In the ever-evolving world of Bitcoin, the current price remains stable below the $27,000 mark. As investors monitor the price action, several factors are influencing Bitcoin’s trajectory. Notably, Goldman Sachs predicts that US inflation will decline slower than the market expects, introducing a new layer of uncertainty. In addition, the ongoing legal battles between the SEC and prominent players like Binance and Ripple are weighing heavily on the minds of market participants. Amidst all this, JPMorgan sparks a discussion on the future of the US dollar in the face of China’s projected economic dominance. With these factors in play, let’s explore how they shape the current landscape of the Bitcoin market.

Goldman Sachs cautions that the expected rate of decline in US inflation is projected to be slower than the current market expectations. The analysts believe that investors may be underestimating the pace of inflation decline, assuming that a sharp economic growth slowdown would lead to a more rapid decrease in inflation. They also suggest that market sentiment towards energy costs may be more pessimistic than what is reflected in commodities futures.

The Federal Reserve recently decided to pause its cycle of interest rate hikes after implementing ten consecutive increases. Many expect the Federal Reserve to lower interest rates eventually, Fed Chair Jerome Powell stated during a news conference on Wednesday that rate cuts would not be necessary for several years. This statement contributed to the strengthening of the US dollar and weighed on Bitcoin. The cautionary note from Goldman Sachs adds to the factors weighing on Bitcoin’s performance.

Bitcoin (BTC) faced downward pressure due to investor concerns surrounding the SEC vs. Ripple lawsuit and the SEC’s actions against Binance. Additionally, increasing expectations of interest rate hikes and hawkish comments from the Fed added to the bearish outlook. Uncertainty surrounding US regulatory matters and ongoing SEC actions pose short-term obstacles for BTC.

China is projected to become the largest economy in the world by 2030, according to the Centre for Economics and Business Research (CEBR). JPMorgan analysts suggest that even if China surpasses the US economy, the US dollar is unlikely to immediately lose its status as the world’s reserve currency. While China is seen as a potential contender, analysts believe that the US economic, technological, demographics, and geographical advantages make a displacement unlikely. The euro and the Chinese yuan are considered significant threats to the dollar, with experts envisioning a transition to a multipolar reserve currency arrangement. The recent strength of the US dollar has impacted Bitcoin’s price due to its negative correlation with the cryptocurrency.

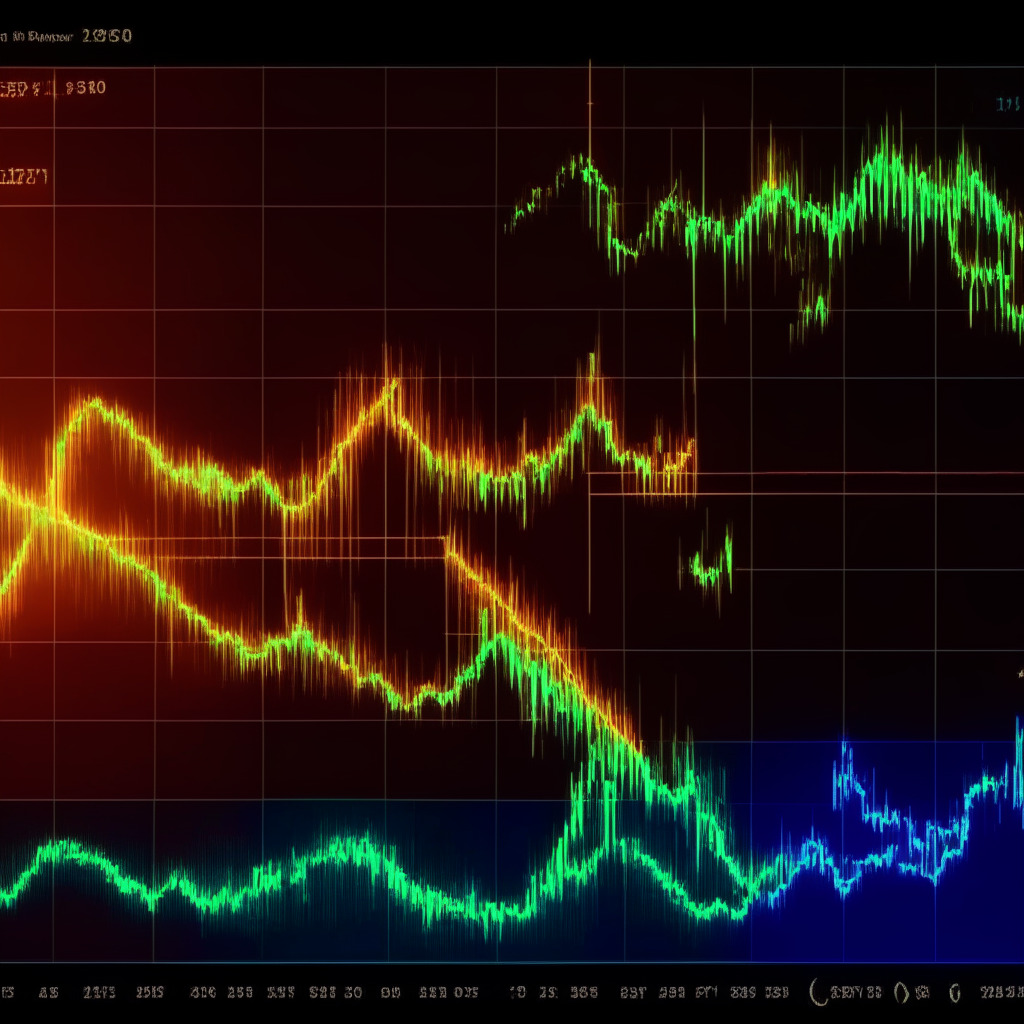

From a technical perspective, the BTC/USD pair recently reached a 50% Fibonacci retracement at $26,610, indicating a weakening bullish sentiment and suggesting a potential price decline if the resistance level at $26,610 holds. On the downside, Bitcoin may find support around the psychological level of $26,100, and a break below this level could lead to further selling pressure, potentially targeting the levels of $25,550 or $24,750. Conversely, a breakout above $26,610 could fuel upward momentum, pushing the price toward the levels of $27,100 or $27,750.

In conclusion, the Bitcoin market is shaped by various factors such as Goldman Sachs’ inflation forecast, the ongoing SEC legal battles, and the discussion of the future of the US dollar. Investors should be aware of these factors and their potential impact on Bitcoin’s price to make informed decisions in this ever-changing landscape.

Source: Cryptonews