This article explores how budgeting applications can help users control impulsive spending and reach their financial objectives. Budgeting apps offer features like tracking expenses, setting financial goals, creating budgets, notifications and reminders, analyzing spending patterns, and encouraging savings to prevent unplanned purchases and promote a secure financial future.

Month: May 2023

XDC Network and SBI VC Trade: Bridging Blockchain and Japanese Trade Finance Market

The XDC Network is partnering with SBI VC Trade to expand its presence in the Japanese market and enhance the trading experience. This collaboration aims to streamline the trade finance sector by improving transparency, traceability, and cost reduction while fostering blockchain adoption in the international trade and finance industries.

Crackdown on Crypto Influencers: SEC Targets Fraudulent Promotions and Price Manipulation

Former SEC official John Reed warns social media influencers promoting and manipulating cryptocurrency prices that they will soon face anti-fraud regulations similar to those governing exchange-listed securities. The existing regulatory loopholes enabling fraudulent activities and price manipulation will likely close soon, as regulatory bodies like the SEC intensify their scrutiny.

Navigating Crypto Amid Federal Reserve’s Liquidity Tightening and Debt Ceiling Debates

Crypto enthusiasts should note Cleveland Fed President Loretta Mester’s support for liquidity tightening and consistent interest rate policy, as her comments impacted Bitcoin’s value. The market’s response demonstrates the significance of global economic events and Federal Reserve policy decisions on the cryptocurrency landscape.

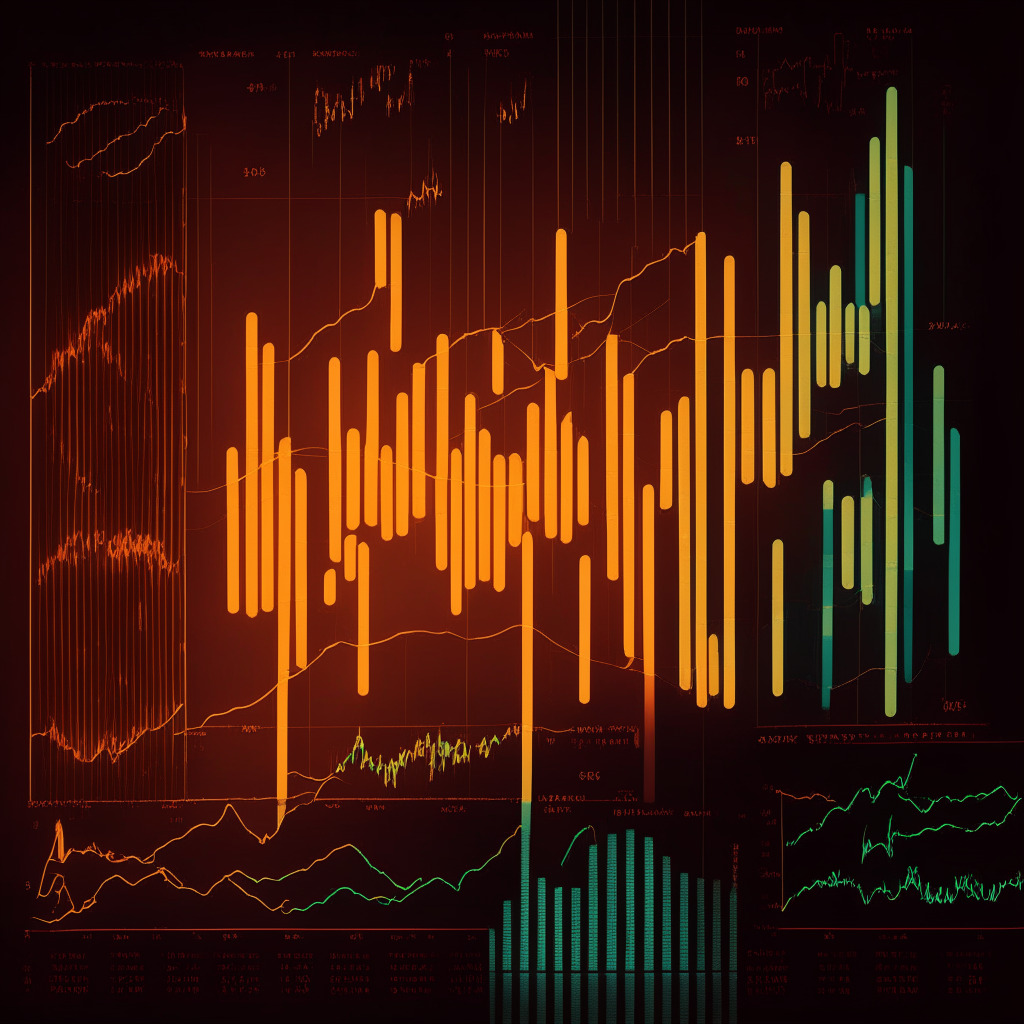

Bitcoin’s 2.5% Dip: Analyzing Market Trends, Binance Australia, and Future Outlook

Bitcoin’s value dipped 2.50% possibly due to Binance Australia users selling at a lower rate, resulting in a 21% price drop. Meanwhile, Tether focuses on sustainable energy for Bitcoin mining, and market participants closely watch debt ceiling developments and China’s web3 innovation plan.

Crypto Market Decline: Asia Trading Hours Impact and Future Predictions

The global crypto market experienced a decline, with Bitcoin and Ethereum dropping 2%. Investors have been liquidating holdings as Bitcoin’s price closes 8% lower for the first time this year. Despite bullish outlooks, a short-term decline is expected due to a debt ceiling deal prompting a T-bill issuance from the US Treasury Department.

Embracing AI and Blockchain: Indian Banking’s Future or Risky Path? Pros, Cons & Main Conflicts

Deputy governor Mahesh Kumar Jain urged Indian banks to adopt AI and blockchain for effective corporate governance and risk management. Technological disruptions, cybersecurity threats, and changing customer expectations can be addressed through strategic technology adoption, ensuring sustainable growth and staying ahead of the curve.

The Enigmatic Rise and Fall of $TATE Coin: Beware of Pump and Dump Scams in Crypto Markets

The low market cap coin Tate experienced a 50,000% pump on Uniswap before crashing 96%. Despite massive gains, influencer Andrew Tate hasn’t mentioned $TATE on Twitter. Such coins’ precarious nature reminds investors to exercise caution and thoroughly research before investing in unknown projects.

The Shaky Future of Bitcoin: Examining Market Fluctuations, Adoption, and Crypto Utility

Bitcoin faces a 6.5% monthly drop but maintains a 68% year-to-date gain. To attract more investment, real utility and development must be demonstrated, according to John Wu, president of Ava Labs Inc. Increased network activity, including BRC20 standard Bitcoin Ordinals and NFTs, has impacted transaction fees and network congestion.

Doge Rush: Merging Meme Appeal & Gaming Utility for a High-Potential Cryptocurrency Future

Doge Rush, a new meme coin, merges meme appeal with practical functionality by offering casual games on DogeHub platform, play-to-earn rewards, and NFT integration. Investors can participate in the ongoing initial stage of Doge Rush presale, having substantial potential for success.

HKMA and CBUAE Collab on Virtual Assets: Boosting Fintech and Challenging US Hegemony

The Hong Kong Monetary Authority (HKMA) and the Central Bank of the United Arab Emirates (CBUAE) collaborate on virtual asset regulations and developments, aiming to strengthen cooperation, promote fintech initiatives, and improve cross-border trade settlement. This partnership coincides with Hong Kong’s Securities and Futures Commission allowing virtual asset service providers to cater to retail investors.

Coinbase CEO Warns US Restrictions May Benefit Adversary Nations: Striking the Crypto Balance

Coinbase CEO Brian Armstrong warns that restrictive crypto policies in the U.S. could benefit adversary nations like China, potentially costing the U.S. its financial leadership. Armstrong urges policymakers to recognize crypto’s potential in revolutionizing various sectors while providing regulatory clarity to protect consumers and maintain global competitiveness.

Regulatory Uncertainty in US Crypto Space – Driving Innovation Away or Safeguarding Interests?

Coinbase CEO Brian Armstrong emphasizes concerns over the lack of regulatory clarity on cryptocurrencies in the United States, arguing that restrictive policies drive innovation away and weaken national security. As countries worldwide adopt central bank digital currencies (CBDCs), the US may struggle to keep pace due to unclear regulations, potentially affecting national security and global financial dominance.

Crackdown on South Korean Crypto Scams: Uncovering $350M Fraudulent Operations & Trust Issues

South Korean police dismantled two cryptocurrency scams worth $350 million, affecting hundreds of victims. The first case involved a “virtual fashion items” marketplace, luring 435 victims into investing $333 million. The second scam swindled investors out of $27 million. These incidents raise concerns over the commitment of crypto businesses to customer protection and the effectiveness of regulations.

Crypto Market Volatility in 2023: Exploring Causes, Remedies, and the Rise of Ether

In 2023, heightened crypto market volatility is driven by factors like US debt ceiling negotiations, Asian regulatory shifts, and Turkey’s political landscape. Ether’s deflationary stance weakens its correlation to Bitcoin, possibly marking a long-term regime change in supply-demand economics between the two digital assets.

Cryptocurrency Debate in Russia: Central Bank’s Ban vs Finance Ministry’s Regulation Approach

In Russia, cryptocurrencies are considered too risky for most but suitable for professional investors, according to Ivan Chebeskov, director of the financial policy department at the Finance Ministry. While acknowledging the high-risk nature of cryptocurrencies, Chebeskov emphasized their potential for investment. Tensions arise between the Central Bank’s focus on banning cryptocurrencies and the Finance Ministry’s push for regulation and taxation, resulting in an uncertain future for Russia’s crypto market.

Debt Ceiling Deal Impact on Bitcoin: Crypto Market Reaction & Future Outlook

Bitcoin steadied after dropping below $28,000 due to progress on a debt ceiling deal, while government debt may prove favorable for the crypto market. Analysts suggest bitcoin’s resilience amid monetary tightening could be due to factors like store-of-value, NFTs, and supply/demand dynamics.

Debate on CBDCs and Crypto’s Role in Dark Web Drug Trafficking: A New Congressional Duel

As the debt ceiling deadline nears, crypto-focused bills address Central Bank Digital Currencies (CBDCs) and cryptocurrencies’ role in dark web drug trafficking. Concerns over privacy and potential legal issues arise from retail CBDCs, while bipartisan bills call for increased transparency and harsher penalties for dark web trafficking.

Evaluating Origin Ether: Rapid Growth vs Sustainability in Yield Farming

Origin Ether (OETH), a new yield farming app, has rapidly gained over $12 million in total value locked (TVL) in just 14 days. Utilizing liquid staking and DeFi protocols, OETH allows users to earn rewards from multiple sources. However, potential investors should cautiously evaluate its long-term sustainability due to the speed of its expansion.

Bitcoin Mining Difficulty Soars: Impact of Ordinals Protocol and Upcoming Halving Dilemma

Bitcoin mining difficulty is set to reach a new record high of 50.91 trillion, reflecting the growing number of mining machines. This surge occurs alongside the Bitcoin network’s hashrate rally and increased network fees, resulting in boosted profitability for miners. With the Ordinals protocol enabling NFTs and BRC-20 tokens on the Bitcoin blockchain, demand for block space increases, maintaining high network fees and incentivizing more miners to join.

Crypto Exchanges Exit or Embrace Canada’s Regulatory Climate: Analyzing Strategies

Bybit exits the Canadian market due to recent regulatory developments, joining other exchanges like Binance, OKX, Paxos, dYdX, and Bittrex. In contrast, Coinbase, Kraken, Gemini, and Shakepay have chosen to engage with regulators and navigate the evolving crypto landscape by filing pre-registration undertakings with Canadian Securities Administrators.

Nansen Layoffs and Crypto Industry Challenges: Adapting to Market Volatility and Uncertainty

Nansen, a blockchain analytics platform, recently announced a 30% workforce reduction due to rapid scaling beyond their core strategy and the ongoing crypto bear market. This raises concerns on the sustainability of businesses within the crypto industry and the impact of market fluctuations on workforce stability.

Hong Kong’s Crypto Haven: Opportunities and Challenges in the Blockchain Future

Hong Kong is transforming into a crypto haven, with developments such as launching the CyberDefender Metaverse for public education, lifting its ban on retail crypto trading, and trialing a central bank digital currency. However, the city must ensure safeguards and education to protect its growing crypto community.

Balancing Blockchain Anonymity and Legal Investigations: Pros, Cons & Conflicts

Researchers from Friedrich-Alexander-Universität Erlangen-Nürnberg propose a standard framework containing five argumentative schemes for validating deanonymized data on the Bitcoin blockchain. This aims to balance protecting suspects’ rights and aiding investigators by providing transparent, analytically sound court proceedings and ensuring fair law application. The findings are potentially applicable beyond German and United States legal systems.

CFTC Advisory on Digital Assets: Balancing Innovation and Compliance in Blockchain Future

The CFTC issued a staff advisory to derivatives clearing organizations, emphasizing compliance in areas related to digital assets: system safeguards, conflicts of interest, and physical deliveries. These concerns highlight the balance between fostering innovation in the digital asset space, and protecting investors and businesses. Regulators’ efforts contribute to a more secure and sustainable ecosystem for digital assets.

AI Safety vs. Progress: Striking a Balance in the Race to Advanced AI and Blockchain Integration

AI experts, including CEOs of OpenAI, Google DeepMind, and Anthropic signed a statement declaring the mitigation of extinction risks from AI as a global priority. While some perceive AI as a solution, others argue that regulation and a risk-averse approach are necessary for a harmonious coexistence between humans and AI.

US Debt Ceiling Chaos Spurs Diversification into Cryptos: Analyzing WSM, QNT, and More

Amid uncertainty over the US debt ceiling, market participants explore diversification into cryptocurrencies such as WSM, QNT, ECOTERRA, INJ, YPRED, LDO, and DLANCE. Enthusiasts consider the environmentally-focused web3 initiative, Ecoterra, an integral part of the global climate change strategy.

ProShares Bitcoin ETF vs BTC: Is Contango Bleed Impacting Performance?

ProShares’ Bitcoin Strategy ETF (BITO) has underperformed compared to bitcoin’s performance this year, due to its futures-based structure and contango bleed. This highlights the limitations of futures-based ETFs and calls for the approval of direct BTC spot ETFs for better investor gains.

Exiting Canada: Bybit’s Move Sparks Crypto Regulatory Compliance Debate

Bybit is pausing its services for Canadian users due to recent regulatory developments in the country. The Dubai-based platform will stop accepting account opening applications from Canadian nationals or residents starting May 31. As Bybit exits Canada, it expands into other markets like Kazakhstan, highlighting the increasing importance of regulatory compliance for crypto firms.

Increased CFTC Crypto Oversight: Balancing Regulation, Innovation, and Market Security

CFTC’s Division of Clearing and Risk (DCR) is increasing scrutiny on cryptocurrencies, focusing on potential risks and adherence to core principles. The move aims to provide security and clarity for investors while balancing innovation and market stability in the rapidly evolving crypto industry.

Dropping Charges against Ex-FTX CEO: Bahamas’ Role & Extradition Treaty Implications

U.S. prosecutors may drop some charges against former FTX CEO Sam Bankman-Fried, depending on the Bahamas government’s stance. The defense argues certain charges violate the extradition treaty between the U.S. and Bahamas. Prosecutors seek a waiver from the Bahamas to try Bankman-Fried for three of the four contested charges.

Insider Trading in Crypto: Wahi Brothers’ Case Sparks Debate on Regulation and Innovation

Former Coinbase Product Manager Ishan Wahi and his brother Nikhil Wahi reached a settlement with the SEC for insider trading in the cryptocurrency ecosystem. The case highlights the need for striking a balance between innovation and regulation, as strict enforcement could hinder the growth of emerging projects, while appropriate measures could enhance the industry’s credibility and reduce bad actors.