The recent 3% dip in Bitcoin prices has sparked concerns about a further downtrend, as Binance suspends withdrawals and BTC transaction costs rise. Factors such as Liechtenstein’s potential adoption of Bitcoin payments for government services and MicroStrategy’s continuous investment could alleviate bearish sentiment, but vigilance is crucial for investors.

Month: May 2023

Aave

Aave plans to deploy Version 3 (V3) on Ethereum’s layer 2 ecosystem, Metis Network, following a unanimous community vote, aiming to boost market liquidity and grant Metis users access to Aave’s borrowing and lending features. However, potential drawbacks may arise from added complexity in an already intricate ecosystem.

Decoding Cointelegraph: Navigating Blockchain & Cryptocurrency’s Challenges and Potential

Cointelegraph magazine offers updated information on the blockchain and cryptocurrency world, covering decentralized technology, adoption across industries, and investment opportunities. Despite potential, scalability and energy efficiency challenges, environmental concerns, and market unpredictability persist. Stay informed for better understanding and participation in shaping the industry’s future.

European Data Act: Boon or Bane for Smart Contracts and DeFi Sector?

The European Data Act’s unclear regulation of smart contracts underpinning decentralized finance (DeFi) is causing anxiety among industry stakeholders. The European Crypto Initiative urges policymakers to address concerns, as the act could potentially hamper DeFi growth and inadvertently damage innovation in the blockchain sector.

Pepecoin’s Rollercoaster Ride: Analyzing Boom, Crash, and Lessons for Crypto Investors

Pepecoin (PEPE) experienced an extraordinary 5,000,000% increase followed by a 45% drop in value. With concerns about investor behavior and token concentration, the crypto community must approach the market cautiously, balancing opportunities and risks in the ever-evolving industry.

Binance Convert Adds SUI, FLOKI, PEPE: Convenient Trading Amid Meme Coin Volatility

Binance recently added SUI, FLOKI, and PEPE tokens to its Convert tool, allowing users to trade these new tokens with ease. This development follows a temporary suspension of market order functions for cryptocurrencies like SHIB, FLOKI, and PEPE due to high volatility. Caution is advised when trading meme coins.

Pepecoin’s Wild Ride: 400% Rally, Whales Profiting, and Uncertain Future Ahead

Memecoin Pepecoin (PEPE) experienced a 400% price rally followed by a weekend drop, causing increased whale activity and paper losses. With many approaching it as an opportunity to buy, its future trajectory remains uncertain, emphasizing the importance of thorough research before investing.

Binance Halts Bitcoin Withdrawals: Isolated Incident or Sign of Future Market Unrest?

Binance, the world’s largest crypto exchange, halted Bitcoin withdrawals twice in 12 hours, causing a 2% drop in its price. While temporary issues with exchanges are not unusual, repeated withdrawal halts may signal deeper underlying problems, potentially leading to financial losses and a loss of trust in major exchanges. Investors should remain vigilant and make informed decisions based on their research and market conditions.

Network Congestion and BTC Withdrawal Issues: Uncovering the Facts and Impact on Crypto Markets

Bitcoin withdrawals face issues on exchanges like Binance and Robinhood due to network congestion, leading to high fees and pending transactions. Binance has temporarily suspended withdrawals, but data reveals significant Bitcoin outflows, causing market-wide selloffs in altcoins. It’s crucial to conduct diligent market research before investing in cryptocurrencies.

Memecoin Whale Loses $600K: The Volatile Nature and Risks of Meme Cryptocurrency Investments

A memecoin whale suffered a 42% loss on their $3 million Pepe token investment, highlighting the highly volatile nature of memecoin investments and the risks involved. This cautionary tale demonstrates the potential hazards associated with speculating in such highly speculative assets.

Bitcoin Network Congestion: DoS Attack Fears Debunked by Increased Demand

Concerns about a potential denial of service (DoS) attack on the Bitcoin network emerged due to a sudden spike in transaction fees and unconfirmed transactions. However, analysts clarified that the congestion was caused by increased demand, not a premeditated attack.

Binance Halts BTC Withdrawals: Network Congestion, Gas Fees, and Crypto’s Future

Binance recently halted Bitcoin withdrawals twice in 24 hours due to a sudden increase in network gas fees and nearly half a million pending transactions. The exchange is working to resume withdrawals and considering enabling Bitcoin Lightning Network to aid in such situations. The congestion is possibly caused by Ordinals, facilitating the minting of NFTs on the Bitcoin blockchain, and increased adoption of Bitcoin Taproot, which anonymizes transactions.

Binance Pauses Bitcoin Withdrawals: Network Congestion Raises Scalability Questions

Binance’s recent pause of Bitcoin withdrawals due to network congestion highlights challenges for users and exchanges, raising concerns about Bitcoin’s scalability. The growing blockchain ecosystem must evolve to address these obstacles, seeking solutions that maintain cryptocurrency’s potential for innovation, risk, and reward.

Binance’s Temporary BTC Withdrawal Closure: Efficiency Concerns vs. Growing Pains Debate

Binance, one of the largest cryptocurrency exchanges, temporarily closed BTC withdrawals due to a high volume of pending transactions. This raises questions about the efficiency and reliability of major crypto exchanges, highlighting the need for constant improvement, adaptation, and transparency to maintain user confidence and secure assets.

Hong Kong Embraces Retail Crypto Trading: Boon or Barrier for Global Adoption?

Hong Kong is positioning itself as a crypto-friendly region, with a licensing regime for crypto exchanges including retail trading set to launch by June 1. This move aims to reduce incentives for retail traders to utilize risky, unregulated overseas platforms and attract talent to establish Hong Kong as a virtual asset hub.

Speedruns and Memecoins: Fueling Crypto Volatility or the Future of Token Creation?

The rise of “memecoins” has led to crypto enthusiasts competing in speedruns to create and deploy new tokens quickly. This growing trend highlights the ease of creating tokens with tools like Contracts Wizard and Remix, but raises questions about legitimacy, market impact, and potential scams. Crypto investors should approach memecoin investments with caution and thorough research.

Meme Coins Spark Market Sentiment Shift: Balancing Mining Incentives and Network Congestion

Bitcoin and Ether prices experienced slight drops while meme coins like PEPE sparked market sentiment shifts. The surge of Ordinals pose challenges like network congestion but offer mining incentives, balancing out with Layer-2 and sidechain solutions.

High Bitcoin Transaction Fees: A Mempool Attack or NFT Boom? Debating the Causes and Impacts

The Bitcoin community is alarmed by high transaction fees and a backlog of transactions, with some perceiving it as an attack on the cryptocurrency. The focus is on Ordinals, a protocol for minting NFT-like assets on Bitcoin’s blockchain, and the recent surge in Bitcoin-based digital assets called inscriptions. While concerns arise, developers utilizing Bitcoin’s technology should be viewed as exploring new possibilities instead of undermining the platform.

Exploring Factors Behind Bitcoin’s Wild Ride and Approaching $28,000 Support Level

Amidst significant market volatility, Bitcoin approaches $28,000 support level, impacted by the US banking crisis and prompted shifts towards alternative safe-havens. The BTC/USD pair gains momentum as Bitcoin’s dominance rate rises and its technical aspects remain stable.

Stagnation Strikes: Fed Rate Hikes, Alleged Token Manipulation, and Kennedy’s Crypto Conspiracy

This week in crypto: Stagnation due to the Fed’s interest rate hike, Binance’s “CZ” Zhao flags Tron CEO’s suspicious token transfer, crypto-based conspiracies from 2024 Presidential hopeful, reports of Amazon’s possible NFT marketplace launch, and El Salvador incentivizes tech innovation.

Speedy Token Creation: Boon for Crypto Education or Gateway to Shitcoin Season?

Digital artist Johnny Shankman demonstrated a method to create new tokens in under 30 seconds, drawing attention to the proliferation of meme coins. While some argue that this can lead to oversaturation and ‘shitcoin season’, proponents believe that greater awareness could make investors more cautious and less susceptible to scams.

Crypto Clashes: Surge in Unconfirmed Bitcoin Transactions and Sky-High Fees – Cause for Concern?

Bitcoin transaction fees hit a two-year high, exceeding $8, driven by the BRC-20 standard and increased complexity of inscriptions. The sudden surge in unconfirmed transactions led Binance to temporarily pause withdrawals, highlighting challenges and opportunities for the crypto ecosystem as it integrates into existing financial systems.

Binance Hiccup Raises Scalability Concerns: Analyzing Bitcoin’s Network Congestion and Fees

Binance’s recent temporary halt of Bitcoin withdrawals due to network congestion highlights concerns about Bitcoin’s scalability and rising transaction fees. As blockchain technology evolves, it’s crucial to develop efficient and cost-friendly solutions to support widespread adoption and accommodate rapid growth of applications like Ordinals.

Striking the Balance: Cryptocurrency Regulations, Innovation, and Consumer Protection

This article discusses the complexities of cryptocurrency regulations, emphasizing the need to strike a balance between fostering innovation and safeguarding consumers’ and investors’ interests. It highlights the importance of international cooperation and well-calibrated regulations to ensure a thriving, secure, and fair market.

Embracing JOMO: NFT Collection Promotes Mental Health and Charitable Giving in Crypto Community

The JOMO Effect NFT project aims to bring positivity to the crypto community by harnessing the “joy of missing out” and raising money for mental health charities. Created by Peace Inside Live, the collection features 40 unique digital art pieces focused on wellness and mental health, minted on Polygon and available through the Magic Eden marketplace.

Binance Halts BTC Withdrawals Amid Network Congestion & DOS Attack: Assessing the Impact

Binance Exchange temporarily suspended Bitcoin withdrawals due to growing network congestion. This decision, influenced by a DOS attack targeting high transaction fees, aims to alleviate user discomfort from slow processing times. Binance has since resumed withdrawals, but these events highlight the need for increased vigilance and innovation.

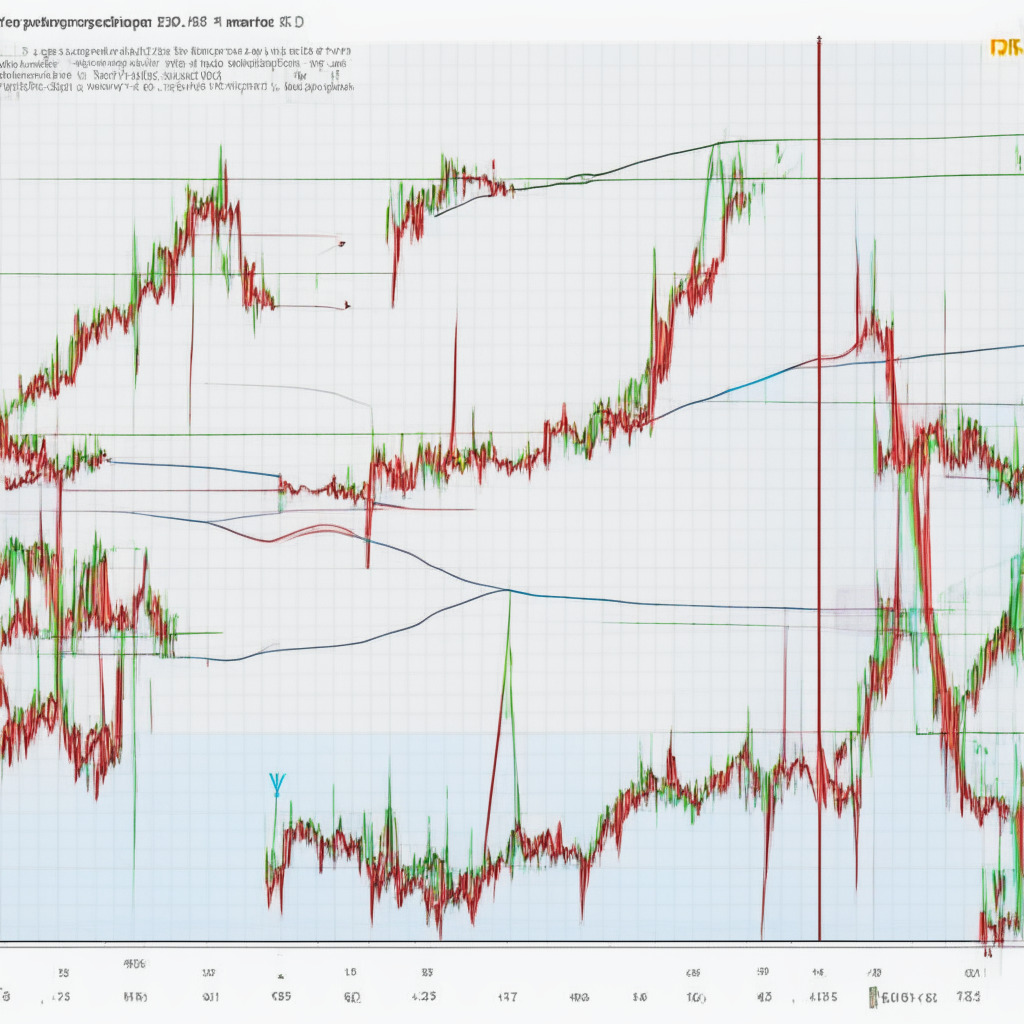

XRP Price Correction: Flag Pattern Suggests Potential Breakout or Prolonged Decline?

The XRP price has experienced a 20% correction, forming a flag pattern between two downsloping trendlines, offering a potential long-entry opportunity. The ongoing retracement is likely temporary, and a breakout above the overhead resistance trendline could lead to a 20% price increase, challenging the $0.55 barrier. However, the market remains indecisive and uncertain.

Cryptocurrency Market Uncertainty: Analyzing BTC, ETH, XMR, OKB, and RPL Price Predictions

Bitcoin’s volatility decreases as bulls struggle to overcome the $30,000-$31,000 resistance zone, indicating a balanced market. Despite short-term uncertainty, some analysts predict a positive long-term outlook, with pockets of strength in major cryptocurrencies showing promise for a short-term turnaround.

Bitcoin Network Congestion: Sign of Growth or Scalability Crisis?

The Bitcoin network experienced heavy congestion on May 7, with the BTC mempool swelling to over 400,000 transactions awaiting confirmation. This raises concerns about the scalability of the Bitcoin blockchain and highlights the need for continued development and innovation to accommodate growing demand and ensure long-term usability.

Blockchain’s Future in Finance: Exploring Pros, Cons, and Potential Conflicts

This article explores blockchain’s impact on the future of finance, discussing its potential to bolster financial security and transparency, while also addressing concerns like market volatility, privacy, and scalability. As the world watches the unfolding blockchain revolution, the question remains if it will transform the financial sector or add to existing complexities.

ShimmerEVM Testnet Setback: Necessary Hurdle or Sign of IOTA’s Lagging Progress?

The IOTA ShimmerEVM network faced a temporary setback due to heavy congestion, as the team works to introduce smart contracts to IOTA. While critics argue ShimmerEVM is late to the game, supporters believe resolving testnet issues will ensure a robust and competitive platform.

Bitcoin’s Symmetrical Triangle Pattern: Predicting the Breakout and Future Market Trends

The ongoing sideways movement of Bitcoin’s price has led to uncertainty in the cryptocurrency market. However, Bitcoin’s symmetrical triangle pattern formation on the daily chart indicates a potential bullish outcome. The Exponential Moving Average and Moving Average Convergence Divergence further favor a bullish recovery in the market.