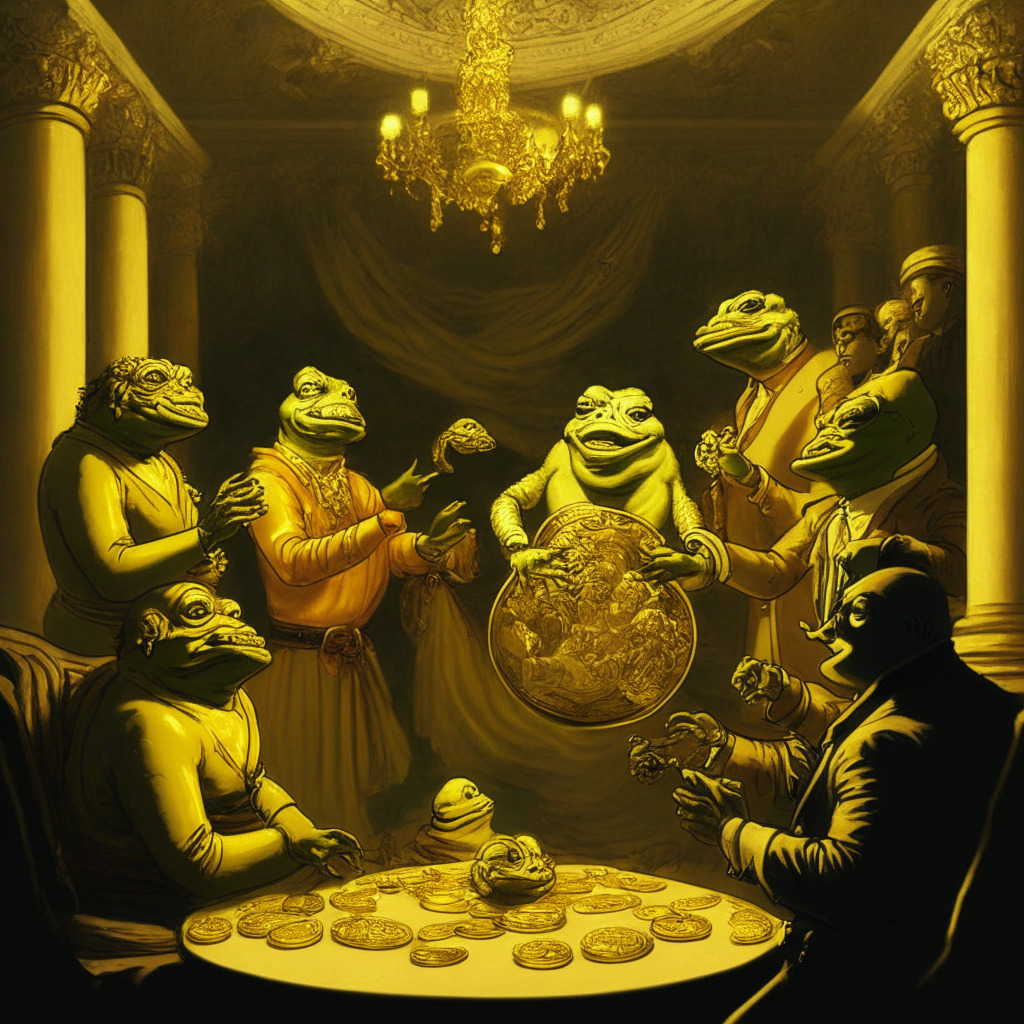

The crypto space sees a shift towards promising meme projects with long-term potential, such as AiDoge, Copium, and Love Hate Inu. These projects offer utility and potential market disruption, attracting investors away from short-lived tokens like $SLUTS.

Day: May 20, 2023

Phygital Toy Revolution: Pudgy Penguins’ Massive Success on Amazon & Future of NFTs

Pudgy Penguins’ “Phygital” Toy Collection & Experience launch on Amazon witnessed over $500,000 in purchases within two days, surpassing 20,000 individual toys sold. This success signals the potential to revolutionize the NFT market and further propel the Web3 space, although sustainability remains uncertain.

Bitcoin: Future Monetary Dominance or Trapped in Traditional Finance’s Shadow?

Bitcoin’s growing number of “wholecoiners,” or addresses holding at least 1 BTC, indicates potential shift towards hyperbitcoinization, where Bitcoin replaces traditional financial institutions as the dominant value system. However, debates persist on the superiority of centralized fiat systems for everyday transactions and challenges including cybersecurity remain in the crypto market.

Tether Reduces Banking Risk & Ripple’s SEC Case Win: Impact on the Crypto Industry

Tether reduced counterparty risk by withdrawing $4.5 billion from banks, reinforcing its USDT stablecoin, while Ripple scored a victory against the SEC in their legal dispute. Simultaneously, security concerns arise as Ledger launches its recovery service for lost seed phrases.

Meme Coins’ Rapid Rise: PISS Coin’s Surge, Stability Concerns, and the Future of Digital Assets

The recent surge of meme coin PISS Coin, up 431% in a day, has sparked discussions on its true value and stability in the digital currency market. The growing interest in unconventional meme tokens raises concerns about their long-term viability, highlighting the need for a deeper understanding of their utility and function within the blockchain space.

Frog-Themed Memecoin PEPE: Bullish Divergence Sparks Hope Amid Volatility

The frog-themed cryptocurrency PEPE recently displayed a bullish wedge pattern, potentially signaling a 20-30% price rally. However, the market sentiment remains partially bullish, and broader market shifts could heavily influence the future of PEPE and other memecoins.

Crypto Market Stagnation Amid SEC Stance, Ripple’s Legal Victory, and CBDC Developments

The market remains relatively flat with Bitcoin and Ethereum’s modest increases; XRP and Litecoin show notable growth. Meanwhile, the SEC maintains its regulatory stance as Ripple wins a minor legal victory, and global CBDC partnerships and unified regulations develop.

Institutional Adoption of Crypto: Canada’s Lead and Impact on Investment Strategies

The shift in perspective towards major cryptocurrencies has led institutional investors and fund managers to recognize Bitcoin as a “serious venue” for investment. Canada’s advanced regulation for crypto trading and its progressive approach towards launching crypto ETFs have attracted a wider range of investors, fostering interest in the digital asset market.

SEC vs Coinbase: Political Warfare Threatens Crypto’s Future and Demands Legal Clarity

The ongoing battle between the SEC, Coinbase, and other cryptocurrency firms highlights the intersection between politics and the legal system in shaping the future of digital asset markets. The outcome of these legal skirmishes will undoubtedly have a lasting impact on the cryptocurrency markets, making it essential for investors to stay informed.

VeeCon Expands Focus: Embracing AI, AR, and NFTs in the Future of Business and Culture

VeeCon’s expanded focus highlights the growing importance of AI and emerging technologies in business and entrepreneurship. Gary Vaynerchuk’s enthusiasm for AI’s potential to revolutionize industries and streamline tasks has led to a broader conference agenda, while maintaining optimism for the future of NFTs.

SingularityNET Coin: Analyzing the Falling Channel Pattern and Potential Reversal

SingularityNET coin (AGIX) experienced a 49.7% drop from its peak price, influenced by a falling channel pattern. A bullish retracement could signal a downtrend continuation. The 24-hour trading volume for AGIX reflects a 223% gain at $402.2 million. Technical indicators may help predict potential market movements and trend reversals.

Balancing AI’s Revolution: Blockchain, Jobs, and Ethics in the Gary Vee Perspective

In this article, Gary Vee shares his optimistic views on AI’s potential to revolutionize industries, particularly content creation and the blockchain and cryptocurrency markets. However, the challenges posed by AI, such as job losses and ethical concerns, must be addressed responsibly and ethically.

Weakening Bitcoin Bull Market: Factors Fueling Bearish Sentiment and the Road Ahead

Bitcoin’s bull market conditions seem to be weakening as investor sentiment shifts from greed to fear. Factors such as a faltering price rally, US Fed speech uncertainty, and a tight jobs market contribute to concerns. While some experts predict potential price recovery, others caution about facing significant challenges and recommend conducting thorough market research before making investment decisions.

Ripple-SEC Case: Setting Precedents for Crypto Regulation and the Industry’s Future

The Ripple-SEC case outcome could set a precedent for future cryptocurrency regulation and classification, impacting the crypto industry. The court’s ruling on XRP as a security or not holds implications for similar cryptocurrencies, potentially shaping companies’ operations and regulations.

Soaring Gas Fees: Will Bitcoin Overcome Ordinal Inscription Challenges?

Recent data from Glassnode suggests the impact of Ordinal inscription on soaring Bitcoin gas fees might be subsiding. The high fees raise concerns for Bitcoin’s growth and appeal to investors, particularly smaller holders. As the crypto market adapts, investors may see improvements in network performance, but should stay informed on market trends and developments.

Cardano Price Sideways Movement: Accumulation Sign or Bearish Omen?

Cardano price experiences sideways movement, staying above the support trendline, suggesting active accumulation and potential bullish reversal. The ADA price could surge, breaching $0.38 resistance, while technical indicators show increased buying momentum. Investors should monitor market conditions and research before decisions.

Meme Coins Enter Politics: Wojak, Pepe, Copium, and Generational Wealth Controversies

Meme coins like Wojak ($WOJAK), Pepe ($PEPE), Copium ($COPIUM), and Generational Wealth ($GEN) are generating strong political reactions and tapping into the potential to create generational wealth. As these projects delve into the political landscape, their enormous potential attracts early investors, becoming an onboarding sub-sector in the crypto space.

Binance’s Latam Gateway License in Brazil: Opportunities and Regulatory Challenges

Latam Gateway, a payment provider for Binance in Brazil, recently received a license to operate as a payment institution and electronic money issuer. As the collaboration between Latam Gateway and Binance grows, Brazil faces challenges in implementing proper oversight and consumer protection measures while fostering innovation in the evolving crypto market.

AiDoge.com: The Future of Meme Coins or Risky Investment? Pros, Cons & Conflict Explored

AiDoge.com, an AI-powered meme generation tool, has raised over $10 million in its ongoing presale. The project combines popular niches of AI and meme coins, offering a meme-to-earn model and strong use cases for its $AI token.

Ideal Bitcoin Breakout Conditions Clash with Correction Fears: Navigating the Uncertain Market

Bitcoin remains in a narrow range amid market uncertainty and fears of a deep correction. Meanwhile, discussions arise on blockchain’s potential role in improving trust in AI through transparency, decentralization, and tamper-proof data management.

Imminent Bitcoin Breakout or $25,000 Crash: Analyzing Market Sentiment and Crypto Safety

Crypto trader Crypto Rover predicts a potential Bitcoin breakout due to a parallel wedge formation on its 3-day chart. However, the possibility of a price crash to $25,000 lingers, while market sentiment remains bearish. Recently, investors have withdrawn coins from exchanges, possibly hinting at future bull runs.

Bitcoin Ordinals Boom: Surging Fees, Growing Popularity, and Unfolding Debate

The total network fees paid for Bitcoin Ordinal minting reached 1,414 BTC ($38.2 million) on May 20, a 700% increase from April 20. Bitcoin Ordinals, developed by cross-chain wallet BitKeep, assign unique numbers to Satoshis, enabling one-of-a-kind digital assets using Bitcoin. However, this approach comes with challenges and limitations, raising concerns over Bitcoin’s evolution and long-term impact on the blockchain ecosystem.

Blockchain Future: Decentralized Utopia or Overhyped Trend? Pros, Cons, and Conflicts Explored

This article dissects the potential applications and drawbacks of blockchain technology, discussing its decentralized nature, security, and transparency benefits. It also addresses challenges such as energy consumption, market speculation, potential misuse for illegal activities, and regulatory uncertainty hindering the technology’s growth and adoption.

Mordinals: NFTs on Monero Blockchain – Risks, Privacy Concerns & Future Prospects

The rise of Mordinals, nonfungible tokens (NFTs) on the Monero blockchain, has sparked concerns within the Monero community about potential risks to privacy, decentralization, and illegal usage. Despite these concerns, proper interventions and approaches can maintain user privacy while allowing NFTs to thrive on Monero without compromising its core principles.

Crypto Funds: Shaping the Market Future, Navigating Challenges, and Democratizing Access

Crypto funds pool money from multiple investors to purchase a diverse range of digital assets, playing a significant role in stabilizing projects and driving demand. However, they face unique risks such as market volatility, hacking, and regulatory uncertainty. These funds provide liquidity, encourage innovation, and make the crypto market accessible to smaller investors, shaping the market’s development.

Falling Wedge Pattern in Solana Price: Temporary Decline or Ominous Trend?

Solana’s price decline due to a falling wedge pattern reflects market uncertainty, but may offer growth potential once completed. The wedge pattern implies a temporary decline before a potential bullish recovery, possibly reaching 30% higher and retesting the $26.1 peak. However, ongoing correction may impact the altcoin’s worth while the pattern remains intact.

Open-Source vs. Closed-Source Wallets: Analyzing Security Risks and Trust in Manufacturers

Charles Hoskinson, Cardano founder, prefers open-source software for security, while Ledger co-founder Eric Larchevêque argues it poses elevated security risks. Larchevêque believes closed-source wallets with secure elements offer higher security levels and states that security always involves trade-offs and requires trust in hardware wallets.

SEC vs Ripple Labs: Impact on Crypto Regulations and the Battle Over Hinman Documents

The SEC’s case against Ripple Labs concerning the selling of XRP as unregistered securities could significantly impact future cryptocurrency regulations. The outcome is uncertain, but the court’s decision on whether XRP represents a security or commodity may set a precedent for the treatment of cryptocurrencies in regulatory matters.

Maximizing Cloud Storage Potential: Provider Selection, Security, and Efficient File Management

Maximizing cloud storage involves choosing the best provider, optimizing real-time collaboration tools, implementing data security measures, backing up files regularly, and utilizing file synchronization features for seamless access and increased productivity.

3AC’s NFT Auction: Success Amid Troubles, Debating the Future of Digital Collectibles

The recent auction of bankrupt crypto hedge fund Three Arrow Capital’s (3AC) NFT collection at Sotheby’s raised $2.5 million, spotlighting the growing popularity and market value of these digital assets. This result comes amidst 3AC’s ongoing bankruptcy proceedings and debt repayments, sparking debate on NFTs’ long-term potential and associated risks.

Ethereum Trend Reversal: Analyzing Bullish Signals and Potential Dips for Reaccumulation

Ethereum coin shows signs of trend reversal, forming higher peaks and troughs, indicating a bull trend with potential for higher prices. The Ethereum Fear & Greed Index projects bullish sentiment, while technical indicators suggest buyers maintain the upper hand, offering pullback opportunities for reaccumulation.

PSYOP Token’s 1000% Surge: Legitimate Investment or Scam Controversy?

The PSYOP Token’s recent 1,000% surge raises legitimacy concerns, with backlash against creator Ben.eth. Despite controversy, it will be listed on Binance, potentially boosting value. Alternative meme coins Copium, Sponge, and AiDoge show great potential and investor caution is advised.