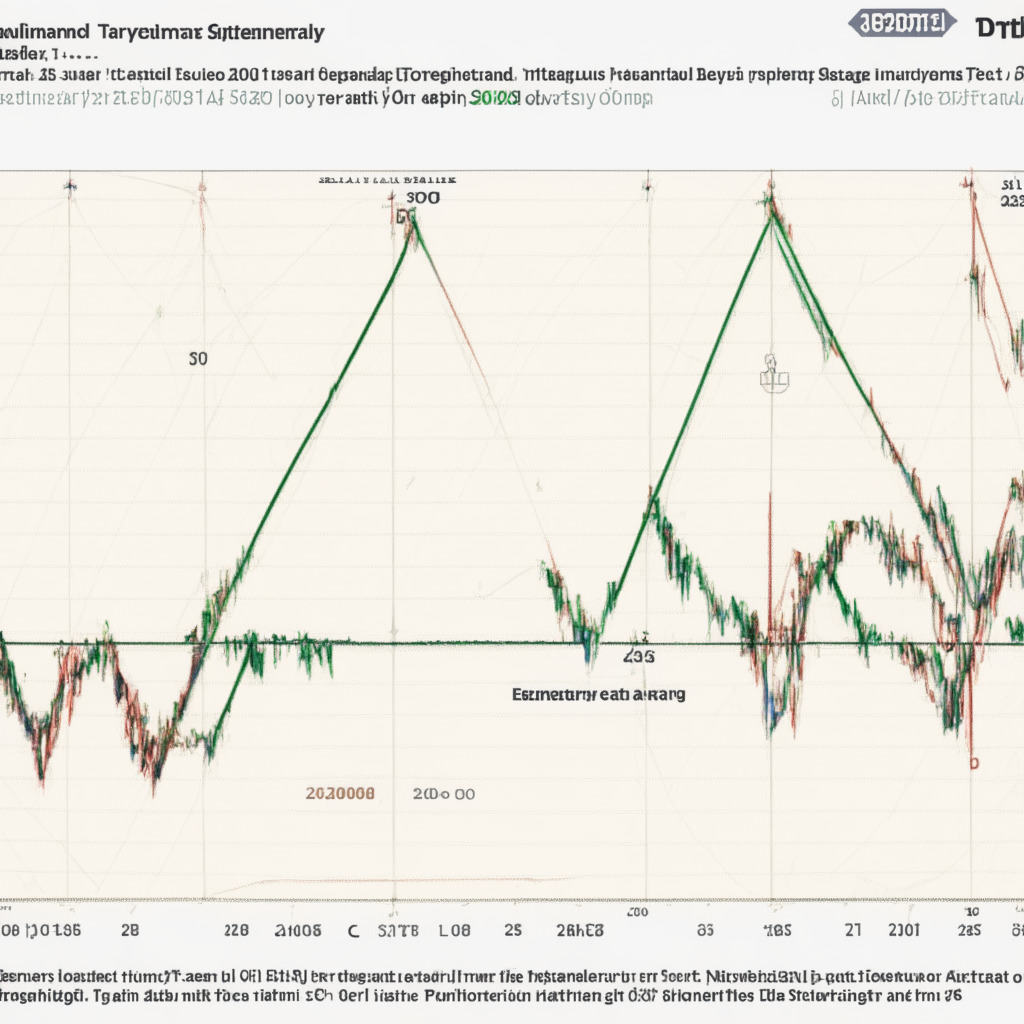

The leading cryptocurrency, Bitcoin, has been moving in a sideways trend for almost two weeks now, showcasing an indecisive period in the crypto market. This consolidation is a response to two converging trendlines revealing a symmetrical triangle pattern, which may play a vital role in determining Bitcoin’s future trend. Furthermore, the Bitcoin Fear & Greed Index stands at 49%, reflecting the uncertain market trend.

A breakout from the triangle resistance could potentially lead to a 7% gain for Bitcoin’s price this week. In contrast, a 4-hour candle closing below the triangle support may result in a 5-6% fall in its price, reaching the lower trend line of the channel pattern around $25,000. As Bitcoin’s price currently stands in a no-trading zone, traders may want to wait for a triangle breakout before entering into new positions.

According to Tradingview, the intraday trading volume in Bitcoin is $9.7 billion, indicating a 26% gain, with an intraday gain of 0.26% resulting in a Bitcoin price of $26,872. This price edges closer to the peak of the triangle pattern, forecasting significant movement from the converging trendlines and indicating the potential for price movement.

If a bullish breakout occurs, the price may surge by 7-6% and hit the downsloping trendline of the channel pattern at $28,000. For Bitcoin to surpass the $30,000 mark, it must genuinely break out of the channel pattern.

On the technical side, the Exponential Moving Averages (EMAs) on the 4-hour chart (20, 50, 100, and 200) indicate that traders may face minimal resistance on a downward journey. Meanwhile, the Moving Average Convergence Divergence (MACD) highlights an unclear trend, necessitating a breakout candle to direct future price trends.

In conclusion, the near future trend for Bitcoin’s price heavily depends on which side of the triangle pattern will break. A breakdown may more likely push the price to $25,000, but for Bitcoin to reach $30,000, it needs to surpass the trendline of the channel pattern; otherwise, the correction will prolong. Market research remains essential before investing in cryptocurrencies, as the presented content reflects the author’s personal opinion and is subject to market conditions.

Source: Coingape