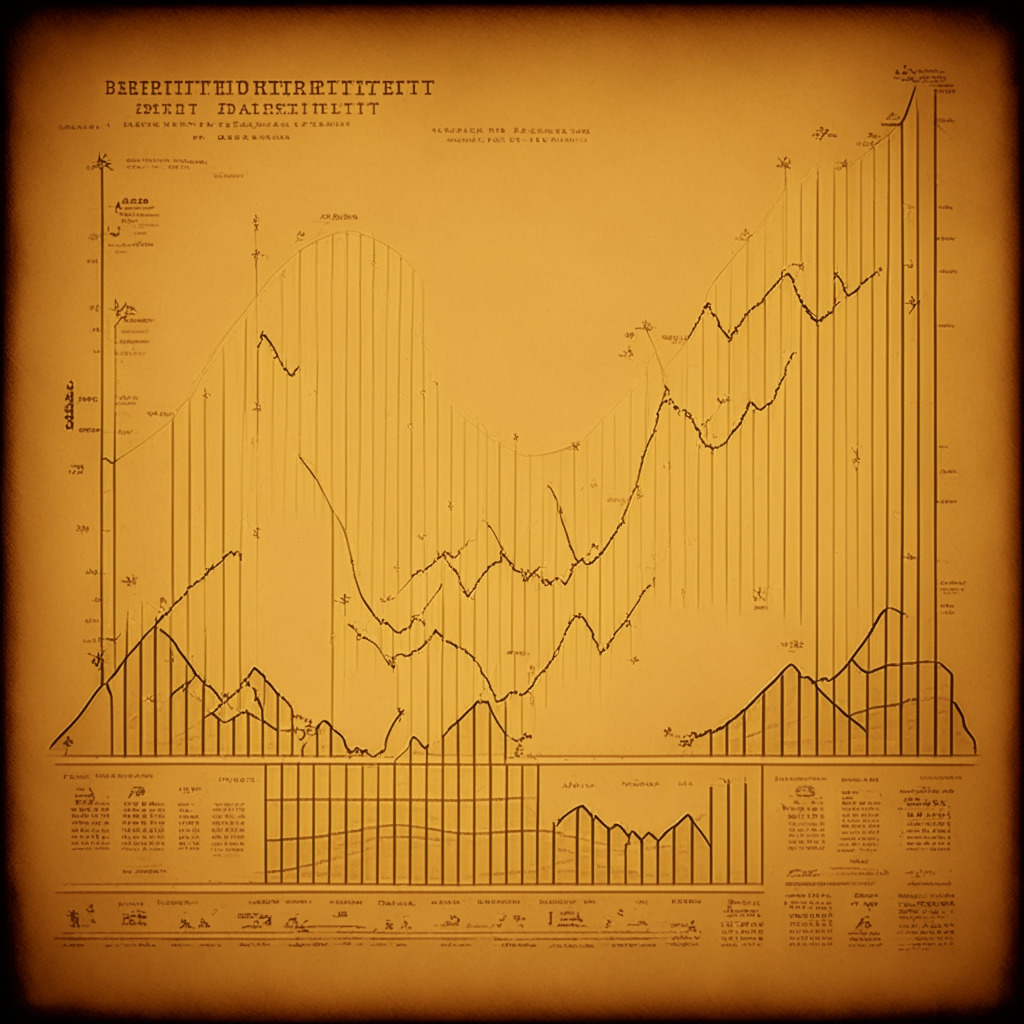

“Even though Bitcoin saw a price surge of 683% in the year following Buffett’s critical comments on non-productive commodities, Bitcoin’s performance unmatched the returns from Berkshire Hathaway’s pertinent stock holdings. The consistent outperformance of Bitcoin’s price against Berkshire Hathway’s shares encourages investors to view Bitcoin as a viable alternative store of value.”

Search Results for: Oracle

AI in Cryptocurrency: The Oracle of Modern Finance or a Risky Bet?

“The financial sector is embracing AI crypto platforms like yPredict for accurate forecasting of volatile cryptocurrency markets using science-backed algorithms and machine learning. However, investments in such technologies carry inherent risks. yPredict’s offerings include a prediction marketplace and analytical tools using the ARIMA model and LSTM tool for accurate price forecasts.”

The Chainlink Boom and the Role of CCIP: Whales, Oracles, and Cross-Chain Applications

Following Chainlink’s Cross-Chain Interoperability Protocol (CCIP) release, LINK experienced a surge due to increased interest from large investors. CCIP, a key initiative aimed at improving cross-chain services and applications, is now live on multiple blockchains, positioning Chainlink as a prominent player in the growing blockchain technology industry.

Sui Network and Oracle Red Bull Racing: Unleashing Blockchain’s Potential in Sports

Layer-1 blockchain protocol Sui Network announces partnership with Oracle Red Bull Racing to create immersive digital experiences for fans. The collaboration aims to exhibit the potential of blockchain technology in developing productive human interactions within the sports industry.

The Oracle’s Verse: Crypto Novel Revolution or Artistic Quality at Risk?

The Oracle’s Verse, a unique “crypto novel,” allows multiple writers to contribute to an ongoing story by selling their creations as evolving non-fungible tokens (NFTs). This innovative concept offers a decentralized alternative to traditional novel writing, providing passive income and instant publication on the blockchain, but raises questions about long-term narrative quality and consistency.

Revolutionizing Crypto Trading with AI: Bitcoin Oracle’s Transparent & Adaptive Platform

Impact Marketing introduces its machine learning crypto asset trading platform, Bitcoin Oracle AI, which offers transparency, adaptability, and a blend of AI and human strategies. The platform collects and analyzes real-time crypto market data to generate potentially profitable trading signals, adapting to the ever-changing cryptocurrency landscape.

AI-Powered Trolly Problem: ChatGPT Predicts Crypto Winners and Losers, But Can We Trust the Oracle?

Coinbase executive Conor Grogan recently unveiled a technique that allows the artificial intelligence (AI) tool […]

Decentralized Social Media: Friend.tech’s Soaring Success Amid Crypto Industry’s Security Chaotic Quarter

“Decentralized social media platform, Friend.tech has surpassed 10,000 ETH in revenue and 30,000 ETH total value locked (TVL). Despite early criticisms questioning its longevity and revenue model, the platform’s continuous growth asserts its increasing appeal. However, digital asset security remains a concern, with Q3 2023 losses nearing $700 million due to securities incidents.”

Crypto Security Alert: $700M Lost in Q3 2023, Reflecting on Weaknesses in Blockchain Safety

“The third quarter of 2023 witnessed a loss of about $700 million in digital assets due to 184 security incidents, according to a report by CertiK. Major causes included private key breaches, exit scams, and oracle manipulation, underscoring blockchain security imperfections. Despite these challenges, the industry continues to evolve with focus on increasing security standards.”

Unveiling the Veil: Chainlink’s Multisig Reduction and Other Noteworthy Crypto Developments

Chainlink’s change to its multisig wallet practices has raised questions around transparency and accountability in the crypto world. Meanwhile, Mixin Network offers a bounty to recover exploited funds, Uniswap seeks increased funding, and Curve Finance’s founder reduces his debt. Progress, despite controversy, highlights the resilience and potential growth of the DeFi sector.

Leap into Blockchain Future: Chainlink Incorporates CCIP into Coinbase Layer 2 Network

Blockchain oracle network, Chainlink, has integrated its Cross-Chain Interoperability Protocol (CCIP) into the Coinbase layer 2 network, Base, enabling developers to create web3 products and launch transactions across different networks. This step advances the adoption of innovative crypto products, as Chainlink’s move towards cross-chain lending expands. However, the challenge of potential centralization criticism remains.

Unmasking the Surge: Dissecting TRB’s Rise and BTCBSC’s Promising Debut

“The Oracle project, TRB has seen a surge of 37%, drawing crypto community attention. Oracles like TRB connect live external data to smart contracts and blockchains. Amid speculation, BTCBSC, a Bitcoin derivative, has raised over $5.8 million, promising faster transactions and incentivized staking, while warning of market volatility.”

Decentralizing Crypto Prices: The Pros and Cons of Relying on Blockchain for Price Estimates

The UTXOracle, a tool created by a developer @SteveSimple, uses Python programming to independently trace Bitcoin’s price using a Bitcoin Core full node, without relying on external sources. This open-source tool calculates an average daily USD price for Bitcoin by scrutinizing block patterns, offering a decentralized method, as opposed to obtaining price info from centralized exchanges. These capabilities can impact crypto smart contracts and promote a fully decentralized finance system.

Navigating the Dawn of the Crypto Revolution: Challenges, Speculation, and the Road Ahead

“We are on the brink of a new era in virtual economics, foreseen by Coinbase exec, Jesse Pollak, with massive crypto application use. Base, Coinbase’s new blockchain, is joining key players like Ethereum, providing a platform for DApps development. However, challenges like reducing DApp access cost and improving wallet experiences need to be overcome. Coinbase envisions exiting the speculative stage into utility for everyday people, realizing the potential of diverse blockchain applications.”

Decoding Chainlink’s Multisig Wallet Controversy: Centralization Concerns Vs. Market Performance

Chainlink recently altered its multisig wallet’s signature rule, shifting from a 4-of-9 to a 4-of-8 requirement. Critics suggest this change and removal of a wallet address may indicate potential centralized control risking the DeFi ecosystem’s integrity. Regardless, Chainlink maintains its utility in DeFi projects and its token value keeps growing.

Massive Ethereum Movements: Buterin’s Wallet Activity Sparks Market Speculation

“A series of large Ethereum transactions linked to Vitalik Buterin have been detected, including a 400 ETH transfer to Coinbase. These deposits, ranging over 10 days and amounting to nearly $3.94 million, have sparked speculation about a potential sell-off and its impact on the ETH price.”

Chainlink’s Signature Change: A Decentralization Dilemma Stirring Trust and Security Concerns

Chainlink recently made an unannounced change to its multi-signature wallet. The number of signatures required for transactions was reduced, which raised concerns about the decentralization risk of the blockchain platform. Despite clarifications from Chainlink, the skepticism remains and highlights the often unresolved trade-off between absolute decentralization and absolute security in the blockchain world.

Decoding the Legal Fray: Fenwick, FTX and the Boundaries of Crypto Accountability

“Fenwick & West, a Silicon Valley law firm, is accused of involvement in a fraud involving the insolvent crypto marketplace, FTX. The firm asserts its services were within legal realms and lacked awareness of fraudulent actions. The case underscores the complexities of cryptocurrency and brings focus on stakeholder accountability.”

Unleashing the Potential and Pitfalls of Chainlink’s Entry into Ethereum Layer 2

Chainlink’s entry into Ethereum layer 2, Arbitrum, will facilitate cross-chain DApp development, aiding high-throughput, cost-efficient scaling. The addition of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) on Arbitrum One should unlock various use cases like cross-chain tokenization and blockchain gaming.

Unraveling the Regulatory and Ethical Quagmires: Navigating through the Crypto Landscape

A U.S. federal judge delayed a sentencing hearing for radio host Ian Freeman, who allegedly created an illegal Bitcoin exchange used by scammers. Meanwhile, the DeFi Education Fund contests a patent claim by tech company True Return Systems. Also, DigiFT’s dETH0924 provides up to 4% APR, boosting Ethereum’s PoS mechanism, while crypto infrastructure provider Qredo integrated Circle’s USDC stablecoin into its wallet.

Decentralized Finance vs Centralized Finance: Coming Conflict or Synergetic Co-Existence?

“CEO of Binance, Changpeng Zhao, predicts a future where DeFi surpasses CeFi, fueled by his belief in the potential of decentralization. However, the Bank for International Settlements argues that pure DeFi has limited real-world application due to its requirement for centralized oracles.”

Exploring the Rising Star of Cryptocurrencies – Chainlink vs. Launchpad.xyz: Potential Gains and Risks

Chainlink’s (LINK) price has increased due to its partnership with Swift’s Cross-Chain Interoperability Programme in tokenization trials. This partnership, along with other positive drivers, like integration with Balancer, predicts a robust upward trajectory for LINK in the cryptocurrency market.

OriginTrail: Leading the Age of Decentralized Knowledge Graphs with AI & Blockchain

“OriginTrail aims to build a ‘trusted knowledge foundation’ via a Decentralized Knowledge Graph (DKG) to counter AI-induced distortions or supply chain fraud. Leveraging blockchain technology, this multi-chain protocol allows users to create ‘knowledge assets’ and extract value from them.”

Chronicle’s Leap Forward: Lower Gas Fees, More Networks and Integrity Questions Unanswered

“Chronicle, the second-largest oracle provider, is set to expand its services to other networks, thereby introducing more competition to the oracle landscape. The Chronicle Protocol aims to reduce gas fees by 60% envisioning higher platform utilization and maintaining uncompromised data integrity with data origin monitoring user dashboards.”

Jump Crypto Specialists Leave to Found Douro Labs: A Strategic Shift or Split in the Blockchain Scene?

Innovative blockchain project Douro Labs, established by ex-Jump Crypto specialists, aims to solve scaling issues within Pyth Network – a blockchain-based Oracle data service instrumental in orchestrating crypto, equity, and FX data across multiple blockchains. This marks a significant shift within the volatile digital trading landscape.

Leveraging the Crypto Winter: The Dawn of Tokenization and a Programmable Web3 Economy

“The future of Web3 technology lies in tokenizing real-world assets (RWAs), potentially unlocking the next crypto surge. Blockchain is already being used by financial institutions for RWA tokenization, creating transparent transactions while reducing intermediaries. However, challenges remain in bridging the physical-digital divide.”

Swift’s Blockchain Integration vs Central Bank Digital Currencies: A Comparative Analysis

Swift’s recent report asserts that short-term blockchain integration is a more feasible solution for market development than unifying Central Bank Digital Currencies and tokenized assets on one ledger. It suggests that connecting existing systems with blockchains addresses interoperability issues between diverse blockchain networks, improving efficiency and user experience.

Unraveling the $6.5M Exit Scam: Dark Side of Decentralization or User Responsibility?

A recent event involving Magnate Finance draining users of approximately $6.5 million has raised concerns about the safety of decentralization. The anonymous founders disappeared, leading to suspicions of an exit scam. The incident resulted in a massive loss, equating to the total value locked in the protocol. Despite the perks of decentralization, its nefarious potential for scams and hacks is increasing, costing the crypto ecosystem an estimated $656 million in the first half of 2023 alone.

Coinbase Ventures Betting Big on RocketPool: A Strategic Investment or Risky Gamble?

“Coinbase Ventures is making strong developments in the cryptocurrency sphere through its association with Rocket Pool. With active participation in Rocket Pool’s Oracle DAO and significant investment in the RPL token, the platform shows faith in not just the token, but the protocol itself. These strides indicate Coinbase’s brand-orientated approach and recognition of Rocket Pool’s potential, especially considering its performance and valuable backing in the market.”

DeFi Protocol EraLend Robbed of $3.4M: A Wake-up Call for Blockchain Security

“EraLend, a Decentralized Finance (DeFi) Protocol, has lost $3.4 million in a ‘re-entrancy attack’. This incident underscores the need for advanced security protocols within blockchain transactions, highlighting how dependencies and vulnerabilities can be exploited.”

Unraveling the Binance Labs’ $10M Bet on Radiant: A Game Changer for DeFi Evolution?

Binance Labs invested $10 million in digital marketplace Radiant Capital, seeking to facilitate new tech developments and expand Oracle support and cross-chain liquidations. Radiant aims to resolve liquidity bottlenecks in the DeFi ecosystem, providing easy omnichain lending experiences and planning to onboard next 100 million DeFi users.

Navigating Blockchain Security: Unpacking the Conic Finance Exploit and the Path Forward

The decentralized finance platform, Conic Finance, was recently exploited for $3.26 million in ETH via a single transaction. This incident highlights ongoing concerns about blockchain security and emphasizes the need for more sophisticated protection measures even as blockchain contracts continue to innovate and evolve.