Big fish in the crypto sea, otherwise known as whale entities, took advantage of the recent decline in cryptocurrency prices, swiftly scooping up vast amounts of Etherum (ETH). Data from LookOnChain reflects that these significant players accumulated an impressive total of $94 million in ETH over the past week.

In the realm of crypto, the term ‘whales’ is designated to those investors who wield control over substantial amounts of a digital asset. Their buying or selling sprees can cause substantial ripples in the market, much like a whale’s movement disturbs the ocean. Hence, their activities are closely monitored by cryptocurrency enthusiasts who are trying to anticipate market trends.

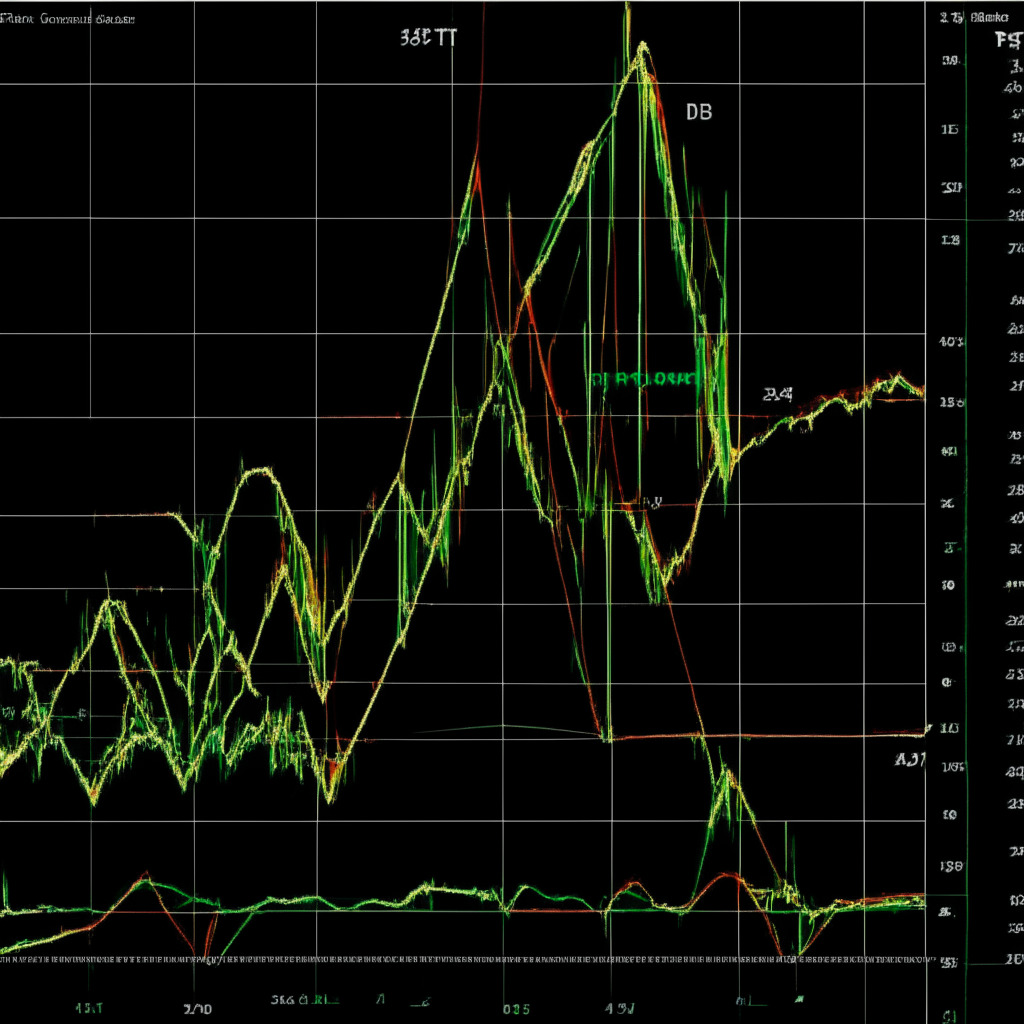

This splurge on ETH by these giants of the market happened amidst a considerable slump in cryptocurrency prices, the weakest it’s been since June. ETH took a plunge from nearly $1700 to a dip below $1550 within just few hours last Thursday. Interestingly, it was in this bleak time that the whales saw an opportunity and swooped in. The speed at which they adapted to the volatile landscape sheds light on the appeal of such fluctuations to big players.

Moreover, ETH’s fall mirrored a similar trajectory of the FTX exchange collapse in November last year, where it dipped below $1,000. The rapid oversold condition of ETH was evident with the relative strength index (RSI) indicator bearing a stark resemblance to the crisis last year. However, where many perceived a grim situation, whales saw potential gain.

It wasn’t only ETH’s big players that took advantage of the turbulence. The well-sized holders of Bitcoin were no different. Wallets containing between 10 and 10,000 units of BTC increased their holdings by a total value of $309 million since August 17, notes the crypto analytics firm Santiment.

The story rings clear: while a plummeting crypto market might provoke stress and panic in some, these holders of significant wealth see dips as prime opportunities. Nevertheless, the activity of whales is a double-edged sword. While their large investments can stabilize falling prices, their massive sell-offs can equally trigger market-wide declines. The fascinating interplay between those major investors and the rest of the market continues to shape the cryptocurrency landscape.

Source: Coindesk