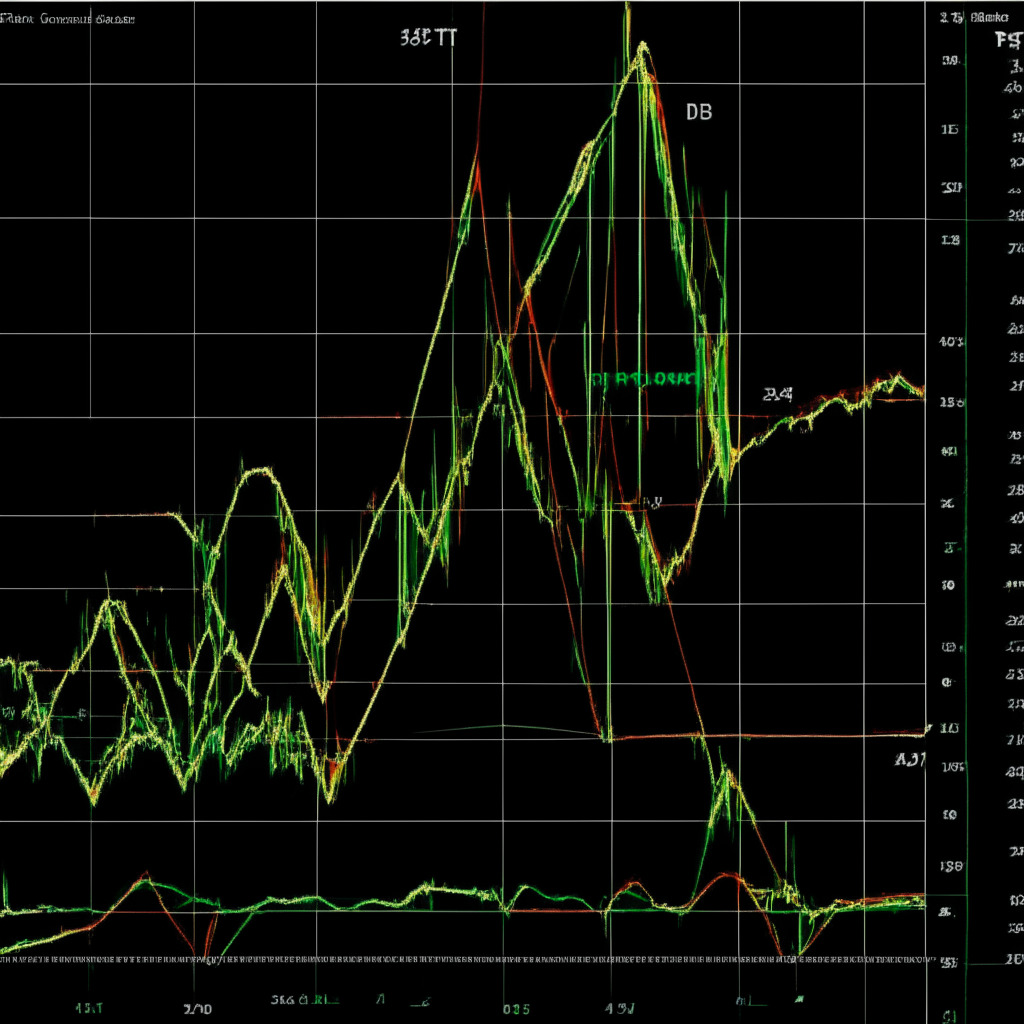

On May 5th, the Ethereum price saw a significant increase, recording a 6.3% intraday gain which can be attributed to several traders converting their Pepecoin profits into Ethereum. In addition to this sudden spike, the coin’s price broke through a resistance trendline of a symmetrical triangle pattern, offering further confirmation of a recovery rally. Interestingly, the Ethereum price correction managed to stay above the 50% Fibonacci retracement level, suggesting a bullish overall market trend.

A breakout from the symmetrical triangle patterns may trigger a fresh recovery in the Ethereum price. The intraday trading volume for Ether during this period reached $10.9 Billion, indicating a substantial 65.5% gain. This recent price hike has allowed buyers to surpass the pattern’s overhead trendline and local resistance of $1946, providing further support for the uptrend resumption. However, the coin price is still 3% short of retesting the aforementioned resistance, now functioning as potential support.

If Ethereum’s price is able to maintain its position above the new flipped support, interested traders should keep an eye out for possible entry opportunities. The subsequent post-breakout rally could cause the coin’s price to surge 10% higher, potentially reaching the previous swing high of $2140. Should the daily candle close below $1946 or the pattern’s trendline, the bullish thesis will be invalidated.

In terms of technical indicators, the Moving Average Convergence Divergence (MACD) depicts a bullish crossover between the MACD (blue) and signal (orange) lines, hinting at an upcoming recovery. Furthermore, the Bollinger Band indicator shows that the Ethereum price has risen above the midline, suggesting that market buyers are attempting to regain control of the trend.

The intraday levels for Ethereum’s coin price are as follows:

– Spot rate: $1930

– Trend: Bearish

– Volatility: Medium

– Resistance levels: $2143 and $2400

– Support levels: $1800 and $1700

It is important to note that the content provided here may include personal opinions of the author and is subject to market conditions. Always perform thorough research before investing in cryptocurrencies, as the author or the publication will not be held responsible for any personal financial losses.

Source: Coingape