The future of blockchain technology holds immense promise in various sectors like finance, supply chain, and real estate, but skepticism and challenges remain. Key concerns include environmental impact, potential centralization of power, and regulatory uncertainties. Its transformative potential and drawbacks will become clearer as the technology evolves and matures.

Month: May 2023

Blockchain’s Future: Revolutionizing Industries or Exacerbating Environmental Concerns?

Exploring the pros and cons of blockchain technology, this article discusses its potential to revolutionize industries, offering transparency, security, and decentralization. However, concerns include energy consumption, regulatory oversight, and potential misuse. The debate between innovation and skepticism shapes the future of this rapidly evolving technology.

Binance CEO’s Stake Sale in US Arm: Strategic Move or Sign of Crypto Market Trouble?

Binance CEO Changpeng Zhao (CZ) plans to sell a significant portion of his shareholdings in Binance.US amidst legal troubles with the CFTC. This move raises questions about Binance’s legal issues and possible consequences for the exchange and its users, while highlighting challenges the crypto industry faces with increasing regulatory scrutiny.

Balancing Bank Regulations: Can Overregulation Hinder Progress and Create a False Security?

JPMorgan Chase CEO Jamie Dimon highlights potential troubles for U.S. banks due to overregulation and its obstructive impact on business practices. Emphasizing the need for a more holistic approach to regulations, Dimon suggests that solely relying on stress tests and overregulation may create a false sense of security and detract from addressing crucial vulnerabilities in the banking industry.

Elon Musk’s Tweet Boosts Milady NFTs: Are They the Next Dogecoin or Just a Short-lived Hype?

The Milady NFT collection saw a 60% price surge after recognition from Elon Musk, drawing parallels to Musk’s influence on dogecoin. However, the collection’s creator faces controversy, and short-lived spikes in token values following Musk’s tweets raise skepticism about the sustainability of Milady’s newfound popularity and valuation.

Elon Musk Appoints New CEO for Twitter’s Transformation Into X Corp: Pros, Cons, and Conflicts

Elon Musk appoints Linda Yaccarino as CEO of Twitter, now to be known as X Corp, aiming to boost advertising and transform the platform. Yaccarino’s experience and connections could propel Twitter to new heights, but potential drawbacks regarding user experience and reactions must be considered.

Celebrity Crypto Endorsement Lawsuit: Florida Connection and its Implications

The ongoing class action lawsuit against celebrities promoting the defunct FTX crypto exchange sees crucial evidence from former compliance chief Daniel Friedberg. Testimony reveals promotional activities were conducted from Florida, potentially establishing jurisdiction and involving high-profile defendants like Shaquille O’Neal, Larry David, and Tom Brady. The case’s outcome could caution public figures in promoting digital assets.

Binance US Reducing CZ’s Stake Amid Regulatory Scrutiny: Adapting or Fleeing?

Binance US and Changpeng Zhao (CZ) are exploring options to reduce CZ’s stake amid intense scrutiny from United States federal regulators. Allegedly attempting to reduce his stake since last summer, Binance US executives now explore ways to decrease CZ’s influence, fearing difficulty obtaining regulatory licenses with him as majority owner.

US Chamber of Commerce Criticizes SEC’s Unclear Crypto Regulations: Coinbase’s Battle for Clarity

The US Chamber of Commerce criticizes the SEC for its disorganized approach to regulating cryptocurrencies, creating a precarious environment for crypto companies. The Chamber pressures the SEC to provide clearer guidelines, as tensions between the SEC and crypto companies like Coinbase emphasize the need for regulatory clarity.

Silvergate Bank Collapse: Lessons Learned on Crypto Regulations and Finance Challenges

Silvergate Capital will be delisting from the NYSE and cutting 230 staff members following a 93% decline in share price since 2023. The company faces regulatory inquiries and investigations, while its liquidation process emphasizes the importance of regulations and scrutiny for financial institutions connected to the cryptocurrency market.

Bitcoin’s Holding Pattern: Macro Data, DeFi Developments, and Industry Challenges

Bitcoin and ether are trading in holding patterns despite macro data and Ethereum’s energy-efficient upgrade. Meanwhile, DeFi developments show promise, with Curve and Aave launching stablecoins soon. While challenges remain, the future of blockchain and digital assets is full of opportunities and uncertainties, requiring informed decision-making from investors.

Crypto Slump: Analyzing Underlying Factors and Potential Investment Gems

Bitcoin dipped below $27,500, neutralizing gains from U.S. inflation data and experiencing a 7.57% decrease in price over the past month. Changing macroeconomic conditions and interest rate hikes contribute to the decline, yet Bitcoin whales show a bullish divergence by acquiring 0.29% of supply.

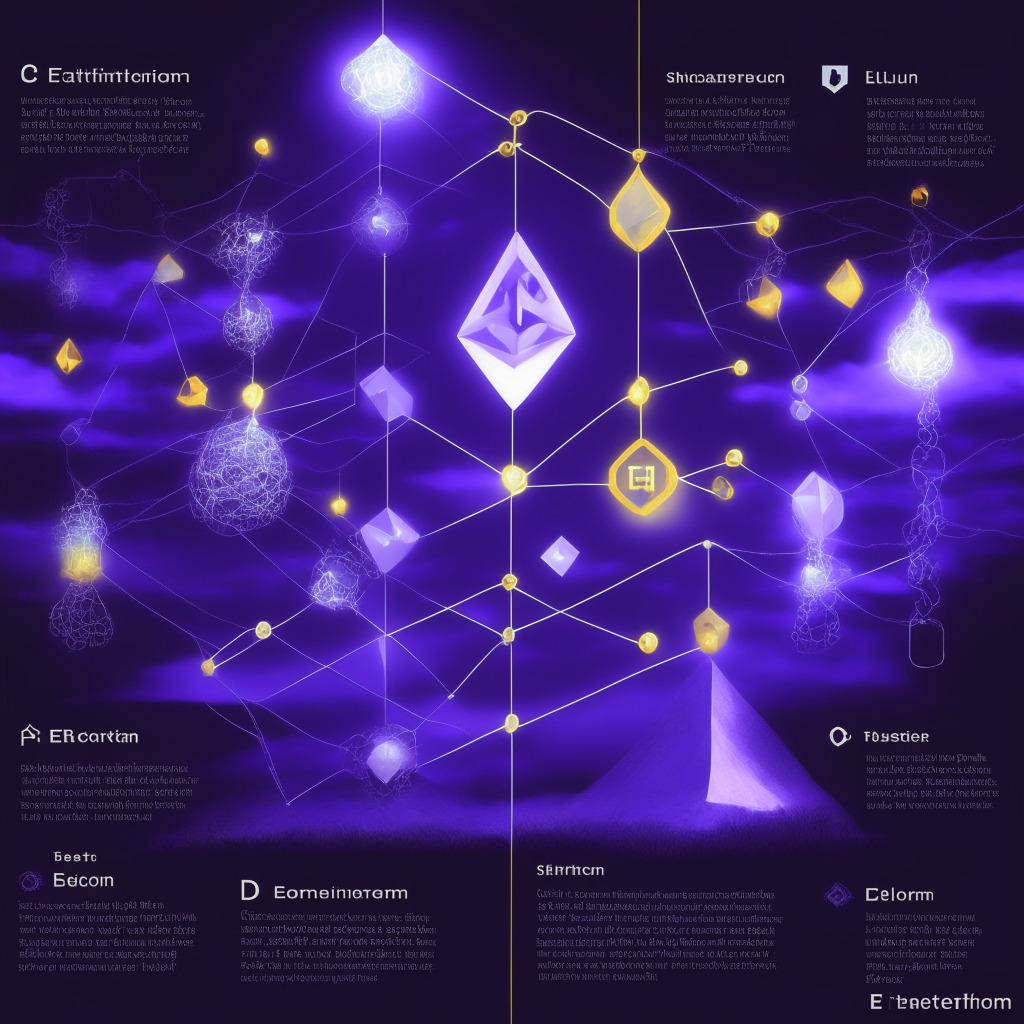

Ethereum’s Unexplained Interruption: How Robustness and Client Diversity Shape the Future

Ethereum’s Beacon Chain faced an unexplained 30-minute interruption recently, highlighting the need for increased client diversity and resilience in the blockchain. Despite concerns, the event also demonstrated the adaptability and robustness of the Ethereum network. Future research and interoperability can help prevent similar interruptions.

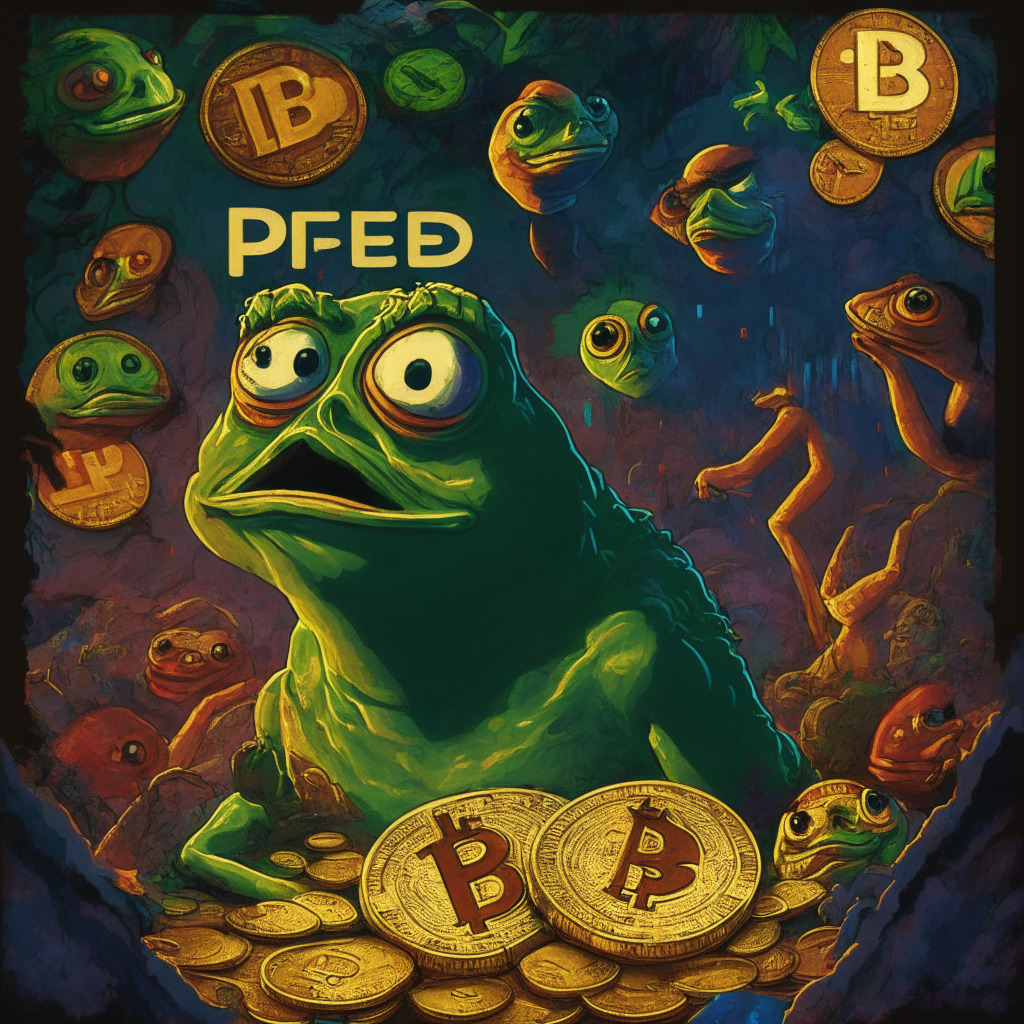

Billion-Dollar Meme Crypto: PEPE Token’s Unstoppable Rise and Dark Side

The PEPE token, a meme-inspired cryptocurrency, has surpassed a $1 billion market cap, sparking both hilarity and concern. Despite promoting a positive community, the token’s growing popularity has led to harassment, toxic behavior, and diehard commitment, challenging traditional perceptions of digital currencies.

Balancing Act: Binance.US Considers Reducing Founder’s Stake for Regulatory Trust vs Decentralization

Binance.US is reportedly considering reducing founder Changpeng Zhao’s ownership stake to enhance the company’s reputation among U.S. regulators. This move could lead to greater trust, expansion, and a safer trading environment but also raises concerns about true decentralization and power concentration within the organization.

IRS Seeks $44 Billion in FTX Bankruptcy: Fallout for Creditors and Alameda Research Partners

The IRS seeks $44 billion from FTX’s bankruptcy and related firms, including a $38 billion claim against Alameda Research. The massive sum raises concerns about the impact on creditors, as IRS claims could take precedence in bankruptcy proceedings. Legal complexities and the LADYS token phenomenon contribute to a high-stakes affair with potentially far-reaching consequences.

Overstepping Boundaries? SEC’s RIA Rule Impact on Crypto, Banks, and Non-Traditional Assets

The U.S. House Financial Services Committee and crypto community criticize the SEC’s proposed advisory clients custody rule, arguing it oversteps authority and affects the banking and digital asset industries negatively. The rule could impose burdensome regulations on banks and hinder digital assets’ growth and innovation, necessitating a reconsideration of the proposal.

BlockFi Bankruptcy Fallout: Customer Rights, Frozen Assets, and the Need for Transparency

BlockFi faced bankruptcy, freezing assets and affecting users with crypto in interest-bearing accounts who lost rights to $375 million. Judge Kaplan ruled BlockFi must return $300 million to custodial wallet users, highlighting challenges and the need for clear communication, transparency, and regulation in the digital asset industry.

FedNow and Metal Blockchain Integration: Stablecoins, Privacy, and Financial Future Debated

The Federal Reserve’s upcoming integration with Metal Blockchain has sparked debates on stablecoins, privacy, and financial system plans. Metal Blockchain’s collaboration with instant payment service FedNow aims to enable rapid stablecoin conversions and potentially create interconnected “bank chains” for a secure, oracle-independent blockchain ecosystem.

BlockFi Bankruptcy Case: Unraveling Crypto Regulations and Future Challenges

BlockFi’s recent bankruptcy case highlights the complexities of crypto regulations and the need for clearer alignment between digital assets and regulatory frameworks. As cryptocurrencies gain mainstream adoption, regulatory authorities must adapt swiftly to ensure fairer and more comprehensive regulations, protecting investors and fostering a stable crypto market.

Ethereum Beacon Chain Halt: A Test of Consensus Client Diversity and Network Resilience

Ethereum’s Beacon Chain faced a temporary halt in block finalization, but quickly resumed normal operations. The incident highlights the importance of consensus client diversity in maintaining stability and security in decentralized blockchain networks like Ethereum, while showcasing its inherent resiliency.

BlockGPT: Decentralizing AI Chatbots and Token Rewards – Boon or Bane for Blockchain?

BlockGPT, a Web3 company, aims to create a decentralized AI chatbot with a tokenized reward system. The launch introduces two tokens, BGPT and AIBGPT, built on PancakeSwap, and offers users NFTs and token prizes for engagement in chat sessions.

M-Pesa Shakes Up Ethiopia’s Mobile Money Scene: Digital Finance and Crypto’s Murky Status

The National Bank of Ethiopia has issued a mobile money-service license to M-Pesa, challenging state-owned Telebirr’s dominance. This development supports Ethiopia’s shift towards greater financial digitalization and increased digital payments accessibility for unbanked Ethiopians. Nonetheless, the legal status of crypto assets remains unclear in the country.

From Crypto Mining to AI Training: The GPU Balancing Act and Miner Adaptation

Ethereum’s migration to proof of stake leaves miners exploring AI training as an alternative use for their GPUs. However, optimal GPUs for crypto mining and AI training have different specifications. Cryptocurrency mining relies on high hash power while AI training primarily depends on vRAM capacity, creating challenges for miners transitioning between the two.

SEC’s Crypto Transparency Under Fire: Will Gensler Meet Committee’s Deadline?

The House Financial Services Committee accuses SEC Chair Gary Gensler of avoiding requests for information on cryptocurrency-related matters, resulting in threats of a hearing. Committee members demand clarification on digital asset exchanges registration and whether ether is a security or commodity. Regulatory clarity and open communication are crucial for the growing crypto market.

Banking Turmoil’s Impact on Crypto: Navigating Market Volatility Amid Uncertain Times

Bitcoin dips below $27,000 amid recent banking turmoil, highlighting the significance of investor sentiments in driving market fluctuations. Cryptocurrency fluctuations demonstrate the interconnected nature of traditional banking systems and digital assets, making understanding these connections crucial for investors navigating the complex world of cryptocurrencies and blockchain technology.

Elon Musk’s Transition to Twitter CTO: Innovative Leap or Disruptive Risk?

Elon Musk plans to transition from CEO to executive chair and CTO of Twitter by late June or early July, overseeing product, software, and system operations. While some believe his tech-savvy leadership might revolutionize the platform, others worry about potential negative consequences and centralization in large tech companies.

Binance Urges US to Adopt Clearer Crypto Regulations Like Europe: A Crossroads Analysis

Binance’s Chief Strategy Officer, Patrick Hillman, voiced concerns over the confusing crypto regulatory environment in the US, urging clearer rules inspired by Europe’s Markets in Crypto Assets (MiCA) framework to support innovation and protect users.

Debunking Meta’s Metaverse Abandonment: AI Integration, Competition, and Future Plans

Meta’s Head of Global Business Group, Nicola Mendelsohn, dispels rumors of abandoning metaverse plans, stating the company’s continued commitment to the project. Despite financial setbacks, Meta aims to combine generative AI and metaverse technology for a groundbreaking digital future.

Avenged Sevenfold Leads Web3 Charge: NFTs, Ticketing, and Challenges in Music Industry

Heavy metal band Avenged Sevenfold leads the exploration of Web3 in the music industry, launching its NFT-based club, Deathbats Club, and partnering with Ticketmaster for token-gated ticket sales. With efforts to provide exclusive opportunities and strengthen fan connections, the band faces challenges convincing other artists to adopt this technology.

Bitcoin Price Resilience Amid Inflation Concerns: Positive or Negative Impact on Demand?

Bitcoin’s price resilience sparks curiosity about its future movement amid easing inflation pressures and labor market challenges. Investors must assess factors like inflation, labor markets, and cryptocurrency prices for informed decisions in the rapidly changing environment.

Exploring Conflicts of Interest: Former SEC Officials and Crypto Connections Debated

Empower Oversight’s lawsuit against the SEC questions potential crypto-related conflicts of interest involving former officials William Hinman and Jay Clayton. The watchdog agency accuses the SEC of failing to comply with FOIA requests, raising concerns about transparency and ethical issues within the regulatory organization, as former officials join law firms and funds associated with cryptocurrencies.