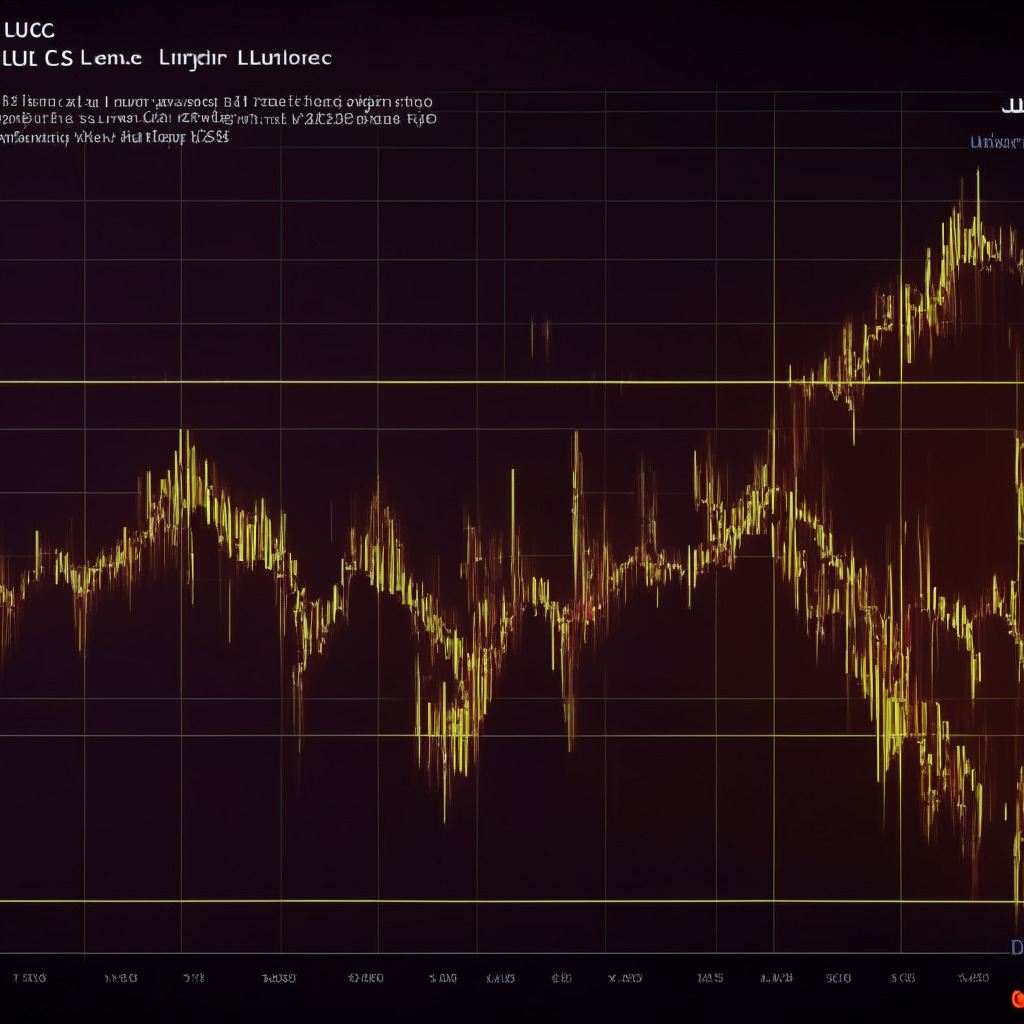

The LUNC price, part of the Terra Classic coin, has remained relatively flat over the past two weeks, hovering between the $0.000094 and $0.000082 marks. As a result, the coin sits in a phase of consolidation with the potential for either side breakout. Despite the wider crypto market experiencing an uptick, the LUNC price has not seen significant movements.

The Terra Classic developer has called upon Dapps to reach out to them, which could potentially reveal some of the reasons behind the price stagnation. At present, LUNC has a daily trading volume of $18.8 million, representing a 21% loss. It currently trades at $0.0000863, remaining within the narrow range.

There are two primary scenarios that could arise from this situation. On one end, the LUNC price might continue to experience a downtrend due to the influence of the wedge pattern. As a result, a breakout from the $0.000094 resistance level could entice buyers and lead to a rechallenge of the pattern’s key barrier.

Should the price breach the $0.000082 range support, a breakdown may occur, fueling a 14% drop in the altcoin’s value and sending it to around $0.00007. On the other hand, if an upward breakout surpasses the $0.000094 resistance, it could lead to an 8% surge before encountering the significant resistance trendline belonging to the wedge pattern.

For a bullish recovery to materialize, the LUNC price must break through the resistance trendline of the wedge pattern. This action could signal an early sign of trend reversal and initiate a notable recovery in the altcoin, with the first target set at the $0.000114 mark.

In terms of technical indicators, the Bollinger Bands show a squeeze which projects high volatility in the market, making a breakout action crucial for determining potential trends. Meanwhile, the daily Relative Strength Index (RSI) slope is experiencing growth, which supports the possibility of a $0.000094 breakout remaining strong.

While some factors suggest hope for LUNC price recovery, the outcome is subject to market conditions and the broader crypto market’s movements. As always, it’s essential to conduct thorough market research before investing in any cryptocurrency, as personal financial losses cannot be the responsibility of the author or the publication.

Source: Coingape