In the latest market movements, the largest cryptocurrency, Bitcoin (BTC) has shown remarkable stability at around $30,718, responding with a limited price jiggle to the United States Consumer Price Index’s (CPI) forthcoming announcement. The index, predicted to hit a 2-year low at around 3.2% amidst an ongoing downward trend in U.S inflation, raises an interesting aspect of possibly provoking a reshuffle in the crypto market.

Cynics, however, view this situation with a pinch of skepticism. Speculations abound over the probability of Bitcoin responding with what’s popularly known as the “Darth Maul” candle — a sudden surge in volatility that obliterates both low and high timeframe price levels. The eddy of uncertainty swirls around BTC’s immediate direction post the CPI data revelation.

But hang on to your speculative hats, the story doesn’t end at the CPI release. Historic track records show that the largest cryptocurrency tends to choose its trajectory somewhat post the data announcement. Smokescreens notwithstanding, the market’s real direction for the day is likely to be uncovered sometime after the CPI release.

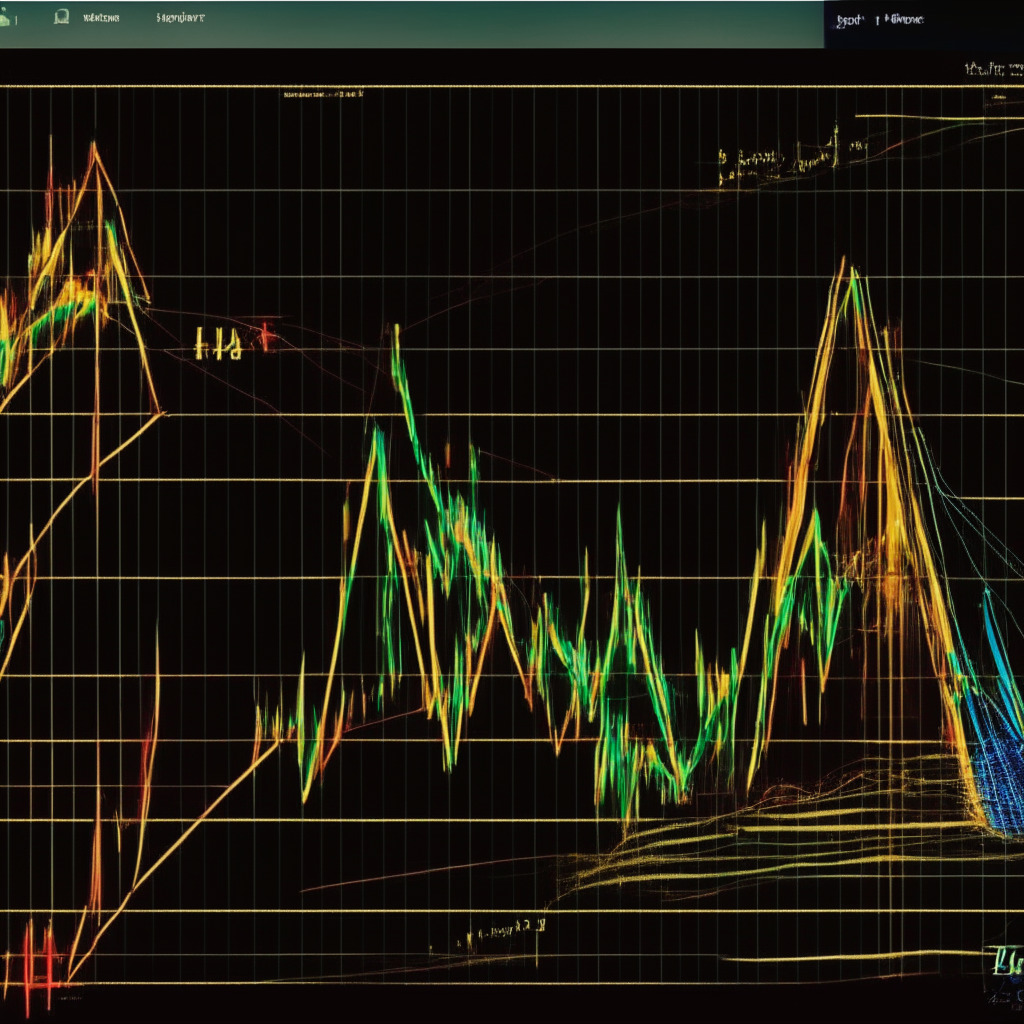

Longer timeframes whisper tales of a potential rerun of the classic bull dances from the past. The BTC monthly chart is witnessing a simmering breakout above its 20-period simple moving average (SMA). If we peruse historical patterns, it becomes evident that Bitcoin surges to momentous bull runs every single time it performs a monthly close ABOVE the SMA 20 line.

Having said that, a degree of caution is warranted. Cryptocurrency investment, as with any financial endeavor, carries inherent risks. Investors, speculators, and observers must carry out meticulous research before firmly deciding their moves.

In the final analysis, blockchain heroes and technology enthusiasts, the crypto market continues its exciting and unpredictable dance. And while the future remains a mystery wrapped in an enigma, one thing seems clear — the cryptocurrency revolution is just getting started. So hold on to your cryptographic hats, the ride promises to be a wild one.

Source: Cointelegraph