Bitcoin price is experiencing a downturn today as ongoing “congestion” frustrates traders and pressures market sentiment. The largest cryptocurrency is under fire after transaction fees hit their highest levels ever, reaching an average of \$19.21 per BTC transaction, with many exchanges charging \$60+ to process them. The nearly 98% full mempool further complicates the situation.

At the heart of the problem are mass transactions “spamming” the Bitcoin network, according to market participants. The issue has been exacerbated by the largest global exchange, Binance, repeatedly halting BTC withdrawals. Citing “congestion” for the outages, Binance ended up creating a backlog of withdrawals, which only served to worsen the already nervous market sentiment. Nonetheless, Binance later confirmed that the backlog had been cleared.

On the other hand, the market’s reaction to the withdrawal pauses has been dubbed “FUD,” or fear, uncertainty, and doubt by Binance CEO Changpeng Zhao. This skepticism does make some sense as it is not the first time that Binance has found itself at the center of BTC price controversy.

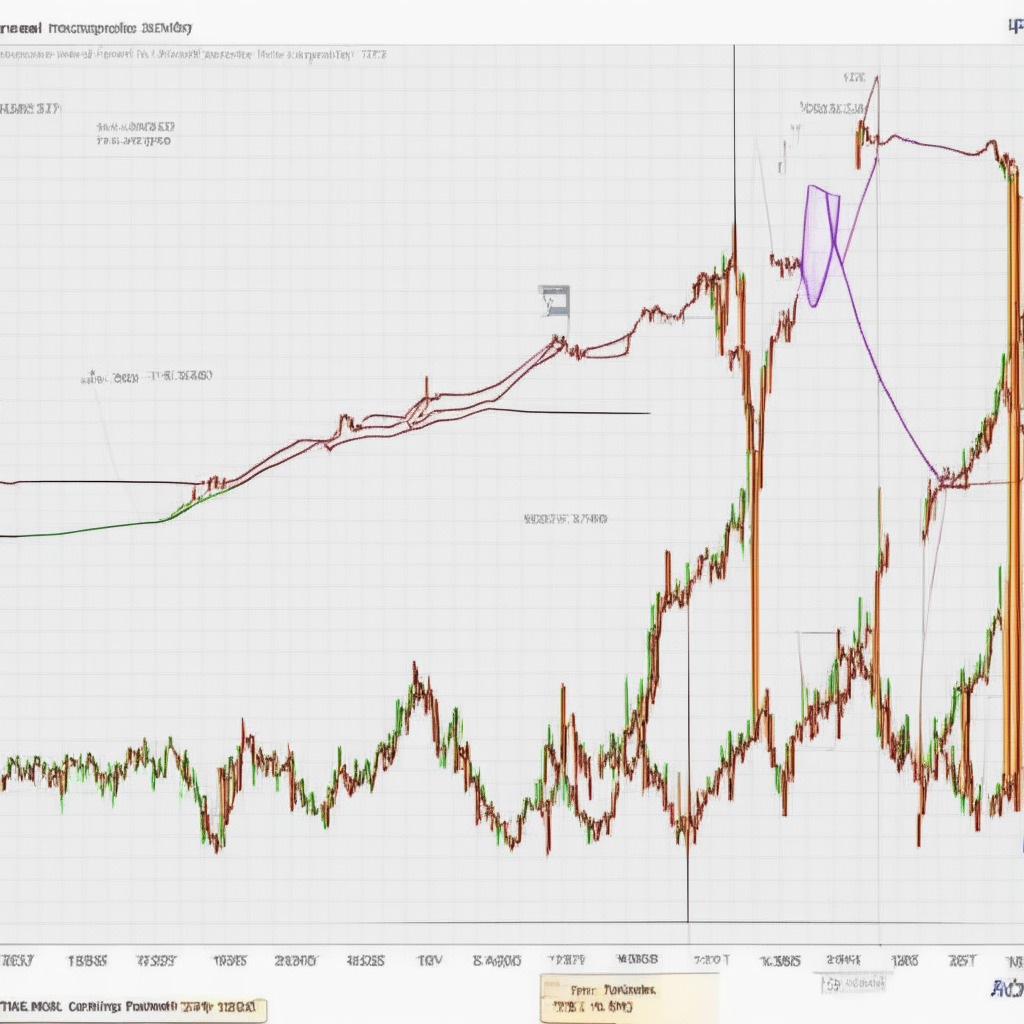

As a result of this gloomy atmosphere, Bitcoin traders are beginning to eye potential targets for a long entry amid an extended downtrend. In the past, the difference in weekend open and close prices have created gaps in the CME Group Bitcoin futures markets. This could signal that an uptick may now ensue to “fill” it in classic style.

Some traders, however, are eyeing targets closer to the spot. As Daan Crypto Trades pointed out, “Still ranging in this \$27-30K region. Now trading back below the mid-range again. No trade zone on BTC for me until we see a proper break or sweep of either of these range extremes.”

Despite the obstacles that Bitcoin is currently facing, the market’s resilience is not to be underestimated. The setbacks may be temporary, and the cryptocurrency could bounce back in the near future. However, the congestion problem needs to be addressed to ensure the long-term growth and stability of the network. In conclusion, while skepticism still lingers, the potential for Bitcoin’s market momentum to rise steadily remains a possibility.

Source: Cointelegraph