In recent news, cryptocurrencies faced a bear market due to the Federal Reserve’s relentless tightening of monetary policies. Cleveland Federal Reserve Bank President, Loretta Mester, stated in an interview that there seems to be no compelling reason to halt the central bank’s rate hike cycle. This announcement boosted the US dollar while causing the value of Bitcoin to drop by 3% within 24 hours to $27,000, as well as a 2% drop for Ether.

On the flip side, the U.S. Commodity Futures Trading Commission (CFTC) staff has issued a warning for companies to take extra precautions and actively counter risks when clearing digital asset transactions. As the CFTC’s Division of Clearing and Risk plans to focus on emerging risks in the crypto space, it encourages firms to identify new or evolving risks and implement tailored risk mitigation measures. These risks include potential conflicts of interest, cyber threats, and the management of physical delivery of digital assets.

Adding to the turmoil in the cryptocurrency market, the U.S. Securities and Exchange Commission (SEC) recently settled charges with a former Coinbase product manager (COIN) and his brother, relating to insider trading allegations involving the exchange platform. Ishan Wahi and his brother Nikhil Wahi were arrested last year and have since pleaded guilty to criminal charges, with Ishan receiving a 2-year sentence and Nikhil a 10-month sentence. The SEC has stated that the brothers’ fines, from their criminal case, satisfy the civil case’s settlements and they will not be seeking any further penalties.

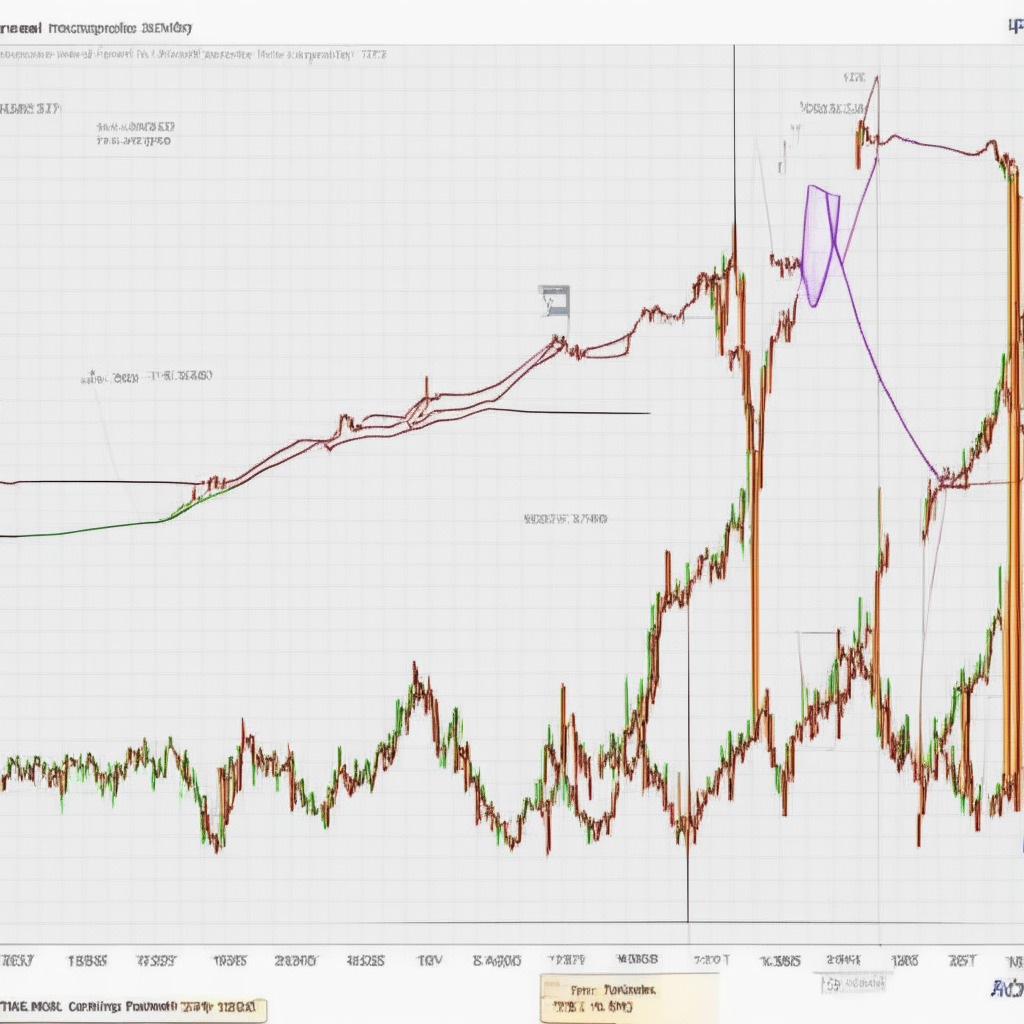

Further fueling uncertainty in the market, the value of XRP experienced an increase of more than 8% to $0.51 in the last month, surpassing market leaders Bitcoin and Ether in growth. This surge may be attributed to speculations regarding a potential settlement of the ongoing SEC / Ripple legal case in the coming weeks, as suggested by crypto services provider Matrixport. If XRP’s value breaks the resistance level of $0.55, it could spark a rally toward the next major resistance level of $0.80, reflecting a 44% increase in value.

With these recent developments in the cryptocurrency market, investors must weigh the pros and cons of the volatile market conditions. The monetary tightening policies imposed by the Federal Reserve, regulatory warnings from the CFTC, and insider trading scandals in the crypto industry may deter some investors. However, the potential for growth and unexpected gains, such as the recent rise in XRP’s value, continue to attract those looking for lucrative opportunities. Despite the challenges and uncertainties, the cryptocurrency landscape persists, showcasing the resilience and adaptability of its proponents and investors.

Source: Coindesk