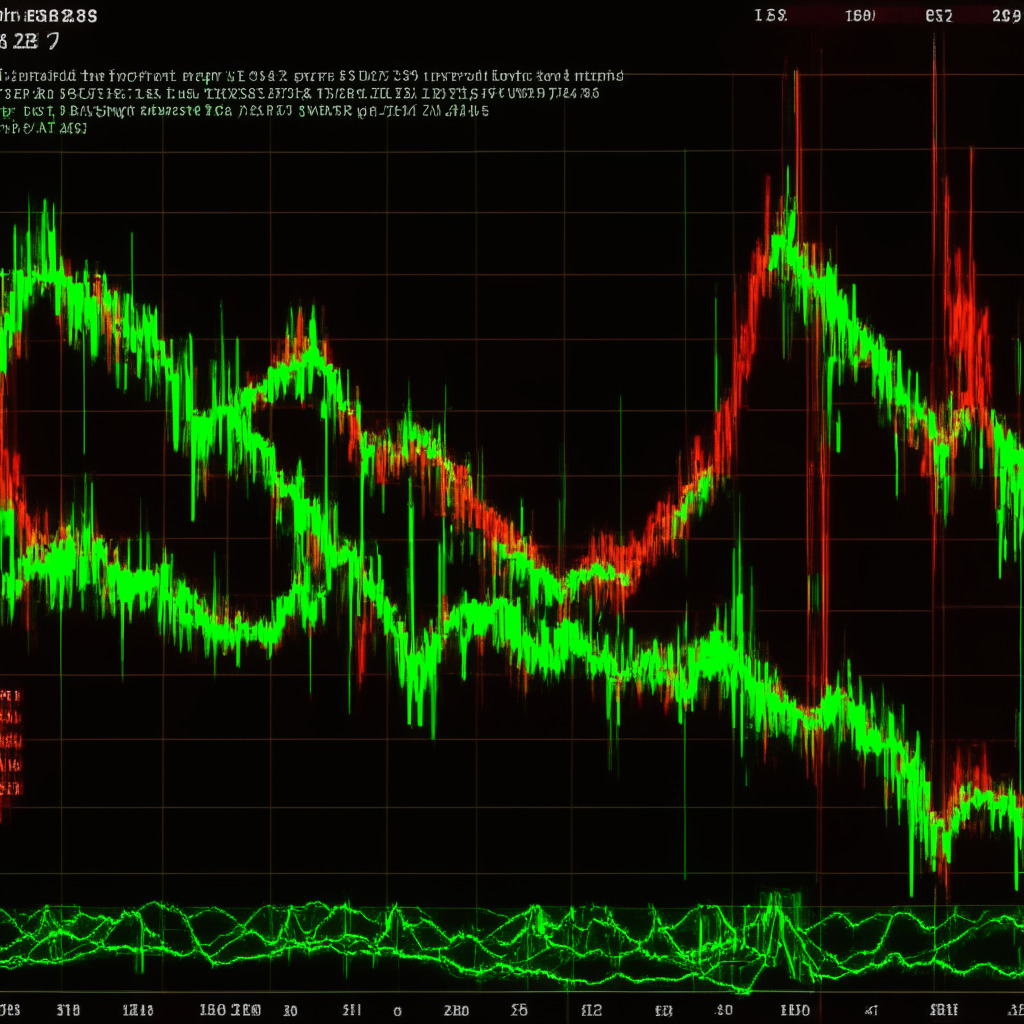

The ongoing correction in Ethereum price seems to have taken a slight sideways detour due to the flattish behavior of Bitcoin, the world’s largest cryptocurrency. Ethereum’s price consolidation is currently trapped in a narrow range between $1830-$1770, causing uncertainty for investors and traders alike. A breakout beyond this range with a daily candle closing is needed to free ETH price from the grip of uncertainty.

The Ethereum price, fluctuating within this narrow range, can be regarded as a no-trading zone. The 100-day EMA at $1770 provides additional support for buyers, helping them maintain higher chart levels. The intraday trading volume in Ether currently stands at $5.59 billion, marking a 3.48% gain.

At present, Ethereum’s price is around $1800, maintaining its sideways trend within the established range. The formation of green and red candles on an alternating basis reveals no clear sign of dormant force in the market. Consequently, potential new trades must wait for a decisive breakout and daily candle closing beyond the range levels to confirm the potential market trend.

A breakout of $1830 could potentially boost buying momentum in the market, making it more likely for the ETH price to increase by 3.5% and reach the overhead trendline of the wedge pattern. Nonetheless, this pattern is driving the current ETH price correction. Therefore, a bullish breakout from the wedge pattern will be a crucial signal for the resumption of a bullish trend.

On the other hand, the current correction has not breached the 505 Fibonacci retracement level and still reflects an overall bullish market trend for Ethereum.

Technical indicators, such as the Moving Average Convergence Divergence, reveal the flattish MACD (blue) and signal (orange) line, implying that the current market trend is uncertain. Additionally, the Bollinger Band’s down-sloping lower band indicates that the selling momentum in the market remains aggressive.

Intraday price levels for Ethereum are as follows:

– Spot rate: $1814

– Trend: Bullish

– Volatility: High

– Resistance level: $1830 and $1940

– Support level: $1790 and $1700

As always, engaging in thorough market research is crucial before investing in cryptocurrencies, as the market conditions are ever-changing. The opinions expressed in this article are those of the author and may not necessarily reflect the publication’s views. It is crucial to keep in mind the potential for personal financial loss when trading.

Source: Coingape