Bitcoin faces resistance at $25,600 as market participants await key developments, such as growing regulatory scrutiny in the US and potential changes in the cryptocurrency market landscape. Meanwhile, Cryptocurrency wallet provider Celsius plans to convert 15 tokens to Bitcoin and Ethereum, and Hong Kong invites international exchanges to apply for licenses amid SEC crackdowns.

Search Results for: MACD

Terra Luna Classic’s Resilient Climb Amidst Founder’s Legal Troubles: Technical Analysis

Terra Luna Classic (LUNC) displays impressive recovery amid market turbulence and Terraform Labs co-founder’s legal troubles. Valued at $0.000095, LUNC holds the #62 position on CoinMarketCap, with signs of purchasing interest on technical indicators. Potential expansion and USTC re-peg proposal could drive significant gains for LUNC.

Bitcoin’s Struggle to Find Support above $24k amidst Economic Turbulence & Miami Mayor’s Crypto Plans

The recent 5% drop in Bitcoin’s price raises concerns about market stability and the crucial $24,000 support level. This follows a hawkish statement from the Federal Reserve and a turbulent week for cryptocurrencies, with the next support level at $24,350.

Bitcoin Stumbles After Fed Pause: Market Reactions and Future Predictions

Bitcoin price dropped 4% after the Federal Reserve paused historic interest rate hikes, despite US inflation easing. The halt was expected to boost crypto markets, but signaling of future increases dampened investor excitement. Technical indicators suggest potential continued declines, while analysts warn of possible price dips below $25,000 or rebounds toward $30,000.

Federal Reserve Decision, Crypto Turbulence, and Top 7 Cryptos to Watch Now

Amid economic uncertainty and cryptocurrency market turbulence, investors may explore cryptos with strong fundamentals and favorable technical analysis, such as WSM, BNB, ECOTERRA, INJ, YPRED, FTM, and LPX. Careful analysis of fundamentals and technical indicators can help navigate the current market environment successfully.

Ethereum Price Outlook: Inflation Deceleration and FOMC Meeting Impact on The Path to $2000

Ethereum’s price touched $1,760 before confirming support at $1,730, fueled by better-than-expected CPI data and optimism around the FOMC meeting. However, the token faces resistance at $1,760 and disadvantages below key moving averages. On-chain metrics show Ethereum staking activities increasing, potentially reducing selling pressure and igniting a short-term uptrend.

Inflation Data and CPI Impact on Crypto Market: Analyzing Bitcoin’s Bullish Outlook

Bitcoin price and crypto market experienced a positive reaction to the US CPI data reveal, as the annual inflation rate softened. Investors turned to riskier assets like crypto, and significant Bitcoin holders increased their positions, signaling a potential bullish turn in the near future.

Bitcoin’s Fate Hangs in Balance Ahead of US Federal Reserve Announcement

The Bitcoin price remains near $26,000 ahead of the key US Federal Reserve policy announcement on Wednesday, which may significantly impact crypto markets. The outcome of the meeting could influence Bitcoin’s bearish momentum and determine its short-term direction.

Fed Skipping Rate Hike: Impact on Crypto Markets and Challenges of Asian Regulations

Crypto traders are optimistic about the Fed skipping a rate hike, fueling a potential bull run for cryptocurrencies. Bitcoin remains stable around the $26,000 level as investors consider increasing Bitcoin holdings. However, Hong Kong’s restrictive crypto regulations prove unattractive to exchanges exploring relocation.

SEC’s Contradictory Stance: Impact on Ethereum, Altcoins, and Crypto Market Recovery

In 2018, SEC Chair Gary Gensler stated that Ethereum and Bitcoin are not securities. Recently, Gensler declared all cryptocurrencies except Bitcoin as securities, launching enforcement initiatives within the cryptosphere. As lawsuits develop, investors must continuously adjust their crypto portfolios and observe market trends to navigate the ever-evolving landscape.

Hinman Documents Impact: XRP’s Potential Surge, Ripple Lawsuit, and Market Predictions

The Hinman documents, containing a 2018 speech by the former SEC director discussing Bitcoin and Ethereum’s potential to evolve into commodities, has stirred up the crypto market, leading to a 2.2% increase in XRP’s value. The documents’ release could significantly impact XRP and Ripple, with both gains and losses possible depending on the market’s reaction.

Bitcoin at $25,000: Bottom Reached or More Fluctuations Ahead? The Debate Rages On

As Bitcoin hovers around $25,000, the market’s potential direction remains uncertain. Facing substantial resistance and support levels, Bitcoin’s next move depends on a breakout from its current consolidation range. Investor indecision and mixed sentiment is evident, making it crucial for crypto enthusiasts to stay informed on market trends and developments.

MATIC Crash: Potential Recovery or Further Decline? Analyzing Market Indicators

The recent altcoin crash caused MATIC price to plunge to $0.518, a 45% tumble within a week. Despite a sharp lower price rejection, a potential recovery faces intense supply at $0.687 and $0.744. Observing market conditions and cryptocurrency trends is vital for investment decisions.

Cardano, Solana, Polygon vs SEC: Battle for Token Clarity and Market Recovery

The Input-Output Global (IOG), responsible for Cardano development, and foundations behind Solana and Polygon, are disputing recent SEC allegations that their tokens are securities. They aim to clear the tokens and maintain operations despite market fluctuations and uncertainty, urging cautious investor decision-making.

Bitcoin & Ethereum’s 7% Dip: Causes, Market Predictions, and Future Scenarios

This article discusses the recent 7% dip in Bitcoin and Ethereum, factors contributing to the downturn, and potential future scenarios. It covers A16z Crypto’s international expansion, Tether demand in Turkey, and regulatory actions by the SEC, while providing market predictions for both cryptocurrencies.

Bitcoin Stability Amid SEC Crackdown: How Altcoins Suffer & Future Market Implications

Amid the SEC’s crackdown on the crypto market, Bitcoin exhibits commendable stability, maintaining support above $25,000 and its market share approaching 50%. However, altcoins experience instability, with SEC allegations implicating tokens like Solana, Polygon, and Algorand.

Bitcoin’s Future Amidst Global Currency Shakeup & Market Turmoil: Support Levels & Predictions

This Bitcoin price prediction article delves into market trends and technical indicators to identify potential support levels for Bitcoin amidst massive selling volume in the crypto markets. With the US dollar predicted to decline as the dominant global currency, Bitcoin’s future price movements are analyzed in relation to Chinese yuan’s potential rise and global financial dynamics.

Crypto Market Sell-Off: Will Bitcoin Break Out or Plunge Further? Pros & Cons Discussed

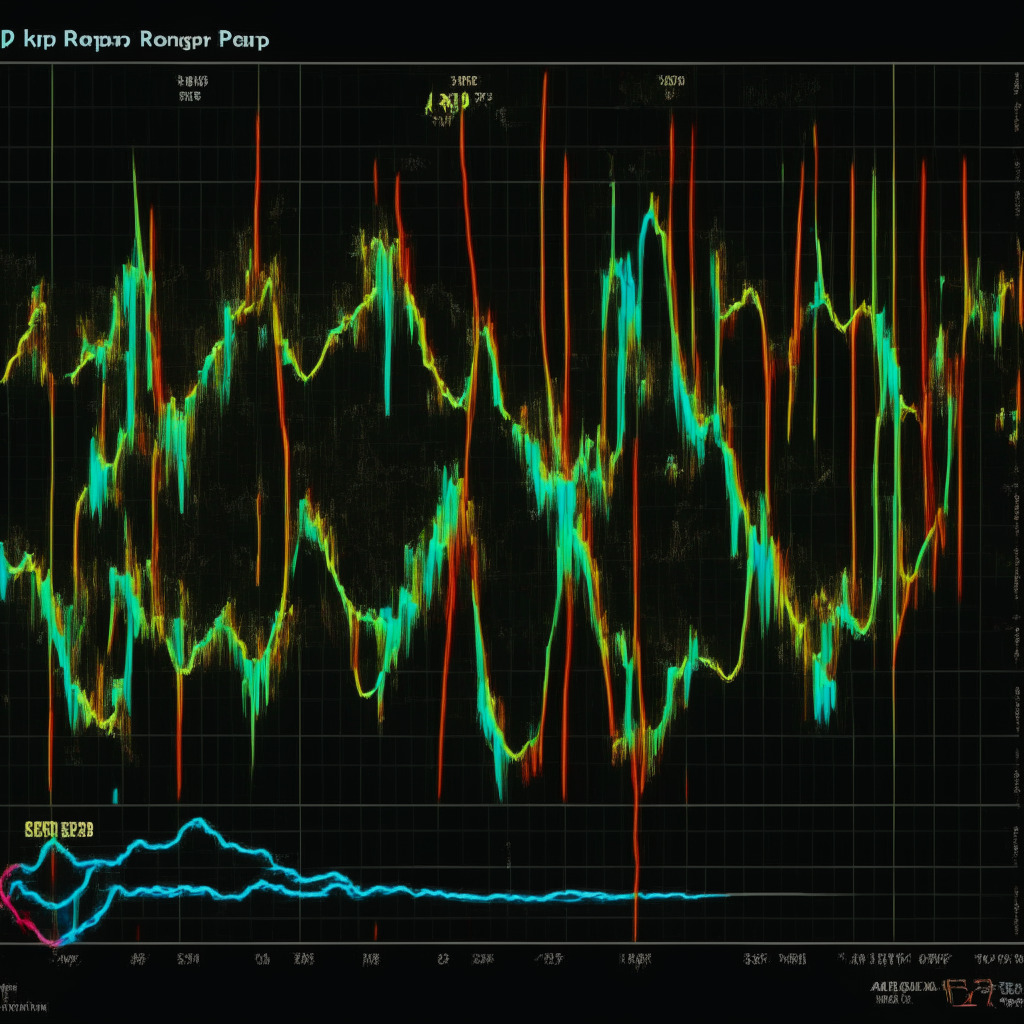

The crypto market experienced a sharp sell-off, but Bitcoin’s price sustained above the lower trendline, reflecting strong accumulation levels for buyers. A falling wedge pattern suggests decreasing selling pressure, potentially leading to a bullish upswing. However, the Moving Average Convergence Divergence (MACD) indicator shows a bearish alignment, which might challenge Bitcoin’s upward potential.

Navigating the Crypto Tug-of-War: Wedge Pattern, Market Shifts, and Future Projections

The crypto market experiences a tug-of-war between buyers and sellers, with Bitcoin’s short-term downtrend in force and potential for consolidation. A falling wedge pattern signals price drop before significant upswing, but a bullish recovery requires a breakout beyond the overhead resistance trendline. Conduct personal research for investment decisions.

Ripple Navigates SEC Challenges: XRP’s Potential Breakthrough and yPredict’s AI Trading Edge

Amid turbulent crypto markets and SEC enforcement actions, Ripple (XRP) is positioning itself for a potential positive outcome in its ongoing legal battle. With strong technical structure and developments in the SEC vs. Ripple case, XRP could experience an upside move soon, making it an attractive entry point for investors. Utilizing innovative AI-powered trading platforms like yPredict($YPRED) can offer traders a competitive edge in the increasingly complex crypto trading landscape.

SEC Labels Solana as Unregistered Security: The Battle for Sustainability in Crypto

The SEC has labeled Solana (SOL) as an unregistered security, leading to an uncertain future and impacting the crypto market. In response, investors are exploring alternatives like Ecoterra, an environmentally-focused project with a unique Recycle-to-Earn mechanism and commitment to sustainability.

Bitcoin’s $26,200 Support: Potential Bounce or Trap for Investors? Pros, Cons, and Conflict

Bitcoin finds support around $26,200, with candlestick patterns indicating weakening bearish sentiment and potential seller exhaustion. However, market uncertainty and technical indicators necessitate a cautious approach. Investors should monitor developments before making decisions.

XRP Price Stuck in Sideways Trend: Analyzing Support, Resistance, and Market Uncertainty

XRP price faces uncertainty, oscillating below the $0.55 resistance mark with no clear buyer or seller dominance. A decisive breakout above this resistance or breakdown below $0.486 will signal the future price direction. Meanwhile, technical indicators like MACD and EMA offer further market insight.

SEC Lawsuit Impact on Memecoins: Analyzing Pepe Coin Struggles and yPredict.ai Potential

Amid turbulent times in the crypto market, memecoin markets thrive, while Pepe coin struggles with legal concerns. Traders seek resources like yPredict.ai, an AI-powered platform providing real-time signals to predict market trends for enhanced decision-making. Stay cautious in volatile cryptocurrency markets.

Binance Lawsuit Fallout Hits Crypto Space Hard, While Ecoterra Rises as Pre-Sale Safe Haven

The SEC vs. Binance lawsuit impacts major projects like BNB, SOL, MATIC, and ADA, causing market turbulence. Meanwhile, investors seek refuge in promising pre-sales like Ecoterra, an eco-friendly blockchain project. Amid uncertainties, research and cautious approach are essential for investments.

Pepe Coin’s Downtrend Dilemma: Time to Focus on Launchpad XYZ’s Stable Ground?

Pepe Coin (PEPE) faces a decline of over 60% from its peak and mixed technical indicators, raising uncertainty for its future potential. Meanwhile, Launchpad XYZ, a promising web3 crypto startup, offers stability with a user-focused portal for web3 trading, NFTs, and fractionalized assets.

SEC Lawsuit Against Binance: Impact on Crypto Market and Bitcoin’s Future Resistance Levels

The SEC lawsuit against Binance led to a market decline and $320 million in crypto trader liquidations. Bitcoin faces strong resistance and uncertainty with conflicting RSI and MACD indicators. As regulatory challenges increase, staying informed on market developments is crucial for crypto investors.

Impact of SEC Lawsuit on Bitcoin: Analyzing Market Reactions and Future Scenarios

This article analyzes the impact of the SEC’s lawsuit against Binance on Bitcoin’s price movement and explores potential future scenarios. It discusses Bitcoin’s breach of a major support level and the bearish sentiment indicated by technical indicators. Staying updated and vigilant in the crypto space is essential for investors.

Bitcoin Bearish Reversal: Prospects of Recovery Rally or Further Downtrend?

The Bitcoin price recently experienced a bearish reversal, with a 5% decline over the week. A breakdown below the $26,500 support level may trigger further drops. Technical indicators, including MACD and EMA, confirm the potential for a downtrend continuation. Caution and research are advised before entering the market.

XRP’s Potential $10 Mark in 2023: Investment Surge, Price Analysis, and Eco-Friendly Alternatives

XRP experienced a recent $2 billion capital surge, sparking speculation around potential price trajectories. While technical indicators suggest bullish sentiment, predicting specific movements remains a challenge. Exploring alternative investments like WSM and Ecoterra can help diversify portfolios and navigate the fluctuating crypto market.

Rounding Bottom Pattern Predicts Render Token Uptrend: Analyzing AI Crypto Rally Potential

The Render token price recently displayed a rounding bottom pattern, suggesting a potential uptrend. A trendline governs the ongoing recovery rally, and after a resistance breakout at $2.45, a 24% rally is anticipated. The formation of the rounding bottom pattern indicates a steady recovery for RNDR, with no major resistance expected until the $3.3 mark.

Bitcoin’s Next Move: Analyzing Potential Scenarios and Market Trends

Bitcoin recently recovered from a low of $26,600, trading above $27,000, causing discussions about its next potential target. Factors influencing future trajectory include market sentiment, technical indicators, and macroeconomic conditions, thus warranting deep market trend analysis and exploration of possible scenarios.