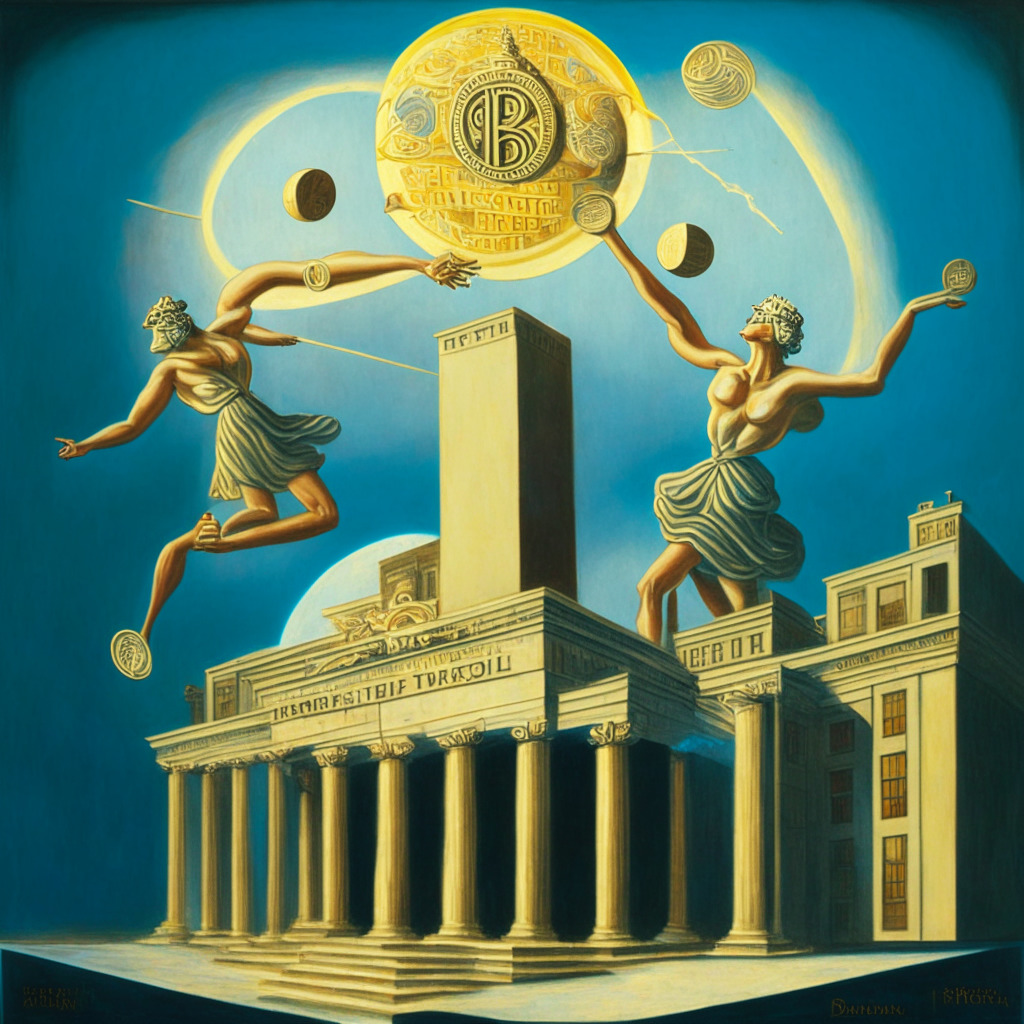

As JPMorgan Chase CEO Jamie Dimon foresees potential troubles for U.S. banks in the future, with the Federal Reserve playing a significant role through overregulation, the banking industry finds itself amidst a series of conflicts. While overregulation might appear to be a safety measure, it might also disrupt the banking system, making it difficult for banks to operate freely.

Already this year, three major U.S. banks, including Signature Bank, Silicon Valley Bank, and First Republic Bank, have collapsed, with Dimon attributing it to “a supervision problem” involving the CEOs and board members. Supervisors often struggle with ensuring that the banks are abiding by regulations. However, the answer to these issues might not just be adding more regulations to the Federal Reserve’s already 200,000-page long stress test. Instead, Dimon argues that an increase in regulation only obstructs business practices.

Highlighting the issue, Dimon mentions that community banks often have a higher number of compliance officers compared to loan officers. This focus on overregulation may be misplaced, especially as it could divert attention away from other problems. In order to better address the problems facing the banking industry, Dimon suggests a more holistic approach when modifying regulations. For instance, mixing rules between liquidity and capital might prove more beneficial.

Dimon also questions the true efficacy of stress tests. Companies that concentrate solely on “that one stress test” might overlook other issues that could crop up, creating a false sense of security. Looking back at historical events, Dimon emphasizes that these have happened repeatedly, and it is important to recognize the patterns to avoid future crises.

J.P. Morgan Asset Management’s chief investment officer, Bob Michele, shares similar sentiments, stating that First Republic Bank’s liquidity issues “should never have happened” due to banking being the “most heavily regulated capitalized industry on the planet.” Michele’s concerns highlight that even the most stringent regulations can’t be the only solution to avoid crises.

As JPMorgan Chase acquires First Republic Bank’s (FRB) assets, after previous efforts to rescue the bank failed, it’s clear that merely layering on new regulations isn’t the solution. It’s crucial to strike a balance in regulation to provide banks with the ability to properly function while ensuring they abide by essential rules. Sole reliance on stress tests and overregulation might only give a false sense of security and detract from addressing key vulnerabilities within the banking industry.

Source: Cointelegraph