The cryptocurrency market showcases mixed results, with varied percentage gains and losses of numerous tokens. BTC and Ethereum experienced decent gains, while Ripple’s XRP, AAVE, and Crypto.com Coin saw slight declines. Investors should watch market trends and remain cautious before making financial decisions in the volatile crypto world.

Search Results for: Lyzi

Bitcoin Soars Beyond $31,000: Analyzing Factors, Risks, and Future of Crypto Market

Bitcoin recently reached a one-year high of over $31,000, with factors such as BlackRock’s application to launch a spot ETF fueling interest. However, skepticism arises as concerns about market sustainability and volatility remain. The rise in value signals growing cryptocurrency adoption, but investors must carefully weigh risks and rewards while navigating this landscape.

SEC Struggles in Binance Crackdown: Analyzing Flaws in the Crypto Scrutiny Approach

In a recent pretrial proceeding against Binance, the SEC struggled to justify a financial freeze order against Binance’s American subsidiary. The SEC’s case appears weak, relying on presumptions of guilt rather than concrete evidence, highlighting potential flaws in their Crypto crackdown tactics.

Bitcoin Bulls Eye $35,000 While ETFs Gain Traction: Analyzing Market Drivers

Bitcoin bulls hold onto the $30,000 level as BTC price consolidates after a recent rally, with sentiment high for a potential rise to $35,000. Increasing interest in crypto assets and Bitcoin ETF filings, along with the upcoming 145,000 BTC options expiry on June 30, are key market events to watch.

Crypto.com Gains VASP Registration in Spain: Analyzing Benefits and Drawbacks

Crypto.com received a Virtual Asset Service Provider (VASP) registration from the Bank of Spain, enabling it to offer products and services in the country. This milestone follows a compliance review with Anti-Money Laundering Directive (AMLD) and other financial crimes laws required for MiCA-based VASP licenses. Increased regulations anticipate a more transparent, trustworthy, and robust crypto market.

Ether ETFs: A Real Possibility or Just Publicity Stunts? Analyzing SEC’s Stance on Approval

The fate of not-yet-filed ether funds depends on the SEC’s treatment of the latest wave of spot bitcoin ETF filings. A bitcoin ETF approval might encourage fund issuers to try ether next, while regulatory clarity could increase ether ETF’s chances in the future.

SEC, IMF, and the Future of Crypto Regulation: Analyzing Diverse Approaches and Risks

The IMF urges regulators to address surging cryptocurrency demand by ensuring users’ digital payment requirements and enhancing transparency in the sector. It warns against strict bans or unclear regulations, suggesting risk management and clear guidelines as a better approach for governing the rapidly evolving crypto market.

Bitcoin Boom: Time for Caution or Full Steam Ahead? Analyzing Market Sentiment and Crypto Stability

Bitcoin has witnessed a 20% price increase, pushing the Matrixport’s Bitcoin Greed & Fear Index to 93%. Meanwhile, crypto custody company Prime Trust faces a shortfall in customer funds, and JPMorgan expands its blockchain-based JPM Coin for euro payments, with Siemens making the first euro transaction.

Crypto.Com’s VASP License in Spain: Analyzing Regulatory Inconsistencies and Market Implications

Crypto.Com has obtained a Virtual Asset Service Provider (VASP) license from the Bank of Spain, indicating progress towards a regulated environment for digital assets in Europe. However, inconsistencies in regulatory treatment of exchanges like Binance raise concerns about uneven application of rules and impacts on market stability and adoption.

Bitcoin-Only Strategy Outperforms Altcoin Portfolios: Analyzing Long-Term Investment Success

A recent analysis by K33 Research shows that a ‘Bitcoin only’ investment strategy outperforms altcoin portfolios in the long term. Historical data reveals that despite a few instances when altcoins outpaced Bitcoin, the flagship cryptocurrency remains a more reliable investment option.

Pepecoin Surges 70%: Analyzing its Dominance Over SHIB, FLOKI, and DOGE

Pepecoin (PEPE) has surged more than 70% this week, outshining other meme coins like SHIB, FLOKI, and DOGE. With trading volumes surpassing $800 million, investors are taking more risks in altcoin and meme coin markets. However, extreme price fluctuations call for cautious investing in these tokens.

Bitcoin Spot ETFs: Analyzing Hopes, Challenges, and Institutional Involvement

The likelihood of a Bitcoin spot ETF in the US remains low despite BlackRock’s application, according to QCP Capital. The SEC has rejected all spot ETF applications so far, and skepticism over approval continues under current SEC leadership. However, institutional interest in BTC and ETH remains strong, with Grayscale Bitcoin Trust showing remarkable recovery.

Massive Crypto Liquidations: Analyzing Market Impact and Future Dynamics

Short traders faced single-day losses exceeding $178 million due to crypto token liquidations. The liquidation frenzy coincided with Bitcoin hitting $30,000 for the second time this year, potentially driven by ETF filings. Market observers predict this upward trend could continue if traditional finance giants receive ETF approvals.

Bitcoin Rally Defies Expectations: Analyzing Market Speculation and Future Risks

The current Bitcoin price rally contradicts traders’ sentiment, with over $158 million worth of short positions liquidated in the last 24 hours. This 20% increase in the past week could indicate excessive speculation and FOMO, potentially leading to short-term volatility and unsustainable long-term growth. Investors are advised to remain cautious and informed.

Bitcoin ETF Applications Fuel Options Market Frenzy: Analyzing Volatility and Demand Shifts

The surge in Bitcoin’s price to two-month highs has increased demand for call options and options market activity. Driven by spot Bitcoin ETF applications, $3.3 billion worth of Bitcoin options contracts were traded on Wednesday. The bitcoin volatility index (DVOL) reached its highest level since early April.

Shiba Inu Burn Rate Soars 7000%: Analyzing Impact on SHIB Ecosystem and Sustainability Debate

Shiba Inu cryptocurrency experienced a 7000% surge in burn rate, resulting in a 10% market cap increase and price hike. Lead developer Shytoshi Kusama teases plans about the release of Shibarium and the “Worldpaper,” exploring various aspects of the SHIB ecosystem.

Bitcoin ETFs Surge and SEC Crackdowns: Analyzing the Crypto Landscape

Bitcoin surpasses $30,000 with a $588 billion market cap amid an influx of spot Bitcoin ETF applications to the SEC. However, it faces challenges from regulatory crackdowns and potential policy changes, emphasizing the need for thorough research before investing in cryptocurrencies.

Dogecoin Price Rebound: Analyzing the Potential for a Bullish Future and Possible Resistance

The Dogecoin price rebounds, breaching the $0.0632 resistance mark due to increased investor interest and support from a positive market sentiment. Triggering a significant recovery, recent developments suggest a potential bull cycle and a possible bullish upswing as the price surges above the 20-day EMA.

SEC Crackdown on DeFi and Stablecoins: Analyzing Pros, Cons, and Market Implications

The SEC is potentially targeting decentralized finance (DeFi) and stablecoins, including Tether (USDT) and USD Coin (USDC), in its enforcement crackdown, according to a Berenberg report. Stablecoins, essential to the DeFi ecosystem, have raised national security concerns due to weak sanctions and money laundering controls. The SEC aims to weaken DeFi’s capacity to rival regulated exchanges and lenders.

BNB Coin’s Potential Upswing: Analyzing Technical Indicators and Market Sentiment

The recent BNB breakdown was anticipated to trigger further decline in the coin’s value. However, the improving bullish sentiment in the crypto market has brought about a minor consolidation phase, raising questions about the sellers’ ability to maintain lower levels. Binance Coin developments coincide with growing interest in the spot Bitcoin ETF, contributing to the bullish sentiment in the crypto ecosystem.

Casa Expands to Ethereum: Analyzing the Rise of Self-Custody in Crypto Market

Cryptocurrency self-custody firm Casa expands its services to include Ethereum, offering private key management for both Bitcoin and Ether. Driven by customer demand for secure alternatives to centralized platforms, Casa strives to make self-custody more user-friendly, emphasizing the importance of individuals controlling their digital assets.

XRP Price Rebound: Analyzing the Ascending Triangle Pattern and Hurdles to $0.55

The XRP price has rebounded 7.66% from a support trendline, surpassing immediate resistance at $0.487, and potentially rising further 11% to hit the $0.55 barrier. However, market indicators like the Average Directional Index reveal the need for more buyer aggression to trigger an aggressive rally and breach this multi-month resistance.

Ethereum Gains 4.8% in Market Recovery: Analyzing Key Factors and Potential Pitfalls

Ethereum price experiences a bullish outlook with a 4.8% gain in 24 hours, alongside a market-wide recovery led by Bitcoin. The pause of interest rate hikes supports risk assets like Ethereum, further bolstered by institutional investors entering the crypto space. Ethereum’s current price sits above key moving averages, hinting at potential short-term gains.

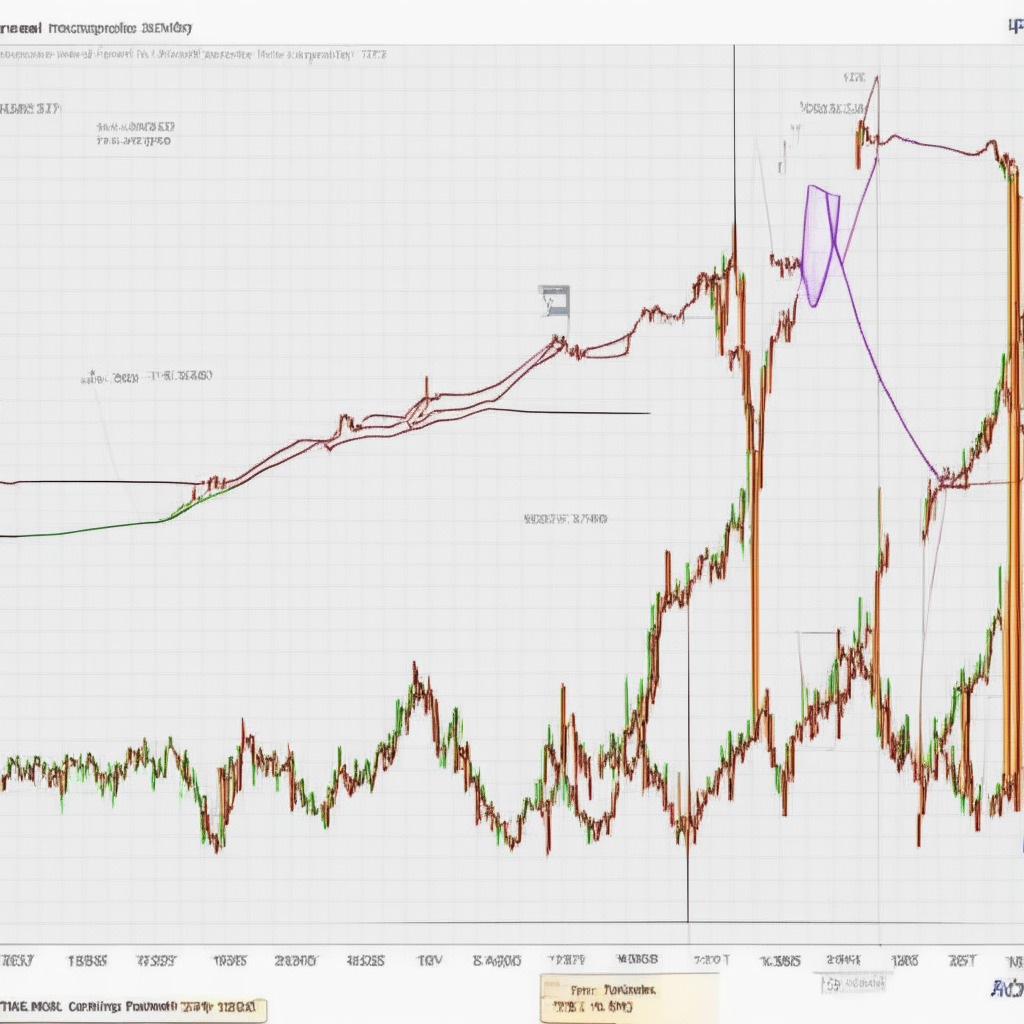

Bitcoin’s $27,000 Struggle: Analyzing the Inverted Hammer and Potential Sell Opportunities

Bitcoin faces a crucial resistance level at $27,000, with speculations of selling pressure increasing due to an inverted hammer candlestick pattern. Observing this level is vital, as it could determine Bitcoin’s future trajectory in the ever-evolving digital currency landscape.

MATIC Price Uncertainty: Analyzing Symmetrical Triangle Pattern & Market Indicators

The MATIC price moves sideways after early June’s bloodbath, indicating no clear dominance from buyers or sellers. A symmetrical triangle pattern reveals potential for a rally during this uncertainty, but a bullish breakout from the resistance trendline is needed for significant recovery.

Ethereum Price Rally: Analyzing the Resistance Barrier and Potential Breakout Prospects

The Ethereum price recently experienced an 8.5% surge after encountering a crucial support level, reaching a resistance zone of $1775-$1765. However, selling pressure halted the rising momentum, suggesting possible consolidation before a significant recovery rally. JPMorgan recently backed Ethereum, despite some disagreements within the crypto community.

Navigating Murky Crypto Regulation: Analyzing SEC, Ripple, and the Safe Harbor Debate

The ongoing SEC vs Ripple case highlights the need for regulatory clarity in the cryptocurrency space. The “Safe Harbor Proposal” and Ethereum’s “safe harbor” designation have stirred debates about fair regulations, fostering innovation, and protecting investors from potential hazards.

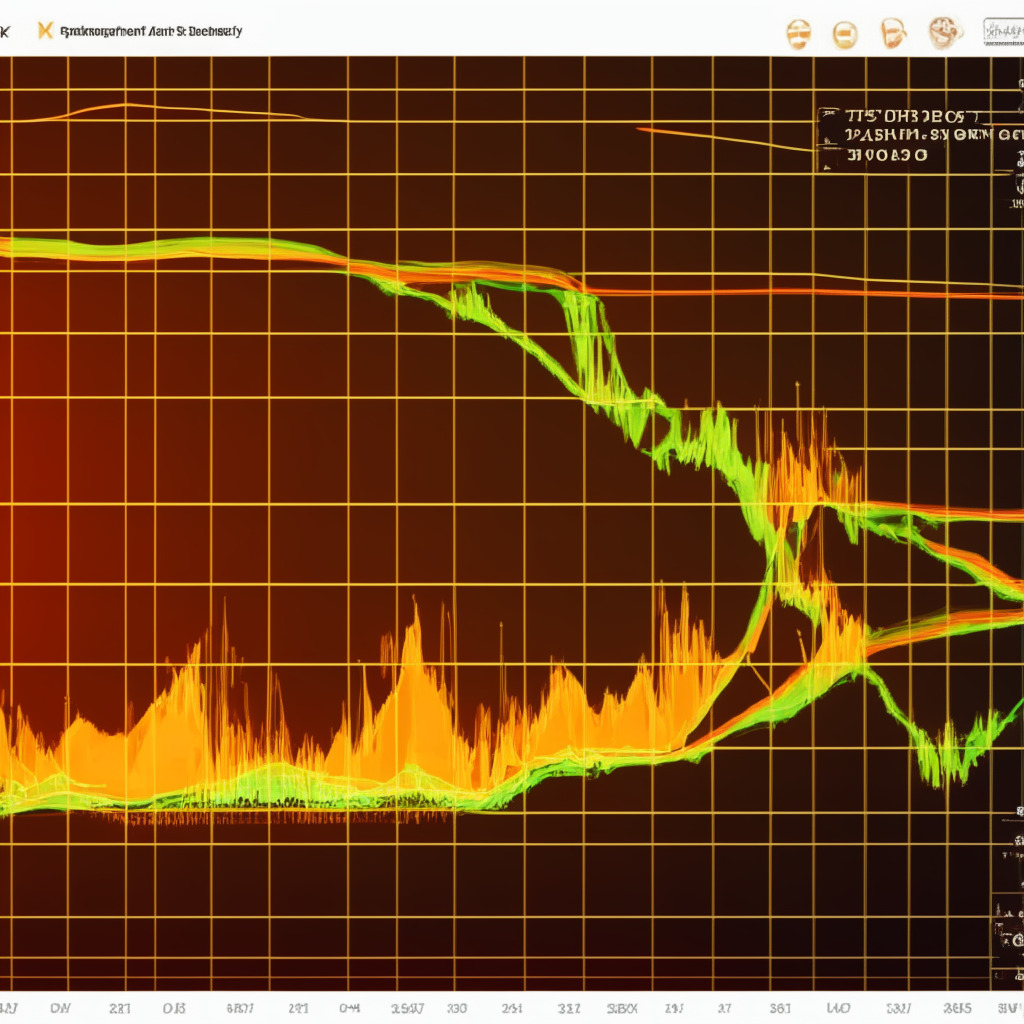

Bullish Signs for Bitcoin: Analyzing the Three-White Soldiers Pattern and Market Outlook

Bitcoin (BTC) forms a bullish three-white soldiers pattern, indicating a potential reversal from a downtrend to an uptrend. With the relative strength index (RSI) and moving average convergence divergence (MACD) in the buying zone, Bitcoin’s positive outlook is supported. As BTC continues to rise, anticipation grows among traders and investors.

Dogecoin’s Stagnant Price: Analyzing the Future of DOGE Amid Uncertainty

Dogecoin’s price has remained stagnant below $0.063 resistance, with daily charts showing short-bodied candles and indecision among buyers and sellers. Traders are stabilizing price action after a plunge on June 10th, and a bullish breakout above $0.063 could hint at an upcoming relief rally. The 20-day EMA and converging DMI slopes may indicate a decline in bearish momentum.

Hong Kong’s Crypto Surge: Analyzing Benefits, Risks, and the Role of Government Support

Hong Kong’s government has invested $7 million in accelerating Web3 development, attracting 150 Web3 firms to Cyberport, its digital innovation hub. As the government aims to build a strong crypto and fintech ecosystem by 2023, addressing potential risks and challenges posed by such innovative technologies is crucial for ensuring security and stability.

AiDoge Listing: Innovation or Gimmick? Analyzing AI Meme-Based Cryptocurrency

AiDoge, a cryptocurrency using artificial intelligence for meme generation, is set to be listed on MEXC and Uniswap DEX exchanges on June 19th. With $AI2 as its ticker symbol, the innovative AI-driven platform appeals to meme enthusiasts and forward-thinking investors amidst ongoing debate on its long-term viability.

LUNC’s Falling Wedge Pattern: Analyzing Volatility and Growth Potential in the Crypto Market

Over the past week, Terra Classic coin (LUNC) experienced a consolidation phase marked by uncertainty, remaining within a falling wedge pattern. A trend reversal could depend on buyer’s conviction in sustaining higher prices, while a bearish outcome may push the price towards the $0.000062 mark. Volatility and sideways movement are expected as long as $0.000102 and $0.0000826 range levels hold.