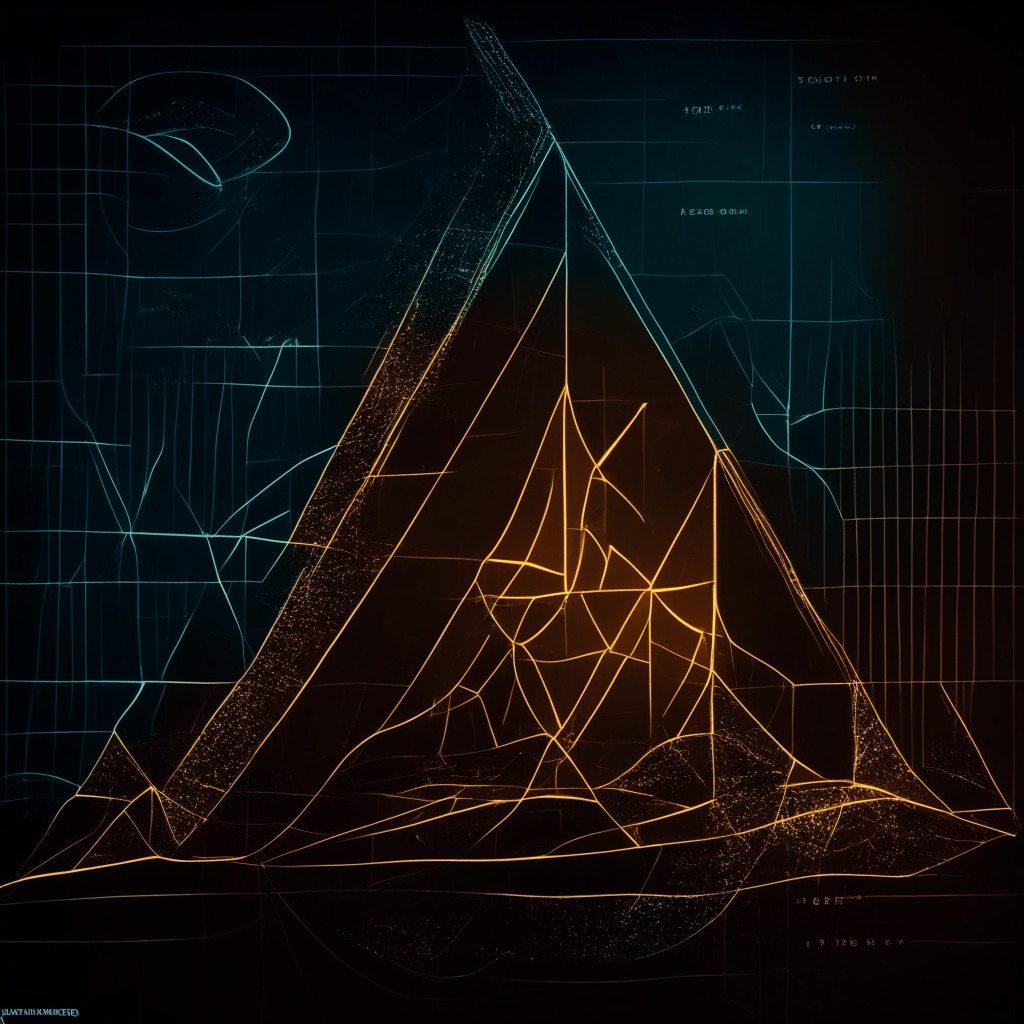

The Cardano coin price, despite ongoing uncertainty, appears to be strictly adhering to two technical levels – a downsloping trendline and a crucial support at the $0.377 price point. These converging levels seem to be gradually squeezing the ADA price, indicating the formation of a descending triangle pattern. In response to this pattern, the coin price may break the bottom support and extend the current downtrend.

At the $0.38 level, the 38.2% FIB and 100-day EMA create a strong support zone. The future trend of Cardano’s price will be determined by a breakout from either side of the triangle pattern. The intraday trading volume of ADA currently stands at $189.3 million, indicating a 13% loss.

As press time, the Cardano coin price hovers around the $0.38 mark, showing a 0.8% gain within the day. The recent reversal from the $0.377 support could suggest that the altcoin may continue its consolidation phase within the triangle pattern. If the supply pressure persists, the ADA price may breach the $0.377 neckline support in the upcoming week. A daily candle closing below the neckline could provide sellers with a new resistance level, offsetting recovery attempts by buyers.

In the event of a breakdown, Cardano’s price might tumble 24% lower to reach the $0.285 support level at the 78.6% Fibonacci retracement level. Conversely, a breakout above the overhead trendline, which may be less likely, would undermine the bearish thesis and initiate a new recovery cycle.

The Moving Average Convergence Divergence (MACD) of the blue and signal (orange) breakdown below the mean signals a bear trend in the market. A bearish crossover between the 20- and 100-day Exponential Moving Averages (EMA) could encourage Cardano sellers for the $0.377 support level.

Cardano’s intraday price levels are as follows: the spot price is at $0.3815, adopting a bullish trend with medium volatility. Resistance level stands at $0.42 and $0.46, while support level lies at $0.37 and $0.34.

Please note that the presented content reflects the opinion of the author and is subject to market conditions. Perform your market research before investing in cryptocurrencies. The author or the publication assumes no responsibility for personal financial loss.

Source: Coingape