“Burn Kenny Coin, a new South Park-themed project, is causing excitement among meme coin enthusiasts with its presale of $KENNY tokens. Garnering $400,000 within 24 hours, this low cap gem hints at explosive growth potential, leveraging scarcity and an inbuilt burn mechanism.”

Search Results for: coin gape

Mr Hankey Coin Makes a Strong Debut on Uniswap: A Shitcoin with Potential or Another Risky Asset?

“South Park-themed Mr Hankey Coin ($HANKEY) made an impressive debut on Uniswap, rallying from a launch price of $0.00125 to $0.0028, captivating presale investors. Contrasting other cryptocurrencies, $HANKEY exhibits potential for growth despite a moderate market cap of $2.5 million.”

Bitcoin Rises Above $30,000: Institutional Investors’ Role and the Outlook for Future Crypto Markets

Despite predictions of a downfall, Bitcoin remains above $30,000 due to interest from institutional investors and a strong market structure. Major companies, such as MicroStrategy and Blackrock, have made significant investments, reinforcing the crypto market’s credibility. However, the possibility of regulatory challenges and market fluctuations calls for vigilance among traders.

Grayscale vs SEC: The Battle for Bitcoin ETF Approval and Its Impact on Crypto Market

The Grayscale Bitcoin Trust (GBTC) experiences a surge in trading volume amid increasing attention towards Bitcoin ETFs. Experts suggest that the SEC may soon approve Grayscale’s Bitcoin ETF application. Grayscale currently has a 70% chance of winning their lawsuit against the SEC, potentially forcing ETF approval by August 2023.

June 2023: Game Changer for Bitcoin ETFs as Major Corporations Join In – Pros and Cons

June 2023 marks a pivotal moment for Bitcoin ETFs as major corporations like Blackrock, Invesco, WisdomTree, and Bitwise submit applications to the SEC. This could boost the crypto market and potentially alter cryptocurrency perception among traditional financial market participants.

MATIC Price Recovery: Can Polygon Coin Surpass $0.75 Amid Market Sentiment Shift?

The MATIC price displays a steady uptrend with dynamic support to buyers, suggesting the potential to surpass the $0.75 mark. However, decreasing volume in its current recovery and possible selling pressure from overhead trendlines could impact this momentum. Technical indicators suggest a short-term buy signal, but market conditions remain subject to change.

Bitcoin Cash Surge: Sustained Growth or Temporary Boost from EDX Listing?

Bitcoin Cash has surged 115.5% in price, reaching $236.6, likely due to its listing on EDX Markets. The rally may lead to an 11.5% increase hitting the $260 mark, but a potential correction phase and resistance level could impede further growth.

Navigating Bitcoin’s Bullish Outlook: Potential $38,000 Highs and Max Pain Threshold Dangers

Bitcoin price sustains above $30,000, attracting more buyers and aiming to challenge seller congestion between $31,000 and $32,000. Despite consolidation, investors should remain cautious as the Relative Strength Index (RSI) retraces from the overbought region, potentially leading to market turbulence.

Battle for Bitcoin ETF Approval: Ark Invest vs. BlackRock – Who Will Prevail?

Cathie Wood’s Ark Invest declares itself as the top candidate for potential SEC approval for a Bitcoin ETF, competing against BlackRock’s recent spot BTC ETF application. Analysts argue that Ark Invest holds an advantage due to an earlier submission date, while the outcome of approval remains uncertain.

El Salvador’s Bitcoin Adoption: A Boon for Crypto or Road to Regulatory Challenges?

Samson Mow, CEO of JAN3, emphasizes the need to educate more people about the crypto market as El Salvador’s progress in developing the Bitcoin ecosystem garners global attention. Their actions could potentially influence other economies and lay the foundation for political measures in favor of cryptocurrency.

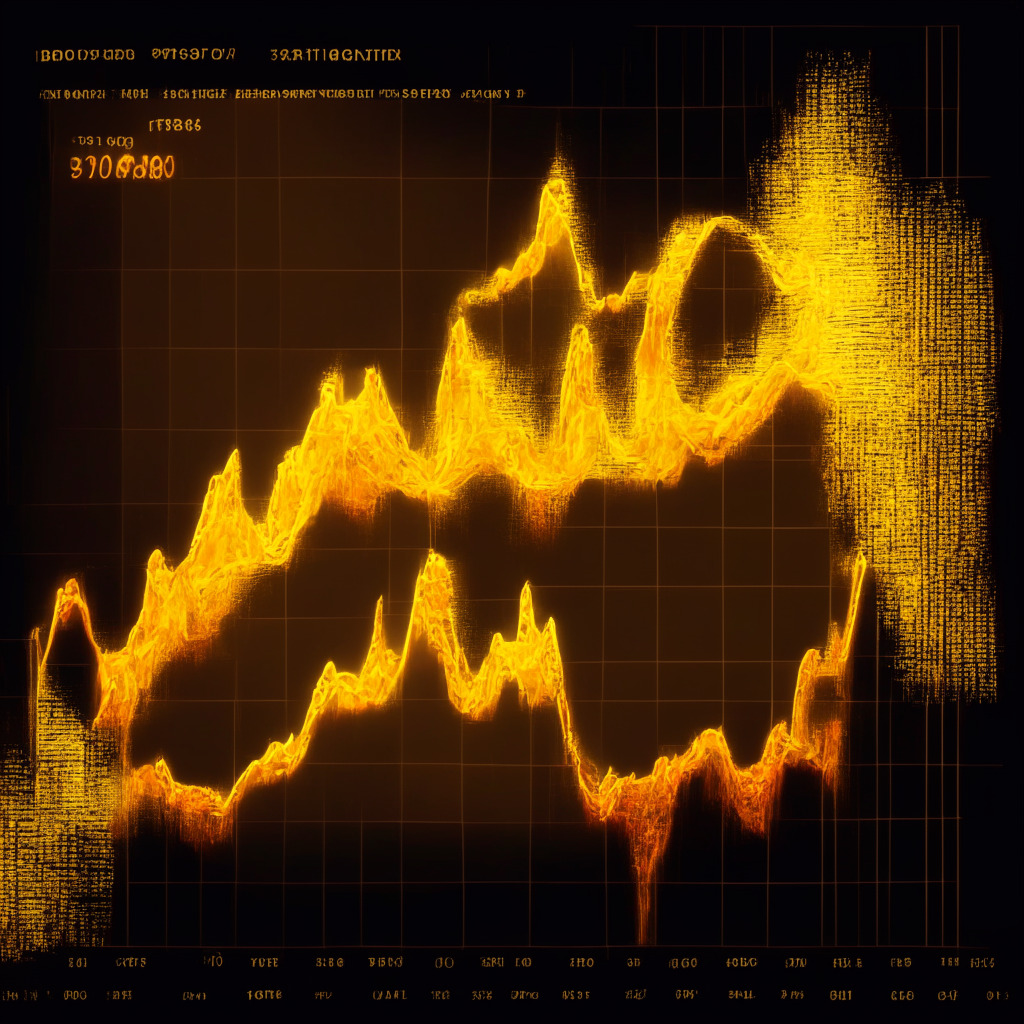

Bitcoin’s Struggle at $30k: Analyzing Market Structure, MACD Signals, and Exchange Supply

Despite a recent 1.1% loss, Bitcoin’s market structure shows an uptick above all applied moving averages and a short-term descending trendline since mid-April, suggesting buyer dominance. With supply held across exchanges at its lowest since 2017, reduced selling pressure and increasing demand set the stage for a potential rally.

Crypto Inflows Skyrocket: Bitcoin Dominates while Altcoins Lag Behind

The cryptocurrency investment sector recently experienced its largest weekly inflows since July 2022, totaling $199 million, mainly due to Bitcoin ETF applications. Bitcoin attracted 94% of the total inflows, while Ethereum and altcoins saw minimal impact on investments. The involvement of traditional financial giants and increasing interest in multi-asset investment ETPs influence the market sentiment.

Navigating the Regulatory Dilemma: Binance, Coinbase and the SEC’s Ambiguous Stance

The legal complications faced by Binance and Coinbase highlight the inconsistent and unclear approach adopted by regulatory bodies like the SEC. Increased collaboration and well-defined guidelines could ensure stability and growth of the cryptocurrency market, balancing security and innovation.

Dogecoin’s Rocky Path to Recovery: Exploring Market Sentiment and Technical Barriers

The Dogecoin price has surged nearly 18% after a recent upswing in buyer accumulation, currently trading at $0.067. However, a downsloping resistance trendline presents a challenge for further recovery. A bullish breakout could potentially lead to a 22% upswing, reaching $0.083, but traders should be cautious and conduct thorough market research before investing.

Coinbase Share Price: Analyzing Bullish Reversal, 42% Rally Potential, and Key Challenges

The Coinbase share price demonstrates a prominent bullish reversal pattern known as the double bottom, suggesting active accumulation and a potential 42% rally. Despite challenges posed by neckline resistance and EMA indicators, a sustained buying could push the asset price further, backed by an optimistic market outlook.

Bitcoin ATH Fuels Bullish Market Sentiments: Pros and Cons of a Strong Uptrend

Bitcoin reaches an All-Time High above $31,000 with bullish market sentiments, as on-chain signals suggest further uptrend. Over 1.8 million Short-Term Holder coins are now profitable, and long-term HODLers’ commitment reduces overall supply, supporting Bitcoin’s price. Favorable fundamentals and positive news solidify the bullish mid-to-long term outlook.

Pepepcoin’s V-Shaped Recovery: Temporary Pullback or Sustainable Rally Ahead?

Pepepcoin’s price has risen 82% amidst a positive crypto market sentiment, showcasing high buying momentum and increasing trading volume. A minor pullback is expected before continuing the prevailing recovery trend, possibly presenting dip opportunities for traders before the resurgence of the recovery rally. Conduct thorough market research before investing.

Bitcoin ETF Hopes Fuel Rally: Can Bullish Momentum Sustain or Is a Pullback Imminent?

Bitcoin price experienced a remarkable recovery, rising 25.4% in two weeks, driven by the possibility of a US spot Bitcoin ETF. The rally reflects a bullish momentum, but a minor pullback might occur before continuing the upward trend. Key indicators project a strong bull trend, but investors should consider potential market fluctuations before making decisions.

Bitcoin’s Struggle to $40K: Analyzing Barriers and Market Influencers Amid Economic Uncertainty

Bitcoin hit a one-year high of $31,400, but Bloomberg Intelligence’s Mike McGlone cautions headwinds could impede progress towards $40,000. Factors like the potential US recession, equity bear market, and hawkish central banks could influence Bitcoin’s performance.

Bitcoin’s Surge to $31K: Leveraged ETF Impact, Future Outlook, and Potential Risks

The recent surge in Bitcoin price to around $31,000 is driven by positive market sentiment following the approval of a new leveraged Bitcoin ETF in the US. Despite potential risks, experts are optimistic about the upward trend.

Bitcoin Bulls Eye $35,000 While ETFs Gain Traction: Analyzing Market Drivers

Bitcoin bulls hold onto the $30,000 level as BTC price consolidates after a recent rally, with sentiment high for a potential rise to $35,000. Increasing interest in crypto assets and Bitcoin ETF filings, along with the upcoming 145,000 BTC options expiry on June 30, are key market events to watch.

Coinbase Victory in Court: Impact on Crypto Regulations and Consumer Protection Debate

The recent Supreme Court ruling in favor of Coinbase, directing customer disputes into arbitration, highlights the evolving regulatory landscape for the crypto industry. It raises questions about consumer protection and the role of organizations like the International Monetary Fund in regulating the crypto space.

Binance.US Resolves Withdrawal Issues, Pushes Stablecoin Adoption Amid Banking Concerns

Binance.US has resolved its USD withdrawal issues, but cautions users that banking partners may cease services soon. The exchange is seeking alternative partners and recommends users convert USD balances to stablecoins, anticipating a transition towards a crypto-only exchange.

Bitcoin ETFs: Market Euphoria and Crypto Bulls Defying SEC Crackdown

The recent rush of spot Bitcoin ETF applications has fueled market euphoria, with experts suggesting approval could profoundly impact Bitcoin’s market structure. Despite SEC crackdowns on major exchanges, bullish sentiments prevail, as evidenced by expiring options in various BTC price ranges showing a net advantage for buyers. Proceed with caution due to market volatility.

Japan’s Stablecoin Law: Opportunities, Challenges, and the Future of Crypto

Japan’s largest bank, Mitsubishi UFJ Financial Group (MUFG), is engaging in discussions with global stablecoin issuers to mint tokens on its Progmat blockchain platform, following Japan’s new stablecoin law. MUFG’s VP of Product, Tatsuya Saito, emphasized the importance of stablecoins in providing reliable assets for investors during volatile trades and how Japan could potentially become a hub for stablecoin issuance.

Litecoin Achieves All-Time High in Transactions: Adoption, Scalability, and Market Impact

Litecoin (LTC) has achieved an All-Time High (ATH) in payment transactions, showcasing its growing acceptance as a practical payment option across various sectors. This milestone also signifies cryptocurrencies’ potential to effectively serve as a medium of exchange, challenging traditional financial systems.

Bitcoin’s Surge: Factors Driving Growth and Challenges Ahead in the Crypto Ecosystem

The recent 19.04% surge in Bitcoin price has brought hope to investors, as the cryptocurrency stabilizes around $29,000-$30,000 range. Key factors driving growth include Tether Holdings announcing Bitcoin mining investment plans, potential approval of a Bitcoin ETF, and the upcoming Bitcoin Halving event.

Bank of England’s Rate Hike Impact on Bitcoin and Ethereum: Navigating Volatility

Bitcoin and Ethereum prices witnessed retracements after the Bank of England’s unexpected 50 basis points interest rate hike, aimed at combating 8.7% inflation. Analysts predict possible consolidations in the crypto market, while traders remain optimistic about Bitcoin reaching $35,000, supported by whale accumulation.

Tesla’s Dogecoin Adoption: Boon or Bane for Crypto Market and Token Value?

A recent Twitter discovery revealed a dedicated page on Tesla’s official website focusing on Dogecoin payments, indicating Tesla’s recognition of Dogecoin as a legitimate payment option. The impact on DOGE’s value and the market remains uncertain, emphasizing the importance of cautious decision-making and thorough market research among investors.

Bitcoin Rally Defies Expectations: Analyzing Market Speculation and Future Risks

The current Bitcoin price rally contradicts traders’ sentiment, with over $158 million worth of short positions liquidated in the last 24 hours. This 20% increase in the past week could indicate excessive speculation and FOMO, potentially leading to short-term volatility and unsustainable long-term growth. Investors are advised to remain cautious and informed.

Pepe Coin Skyrockets 40%: Will SHIB, DOGE, and FLOKI Follow This Crypto Rally?

The cryptocurrency market surges as Pepe Coin (PEPE) experiences an impressive 40% gain, raising investors’ interest and questioning if popular cryptocurrencies like Shiba Inu, Dogecoin, and FLOKI will follow. Despite market challenges, PEPE emerges as the crypto rally’s biggest winner.

Surge in Spot Bitcoin ETF Applications: Industry Expansion or Consumer Risk?

Financial giants Valkyrie and Bitwise have joined the race to bring a spot Bitcoin ETF to market alongside BlackRock, Invesco, and WisdomTree, aiming to offer accessible, regulated options for investors. Despite previous SEC rejections, crypto industry participants believe BlackRock’s entrance could change the SEC’s stance, potentially leading to increased legitimacy and regulation in the cryptocurrency market.