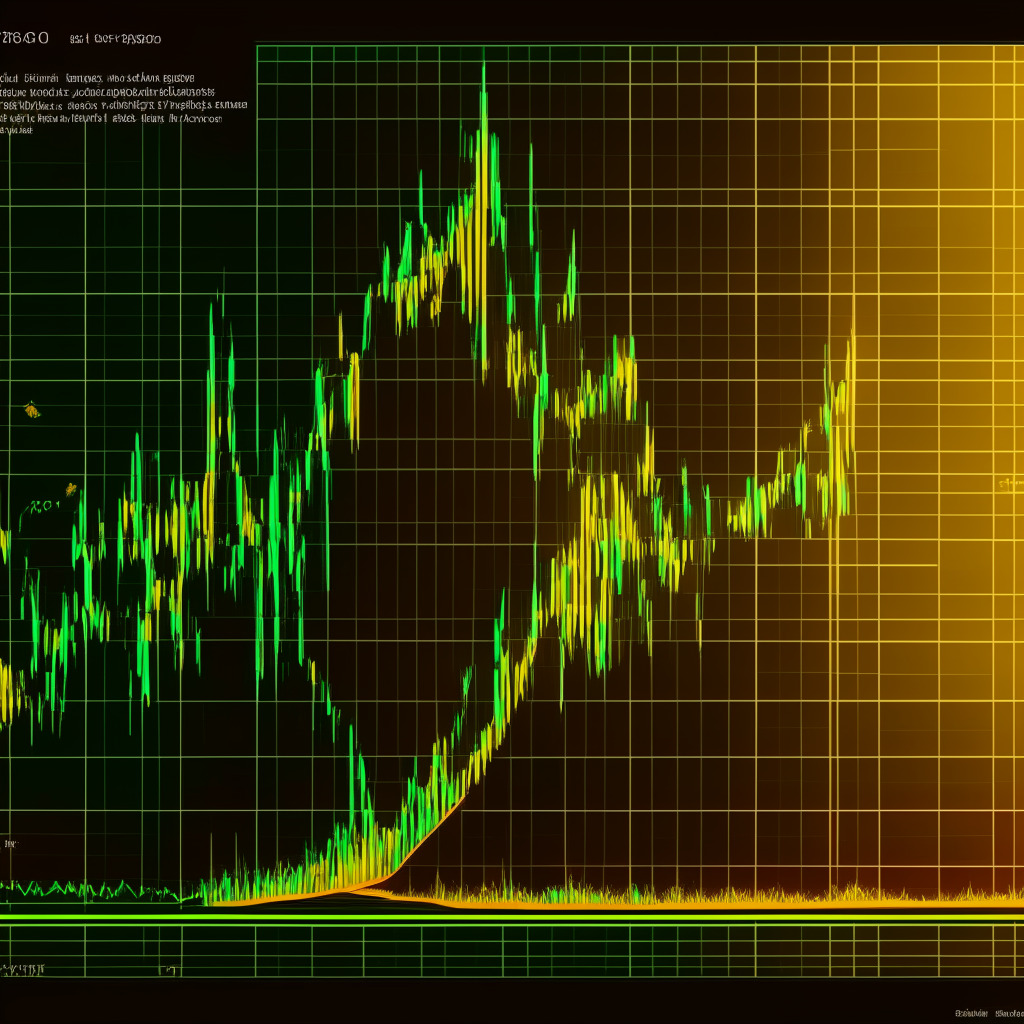

In a time of heightened interest and speculation, the BTC price appears to be holding steady on a 200-day trend line. Some traders are even placing their bets that the current low is in, as data from Cointelegraph Markets Pro and TradingView indicates. Despite the cryptocurrency retracting from local highs exceeding $28,000, the market has yet to witness a complete reversal.

Many are considering this news to be a good sign, as BTC/USD successfully adheres to a long-term trend line which was previously lost as support in the early days of August. This trend line comes in the form of the 200-day exponential moving average (EMA), currently at $27,180. Multiple hourly candles closing below into the end of August couldn’t cause a more profound breakdown. As a result, Bitcoin is close-knit with the 200-day EMA as the month draws to a close.

This bullish outlook significantly differs from the many bearish market viewpoints presently shared by renowned sources. Many of these sources predict Bitcoin to return to $25,000 or dip even lower. Yet, the trader Jelle maintains optimism, placing significance on Bitcoin holding above $27,000.

As Bitcoin continues to face resistance reclaiming certain bull market moving averages earlier in the month, the BTC price outlooks continue to contradict each other, rekindling a spectrum of contradictory expectations swirling around cryptocurrency.

Additionally, developments in other cryptocurrencies are influencing the market scenario. Crypto exchange Binance has proposed plans to gradually ax support for its BUSD stablecoin by February 2024, guiding users to instead use the First Digital USD stablecoin, launched by the Hong Kong-based trust company First Digital Group. This is to align with Paxos’ intent to cease BUSD redemption by that time.

All of these events appear to show the industry’s predisposition to a sort of continually evolving dynamic that is as uncertain as it is exciting. All these factors combined, it provides a complex environment where stakeholders need to monitor trends closely. In a market as volatile as cryptocurrency, decisions must be informed, calculated, and not without conducting individual research to truly comprehend the accompanying risk.

Source: Cointelegraph