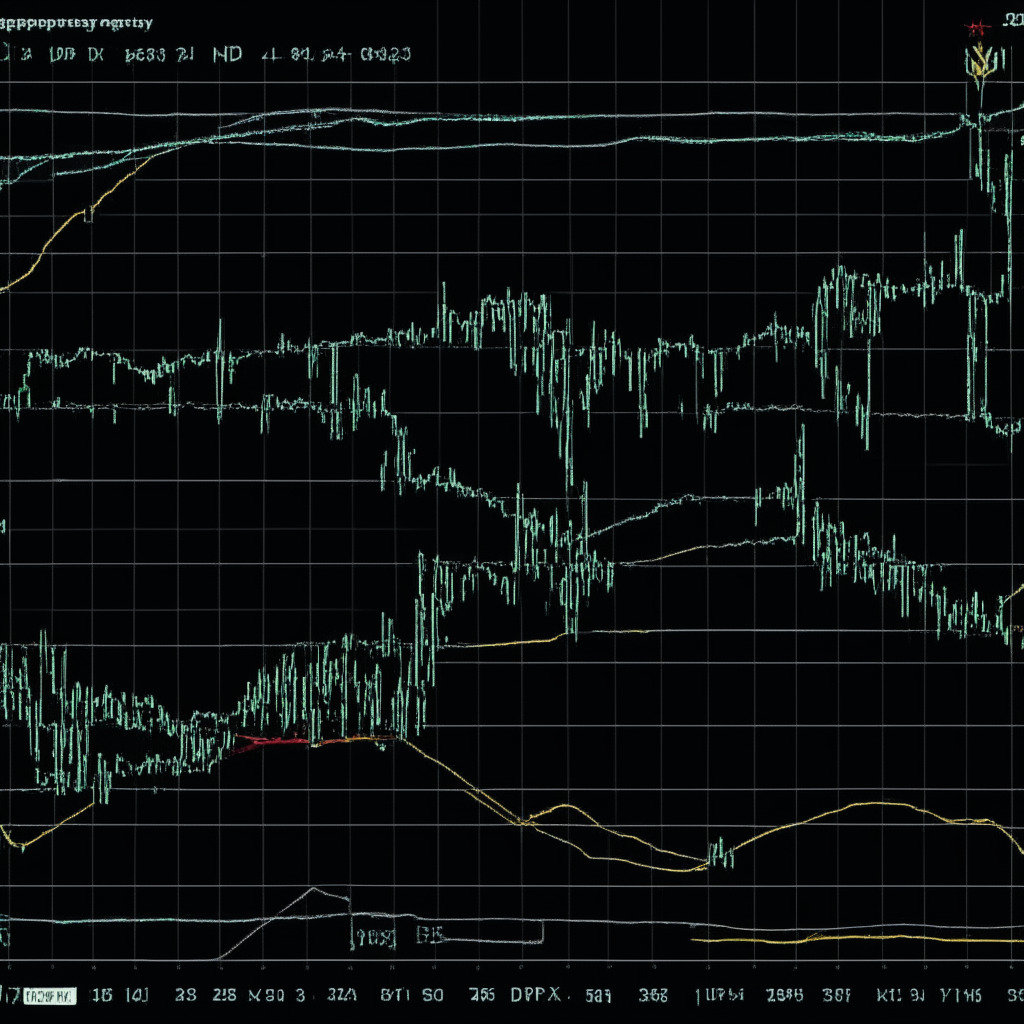

Symmetrical Triangle Pattern: Predicting Bitcoin’s Breakout and Implications for Traders

Bitcoin’s price has been demonstrating a sideways trend in recent weeks, forming a symmetrical triangle pattern. As the price spread tightens, a breakout point is approaching, potentially aiding buyers in regaining buying pressure. Technical indicators reveal traders’ hesitancy, but a post-breakout rally could elevate the Bitcoin price by 5-6%.

Tornado Cash DAO Breach: Analyzing Decentralized Governance and Security Challenges

A security breach at the decentralized autonomous organization (DAO) of Tornado Cash raised concerns as an attacker initiated a malicious proposal, gaining control over certain project aspects. This highlights the potential risks of decentralized management and emphasizes the importance of increased vigilance and robust security measures in ensuring a secure future for digital assets.

Bitcoin’s Symmetrical Triangle Formation: Potential Breakout or Breakdown on the Horizon?

The cryptocurrency market is closely monitoring Bitcoin’s symmetrical triangle pattern, which could indicate a potential breakout in the near future. Bitcoin currently faces significant resistance around the $27,250 level, and key technical indicators suggest the possibility of a breakout above this level. Examining patterns and indicators can help investors make informed decisions while managing the inherent risks in this volatile market.

Influencers and Memecoins: Boon or Bane for the Crypto Market’s Future?

Crypto enthusiasts are drawn to memecoins like PEPE Coin, raising concerns over ethical practices when linking tokens with influencers. Unscrupulous actors have connected tokens like PSYOP memecoin with influencer Andrew Tate, impacting token prices and raising questions about the greater good of such linkages within the crypto market.

Meme Coin Mania: AiDoge, Copium, and Love Hate Inu Lead the Pack While $SLUTS Struggles

The crypto space sees a shift towards promising meme projects with long-term potential, such as AiDoge, Copium, and Love Hate Inu. These projects offer utility and potential market disruption, attracting investors away from short-lived tokens like $SLUTS.

Bitcoin: Future Monetary Dominance or Trapped in Traditional Finance’s Shadow?

Bitcoin’s growing number of “wholecoiners,” or addresses holding at least 1 BTC, indicates potential shift towards hyperbitcoinization, where Bitcoin replaces traditional financial institutions as the dominant value system. However, debates persist on the superiority of centralized fiat systems for everyday transactions and challenges including cybersecurity remain in the crypto market.

Tether Reduces Banking Risk & Ripple’s SEC Case Win: Impact on the Crypto Industry

Tether reduced counterparty risk by withdrawing $4.5 billion from banks, reinforcing its USDT stablecoin, while Ripple scored a victory against the SEC in their legal dispute. Simultaneously, security concerns arise as Ledger launches its recovery service for lost seed phrases.

Frog-Themed Memecoin PEPE: Bullish Divergence Sparks Hope Amid Volatility

The frog-themed cryptocurrency PEPE recently displayed a bullish wedge pattern, potentially signaling a 20-30% price rally. However, the market sentiment remains partially bullish, and broader market shifts could heavily influence the future of PEPE and other memecoins.

SingularityNET Coin: Analyzing the Falling Channel Pattern and Potential Reversal

SingularityNET coin (AGIX) experienced a 49.7% drop from its peak price, influenced by a falling channel pattern. A bullish retracement could signal a downtrend continuation. The 24-hour trading volume for AGIX reflects a 223% gain at $402.2 million. Technical indicators may help predict potential market movements and trend reversals.

Weakening Bitcoin Bull Market: Factors Fueling Bearish Sentiment and the Road Ahead

Bitcoin’s bull market conditions seem to be weakening as investor sentiment shifts from greed to fear. Factors such as a faltering price rally, US Fed speech uncertainty, and a tight jobs market contribute to concerns. While some experts predict potential price recovery, others caution about facing significant challenges and recommend conducting thorough market research before making investment decisions.

Cardano Price Sideways Movement: Accumulation Sign or Bearish Omen?

Cardano price experiences sideways movement, staying above the support trendline, suggesting active accumulation and potential bullish reversal. The ADA price could surge, breaching $0.38 resistance, while technical indicators show increased buying momentum. Investors should monitor market conditions and research before decisions.

Binance’s Latam Gateway License in Brazil: Opportunities and Regulatory Challenges

Latam Gateway, a payment provider for Binance in Brazil, recently received a license to operate as a payment institution and electronic money issuer. As the collaboration between Latam Gateway and Binance grows, Brazil faces challenges in implementing proper oversight and consumer protection measures while fostering innovation in the evolving crypto market.

Ideal Bitcoin Breakout Conditions Clash with Correction Fears: Navigating the Uncertain Market

Bitcoin remains in a narrow range amid market uncertainty and fears of a deep correction. Meanwhile, discussions arise on blockchain’s potential role in improving trust in AI through transparency, decentralization, and tamper-proof data management.

Crypto Funds: Shaping the Market Future, Navigating Challenges, and Democratizing Access

Crypto funds pool money from multiple investors to purchase a diverse range of digital assets, playing a significant role in stabilizing projects and driving demand. However, they face unique risks such as market volatility, hacking, and regulatory uncertainty. These funds provide liquidity, encourage innovation, and make the crypto market accessible to smaller investors, shaping the market’s development.

Maximizing Cloud Storage Potential: Provider Selection, Security, and Efficient File Management

Maximizing cloud storage involves choosing the best provider, optimizing real-time collaboration tools, implementing data security measures, backing up files regularly, and utilizing file synchronization features for seamless access and increased productivity.

3AC’s NFT Auction: Success Amid Troubles, Debating the Future of Digital Collectibles

The recent auction of bankrupt crypto hedge fund Three Arrow Capital’s (3AC) NFT collection at Sotheby’s raised $2.5 million, spotlighting the growing popularity and market value of these digital assets. This result comes amidst 3AC’s ongoing bankruptcy proceedings and debt repayments, sparking debate on NFTs’ long-term potential and associated risks.

Ledger Wallet Recovery Debates & Exciting Developments: A Busy Week for Crypto Enthusiasts

This week in crypto, Ledger introduced a wallet recovery service, ETH staking demand soared, Tether invested in Bitcoin, and Samsung partnered with the Bank of Korea for CBDC research. Additionally, Ripple acquired Metaco, and a Uniswap survey highlighted the need for DeFi simplification.

G7 Consensus on Crypto Regulation: Balancing Innovation and Security in Blockchain Future

The G7 nation leaders have reached a consensus on blockchain and cryptocurrency regulations, fueling debates on potential benefits and drawbacks. Advocates believe regulations can provide structure, legitimacy, and credibility to the industry, while opponents argue it may stifle innovation and lead to excessive centralization of power.

Bitcoin’s Struggle for $27,000: Factors Affecting Market Sentiment & Future Projections

As Bitcoin hovers around $26,800, market sentiment turns bearish amid influences such as debt ceiling discussions, regulatory uncertainties, and the US dollar’s strength. With active trading decreasing and price barriers at $27,200 and $26,600, cautious behavior among investors and a neutral market condition indicate the potential for price decline or breakthrough, making it crucial for investors to remain vigilant of market uncertainties.

Meta’s Instagram Enters Decentralized Space: New App Competes with Twitter, Challenges Ahead

Meta, Instagram’s parent company, plans to launch a decentralized, text-based conversation app to compete with Twitter. The app will work in tandem with other decentralized social media platforms, broadening user reach and fostering independence from potential control by a single entity. However, concerns arise about limited oversight, problematic content, and ensuring user safety.

SEC vs Ripple: Potential Settlement and the Future of Crypto Regulation Debate

The SEC’s decision not to appeal the court order to reveal controversial documents in the XRP lawsuit has sparked settlement speculation. This case highlights the ongoing debate on regulation, with potential outcomes impacting the entire cryptocurrency industry, including innovation and investor uncertainty.

BitDAO Token Rebranding to Mantle: Benefits, Challenges, and Impact on Holders

BitDAO’s native token BIT is set to rebrand as Mantle after a community majority vote. The BIP-21 proposal aims to consolidate the BitDAO ecosystem under the “One brand, One token” philosophy in preparation for the launch of a new Ethereum-based layer-2 mainnet, developed by Mantle.

Balancing Public Trust and Privacy: Cryptoasset Holdings of Lawmakers in South Korea Debated

South Korea’s Justice Ministry clarifies its stance on the cryptoasset holdings of public officials working with cryptocurrency regulations, assuring that bi-annual checks are conducted. Amidst controversies surrounding lawmakers owning cryptocurrencies, the debate over mandatory transparency versus private, personal information arises, with worldwide implications as the adoption of cryptocurrencies increases.

RFK Jr.’s Bitcoin Campaign Donations: Innovation or Recklessness?

Democratic presidential candidate Robert F. Kennedy Jr. announces plans to accept Bitcoin campaign donations, addressing issues like Bitcoin’s classification as a security and considering pardoning individuals like Ross Ulbricht. His pro-cryptocurrency stance highlights trust in blockchain’s future but raises concerns about transparency and regulation.

Aave’s Polygon Issue: Funds Stuck, Solution Hinges on Crucial Governance Vote

Aave recently faced an issue with its V2 Polygon platform, preventing users from interacting with Wrapped Ether, Tether, Wrapped Bitcoin, and Wrapped Matic pools, and withdrawing assets. Aave V2’s ReserveInterestRateStrategy upgrade is incompatible with Polygon, impacting assets worth $110 million. Aave assures funds are safe, pending a governance vote to resolve the issue.

Battle between Bitcoin and $27k: Impact on Crypto Market and Top Coins to Watch Now

The cryptocurrency market struggles amidst economic challenges, yet Fed Chair Jerome Powell’s hint at potential rate abatement offers hope. Top cryptos to watch include AiDoge, BGB, $COPIUM, RNDR, ECOTERRA, INJ, and YPRED, offering diverse opportunities based on fundamentals and technical analysis.

Ethereum Self-Custody Solutions Surge: Casa Controversy and the Future of Crypto Security

The demand for Ethereum self-custody solutions is growing, driving companies like Bitcoin wallet provider Casa to offer Ethereum support. Casa aims to simplify self-custody by incorporating best security practices, making it more enticing for users to control their crypto assets instead of relying on centralized exchanges, thus enhancing security.