The XRP price has plunged to a support trendline of a bullish ‘Flag’ pattern, indicating potential accumulation and reversal. However, skepticism remains, as market moves are unpredictable. Investors should approach predictions cautiously and conduct their own market research before investing in cryptocurrencies.

Month: May 2023

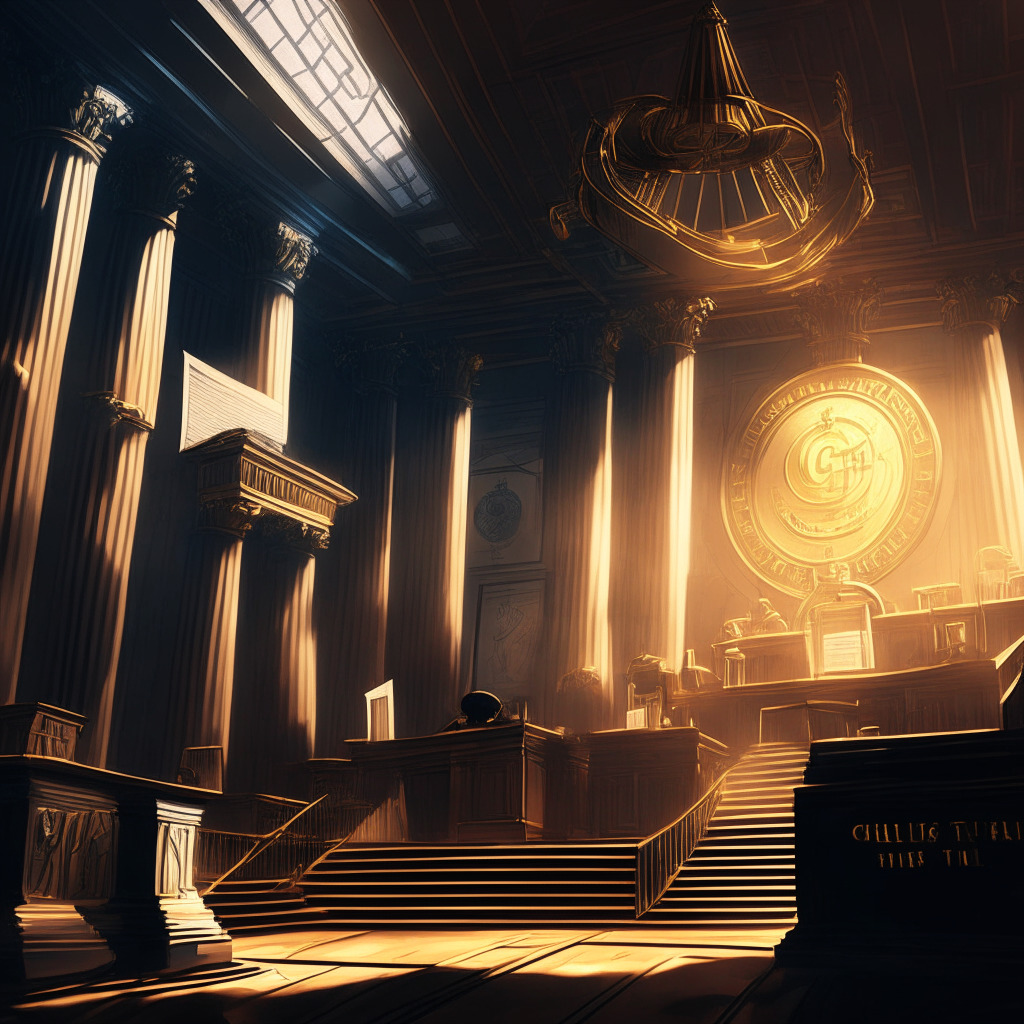

Bittrex US Bankruptcy Shakes Industry: Will Binance.US Face Similar Fate?

Bittrex US files for Chapter 11 bankruptcy following SEC’s accusation of running an unregistered securities exchange. The decision raises concerns over the future of other exchanges, as the crypto industry navigates a complex regulatory landscape.

Solana’s Saga Mobile Flagship: Revolutionizing Web3 Experience for Android Users

Solana’s Saga mobile flagship Android phone offers a seamless web3 experience, featuring Seed Vault for secure self-custody, biometric authentication, and the Solana dApp Store. The phone enables web3 transactions, token trading, NFT minting, on-chain gaming, and instant dApp accessibility.

Cipher’s Mining Power Surge: Canaan’s Struggles vs Investors’ Gain in Crypto Ecosystem

Cipher Mining acquires 11,000 Bitcoin mining rigs from Canaan Inc., projecting a significant increase in computing power to 7.2 EH/s by Q3 end. As Cipher stock surges, Canaan faces decline in sales, emphasizing the need to understand evolving blockchain industry dynamics for long-term success.

Crypto Market Rebound: Analyzing Galaxy Digital’s Q1 2023 Turnaround and Future Sustainability

Galaxy Digital reports a net income of $134 million for Q1 2023, a significant improvement from previous losses, highlighting the recovering cryptocurrency market. With assets under management rising, the industry’s potential for sustainable growth relies on cautious optimism, learning from past fluctuations, and emphasizing oversight and transparency.

Binance Listing Impact on Floki Inu and PEPE Coin: Popularity vs Credibility Debate

Binance recently listed Floki Inu and PEPE Coin due to growing demand for meme coins. Although Floki Inu’s price surged, it couldn’t sustain momentum. These listings highlight the influence of external factors on cryptocurrency volatility and the importance of conducting extensive market research before investing in such assets.

Exploring the Future of Blockchain: Opportunities and Challenges in Decentralization

The future of blockchain technology holds immense potential, impacting industries like finance, healthcare, and supply chain management. However, challenges such as scalability, interoperability, ease of use, and regulatory uncertainty remain. Ensuring user safety and security must be prioritized as the ecosystem continues to evolve.

Sudden $57M Token Influx to Alameda Research Wallets: Questions Arise or Growing Pains?

Alameda Research wallets, controlled by the FTX Bankruptcy Estate, have received over $57 million of tether (USDT) and $300,000 worth of mask (MASK) tokens, sparking curiosity and concern. Further investigation and transparency are needed to quell any potential fears for those affected.

Meme Coin Frenzy: Unstoppable $SPONGE Phenomenon and Its Sustainability Debate

The meme coin frenzy continues with $SPONGE, now listed on six centralized exchanges (CEXs) and up 1,290% in 7 days. The coin’s high liquidity suggests significant backing, potentially mitigating price volatility. With more CEX listings expected, $SPONGE’s popularity and market for meme coins remain strong.

Investor Sentiments Divide in the Blockchain and Digital Assets Industry: Shift or Solidify?

The Goldman Sachs report “Family Office Investment Insides” reveals that 32% of family offices hold investments in digital assets, with 19% driven by their belief in blockchain technology. However, interest in potential crypto investments has sharply decreased to 12% in 202>Title

Diverging Bitcoin Prices on Binance.US vs. Coinbase: Analyzing Pros, Cons, and Main Conflict

The price divergence between BTC/USD on Binance.US and other major exchanges, like Coinbase, has risen significantly, raising concerns among crypto experts. This could be attributed to market makers exiting Binance.US in anticipation of potential regulatory action and reduced liquidity, further highlighting the complexity of the crypto market.

Navigating Meme Coin Volatility: Diversification and Active Management in Crypto Investing

The article highlights the extreme volatility of meme coins like Dogecoin and PepeCoin and emphasizes the importance of diversification and active management in crypto investments. By including established coins like Bitcoin and Ethereum, investors can reduce risk and better navigate the unpredictable crypto market.

Blockchain Future: Exciting Prospects, Potential Pitfalls, and the Ongoing Debate

The recent disruptive blockchain event in New York highlighted the promising nature of blockchain technology, its prospects, and obstacles. Participants discussed opportunities brought about by the blockchain revolution, addressing skepticism about limitations, and emphasizing the potential benefits in various sectors such as supply chain management and financial services.

Lightning Network: Revolutionizing Speed and Efficiency in Crypto Transactions

The Lightning Network (LN) aims to address Bitcoin’s slow transaction speed by enabling high-volume micropayments with near-instant times, minimal fees, and a capacity of 1 million transactions per second. However, concerns like manual address entry errors and ongoing refinement warrant caution. LN has garnered attention from companies like Kraken and Coinbase, but debates on LNURL adoption persist.

FTX Founder Faces Criminal Charges: Market Collapse or Fraud to Blame?

Sam Bankman-Fried, founder of the defunct cryptocurrency exchange FTX, faces 13 criminal charges including money laundering and wire fraud. His defense seeks dismissal of ten charges, alleging legal shortcomings and extradition process violations. The case’s outcome may impact future cryptocurrency industry regulations and investor enthusiasm.

Blockchain Future: Revolutionizing Industries or Undermining Stability? Pros and Cons Debated

This Cointelegraph article explores blockchain’s potential impact on various markets and sectors, discussing advantages such as secure transactions and decentralized systems, while addressing concerns like energy consumption and the loss of authority in the financial sector.

Apollo-backed NovaWulf Bids for Bankrupt Crypto Lender: Market Shift or Risky Venture?

Apollo Global Management, a leading private credit investor, has partnered with crypto investment firm NovaWulf in a bid to acquire bankrupt crypto lender Celsius Network. With support from a consortium that includes Gemini Trust, the acquisition aims to restructure and rescue the lender using blockchain technology, amidst concerns about security and trust in the platform.

Exploring Blockchain’s Transformative Power & Hurdles: DeFi, Gaming, and Privacy Debates

Blockchain technology holds the potential to revolutionize industries like finance and gaming by enabling decentralized, transparent ecosystems. However, challenges arise in market volatility, adoption, and regulatory issues. Education and collaboration among stakeholders are crucial for harnessing blockchain’s transformative power for the common good.

Warren Buffett’s Cash Move: Potential Impact on Bitcoin Amid Global Recession Fears

Warren Buffett’s move towards cash, indicating a potential stock market crash, and Bitcoin’s high correlation with Nasdaq raises concerns about downside pressure on the cryptocurrency. With a 6% decline in Bitcoin’s price last week and possible rate cuts, investors should closely monitor developments and conduct thorough research before deciding on investments.

SEC’s Proposed Custody Rule Revision: Coinbase’s Push for Crypto Protection and Market Impact

The SEC’s proposed revisions to RIA custody rules have been met with pushback from Coinbase, who asserts that the regulation unfairly targets crypto and fails to protect all asset classes, including cryptocurrencies. Coinbase legal chief, Paul Grewal, has called for several changes to ensure adaptability and protection of future investments.

Binance Expands NFT Marketplace with Bitcoin Ordinals: Boon or Bane for the Crypto World?

Binance plans to expand its NFT marketplace by supporting Bitcoin Ordinals or Bitcoin NFTs, offering wider trading options. While this move has potential benefits, it raises concerns of NFT market oversaturation, opposes decentralization, and highlights the risks associated with investing in new cryptocurrencies.

Dogecoin Struggles Amid New Meme Tokens Rise: Can DOGE Make a Comeback?

Dogecoin’s value has fallen 2.5% in the past 24 hours, experiencing an 8% week-over-week drop and a 30-day decline of 11%. In contrast, newcomer SpongeBob (SPONGE) has gained a staggering 9,000% since its launch. A major issue for Dogecoin is its dependence on Elon Musk for traction, which has lessened as Musk remains less vocal about crypto. Meanwhile, SPONGE emerges as the new hot meme token, gaining interest from traders and investors.

Paxful’s Comeback: Assessing Trustworthiness Amid Legal Turmoil and Leadership Changes

After a month-long hiatus due to a lawsuit and leadership disputes, the peer-to-peer Bitcoin marketplace Paxful is back online. However, the lack of transparency on the ongoing lawsuit and company leadership changes has raised concerns about its trustworthiness among some industry participants.

Crypto Kidnapping: A Wake-Up Call on Privacy Risks and Law Enforcement’s Stepping Up Efforts

Spanish National Police rescued a kidnapped crypto portfolio manager held at gunpoint for a $1.1 million ransom. This incident highlights the dangers of exposure in the crypto industry and the increased attention law enforcement agencies are giving to crypto-related crimes.

AI-Generated Music on Spotify: Fraud Concerns vs Creative Exploration

Spotify removes 7% of AI-generated music by startup Boomy amid concerns of fraudulent activity and copyright issues. While the industry is apprehensive about the technology, some artists are eager to explore its potential. This conflict may shape AI’s future role in the music industry.

Bitcoin NFTs Gain Traction: Binance’s Bold Move and Its Impact on the Marketplace

Binance announces plans to support Bitcoin NFTs called Ordinals, expanding beyond Ethereum, Polygon, and BNB Chain-based NFTs. The move aims to attract more collectors and trading opportunities, simplifying user onboarding and offering a secure method of entering the growing market.

XRP

The XRP price dropped 2.5% amid a declining cryptocurrency market, but Ripple’s recent report on central bank digital currencies (CBDCs) emphasizes the potential role of XRP in the future economy. Despite current downtrend, Ripple’s stablecoin partnerships and growth in the global value of CBDCs offer positivity and long-term growth possibilities.

Binance’s Entry in Bitcoin-Based NFTs: Pros, Cons, and the Future of Ordinals Inscriptions

Binance announces support for Ordinals inscriptions on its NFT marketplace, marking its entry into the Bitcoin-based market. The update, scheduled for later this month, will allow users to purchase and trade inscriptions using Binance accounts, alongside Ethereum and BNB Chain NFTs.

Bitcoin Ordinals on the Rise: Exploring Pros, Cons, and Market Impact

Bitcoin non-fungible tokens (NFTs) gain popularity in the Web3 space, with major exchanges like Binance and OKX supporting them. The expansion of the multichain NFT ecosystem is vital for the broader cryptocurrency market but remains a controversial subject within the crypto community.

New York’s Blockchain Hotspot: Milestone or Risky Endeavor in the Financial Hub?

New York, a financial hub, is gaining attention in the blockchain and cryptocurrency space with developments possibly positioning the industry as a focal point of innovation. However, skepticism persists, raising concerns over volatility, security issues, and regulatory challenges in this nascent market.

SHIB Comeback or Temporary Blip? Debating the Recent Surge in Coin Burns

SHIBarmy burned over a billion Shiba Inu coins in the last 24 hours, leading to a 13150% spike in the SHIB burn rate, potentially rekindling investor interest. However, the coin’s long-term trend may still point towards waning interest.

Blockchain Future: Unraveling Opportunities, Challenges, and Safeguarding Crypto Investments

The world of cryptocurrencies and blockchain has been revolutionizing industries and attracting attention. This article discusses the potential of blockchain, market volatility, safety concerns, and the future of digital assets. Stay updated with our blog for accurate and engaging crypto content.