The Professional Bowlers Association (PBA) and Bowlero have launched League Bowler Certification Awards, tokenized achievements in the form of non-fungible tokens (NFTs), on the Avalanche blockchain. These soulbound tokens will be airdropped to around 300,000 Bowlero league participants to recognize their bowling accomplishments, paving the way for blockchain integration in the sports industry.

Month: May 2023

Openfort’s Wallet-as-a-Service: Revolutionizing Crypto Gaming or Overhyping Infrastructure?

Crypto startup Openfort raised $3 million to develop its wallet-as-a-service software for game developers and publishers. Offering frictionless wallet technology via APIs, Openfort aims to simplify and enhance the gaming experience by abstracting cumbersome crypto transaction elements and supporting Ethereum-compatible networks.

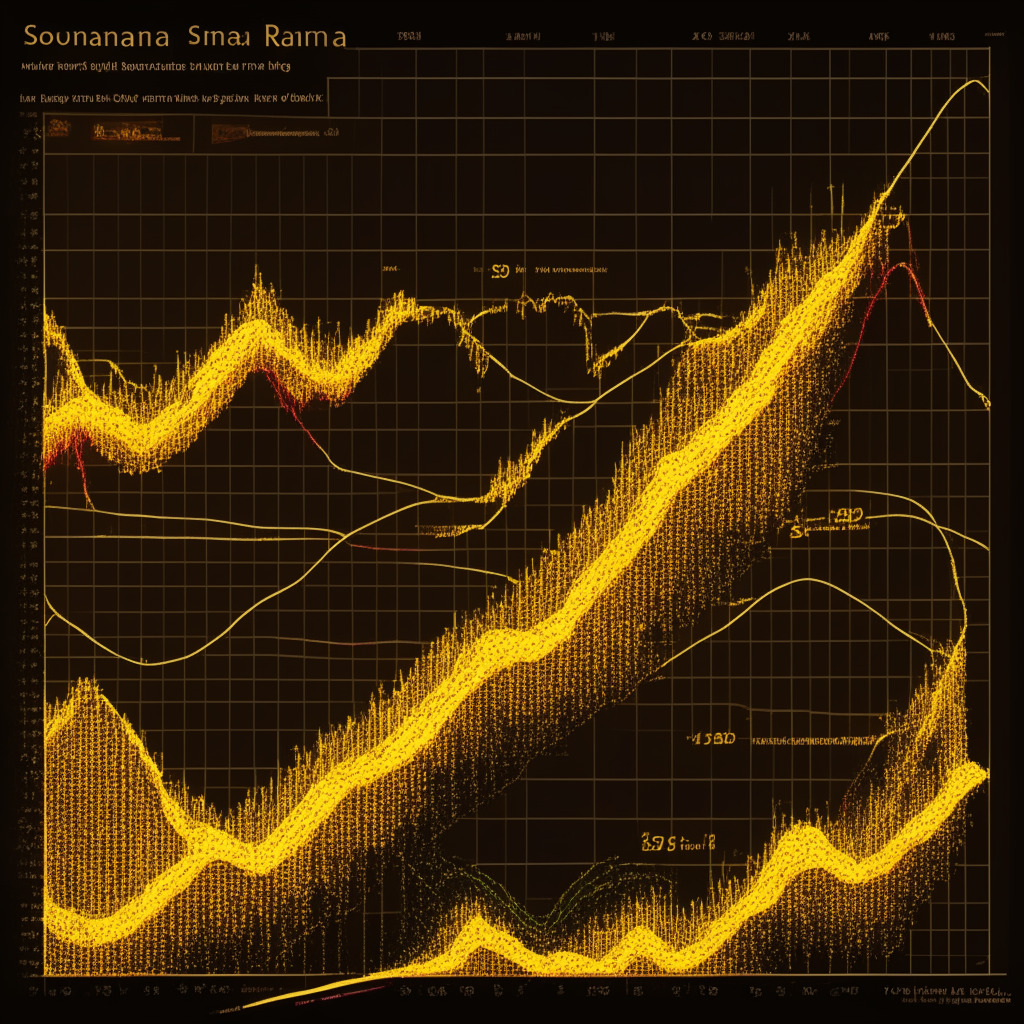

Solana’s Wedge Pattern: Potential Breakout and Profit Opportunities in a Volatile Market

The SOL price remains within two falling converging trendlines, forming a wedge pattern that could impact its future trajectory. As buying pressure intensifies at the lower trendline, chances of a bullish reversal increase. However, any reversal will face resistance from overhead levels, requiring a breakout for restoring bullish momentum.

EOS Network Legal Battle Looms: Debating Legal Action vs Hard Fork and Community Impact

EOS Network Foundation’s founder, Yves La Rose, considers legal action against major investor Block.one for allegedly reneging on a $1 billion investment promise. The resulting under-capitalization has hindered the EOS Network’s development, causing the EOS token’s value to decline. The community must weigh the risks of legal action or a hard fork to prioritize the project’s long-term stability.

BlockFi Bankruptcy Battle: Examining the Controversy and Balancing Innovation with Regulations

BlockFi’s bankruptcy battle faces tensions with creditors citing poor management and restructuring plans. A withdrawn wind-down plan suggested recovering funds through claims against commercial counterparts, but a corrective letter clarifies that soliciting acceptances remains unlawful. An upcoming hearing on June 20 will determine BlockFi’s legacy.

Uncertainty Looms: Bitcoin, Debt Ceiling Talks, Tron Rumors, and Legal Challenges in Crypto Markets

Bitcoin faces uncertainty with its price dropping below $27,000, while Tron’s TRX gains 8% on rumors of becoming legal tender in Hong Kong. Meanwhile, the Digital Currency Group struggles to repay a $630 million debt to Gemini amidst SEC accusations, and Malaysia orders Huobi Global to halt operations for unregistered activities.

Apple Pay Integration in STEPN Game: Boosting Web3 Adoption or Just a Temporary Fix?

The move-to-earn game STEPN integrates Apple Pay as a fiat onramp for in-app purchases, expanding accessibility and eliminating the need for a crypto wallet to purchase in-game NFT assets. This strategic step aims to onboard the next 100 million users to Web3 and remove barriers to entry.

BitMEX Hong Kong: Embracing Compliance or Compromising Security? Pros and Cons Explored

BitMEX Hong Kong is designed to comply with the upcoming Virtual Asset Service Provider (VASP) regime, set for May 2023. Users will transition to HDR BMEX Limited and use the dedicated BitMEX Hong Kong app, offering greater portfolio control and streamlined user experiences.

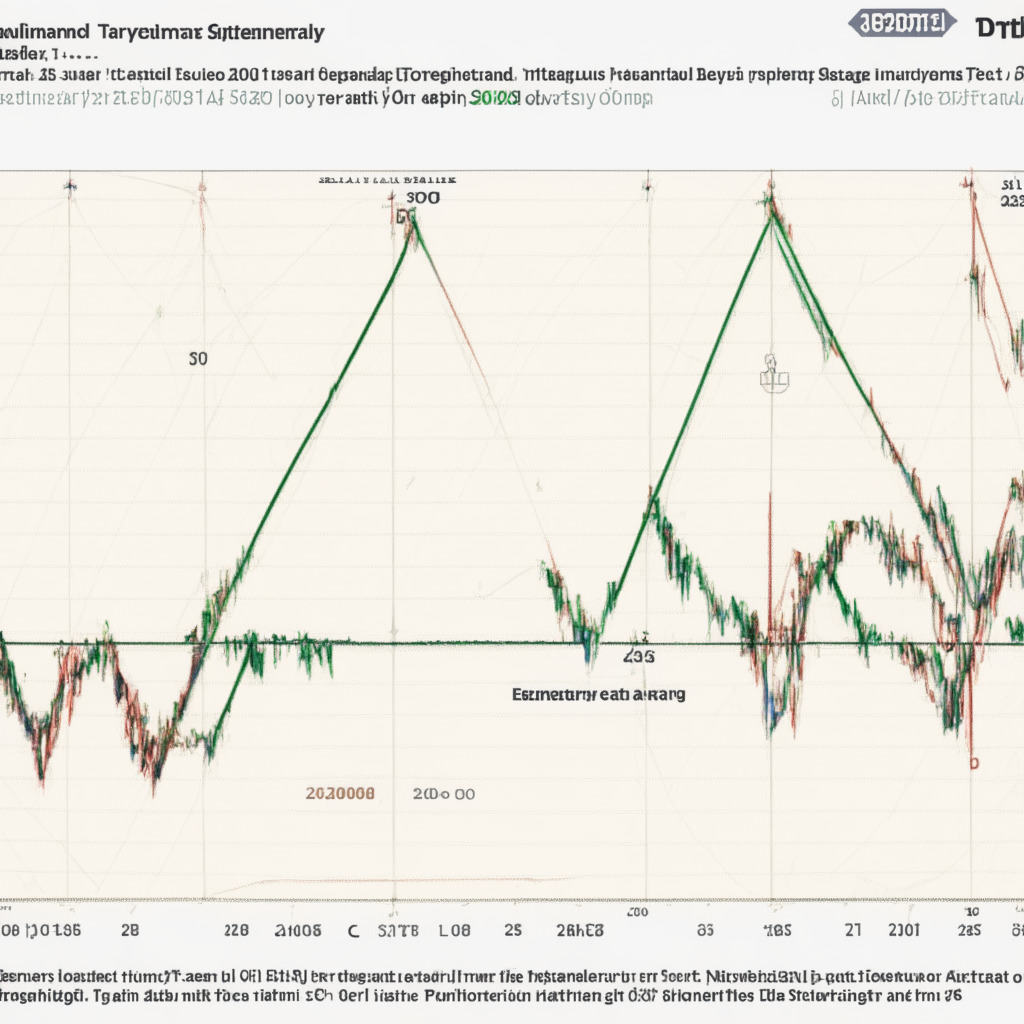

Bitcoin Sideways Trend: Triangle Breakout Decides Next Move Between $25K-$30K

Bitcoin’s future trend relies heavily on a breakout from the current symmetrical triangle pattern, with potential gains of 7% or losses of 5-6% at stake. The Bitcoin Fear & Greed Index, currently at 49%, mirrors the uncertain market trend. Price movements depend on breaking the triangle pattern and surpassing the channel pattern’s trendline.

High-Profile Phishing Attack: Stolen NFTs, 100 ETH Loss, and Lessons Learned

In a recent high-profile phishing attack, valuable tokens from Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) were stolen and sold on the Blur marketplace, resulting in losses surpassing 100 ETH. This alarming event underscores the importance of staying vigilant in the crypto and NFT space, as phishing scams continue to threaten the security and livelihood of cryptocurrency owners.

Hotbit Closes Shop: Centralized Exchanges’ Future in Jeopardy or Crypto Evolution?

Hotbit announces the end of its centralized exchange operations amid a rapidly-changing crypto landscape. The decision marks a turning point, sparking debates on the viability and stability of centralized business models as decentralized businesses gain focus in the industry.

Malaysia Cracks Down on Unregistered Crypto Exchanges: Challenges and Opportunities

Malaysia’s Securities Commission (SC) has ordered Seychelles-based crypto exchange Huobi to cease operations due to running a digital asset exchange without proper registration. The move highlights the need for compliance with local regulations and the protection of investors’ interests in the growing Malaysian crypto market.

Gemini, DCG, and the $630M Loan Debacle: Navigating Risk in the Crypto Landscape

Gemini, owned by the Winklevoss twins, announces Digital Currency Group’s (DCG) failure to make a $630 million loan payment, igniting concerns about DCG’s capabilities and potential default. Gemini considers offering forbearance and submitting an “amended plan of reorganization” to mitigate the situation. The outcome may impact risk management and long-term implications for DCG and its creditors.

Debt Ceiling Talks and Crypto: Biden and McCarthy’s Clash to Impact Market Future

As the U.S. debt ceiling deadline approaches, President Joe Biden and House Republican Speaker Kevin McCarthy’s varying viewpoints on protecting wealthy tax evaders and cryptocurrency traders may significantly impact the future of cryptocurrencies. The outcome of their discussion could reshape the crypto landscape, affecting the technology, markets, and safety of digital assets.

Predicting Bitcoin’s Fate Amid US Debt Ceiling Crisis: Expert Insights and Market Dynamics

Legendary trader Peter Brandt predicts potential Bitcoin price downfall amid U.S. debt ceiling dilemma and market volatility. Despite being bullish on a $40,000 target, bearish sentiment increases. Brandt, known for accurate past analyses, warns against dismissing downside risks and overconfidence in price predictions.

Pepe Coin’s Tenuous Future: Exchange Reliance vs New Meme Token Potential

Pepe Coin (PEPE) has seen significant growth due to exchange listings, but its reliance on them might hinder future gains. Newer meme tokens like SpongeBob (SPONGE), Copium (COPIUM), and AiDoge offer untapped growth potential, presenting alternative opportunities for traders in the market.

Inferno Drainer: How a Scam-as-a-Service Stole $6M and What We Can Learn From It

A scam vendor called “Inferno Drainer” has stolen $5.9 million in assets from 4,888 victims across 689 phishing websites. Specializing in multi-chain scams, Inferno Drainer provides scammers with ready-to-go code in exchange for a 20% cut of stolen funds. Crypto scams and hacks continue to pose a threat, reinforcing the importance of security and vigilance in the crypto market.

Terra Execs’ Legal Battles: Blockchain Future & the Need for Regulatory Compliance

Terra/LUNA co-founder Do Kwon and CFO Han Chang-Joon face an appeal against their release conditions in Montenegro. They are accused of forgery using false passports, with potential prison sentences of up to five years. The US SEC, South Korea, and Singapore are also pursuing charges against the Terraform Labs executives. The ongoing legal battles emphasize the need for regulations and transparent compliance in the cryptocurrency sphere.

Digital Pound: Navigating New Legislation, Privacy, and AML Regulations for CBDC Adoption

The introduction of a digital pound in the U.K. requires new legislation defining its characteristics and amendments to current data, privacy, and anti-money laundering regulations. The Treasury and Bank of England are currently seeking public feedback on its design while developing its policy and technology aspects. The legal framework should address ownership, security, and ensure privacy while protecting citizens from fraud.

Debunking MetaMask Tax Collection Rumors and the Future of Crypto Taxation

ConsenSys, the company behind MetaMask, denies allegations of collecting taxes from users, clarifying that the rumor was based on inaccurate information. The misunderstanding originated from a misreading of MetaMask’s terms of service. As tax policies evolve, crypto traders should prepare for potential higher tax obligations in the future.

Centralized Exchanges’ Future: Risks, Regulation, and Decentralization Debate

The future of centralized exchanges like Hotbit and Bittrex seems uncertain amid deteriorating operating conditions, collapsing institutions, and increased regulation. As the crypto industry grapples with centralization versus decentralization, alternatives like holding one’s own crypto or trading on decentralized exchanges gain momentum. Reevaluation of existing models and exploration of options addressing operational and security concerns are essential for the crypto ecosystem’s maturity and adaptability.

Gemini vs. DCG: The $630 Million Default Drama and its Impact on the Crypto Ecosystem

Gemini accuses Digital Currency Group (DCG) of not fulfilling a $630 million payment related to a loan made to bankrupt crypto lender Genesis. This highlights potential vulnerabilities in the digital assets ecosystem as DCG’s default could impact the industry. A resolution requires good faith negotiations and emphasizes the importance of transparency, accountability, and proper risk management.

XRP’s Uncertain Future: Ripple-SEC Case Impact and Diversifying Altcoin Investments

XRP price dropped 1.5% following the news of a one-week extension for Ripple and the SEC to file motions for summary judgment. Despite the dip, XRP has gained 8% in a week, with optimism surrounding the Ripple-SEC case driving gains. The upcoming June 13 deadline for case filings could bring a conclusion, potentially leading to a massive XRP rally if the ruling is in Ripple’s favor. However, mixed chart indicators and case uncertainties suggest investors should diversify their portfolios.

Bitcoin Consolidation Breakout: Factors, Indicators, and Future Price Movement

This article explores factors indicating a potential Bitcoin consolidation breakout, highlights President Biden’s budget proposal addressing digital assets, and discusses Robert Kiyosaki’s optimism on Bitcoin as protection against economic uncertainty. It also examines technical levels and the potential for a bullish reversal. Stay informed and adapt to the ever-changing crypto market environment.

Malaysia’s Crackdown on Huobi Global: Balancing Regulation and Crypto Innovation

The Securities Commission Malaysia (SC) has ordered Huobi Global to halt its operations, including disabling its website and mobile applications, for operating without proper registration. Malaysian investors are urged by the SC to cease trading, withdraw funds, and close their accounts, highlighting the ongoing tension between cryptocurrency exchanges and regulatory bodies.

Massive $Copium Coin Burn Ignites 700% Surge: Meme Coin Boom or Risky Gamble?

In a recent turn of events, 300 million $Copium coins have been burned, leading to a 700% surge in value within hours of its Uniswap launch. Although the meme coin market is volatile, $Copium’s unique launch structure, token burning, and rapidly growing popularity among influential crypto figures create potential for further growth. However, investors must maintain a cautious approach.

Terra Classic’s CosmWasm v1.1.0 Upgrade: Reviving Utility and Expanding Possibilities

The Terra Classic developer group Joint L1 Task Force (L1TF) announced the official date for the CosmWasm v1.1.0 parity upgrade, bringing Terra Classic on par with blockchains like Terra 2.0 and Cosmos. This update enables projects across Cosmos and Terra Luna 2.0 to develop on Terra Classic, reinstating burn tax and increasing staking rewards.

Tornado Cash Attacker’s Surprising Move: Blockchain Security in Decentralized Systems Debated

The attacker of decentralized autonomous organization, Tornado Cash, submits a proposal to return control, sparking skepticism and optimism among crypto enthusiasts. The incident highlights the vulnerabilities and potential resilience of decentralized systems while emphasizing the importance of community-based approaches to mitigate risks and maintain trustless relationships in blockchain technology.

Hotbit Shutdown Sparks Crypto Exchange Debate: Centralized vs Decentralized Future

Crypto exchange Hotbit announces cessation of operations due to deteriorating conditions, citing former team member investigation, FTX collapse, USDC depegging, and funds outflow from centralized exchanges. Hotbit’s situation highlights the need for exchanges to balance security, decentralization, and regulation for long-term success in the evolving crypto world.

Narrow Crypto Trading Ranges: A Sign of Looming Volatility or Market Stagnation?

Bitcoin’s price is currently in a narrow trading range despite US banking sector concerns and debt ceiling issues. Analytics firm Glassnode data indicates tight ranges like this often precede significant market shifts and high volatility. Investors should monitor trends closely to safeguard their investments in the evolving crypto-financial landscape.

Innovative Advanced Limit Orders in DeFi: Exploring Opportunities and Weighing Risks

Mangrove, a Paris-based decentralized exchange (DEX), recently launched on Polygon’s testnet, featuring an innovative “advanced limit order” functionality. This allows trading intentions to exist on-chain as a programmable code without locking up funds, offering increased flexibility and options for DeFi traders in their transactions.

Tornado Cash Attack: Hacker’s Change of Heart Raises Questions on Trust and Blockchain Security

A new proposal surfaces to potentially restore Tornado Cash’s governance after a malicious attacker hijacked it. Quick action by community member Tornadosaurus Hex aimed to limit damage while the attacker surprisingly signaled intent to return governance control. This incident highlights the need for constant vigilance in blockchain cybersecurity.