Despite the downward trend in Shiba Inu (SHIB) price that began in November 2021, recent market movements suggest that this memecoin might be gaining momentum, with three factors potentially driving significant growth in the near future.

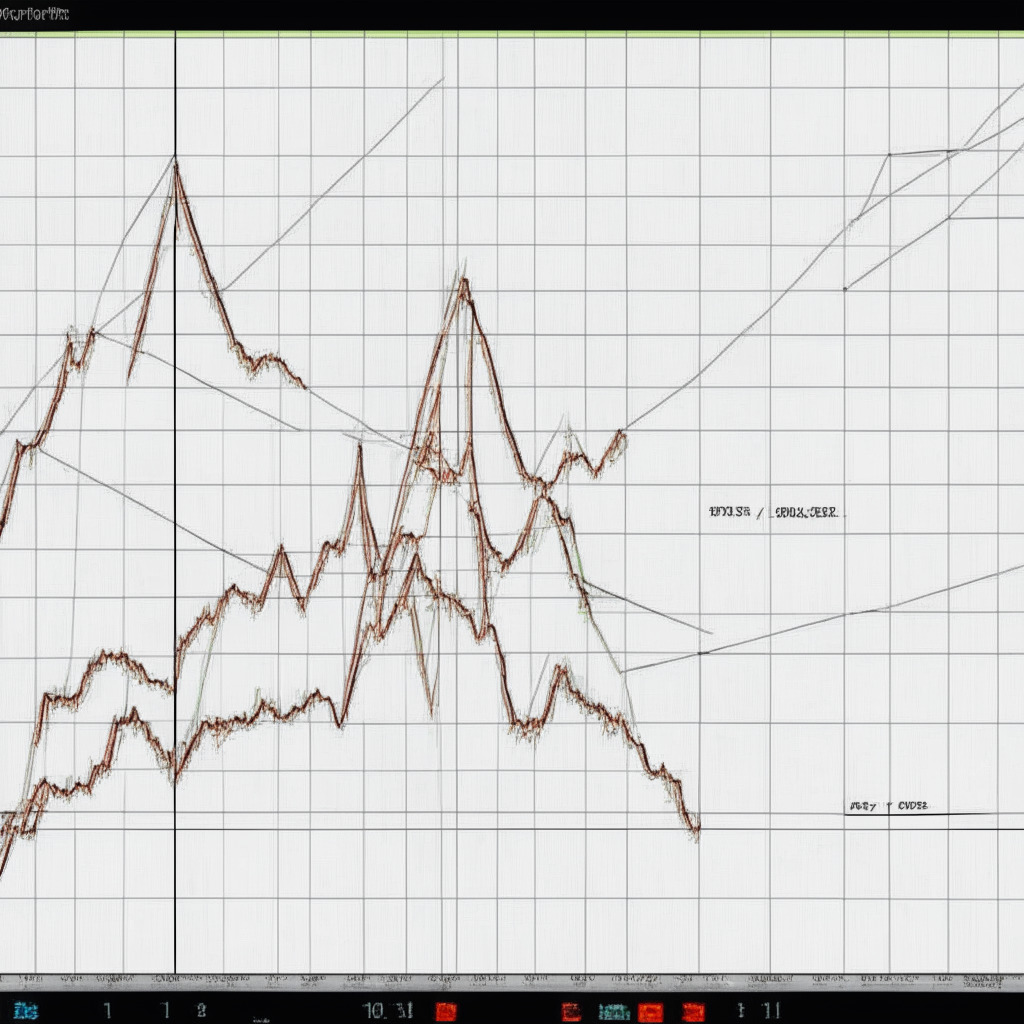

First, a symmetrical triangle pattern has formed in the Shiba Inu price chart on the weekly time frame. This pattern, which has developed over nearly a year, indicates a particular direction for the coin’s current sideways trend. As the SHIB price has recently fallen back to the pattern’s support amid market corrections, a bullish scenario could see the ascending trendline rejuvenate bullish momentum, driving the price back up to the upper trendline at approximately $0.0000135.

Second, the Shiba Inu price, trading at $0.00000865 at the time of report, appears to be experiencing a short-term consolidation phase above a long-standing support trendline. Sideways movements in the market have revealed numerous unsuccessful attempts by sellers to push the price lower, suggesting aggressive accumulation by participants. This buying pressure could propel the price upward, with a potential breakout from the $0.00000917 resistance, indicating the start of a new bullish cycle within the pattern.

Lastly, the Relative Strength Index (RSI) on the weekly chart has turned bullish. As a momentum indicator, the RSI gauges the strength of a recent asset movement. Despite the SHIB price forming lower highs, the weekly RSI slope reveals a rising trend, hinting at increased buying pressure even amid the sideways trend. This bullish divergence means a higher likelihood of a bullish reversal and an upside breakout from the triangle pattern.

A possible breakout from the upper trendline of the triangle pattern could intensify bullish momentum and signal an early sign of trend reversal. Subsequent price targets after this pattern’s completion could be $0.0000157 and $0.00001782.

It is essential to keep in mind that the information provided is based on market conditions and the personal opinion of the author. Cryptocurrency investments should be made after thorough market research, with the understanding that neither the author nor the publication will be held responsible for any personal financial losses.

Source: Coingape