In a recent revelation, Coinbase CEO, Brian Armstrong, asserted that Binance traded a considerable chunk of its USDC, a preferred stablecoin on Coinbase, for another stablecoin. To the surprise of many, this did not destabilize the market capitalization of USDC.

The curious thing about Binance’s recent activities is the exchange platform’s inclination towards lesser-known stablecoins. This follows a series of redemption of USDC for United States dollars, leading to speculations. Popular belief now holds that the recent series of events indicates Binance’s conversion towards its new choice “First Digital USD (FDUSD)”.

Historically, Binance had a significant amount of USDC reserves. September 2022 witnessed the crypto exchange announcing the auto-conversion of all user-held USDC on the platform to Binance USD, a Binance-branded stablecoin issued by Paxos Trust Company. It should be noted that they did not reveal plans about selling or converting its reserves to other stablecoins at that time.

This hints at a broader trend: Binance repeatedly showing interest in newer stablecoins. This followed a halt by the New York Department of Financial Services on Paxos regarding the issuance of the dollar-pegged BUSD stablecoin.

In response, Binance resolved its stablecoin needs by turning to TrueUSD (TUSD). However, TUSD had to halt its issuance as well following its depegging. Binance, undeterred by the setbacks, turned to another relatively unknown stablecoin – FDUSD.

Defying odds, FDUSD gained traction in a few weeks, prompting Binance’s decision to launch several trading pairs for the stablecoin, coupled with zero trading fee offers. Even USDT felt the pressure due to the brimming attention towards FDUSD.

Although USDC was once seen as a genuine competitor to the market leader, USDT, the past year saw USDC’s market cap shrinking by nearly half. It fell from $44.5 billion at the start of this year to $26 billion today.

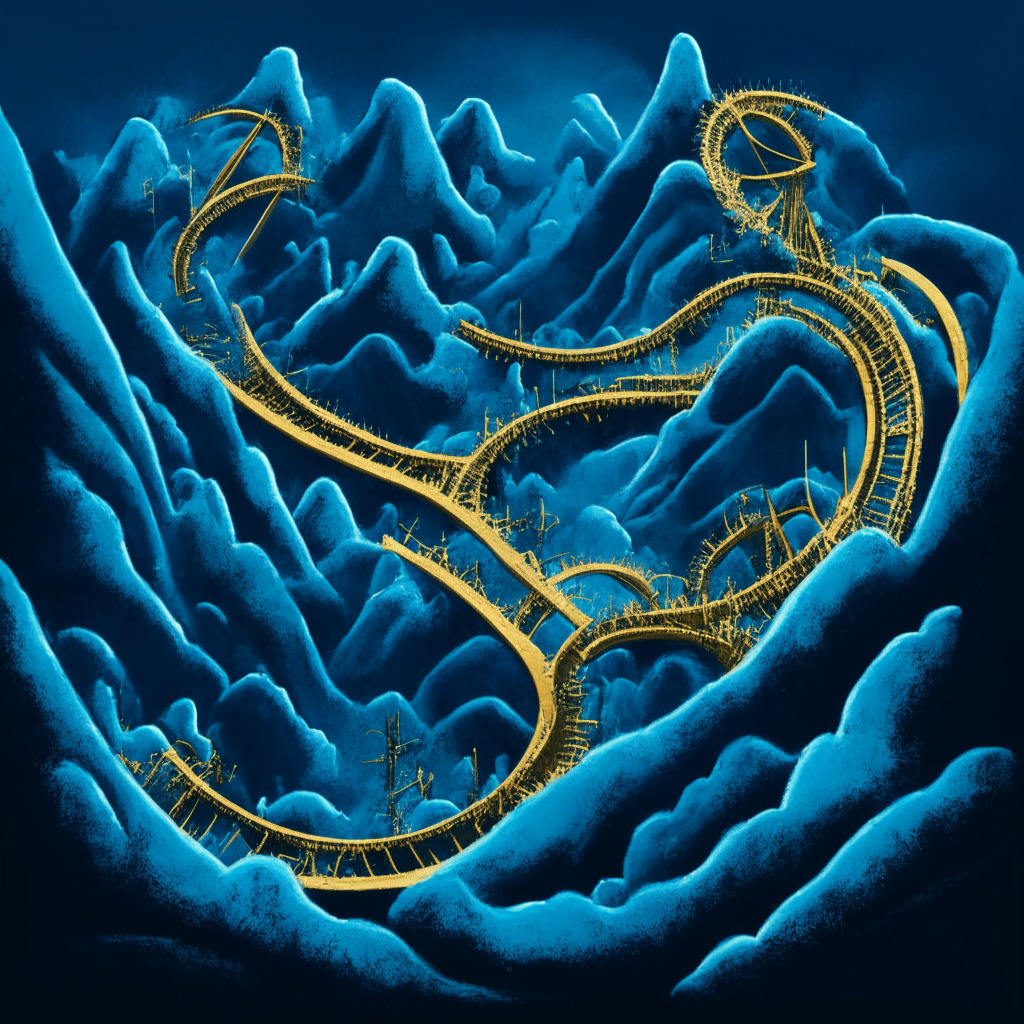

The fascinating trend that we observe demonstrates an interesting dynamic of the crypto markets. Who could have expected that Binance’s decision to divest from a stablecoin like USDC towards a newcomer like FDUSD could lead to such market intrigues? However, it’s worth watching how these decisions play out as, for now, the market has held phenomenally. But one can only wonder if such eccentricities could lead to any major market upheavals in the future.

Source: Cointelegraph